This is the fourth chapter of “The Dream of the 90's is Alive in 2024: How Policy Can Revive Productivity Growth,” a new research report from Employ America. "The Dream of the 90's" examines the macroeconomic conditions that led to strong growth in the late-1990s and what policies can revive that productivity growth today.

Previous Chapters:

Part I: The Three Drivers of Productivity Growth

Part II: Clear Eyes, Full Employment, Can't Lose

Part III: Boom Goes the Fixed Investment

Tight labor markets and strong investment are crucial to securing the three-legged stool of productivity growth, but a stable supply of the essentials may be the most important to focus on today. Without an adequate supply of certain essential commodities, inflation can quickly erode any boost to growth. For this reason, it is critical that policymakers understand the range of tools available to help secure this supply of essentials.

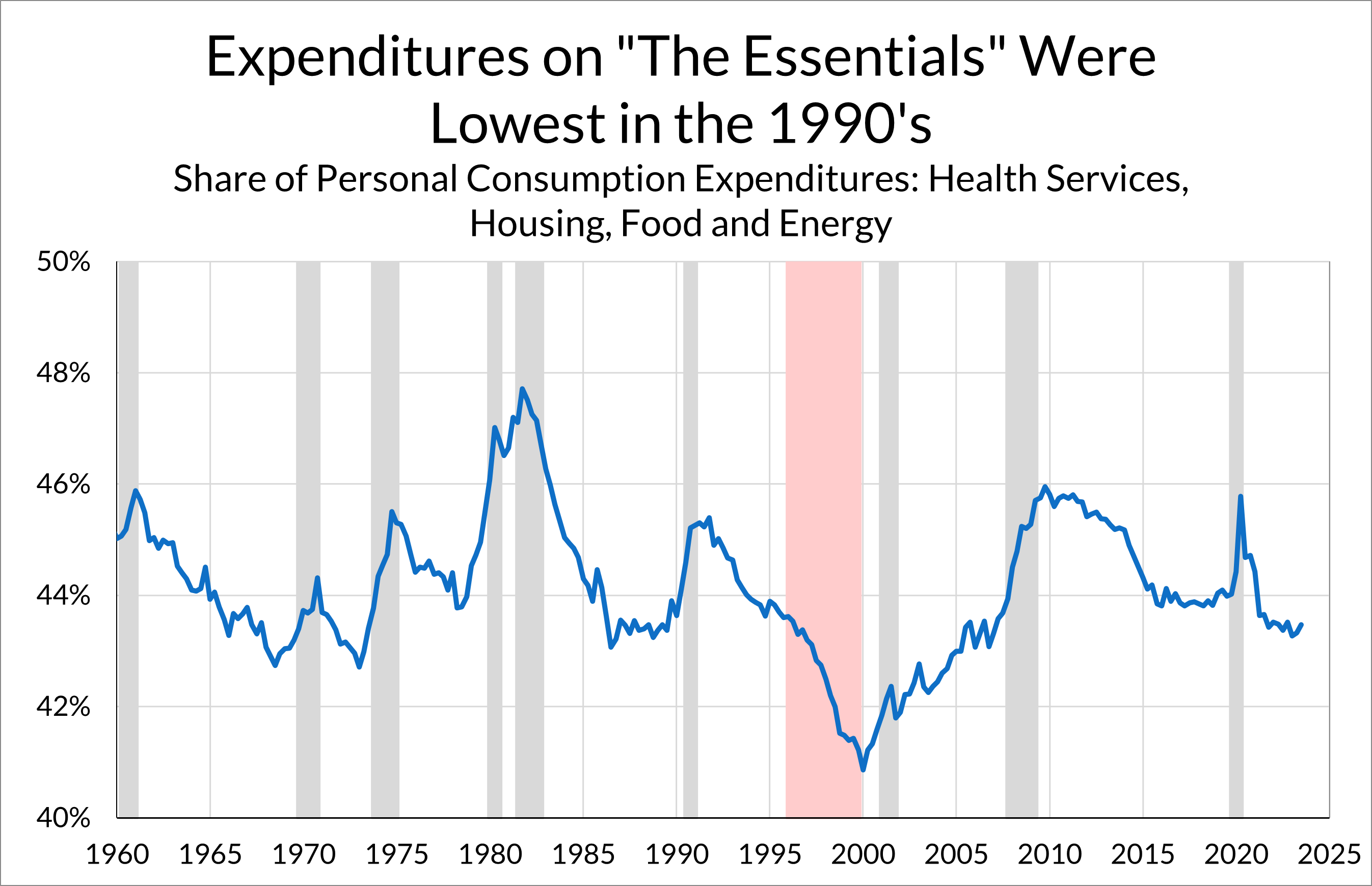

The booming economy of the 1990s saw relatively few significant supply-side disruptions. During the 1970s, by contrast, these supply-side issues created significant difficulties. In the 1990s, the supply of basic components of personal consumption, such as energy, food, health, and shelter, remained robust and adapted to growing demand. Supply side stability meant inflation pressures remained contained in these key sectors, and created space in household budgets to increase their spending on durable goods, helping to justify the investment boom.

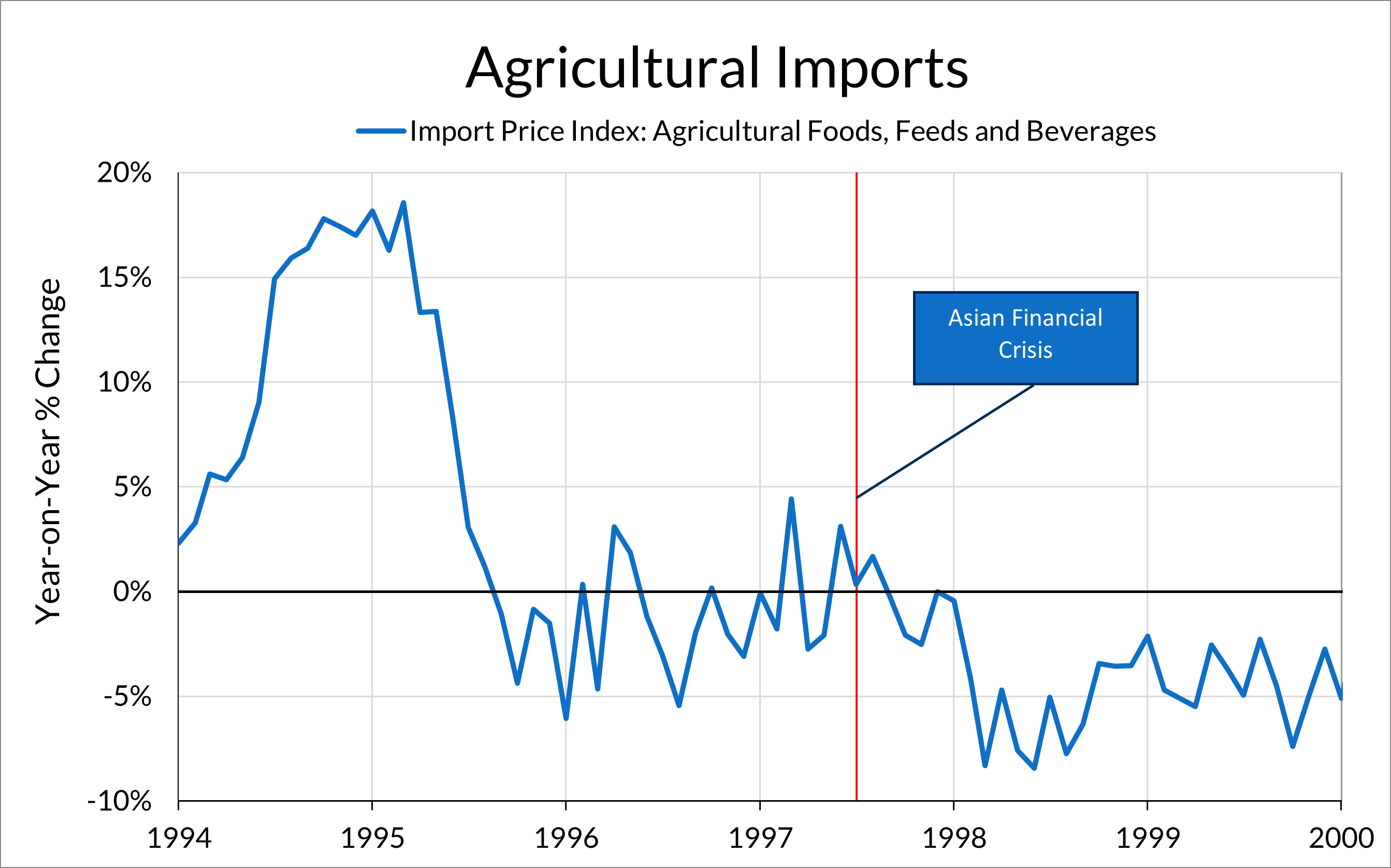

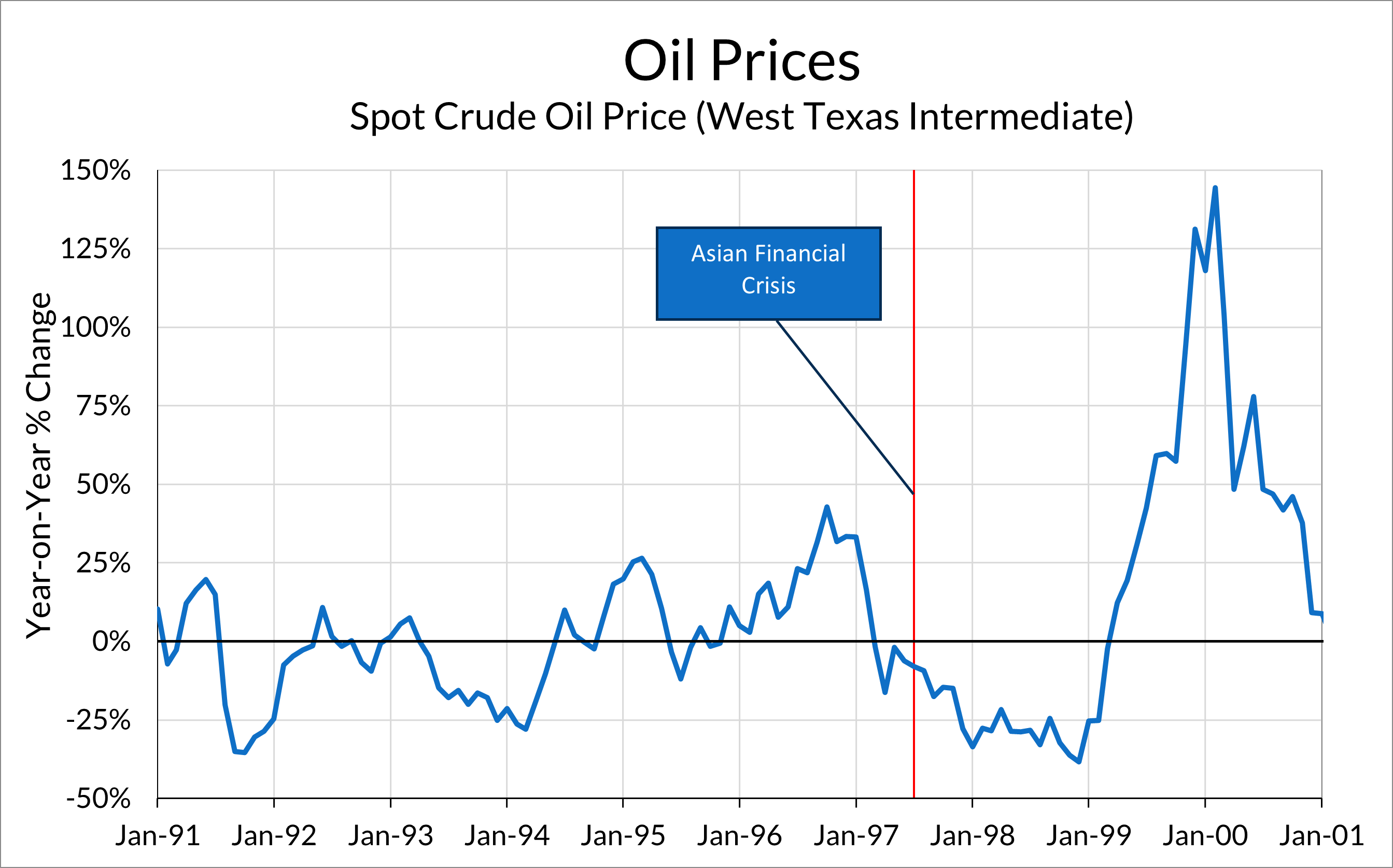

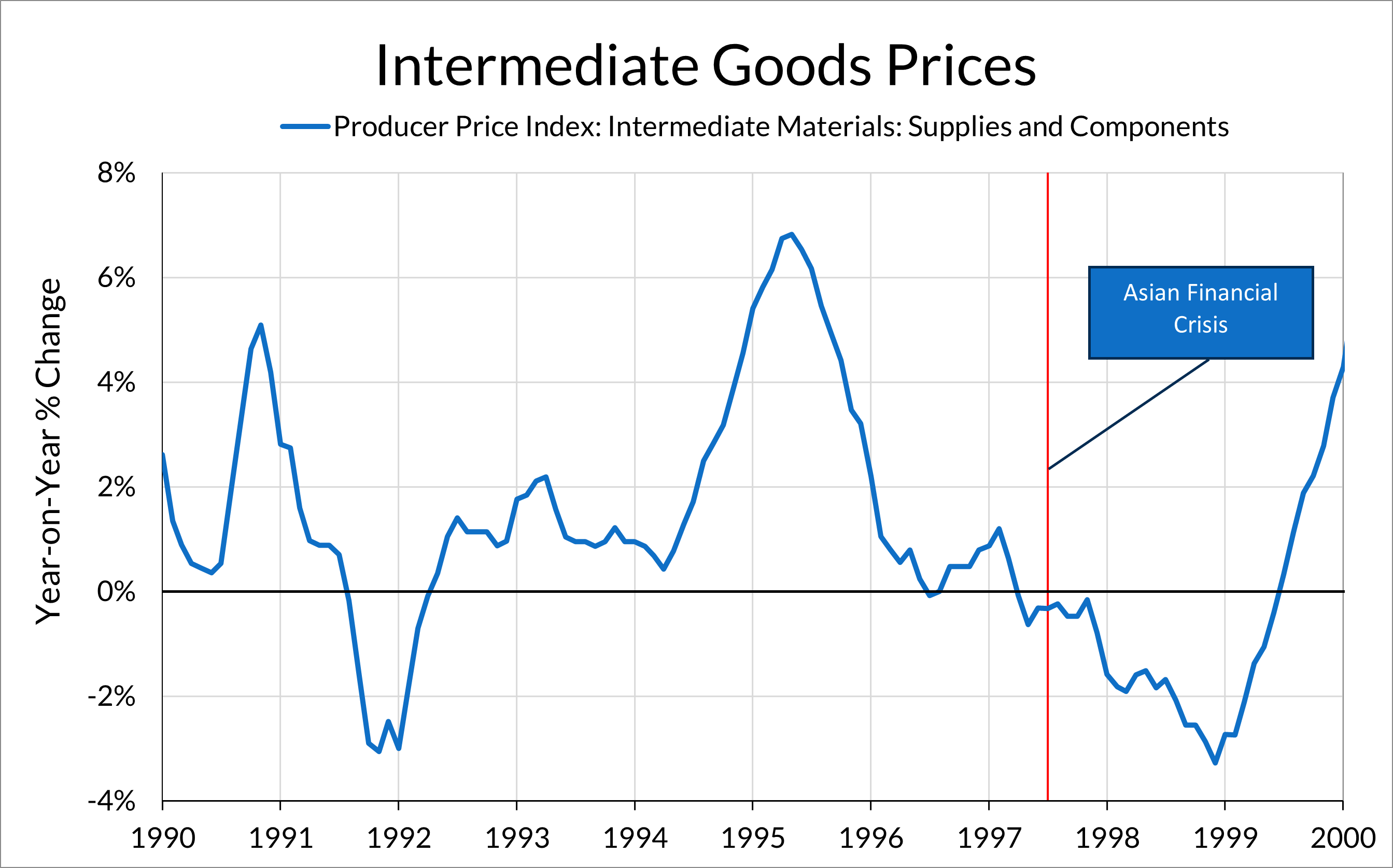

Now, the good fortune of the 1990s was in part a question of luck. The devaluation of Asian currencies and falling commodity prices after the Asian Financial crisis turned out to mostly be a boon for US consumer prices. Prices of raw materials—metals, oil, and agricultural products—fell as a result of the crisis. Consumers, who already enjoyed years of mostly stable oil prices after the US intervention in Kuwait, saw a decline in the price of energy goods and services.

Sources: IMF, Federal Reserve Bank of St. Louis, Bureau of Labor Statistics

In health care, constrained inflation was the result of deliberate efforts to rein in cost growth by domestic policymakers and businesses. Part of this was attributable to the rise of HMOs in the early 1990s, which managed health care spending not only by managing access to care, but by negotiating better prices from health care providers. Policy also played a role, as the Balanced Budget Act of 1997 introduced provisions to reduce the growth of Medicare and Medicaid spending by managing utilization and reducing the growth of prices paid (Catlin and Cowan, 2015). Given the influence of Medicare payment rates on private reimbursement rates, these changes to government health programs likely also helped reduce private costs of healthcare spending.

Thanks to this stable supply of “essentials”, consumers spent a lower share of their overall consumption expenditures on energy, food, health, and shelter in the late-1990s than at any other point in the data. The late 1970s, 2000s, and 2010s faced supply challenges in one or more of these areas. Energy supply issues were particularly challenging during the 1970s, as well as during the 2000s commodities boom. Medical inflation was relatively well-contained in the 2010s after an inflationary decade in the 2000s, but shelter inflation was a chronic issue. As our own Alex Williams chronicled in his piece on “Physical Capacity Shortages” the 2006-10 housing bust structurally scarred homebuilders’ investment intentions and with it, we lost a substantial share of the homebuilding supply chain. From food to energy to housing to healthcare, the low share of income spent on these essentials in the 1990s set consumers up to spend more generously on discretionary goods and services so long as capacity constraints did not bind. This confidence in consumer spending redounded to business revenue, and gave firms the reason and the funding to stand up additional supply as a result.

The stability of the supply-side in the late-1990s helped keep inflation contained, and as a result the Federal Reserve was comfortable allowing the labor market to remain tight. The unemployment rate fell below 5% in mid-1997—and kept falling—for the first time since the 1960s. Reading the FOMC meeting transcripts during this time, a recurring theme arises where FOMC members were puzzled at the fact that they were seeing such high growth and low unemployment without a rise in inflation. Fed estimates of the “Non-accelerating inflation rate of unemployment” (NAIRU) were around 5.5% during this time.

For a number of meetings now, the economy has seemed to be déjà vu. For some time, we have felt that we were looking at a fully utilized economy, one with tight and tightening labor markets that seemed likely to begin to show escalating labor costs and from there escalating inflation—in short, an overheating economy. But that has not happened so far. In fact, inflation is flat to down according to many statistical series.

Edward W. Kelley Jr (member of the Board of Governors of the Federal Reserve, 1987 - 2001), during March 25th, 1997 FOMC Meeting

The lack of inflation raised enough doubt about these NAIRU estimates that the FOMC was willing to avoid trying to preempt inflation, and instead wait to see inflation before acting:

Uncertainty about NAIRU has, in my view, made monetary policy more cautious in responding to forecasts of inflation that depend on the relationship between the current unemployment rate and some estimate of NAIRU.

Laurence H. Meyer (member of the Board of Governors of the Federal Reserve, 1996 - 2002), January 16th, 1997

If inflation had reared its head, the Fed would likely have tightened policy, risking knocking out the other two legs of the productivity stool. The committee was primed to see growth and the labor market as a harbinger of inflation—but because inflation cooperated, they were willing to let the boom continue.

Of the three productivity drivers of the 1990s discussed here, the supply-side situation for essentials looks to be the most precarious of the three legs of the productivity stool. The recent recovery was plagued by supply chain issues, leading to price spikes in food and energy. With interest rates as high as they are, firms may be less willing to hold the requisite inventory to weather new exogenous shocks, and less willing to make broader investments in resilience on their own. The demand for shelter from the rapid labor market recovery, the pace of household formation and the shift towards work-from-home ran up against a highly constrained supply of housing after decades of underbuilding. What this means is that policy has the most work to do in reinforcing and bolstering the supply side. This dovetails neatly with a broader push towards decarbonizing and revamping the energy system, but similar efforts for other sectors like housing may also be needed.