This is the first chapter of “The Dream of the 90's is Alive in 2024: How Policy Can Revive Productivity Growth,” a new research report from Employ America. "The Dream of the 90's" examines the macroeconomic conditions that led to strong growth in the late-1990s and what policies can revive that productivity growth today.

The last major productivity gains in the US economy happened in the 1990s. We have the opportunity today to recreate some of the dynamics that produced those sustained productivity gains. To restore this productivity growth today, policy should focus on the core drivers of 1990s measured productivity growth: a mature labor market, a fixed investment boom, and a stable supply of essential commodities and services. Each of these dynamics should be reinforced using the relevant fiscal, monetary, and industrial-level policy tools. Failure to do so risks abandoning strong growth, a more resilient economy, and sustained wage growth.

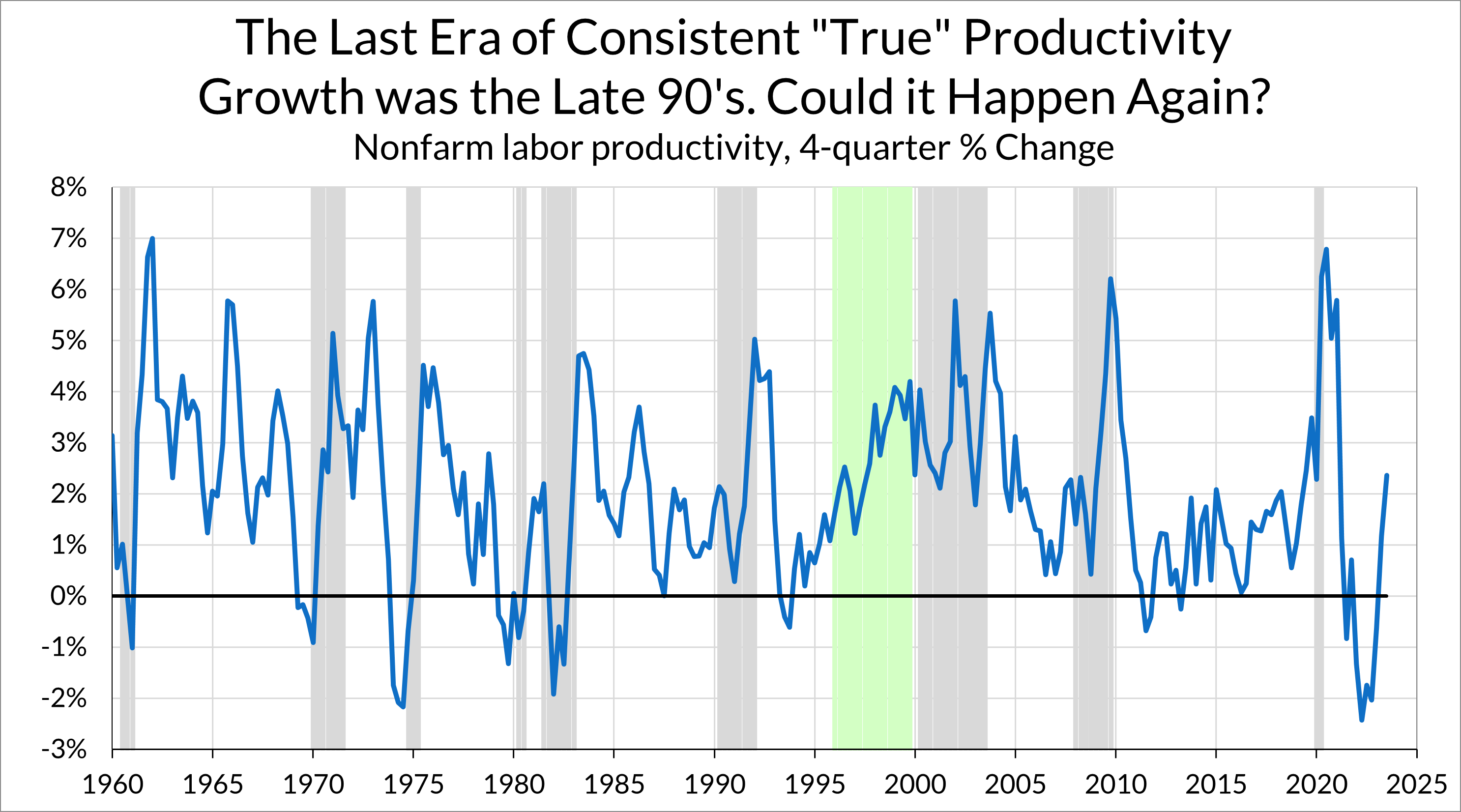

Despite recession worries, the 2023 economy outperformed. One of the biggest surprises last year was the remarkably strong growth in real output and productivity. Against headwinds from rising interest rates, real GDP grew at a steady rate of just over 3% during 2023. Labor productivity, which had disappointed in 2022, made a significant comeback in 2023. Output per hour in the nonfarm business sector grew by 2.7% in 2023, substantially above the 2010s average of 1.1%, and a substantial turnaround from the 2% contraction in productivity in 2022. Many policymakers and commentators reflexively credit this productivity growth to the latest technological developments, such as artificial intelligence to GLP-1 agonists. However, a more detailed and data-driven view, tells us that—at least so far—the causes of the 2023 productivity rebound are more like those which drove the 1990s boom instead.

Will this pace of productivity growth continue, or will we return to the slow growth of recent years? The 2010s were a decade of low productivity and GDP growth. It is tremendously important that we avoid that same fate today as the pandemic recedes.

Productivity growth provides the foundation for sustainable wage growth and long-term improvements in living standards. The first chapter of the most recent Economic Report of the President is devoted to policies designed to promote growth. Chicago Fed President Austan Goolsbee says that continuing to see high productivity growth rates “would be one of the greatest developments ever.”

The Three Drivers of Productivity

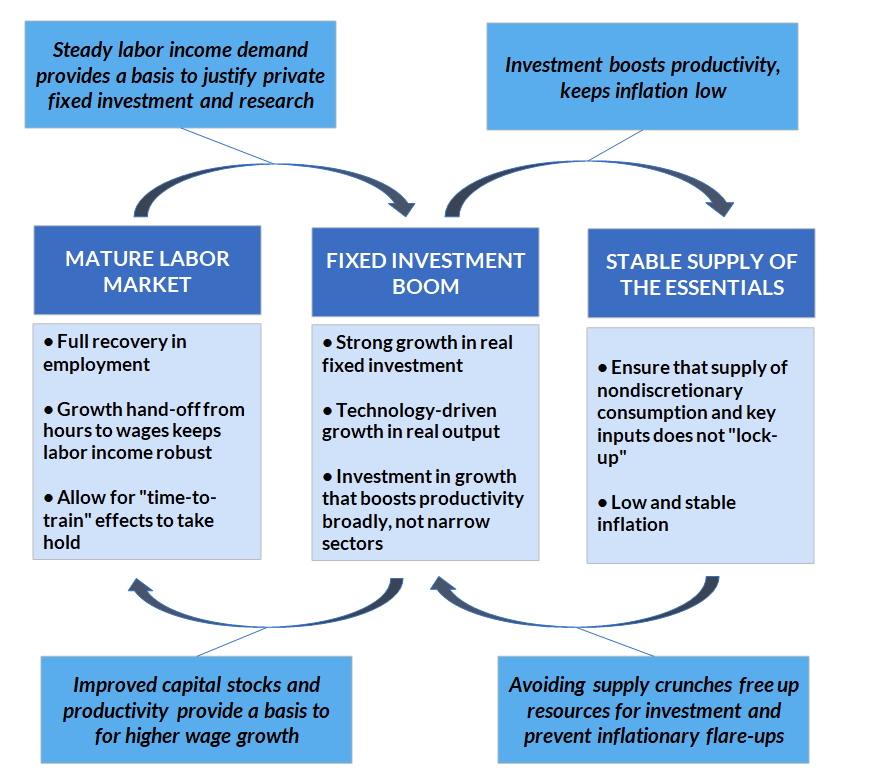

We don’t know with certainty whether the coming years will once again bring strong productivity growth. But that doesn’t mean productivity growth is determined simply by luck and random technological developments that policymakers will need to simply react to. In this report, we argue that the lessons of the past—particularly the 1990s—show that productivity growth is the result of three particular macroeconomic conditions that foster an environment conducive to productivity growth:

- A mature labor market: During a recovery, workers return to employment and move to better jobs. After a period of getting accustomed to these new jobs, output per hour increases. As the labor market reaches full employment, “job-driven” growth transitions to “wage-driven” growth, supporting consumer demand.

- A fixed investment boom: led by strong consumer demand and accommodative financing conditions, businesses invest in expanding equipment, supplies, and intangible capital which leads to increased productivity and improved price-to-quality ratios.

- A stable supply of “the essentials”: Low and stable inflation in non-discretionary consumables (such as food, energy, housing and healthcare) subdues broader inflation and creates budgetary space for increased discretionary goods and services spending, supporting the fixed-investment boom.

These dynamics are mutually-reinforcing. When job gains taper off, as they do after employment recovers, strong wage growth keeps labor income growth robust. This in turn keeps consumer demand strong, validating past investment while encouraging further development of the capital stock and technological base. Capital deepening promotes labor productivity and provides a basis for stronger wage growth. Investment in the supply of non-discretionary consumption can improve price stability in those sectors.

Party Like It’s Nineteen-Ninety-Something

To understand how policy can foster the conditions that lead to productivity growth, we will look at the most recent episode of sustained productivity growth: the late 1990s. From there, we can come to a clearer understanding of what policies need to be enacted to repeat that experience.

Productivity is a tricky metric to really understand. The way that productivity is measured means that productivity is reported to increase during recessions, when businesses are doing poorly and often actively slowing down or curtailing production. When employment goes down quickly, and output takes longer to go down, measured productivity increases quickly and mechanically. Outside of these spurious “productive recessions,” productivity growth has largely been stuck since the 1990s.

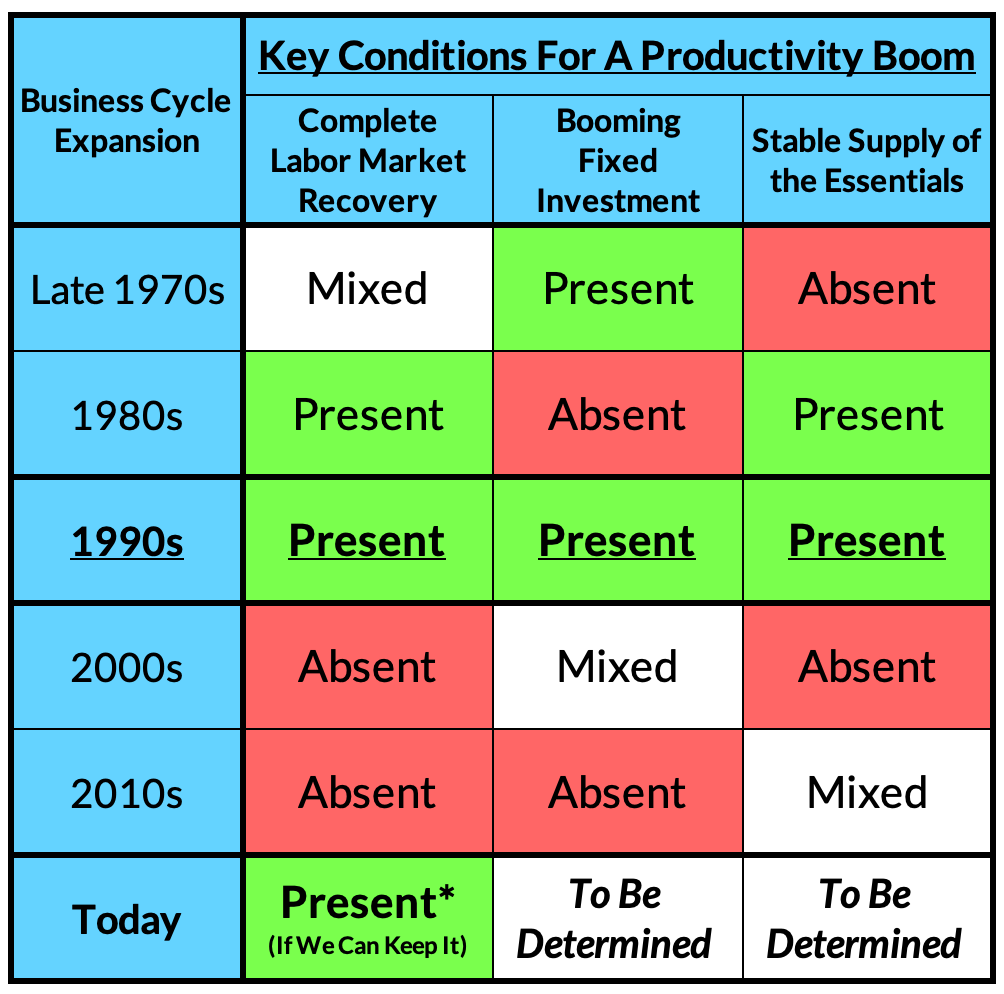

The high productivity growth in the late-1990s was made possible by a unique confluence of conditions. While other recoveries before and after the 1990s met some (but not all) of the three drivers of productivity growth, what made the late-1990s so special was the fact that the U.S. economy experienced all three conditions of a full and sustained labor market recovery, a fixed investment boom, and a steady supply-side.

After the recession of 1990, prime-age employment rates regained their pre-recession highs by 1995 and continued to climb further. Employment rates peaked at the end of the decade, with prime-age employment reaching its highest-ever recorded value of 81.9% in April, 2000. In the late-1990s, job growth handed-off to wage growth as the pace of job growth slowed (but remained positive) and wage growth accelerated.

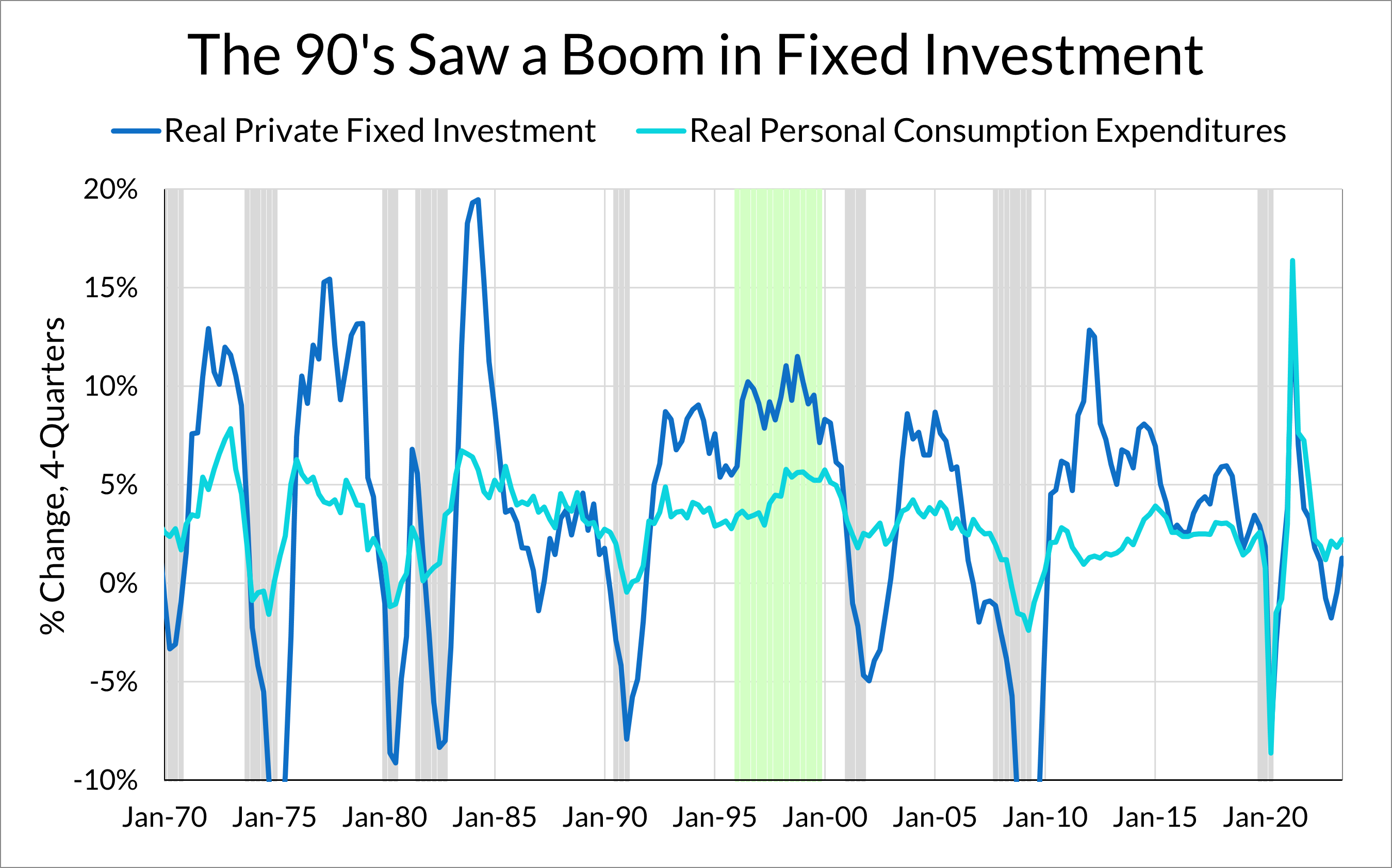

In the late-1990s, growth in real private fixed investment boomed. This investment boom was in large part driven by rapid quality improvements in computer equipment and software. These quality improvements appeared in the national statistics as a decline in the price index for those investment components, leading to substantial real growth in investment without requiring a commensurate increase in nominal investment. The widespread usage of computers also led to improvements in growth across the broader economy.

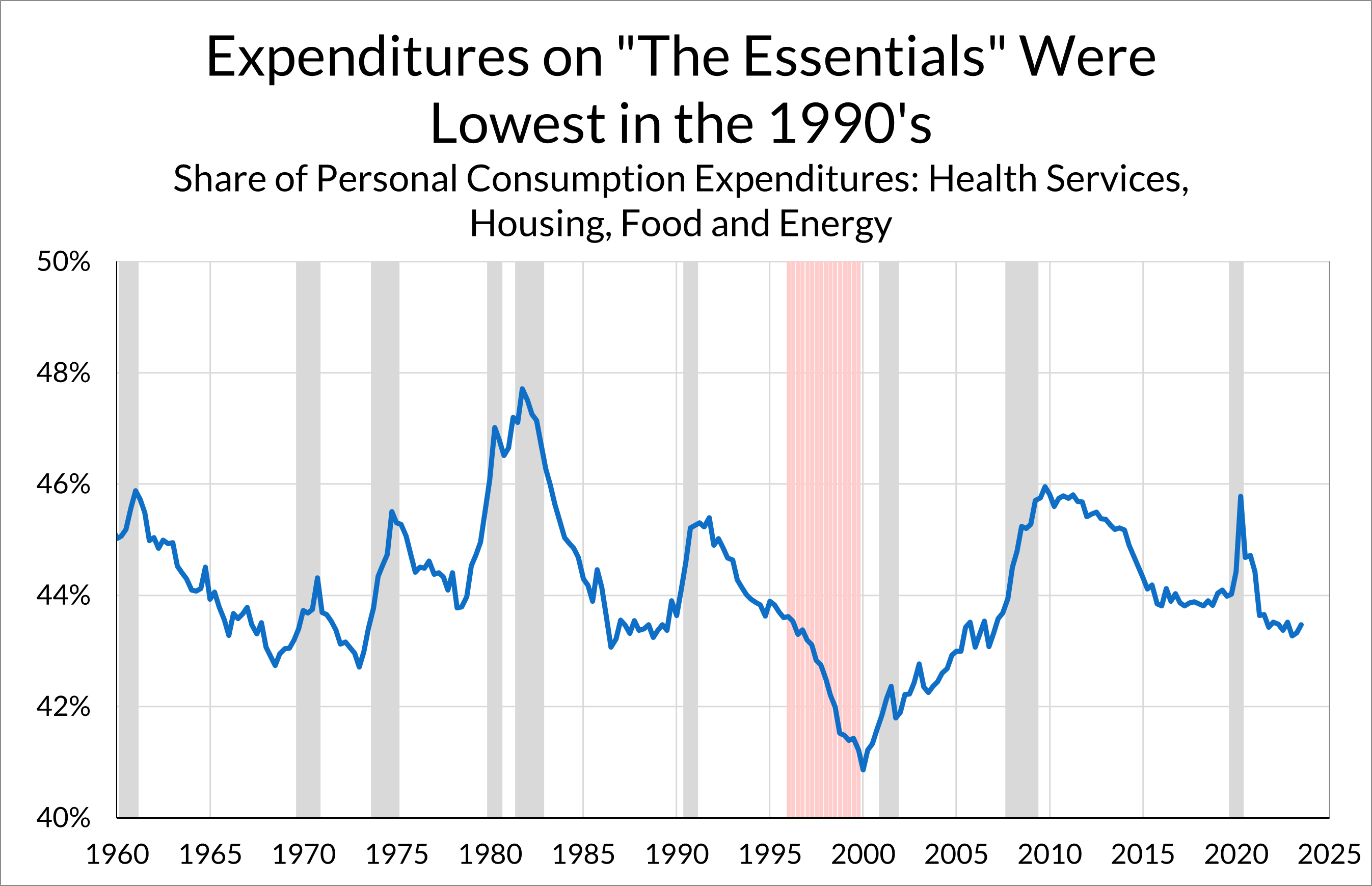

Finally, the 1990s were fortunate enough to avoid substantial supply disruptions in food and energy. Luck played an important role here; the American consumer benefited from the Asian financial crisis in the form of lower import and commodity prices. This fortune, combined with low rates of health services and rent inflation meant that the 1990s saw the lowest share of personal consumption expenditures going to food, energy, health, and shelter in the last 75 years.

Other recoveries did not share the experience, due to missing one or more of the three drivers of productivity growth. The 1980s, for example, did not see a boom in fixed investment, due to tight monetary policy. The sluggish 2010s labor market recovery from the Global Financial Crisis was so sluggish it failed to regain its pre-recession level of prime-age employment until the end of the decade. The 1970s and 2000s were afflicted with energy shocks.

Productivity Growth is a Choice

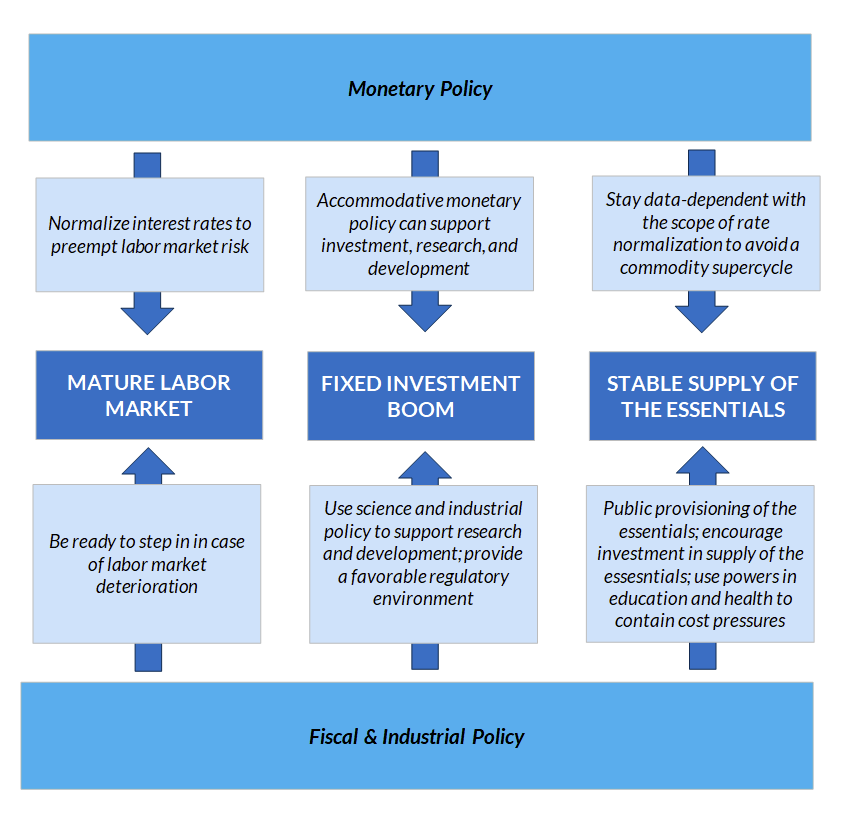

What has to happen for the economy to return to a period of strong productivity growth? To restore 1990s-style productivity growth today, policy should encourage the core drivers of productivity growth: a mature labor market, a fixed investment boom, and a stable supply of essential commodities and services. We have the opportunity to recreate the positive productivity dynamics of the 1990s, as long as fiscal, monetary, and industrial-level policies provide smart support to the economy. Continued productivity growth is possible, and it depends on enacting sufficiently supportive monetary, fiscal, and industrial-level policies. Strong productivity growth is not just something to hope for; it is a goal that policymakers can actively aim for.

Things look good for the first driver, a mature labor market. The labor market has fully recovered thanks to the strength of the post-pandemic recovery and the support of fiscal and monetary policy. As churn slows and workers develop experience in their current jobs, a maturing labor market will likely continue to support higher productivity growth. This will likely become a stronger force as we move away from the “early innings” of the recovery. However, consolidating and expanding these gains will require policymakers to preempt any downside labor market risks.

For the second driver, a fixed investment boom, the recovery has not been as remarkable as that in the labor market. This is not all bad news though, as this room to run provides further runway for this productivity-enhancing dynamic. As it stands, tight monetary policy appears to be slowing investment growth. Despite this, fiscal supports are helping to keep investment into energy and manufacturing construction on a firmer trajectory. If the Fed is generous in its approach to interest rate normalization, a boom in fixed investment may well be possible without overheating consumption (or inflation).

As to the last driver, a stable supply of the essentials, the economy is in a bit of a tricky spot right now, and would benefit from more policy attention. Pandemic supply chain disruptions and commodity price spikes—which the 1990s economy was lucky to avoid—have shown how important it is to maintain a stable supply of basic goods. The energy transition in particular is an elephant in the room. We at Employ America have proposed and helped implement approaches to ensuring the cost of energy goods and services remains appropriately affordable and stable by using the Strategic Petroleum Reserve. At the same time, public provisioning of inventory and storage in critical minerals such as lithium can help manage commodity market volatility, spurring private investment in more energy infrastructure. Finally, good public options for certain non-discretionary services, such as housing, healthcare, childcare, or home care, can help make sure prices remain structurally stable, rather than tracking directly with rising wages.

The next three chapters of this piece will examine the 1990s through the lens of each of these three key drivers of productivity growth. As we will demonstrate, the 1990s experience of full employment, a fixed investment boom, and a steady supply-side was partly due to policy, and partly due to luck. At the end, we will assess where we stand today with respect to each condition, and what policies can be brought to bear to ensure that each leg of the productivity stool is sound.

The core lesson is clear: We should not simply rely on luck to bring another era of productivity growth; policy must be proactive in securing all three of these necessary ingredients for another productivity boom.