Refer to the Fedspeak Monitor page for past Fedspeak.

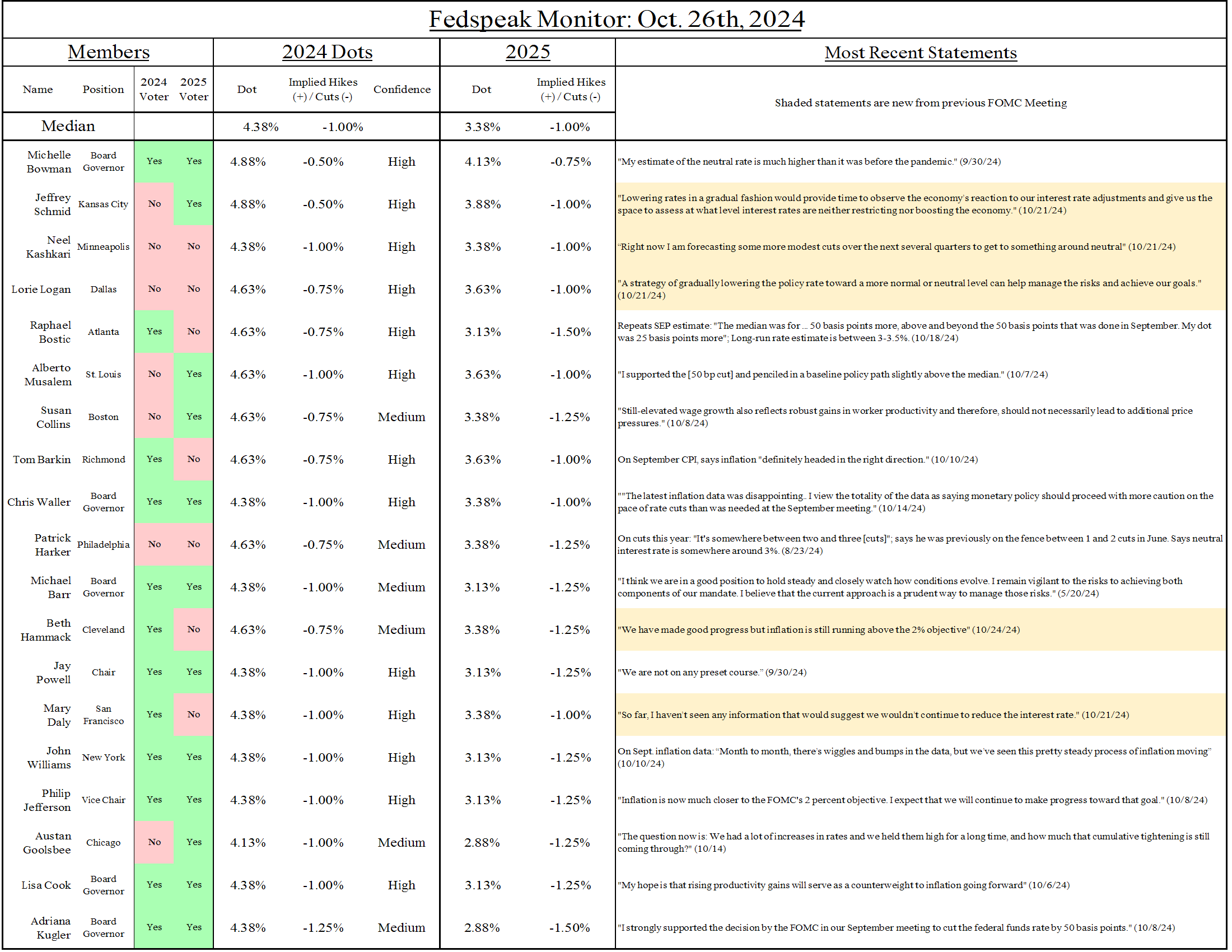

This is the last chance for Fedspeak before the pre-November meeting blackout period. This week we mostly heard from the hawkish side of the committee, all of whom are emphasizing a gradual path of rate cuts:

- Shmid: "Lowering rates in a gradual fashion would provide time to observe the economy"

- Kashkari: "Right now I am forecasting some more modest cuts over the next several quarters."

- Logan: "A strategy of gradually lowering the policy rate... can help manage the risks and achieve our goals"

We heard from Hammack for the first time, but she didn't say much ("We have made good progress but inflation is still running above the 2% objective"). Daly suggests we press onwards with rate cuts: "I haven't seen any information that would suggest we wouldn't continue to reduce the interest rate."

Between now and the FOMC meeting we'll get another round of jobs data—which will come with an extra layer of uncertainty with hurricane and Boeing strike effects—and the election. Over the last few weeks, Committee members have expressed concern over the speed of rate cuts and doing a full 100 bp this year, but there has been little active talk of a pause in November. The base case for November is a 25 bp cut, but December is looking uncertain.