This is the third chapter of “The Dream of the 90's is Alive in 2024: How Policy Can Revive Productivity Growth,” a new research report from Employ America. "The Dream of the 90's" examines the macroeconomic conditions that led to strong growth in the late-1990s and what policies can revive that productivity growth today. Subsequent chapters will be published over the coming days.

Previous Chapters:

Part I: The Three Drivers of Productivity Growth

Part II: Clear Eyes, Full Employment, Can't Lose

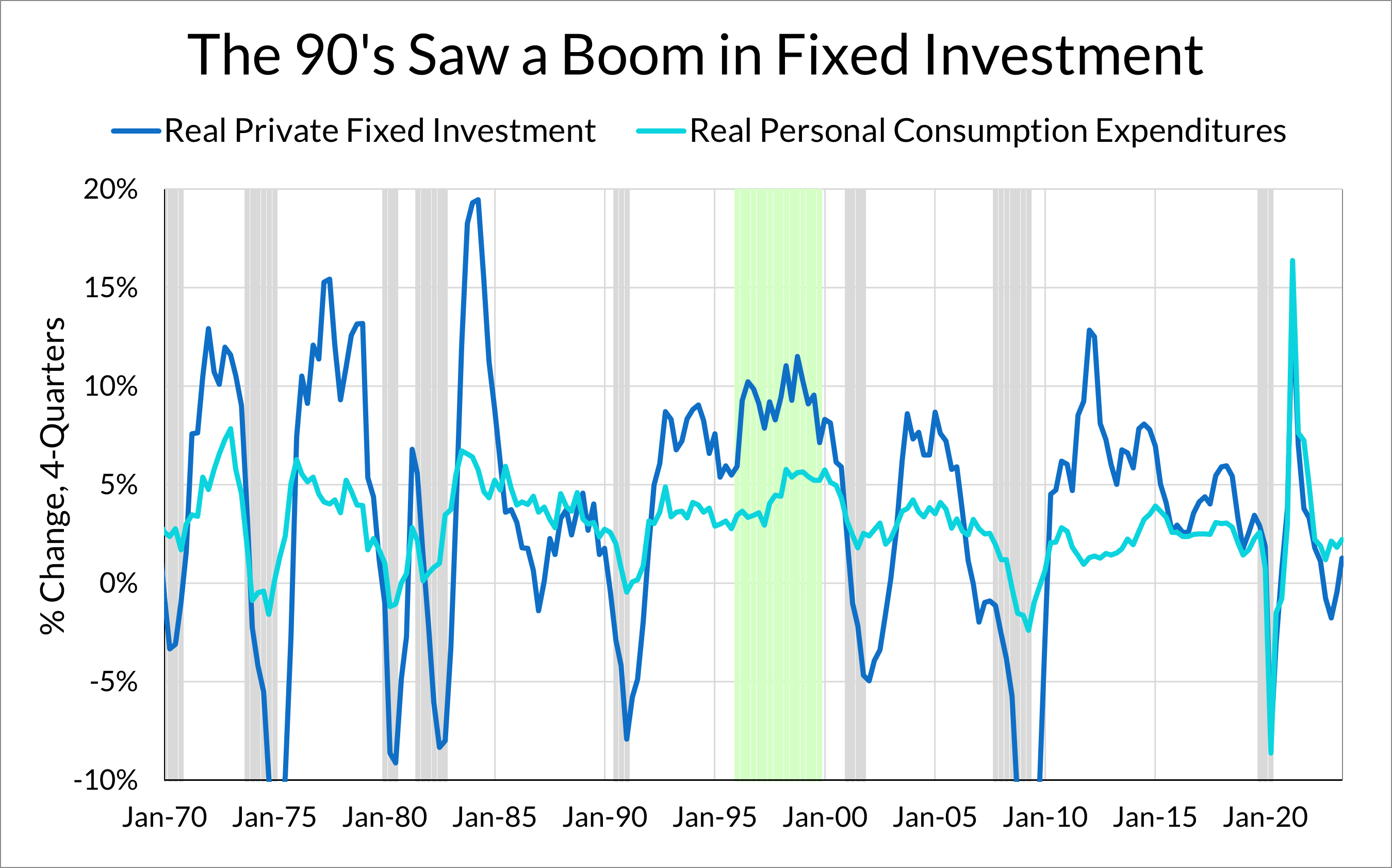

The second leg of the productivity growth stool is a boom in fixed investment. This means businesses buying more equipment and bigger facilities in order to expand capacity or improve efficiency or productivity. As new technology is adopted and production methods improve, greater output can be achieved without increasing hours worked. This is the heart of productivity growth in many ways, and is critical to achieving disinflationary dynamics over the medium term.

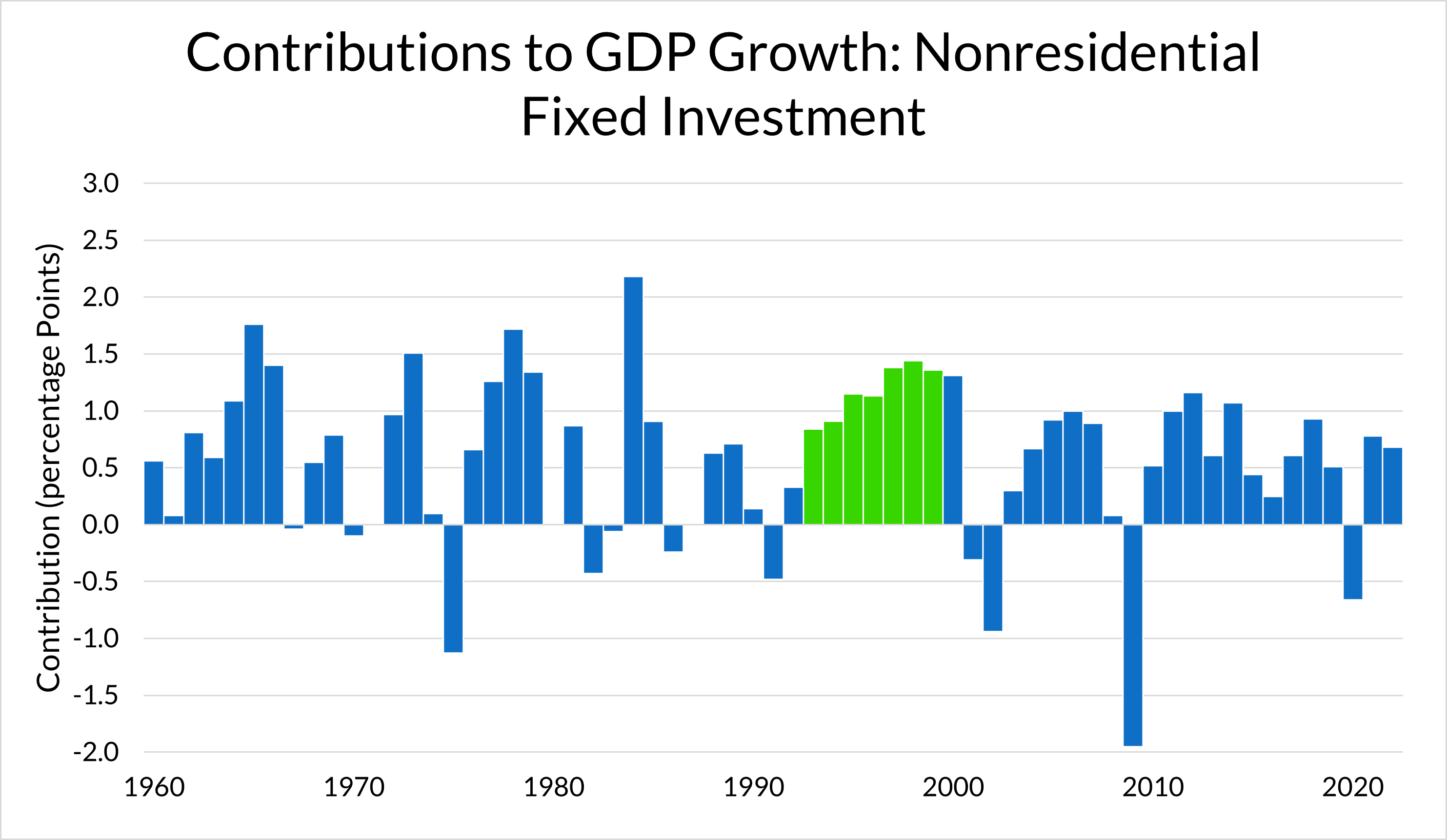

The 1990s productivity boom saw substantial growth in investment, particularly in business and nonresidential fixed investment. Throughout the period, businesses were steadily investing in expanding equipment, supplies, and intangible capital to meet consumer demand. As those new and improved capital goods came into service, businesses steadily shifted to higher-productivity production processes.

During this period, fixed investment made solid contributions to real GDP growth, reliably contributing between 1.0 and 1.5 percentage points between 1995 and 2000. Fixed investment did grow during the post-2000 and post-2007 recoveries, but neither recovery saw investment really boom the way it did in the late-1990s.

Quality Improvement and Real Growth

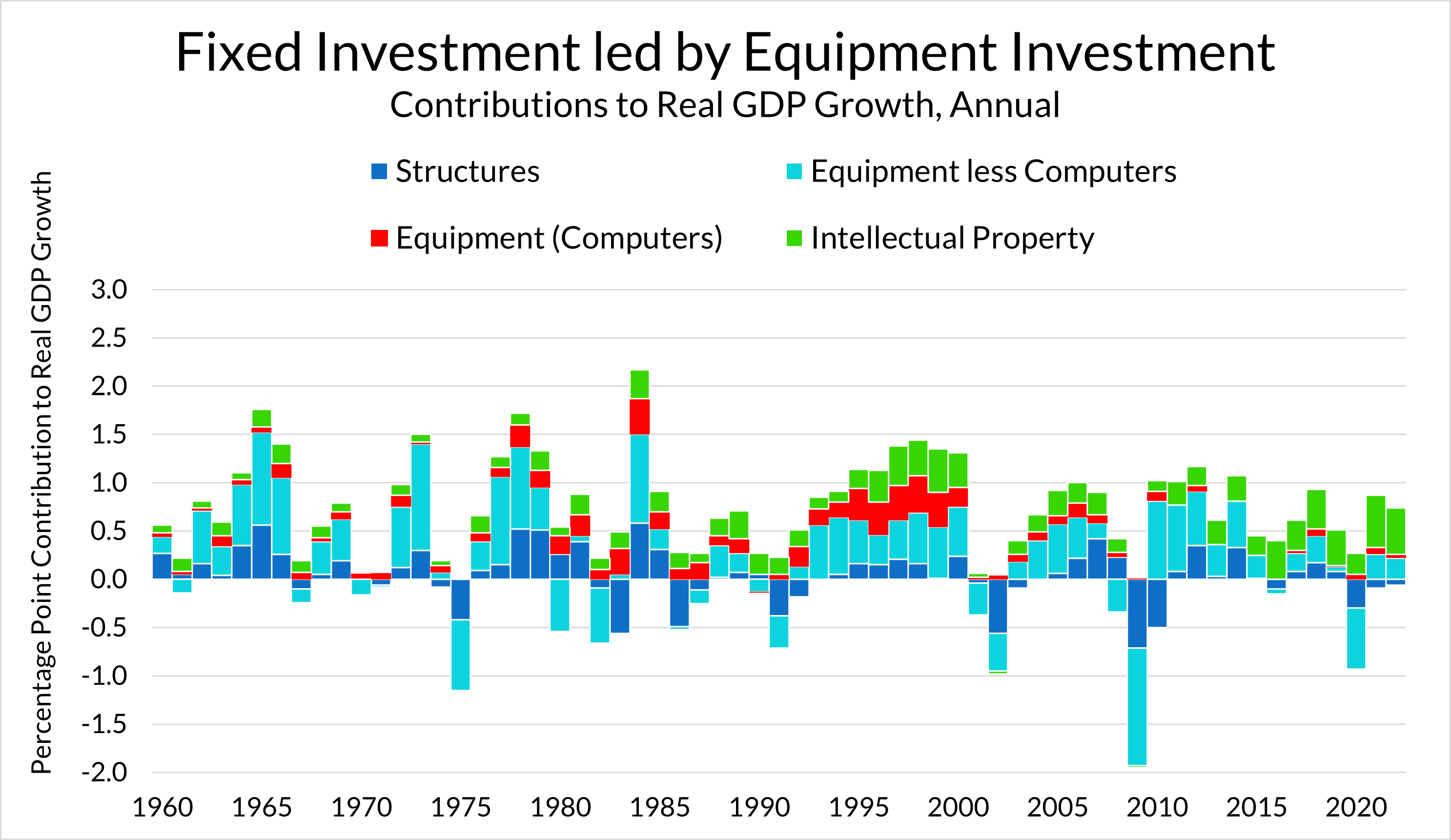

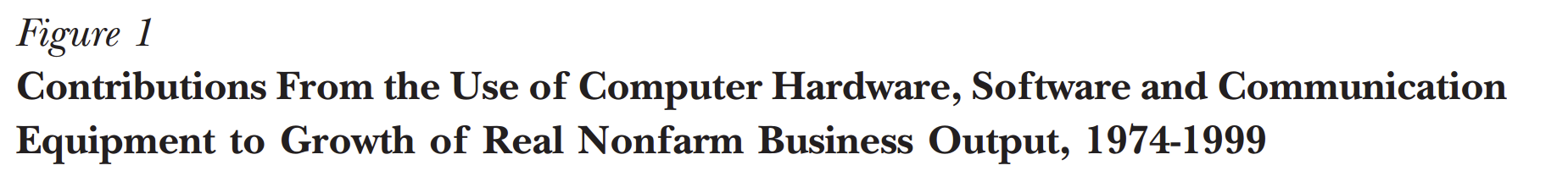

In the 1990s, equipment investment—particularly in Computers and Peripherals—led the investment boom. Investment in computer equipment alone reliably contributed upwards of 0.3 percentage points to GDP growth between 1995 and 1999, a remarkable contribution rare outside this era. Investment in software (a sub-component of Intellectual Property Products investment) also played an important role.

Crucially, the 1990s fixed investment boom did not come at the expense of personal consumption growth. In fact, real personal consumption expenditure growth accelerated in the late-1990s. Some worry that there is a fixed level of output that the economy can achieve, such that increasing investment must mean decreasing consumption, and vice versa. This viewpoint is flawed for a number of reasons, and the experience of the 1990s is clear evidence of that fact.

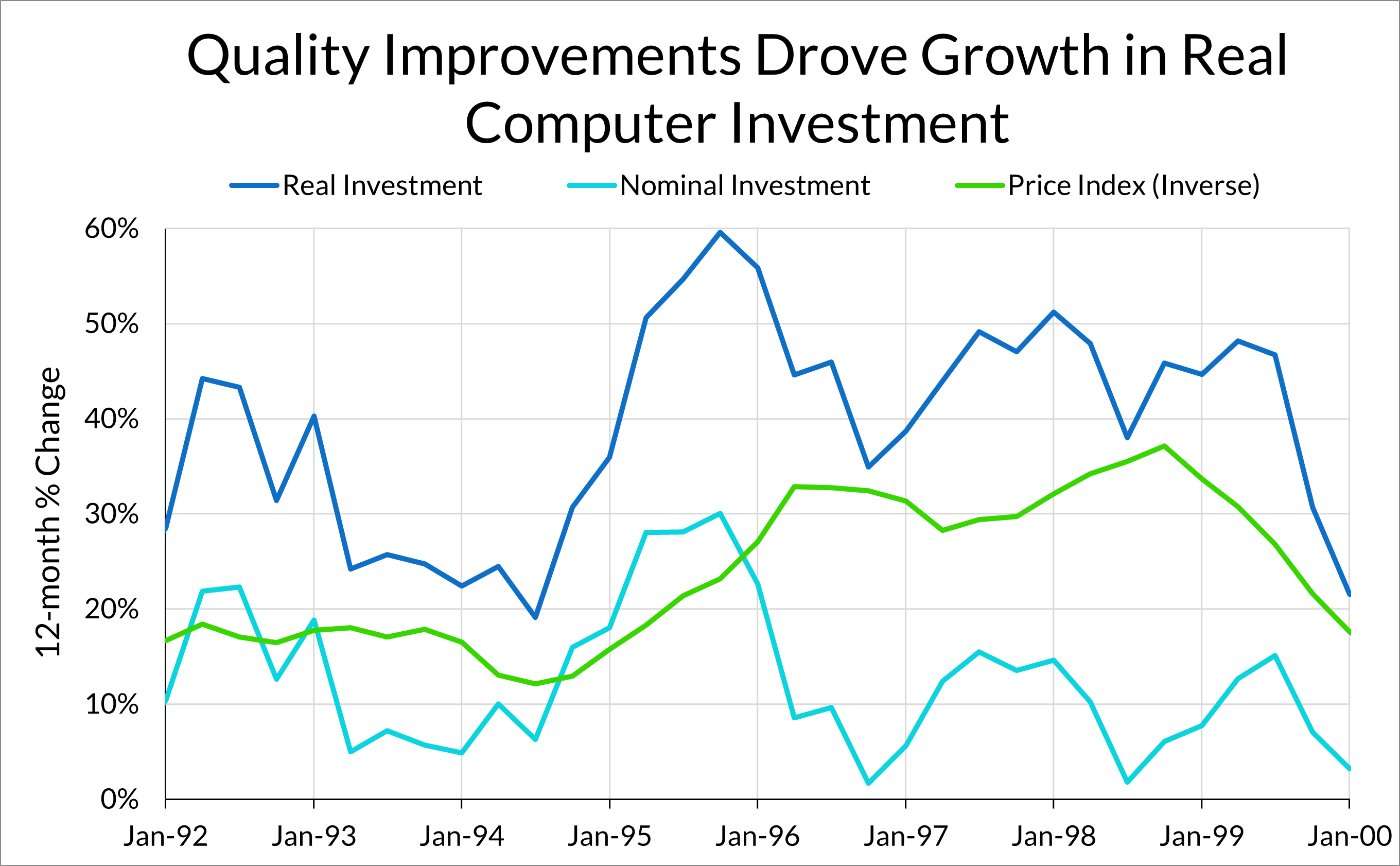

For one, the inputs to fixed capital and consumption can be quite different. Second, technological improvements made it possible for real investment in computers to grow rapidly with a commensurate increase in nominal expenditures. Nominal expenditure grew at a steady rate of 10% per year throughout the decade, but the strong acceleration in the late-1990s was also a consequence of the rapid fall in the relevant price deflators.

Those deflators fell so quickly, primarily, thanks to the tremendous improvement in the quality of computers, particularly in semiconductor technology (and thus processing speed). Even if a new computer model keeps the same price as an old model, better specs mean a de facto decline in the price of computing speed. The efficiency gains were so significant that the industry temporarily outperformed Moore’s Law—a technological, rather than economic law—as the rate of improvement in processing speeds accelerated.

The improvement in computer quality was so rapid that the Bureaus of Economic Analysis and Labor Statistics had to engage the industry proactively in order to capture these changes in price indices. There is no guarantee that national price statistics correctly account for improvements of quality, and price changes are even more difficult to measure when consumers are rapidly substituting between items as quality increases. During this time period, the frequency at which computer models would improve features such as storage capacity, memory, and processor speed was quite rapid:

What makes this dynamic so interesting is how integral appropriate price indices are to establishing the possibility of continued real growth even as nominal investment holds steady. The BEA, for their part, worked with IBM in the 1980s to develop quality-adjusted price indices for computer investment, partly in an effort to encourage the BLS to develop hedonically-adjusted price indices for the computer industry. The BLS began to study hedonic adjustments in the producer price indices for the computer industry in 1987, and found that the normal resampling schedule for the PPI was far too infrequent to capture the frequent changes in computer models. Hedonic adjustments for computer investments were incorporated into the PPI series by 1990, and are used to derive the BEA price indices for computer investment to this day. The storyline of the development of price indices highlights an important fact about growth: given sufficient technological advancement, real growth is possible even without a surge in nominal expenditures.

The capital deepening from increased real computer investment contributed to labor productivity growth in a number of other sectors. Oliner and Sichel (2000) estimate that of the 1.04 percentage point increase in labor productivity from the first half to the second half of the 1990s, 0.45 percentage points came from the capital deepening associated with information technology investments. These estimates are similar in magnitude to other estimates from Jorgenson and Stiroh (2000) and Whelan (2002). (1)

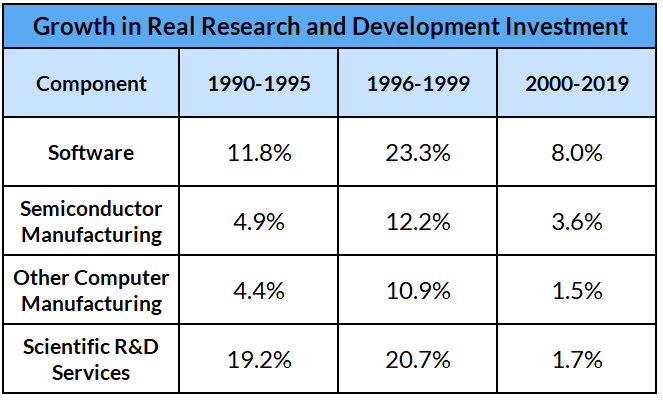

These technological advancements didn’t happen only by chance. Businesses had made decisions to invest more into research and development, and new technologies followed. Private research and development, led primarily by the semiconductor, electrical components, computer manufacturing, and non-manufacturing scientific research and development components, consistently grew at a healthy clip during the late 1990s in a manner not seen in the post-2000 and post-2007 recoveries.

Three policy factors enabled the 1990s surge in fixed investment and technological growth: sustained demand sufficient to justify these investments, sufficiently accommodative financial conditions, and public support for research and development. As discussed previously, the first was enabled by the maturation of the labor market from a full employment recovery to strong wage growth (and thus robust labor income growth). This was missing from the post-2000 and post-2007 recession recoveries, neither of which saw persistent growth in research and development spending at the level of the late-1990s.

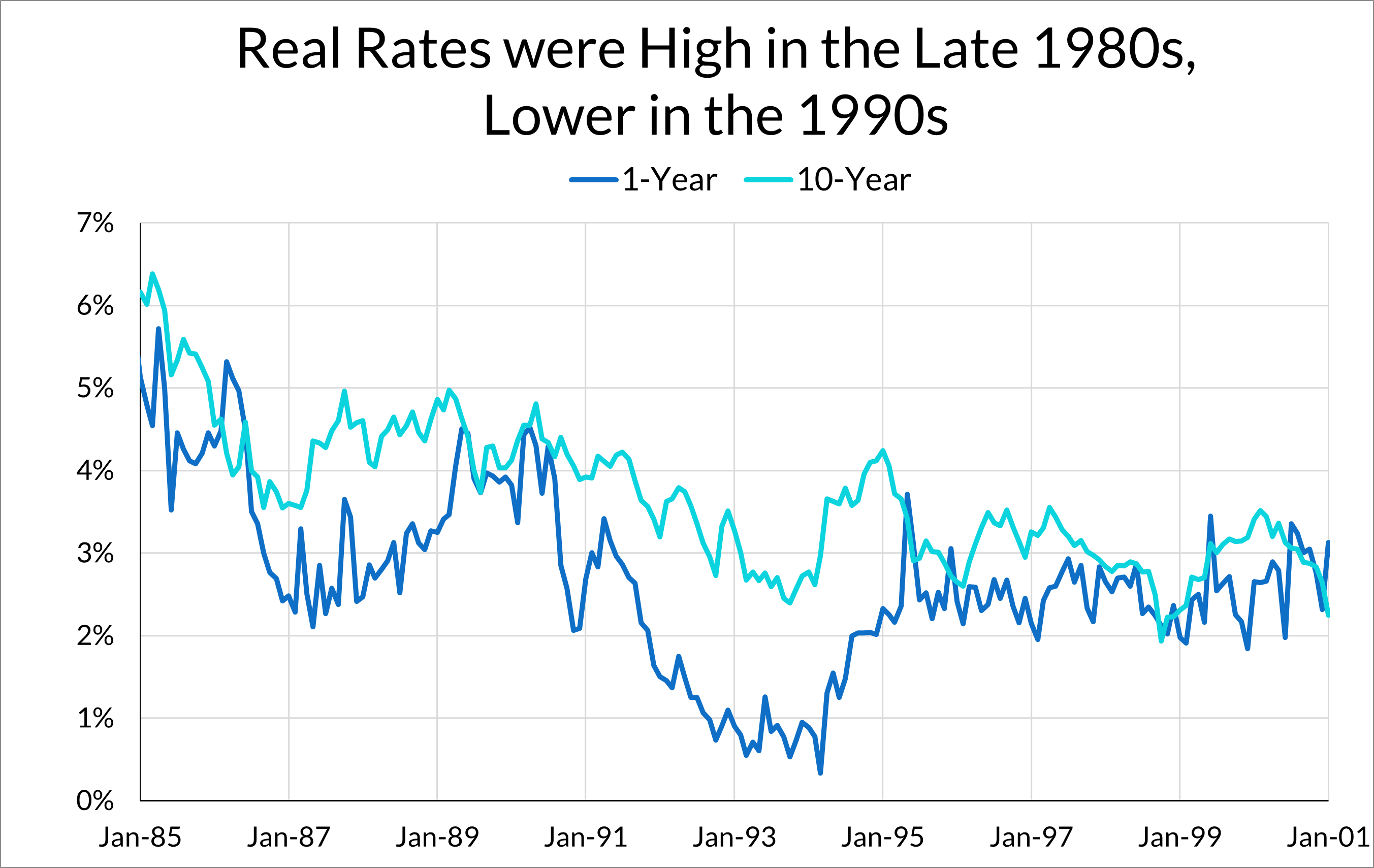

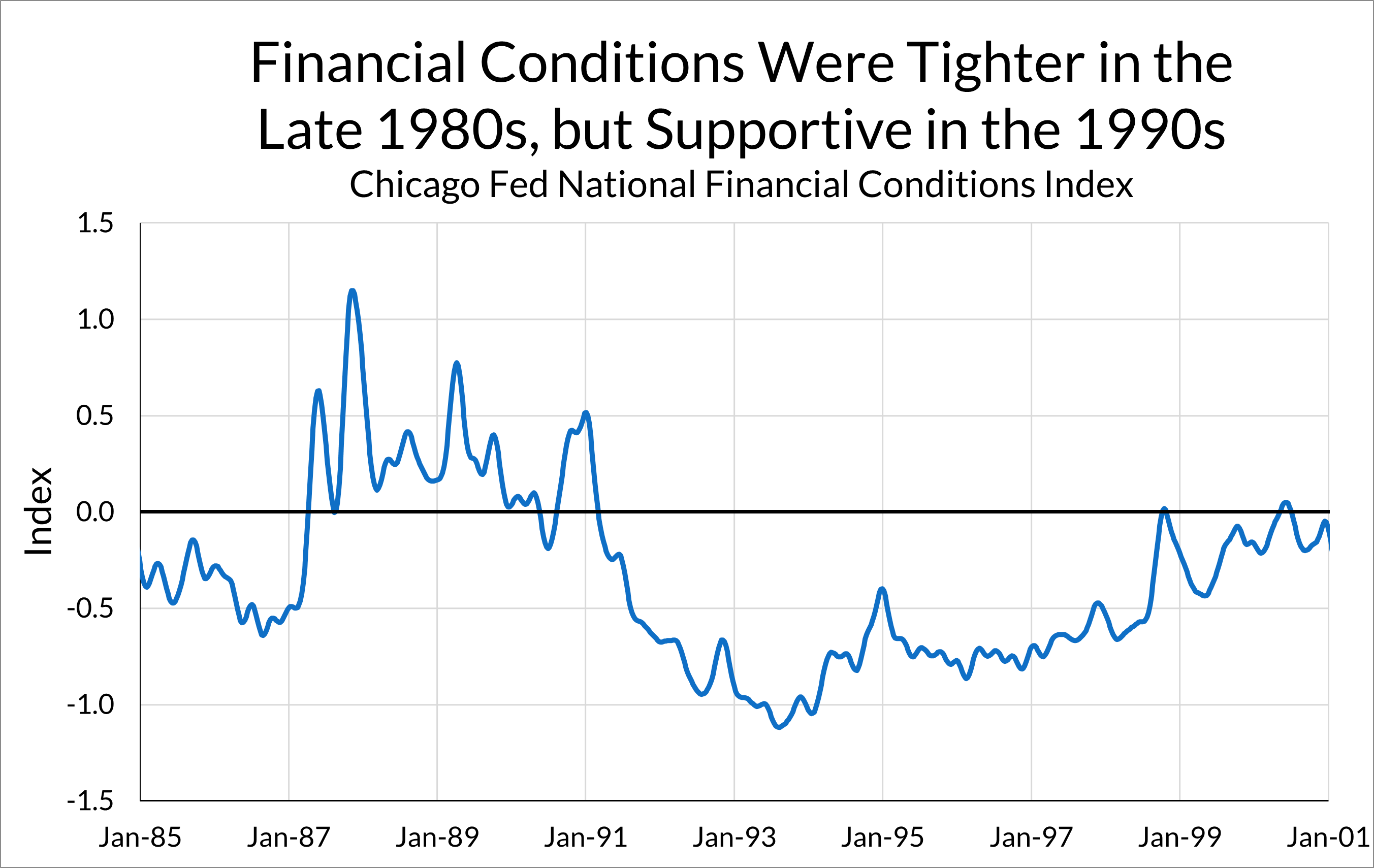

Yet, a full recovery in employment alone is not sufficient to produce the kind of productivity growth we are looking for. The 1980s, like the 1990s, saw a similarly strong recovery in employment but never achieved the fixed investment growth of the 1990s. The tight monetary policy of the time and the ongoing savings and loans crisis meant high real interest rates and tight financing conditions increased the cost to finance investment for firms. These high financing costs in turn likely prevented a fixed investment boom. Indeed, the 1990s boom ended just as the Fed began aggressively tightening in 1999 and 2000 and broader measures of financial conditions tightened.

Ultimately, financial conditions likely played a role in the achievement of the 1990s productivity growth through their impact on business investment in fixed capital. In the 1990s, this strong investment reinforced productivity growth, and was supported by favorable financing conditions, especially within technology-adjacent sectors. When it came to a close, this was in part due to the tightening of financial conditions. The manufacturing sector saw general weakness in the aftermath of the Asian Financial Crisis, and the rest of the economy aggressively weakened in response to the Fed’s 1999-2000 hiking cycle.

There is also a growing literature exploring the endogenous relationship between productivity growth and the business cycle, both empirically and theoretically. Ma and Zimmermann (2023) show that tight monetary policy is associated with reductions in innovation investment, using measures such as investment in intellectual property products, venture capital funding, and patents. They argue that both of the channels discussed here—expectations of demand and financing conditions—are at play (tight monetary policy reduces expected future demand and tightens financial conditions).

Semiconductors and Telecoms

Finally, the actual technological improvements that drove the quality improvements in semiconductors were themselves products of deliberate efforts by the government to coordinate research and development under a “science policy” paradigm. Although it came with some longer term strategic costs, the US semiconductor industry managed to recapture the technological frontier during this decade by using a low-budget strategy that focused on dividing and coordinating research between public and private research labs.

This strategy shortened product cycles, allowing for faster innovation. Prior to the 1990s, companies generally planned their product cycles assuming that the rate of technological progress would generally follow Moore’s Law. But in the 1990s, the semiconductor research consortium and a public-private partnership SEMATECH created industry roadmaps that moved the industry from a three-year development cycle to a two-year development cycle. While the government cannot summon technological progress out of thin air, the public coordination of private resources played an important role in directing resources towards technological development:

Economists are largely accustomed to thinking of the speed of technological change as something that is exogenous, dropping in gracefully from outside their models. One moral of the history of SEMATECH and the technology roadmap is that the pace of technological change may have an internal policy component as important as its external scientific foundations. Particularly where many complex items of technology secured from a broad variety of sources must be coordinated in a fairly precise manner in order to create economically viable new technology platforms, vague and diffuse factors like expectations and even political coalitions may play an important role.

Flamm (2009)

Despite these benefits, some information technology investments had more ambiguous impacts. The very end of the decade saw a huge boom, and subsequent bust, in investment in telecommunications equipment and structures. Unlike the technology-driven improvement in real computer investment, the acceleration in telecommunications investment in 1999 and 2000 was primarily driven by an increase in expenditures in telecommunications equipment and structures. Enabled by the 1996 Telecommunications Act and spurred by an overly-optimistic view of demand growth, the industry overinvested in expanding fiber-optic networks.

While the tech bubble affected information technology investment more broadly, the boom-and-bust was primarily felt within telecommunications investment. While we will not go into a full accounting of the 1990s tech bubble here, overoptimism about demand for telecommunications services, winner-take-all competition to achieve scale and benefit from scale effects (Doms, 2004), and corporate fraud all contributed to overinvestment in telecommunications. The tech overoptimism allowed telecommunications (and broader information technology) investment to continue to boom in 1999 and 2000, even as credit spreads widened.

Unlike the growth in computer investment, which consistently boosted growth throughout the late-1990s and boosted productivity growth, the telecommunications bubble played a much smaller role in supporting productivity growth. Of Oliner and Sichel (2000)’s estimate that information technology capital deepening boosted labor productivity by 0.45 percentage points in the late-1990s, only 0.05 percentage points came from telecommunications.

Today, the outlook for fixed investment is mixed, and highly dependent on the policy trajectory. While GDP growth was strong in Q3 and Q4 2023, the fixed investment picture is mixed. On one hand, fixed investment in areas supported by fiscal policies (such as Computer Equipment, from CHIPS, or Electrical Power Structures, from IRA) have proven resilient. On the other hand, other areas of investment appear to be held back by tight monetary policy. Worryingly, real investment in research and development declined in the last two quarters of 2023. To support the three-legged stool of productivity growth, the economy needs fixed investment. Choosing the right mix of monetary policy accommodation and industrial-level policies to support will determine the success of policy.

(1) In the same issue of the Journal of Economic Perspectives, Gordon (2000) argued that the contribution of computers to technology growth is far less impressive. As Oliner and Sichel (2000) point out, Gordon’s argument is based on interpreting a large portion of the 1990s productivity boom as explained by cyclical factors, and is more focused on the implications of computers for trend productivity. Since our focus in this piece is on productivity as a cyclical phenomenon itself, we consider the interpretation by Oliner and Sichel (2000) as the relevant lens through which to view the data.