What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

By Alex Williams

Inflation readings have played a major role in policy discourse throughout 2021, with different groups reading different things from the same data. In all cases, there has been a general tendency to overreact to one-off movements in data either directions, especially those that are later subject to substantial revision. As the year ends, the final three inflation prints are more likely to be on the hotter side of what policymakers are comfortable with, especially due to developments in motor vehicle and air travel prices. However, it’s worth asking whether these hot prints actually tell us anything about the likely path of inflation in 2022.

Much of the elevated inflation in the near-term is already baked in through dynamics that have been well-identified through the course of the pandemic. As the recovery proceeds and industries return to normal, inflation at such elevated readings will require that the current pandemic-related dynamics and bottlenecks persist for much longer than currently foreseen, or that new inflationary dynamics emerge. The expectation that new inflation pressures will necessarily arise is not a firm basis for initiating a financial tightening cycle, and commentators should be careful not to read too much into hotter prints.

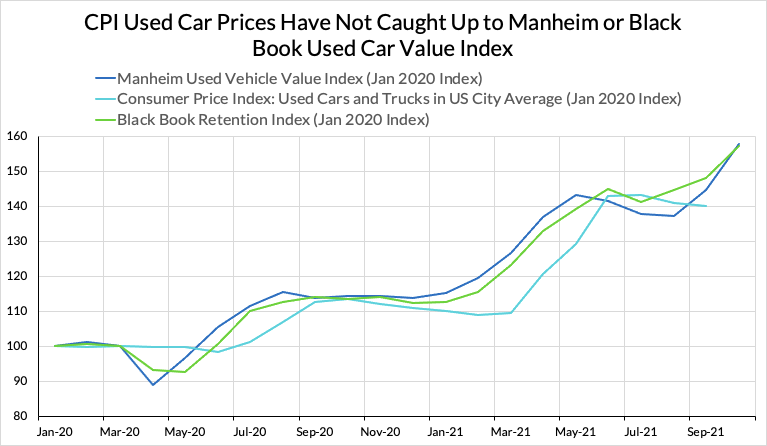

The first well-identified pandemic inflation dynamic is in used cars. Private indicators have led CPI readings by 2-3 months throughout the pandemic, and these indicators are showing a steep increase in used car prices in the coming months, suggesting a stronger set of CPI print, as early as this week’s.

High used car prices have been driven by a confluence of factors. At the beginning of the pandemic, many rental car companies sold off their fleets, providing the drop in prices we see in the early months of the pandemic above. As reopening progressed, these companies had to buy back whole fleets in order to respond to spiking demand for car rentals. However, in 2022, much of this dynamic should roll off as fleets will largely be rebuilt.

The semiconductor shortage, by disrupting the pipeline of new vehicle production, also added a further source of demand for used cars. With new vehicles either unavailable or experiencing price spikes of their own, some would-be buyers of new cars turned to the used car markets. While the semiconductor shortage has proved tremendously disruptive to a wide array of industries, automotive manufacturers have begun revising projections as the shortage abates into 2022.

At the same time, the strong household balance sheets created by the fiscal response to the pandemic interrupted a key source of supply for used cars: repossession from owners in default. It would take a particular kind of callousness to argue that higher inflation in used car prices today is not worth helping households to make their car payments over the duration of the pandemic. As elevated demand rolls off, supply-side problems will likely play less of a role.

Another key industry to watch for its impact on inflation in the near term is air travel.

Consumer Price Index measurements of airfares remain below Producer Price Index measurements. At the same time, demand for air travel has increased, as evidenced by the recovery in load factor, which is designed to proxy something like the percentage of filled seats on US passenger flights. As demand rises, fares should move towards their pre-pandemic level, especially with today’s pressure on jet fuel prices. Taken together, these dynamics suggest that a return to pre-pandemic level capacity utilization and producer prices will drive a return to pre-pandemic fare pricing and boost near-term inflation. However, given the ongoing uncertainty over the pandemic - especially in high-price business travel - it is unclear the role air travel will play in driving inflation in 2022.

Without digging too far into other dynamics - the role of port disruptions may fade as the rush to ship goods before the Christmas holiday ends - it is worth asking whether hot inflation prints over the next few months tell us anything useful about inflation in 2022. Some stickier price dynamics do have high informational relevance to 2022 (month-over-month) inflation readings, like the faster recovery in rent and owners’ equivalent rent.

Given the fact that these strong prints could be substantially driven by specific disruptions that are steadily abating as the pandemic recovery proceeds, there is reason to be cautious of crude extrapolation. Some automakers are finally starting to get their chips, while others are building cars that don’t need as many, rental car companies are getting closer to normalizing their fleets, and are holding onto rental cars just a little bit longer.