See here for the Fedspeak Archive.

Powell's Jackson Hole speech made clear that rate cuts will begin in September. The two key, powerful statements from Powell were:

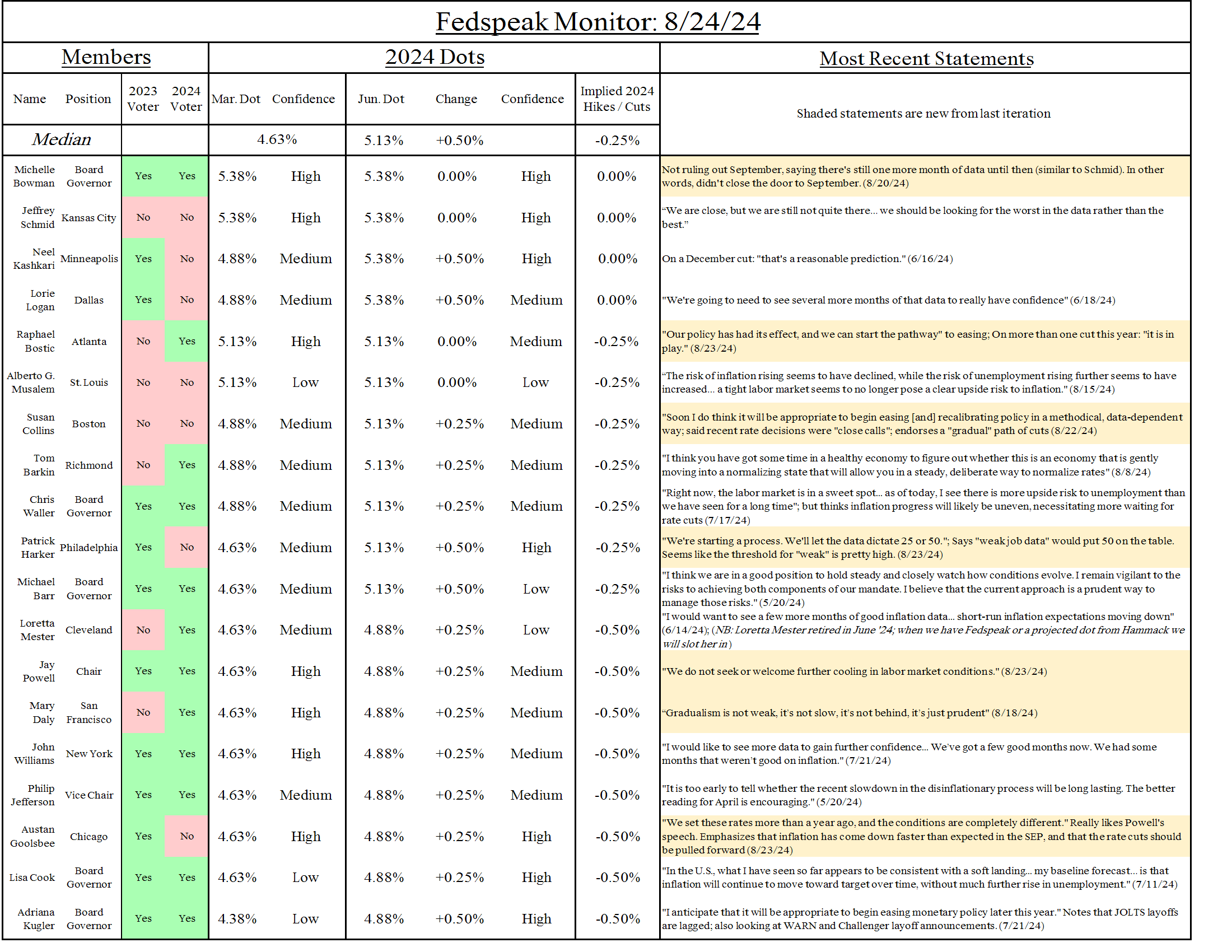

- "We do not seek or welcome further cooling in labor market conditions."

- "We will do everything we can to support a strong labor market as we make further progress toward price stability."

Most notable what he did not say: "gradual." Powell is keeping the door open to a larger cut in September. This stands in contrast to comments from other committee members this week that they want to see a gradual pace of cuts:

- Daly: "Gradualism is not weak, it’s not slow, it’s not behind, it’s just prudent"

- Goolsbee: Favors a "gradual" pace of cuts

- Collins: "soon I do think it will be appropriate to begin easing [and] recalibrating policy in a methodical, data-dependent way."

- Harker: says business leaders want the process to be done "methodically" and signaled in advance.

Those comments were made prior to Powell's speech. Post-Powell, Goolsbee played coy but he's clearly very happy with Powell's speech. On the pace of rate cuts, he points to the SEP: the Committee has already said there should be multiple cuts over the next 12-24 months, and inflation has come down faster than projected in the SEP. The natural implication is that those rate cuts would be pulled forward. Harker thinks 50 is a possibility but only if the labor market data next month looks bad.

Other Fedspeak: the two most hawkish members, Bowman and Schmid, opened the door to September, but are not yet convinced. Bostic is on board for September and open to multiple cuts this year, saying inflation has come down faster than he expected. His tone on both inflation and unemployment has changed quite a bit over the last month.

Finally: A widely-circulated comment from Harker seemed to indicate that he sees unemployment rising to "just below" 5%; this seems to be a misrepresentation of his actual views, which are that unemployment would rise to "somewhere" below 5%, and "that's what we predicted", suggesting that his views on the unemployment rate trajectory hasn't actually changed that much. Still, Harker has been on the higher side of unemployment projections on the committee.