Summary

Since the passage of the Inflation Reduction Act, efforts to secure the supply of energy transition commodities have intensified considerably. The Biden Administration has announced prizes, funding for research and development initiatives, and loans for recovery projects to improve the U.S. supply chain for critical minerals. Other advanced economies are taking action: Canada has announced an ambitious critical minerals strategy and the European Union briefly considered stockpiling critical minerals. These activities are at least partially a response to China’s aggressive strategy and continued dominance in the supply chain. Recently, the US and allied nations have floated the idea of a “buyers club” to secure supply of critical minerals.

Across nations, the agency or agencies tasked with executing the obligations such a club would have a number of design questions to answer including what products to target, how to price the products, and how to match government authorities to the financial realities of commodity markets. We consider these questions in a continuation of our Contingent Supply series, exploring how a critical minerals club (and the executing agencies of member governments) could undertake our SPR approach to boosting production of a highly volatile commodity, lithium. The boom and bust cycles of lithium investment and mine development have helped drive shortages and ultimately, hindered the transition to green energy. This piece will describe why building storage capacity for spodumene, a key lithium precursor, is the right approach for a U.S.-led critical minerals club.

Overview

The speed of the news cycle on global efforts to secure critical minerals is breathtaking. The US and several allies are considering a critical minerals club to “rely less on China,” while the major lithium producers of Latin America are considering an “OPEC for lithium,” all while China continues to pursue an aggressive strategy to maintain supply chain dominance. We recently wrote about how the Biden Administration could use the Indo Pacific Economic Framework (IPEF) to secure the critical minerals supply chain by de-risking investment for producers such that they are protected from the harmful downturns that have afflicted commodity markets over the past few decades. Expanding beyond IPEF to include more nations would be worthwhile, as the rich mineral deposits in Latin America, coupled with purchasing power from the EU would form a powerful market-shaping bloc of nations.

Concerted action among major purchasers (US, EU, Japan, India) and producers (Australia, Canada, Brazil, Chile, Indonesia, Philippines) could help build an international bloc capable of mitigating price volatility, while limiting the ability for any single actor to dominate the supply chain. However, the markets for several critical minerals are underdeveloped and lack the mechanisms for producers to effectively hedge their production, particularly compared to more mature commodities, like crude oil.

Since at least the 1980s, the crude market has been strengthened and deepened by the ability for producers to hedge price risk (through liquid benchmarks like West Texas Intermediate), increasing access to finance for new exploration and production, while crowding in investment from the financial sector. Of course, even in the crude oil market, good public policy could strengthen the dynamics in the oil market, by utilizing the purchasing power and storage capacity of a public asset like the Strategic Petroleum Reserve to create more affordable hedging options and to weather price volatility. This was the animating principle behind Employ America’s proposal to boost domestic oil production. Should nations establish a critical minerals club, they should prioritize building similar capabilities over time.

Doing so would require two key actions by governments: (1) building the warehousing capacity necessary to weather price volatility and for new benchmarks to trade at high volumes; and (2) supporting the development of market benchmarks for acquisition contracts and hedging instruments like puts or forward for critical minerals. This piece will focus on the first, specifically on how a buyers club should focus a lithium reserve strategy on spodumene.

The Importance of Reserves and Selecting the Right Product to Store

Building storage reserves is a crucial component of any commodities resilience effort. From an economic resilience and national security perspective, reserves allow nations to protect themselves against supply disruptions, the foremost purpose of the petroleum reserves set up after the creation of the International Energy Agency, including the Strategic Petroleum Reserve. But beyond protection against a disruption, the ability to take in and store excess product to prevent a price crash and alternatively, to release product to the market as prices rise, can help mitigate the supercycle dynamics typical to commodities. The prevention of these crashes ultimately provides an important incentive to the marginal explorer and producer to invest, keeping the level of investment from falling sharply.

However, storing commodities is a complicated endeavor. They occur naturally in different forms and grades and are extracted with wildly different chemical properties, all dictating different storage requirements that vary in cost and complexity. This complicates any effective hedging strategy. An analogy can be drawn from the oil market: crude is a precursor for major oil products, from jet fuel to diesel and nations typically hold crude in reserves because it can be stored in large quantities for long periods of time without substantial degradation. By comparison, refined products like diesel or gasoline deteriorate quickly. Of course, storing crude rather than refined products creates challenges too—insufficient refining capacity can contribute to refined products shortages, which tend to fall more narrowly on end consumers. In the end however, the oil market has settled on a system that holds the more stable precursor in long-term storage, and lithium storage could justifiably follow a similar track.

Spodumene Could Be the “Crude” of Lithium

“Lithium” is not a singular product, but a whole class of chemical compounds that include the base element–many of which are used for different functions and purposes. For example, lithium carbonate (Li2CO3) is used for lithium iron phosphate batteries, while lithium hydroxide is used for nickel-manganese-cobalt (“NMC”) chemistries. Spodumene, a lithium precursor, is the most analogous to crude, and can be processed into numerous chemical compounds necessary for the energy transition. Spodumene has several advantages for storage over other lithium compounds: (1) it can be more easily and affordably stored; (2) its relative simplicity in grades (compared to other lithium compounds) makes it easier to trade in higher volumes; and (3) it has a short production cycle.

First, compared to other lithium compounds that must be kept dry or are inherently more dangerous, spodumene is relatively simple to store, and relatively lower in complexity and cost. A storage facility was built in Western Australia for approximately $17mm, with a direct conveyer connection to the Port of Bunbury and over 55,000 tonnes of bulk storage space. Though costs would certainly vary project to project, storing a market surplus of 300,000 tonnes of spodumene could reasonably cost less than $250mm. According to our calculations, this scale of storage could be enough spodumene to fulfill the lithium carbonate needs for nearly 2.8 million electric vehicles (assuming 50kwh packs and 850g of lithium carbonate per kwh).

A storage facility of that size would have been sufficient to weather the supply glut and price crash that followed a dramatic downscaling of EV subsidies in China. During that episode, Chinese lithium chemical refiners frequently defaulted on existing contracts, which left a number of miners with inventories they could not sell and substantial debts. This led to a predictable wave of bankruptcies and loss of knowledge and impairment of capital among producers.

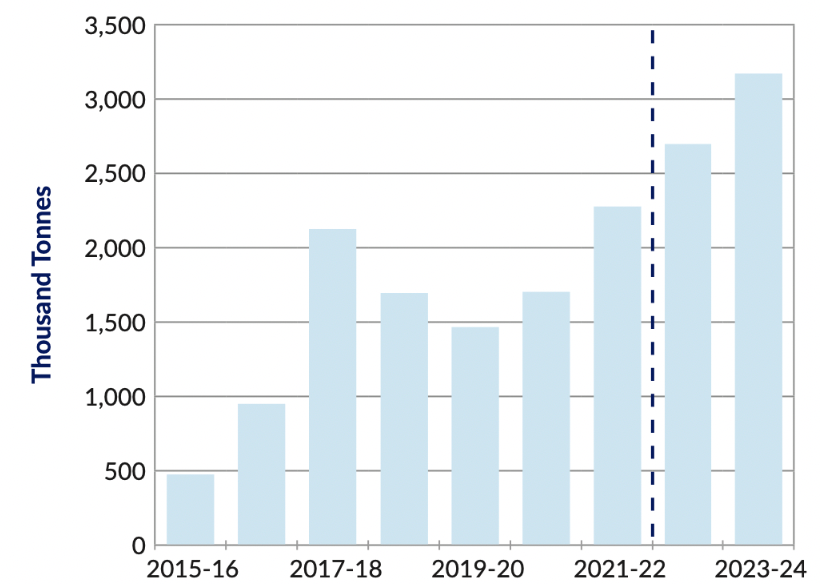

In that downturn, the “swing producers” for lithium were spodumene producers. Alliance Minerals closed in late 2019, North American Lithium and Nemaska went bankrupt and Altura was acquired and then put on care and maintenance by Pilbara Minerals. Had those assets not shut down when spot price levels for spodumene fell to $400 per tonne, we might not be facing the same degree of price pressures and shortages in lithium that we see today. The downturn and resulting output cuts of 2018-2020 can be seen below in Australian exports.

Second, compared with spodumene, storage for refined lithium products is complicated by the vast differences in grades among finished and intermediate products and the difficulty in pricing these differences. As Wood Mackenzie recently stated in a report:

“We predict that 2023 will see a rising number of formulae being used in pricing both the finished lithium chemicals and the intermediate products, including the potential production of lithium sulphate. The clarity people seek will not emerge in 2023, and it will likely be several years before we will observe any commonality.”

This dramatically impairs the ability for investors, producers, and policymakers alike to design an effective hedging strategy for lithium chemicals. The range of purities and grades is as wide as the split in end products, depending on battery chemistry. Though future carbonate and hydroxide markets may develop, they are likely to be complicated by these grade and purity differences.

Finally, in the context of the critical minerals club attempting to boost production, it makes sense to target minerals that are short-cycle. Short-cycle minerals are ones where production can be dialed up and down with relative ease, and where the marginal cost of production is lower. Again, oil offers a useful model. Structuring the program around shorter-cycle assets, like shale – where crude oil can be tapped within as little as three months – rather than longer-cycle assets such as offshore – which are harder to turn on or off, and less likely to be responsive to the scope of a hedging program – makes this public hedging strategy more likely to be successful .

Spodumene has clear advantages from this perspective. Spodumene mines are relatively quick to build, taking two to three years after permitting is complete. The production of the concentrate is relatively cheap. Capital expenditure budgets for spodumene mines, particularly outside of Australia or Canada are very low, as low as $800-$1200 per tonne of spodumene production per annum (compared to spot prices around $6,000 per tonne).

Conclusion

Focusing a lithium reserve strategy on spodumene would make a lot of sense for a US-led critical minerals club. Spodumene is plentiful in the United States (in North Carolina) and among major U.S. allies including Australia, Canada, and Brazil. It can be stored safely and economically compared to other lithium chemicals, and its short-cycle production makes it easier to dial up and down based on the markets. Our next piece will focus on the logistics and decision choices that would entail building the storage facilities themselves.