Retail sales showed strength in January. As a proxy for gross labor income trends, it confirms both (1) the resilience we're seeing in the labor market and (2) the amplified role of residual seasonality (December understates growth, January overstates/rebounds). Real-time data-watching was already complicated enough due to aggressive base effects distorting year-over-year comparisons (Omicron was only last Jan/Feb). But short-term (e.g. 3-month) annualized rates aren't much of a remedy when seasonal adjustment is less reliable. The way forward? Try to take a quarterly view (3-month moving average) and compare relative to what we saw in previous quarterly periods.

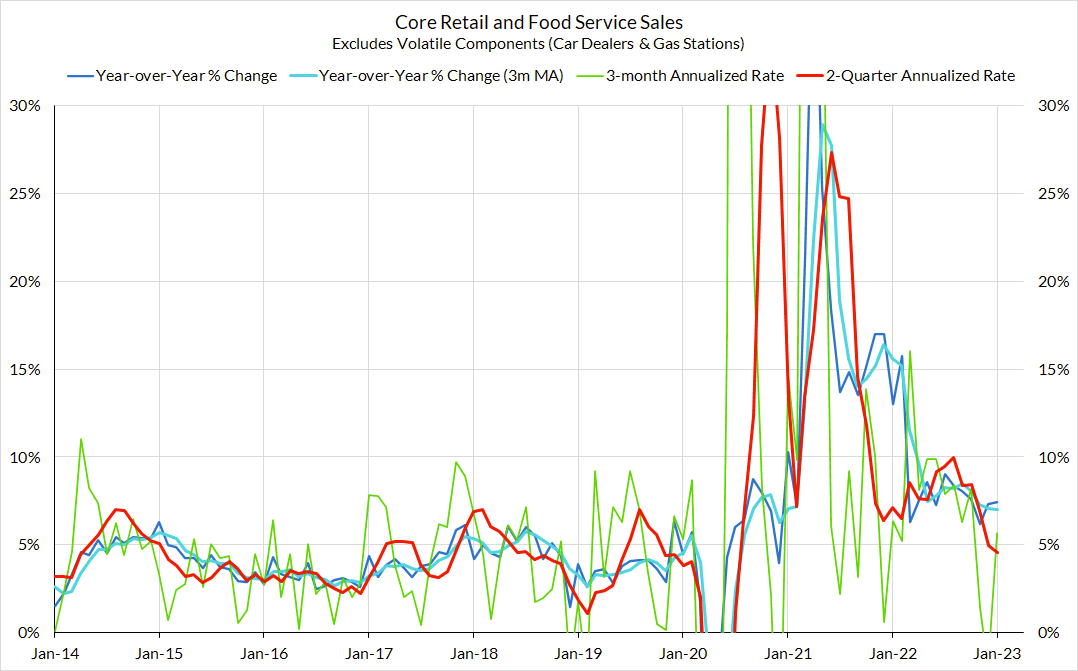

Right now it still shows a normalization of spending growth—a slowdown from a breakneck pace of spending (associated w/ reopening the economy), but hardly the stuff of recession either. Whereas year-over-year growth rates are still running at 7-7.5%, the 2-quarter annualized rate of core retail sales growth is 4.6%, in line with what was observed pre-pandemic. While we would lean more on the latter, there is no inherent truth to one growth rate over another and the strength in January is a reason to stay open to the prospect of scenarios with stronger growth.

For those who were following the seasonal factors closely, a bounceback in (headline and core) retail sales in January was already on the cards. Today's release confirms that. Did consumer spending really take a nosedive in December only to miraculously resurrect itself in January? Probably not. Seasonal adjustment around this time of year is hard, especially as patterns between pre-pandemic and post-pandemic remain in flux.

On the other hand, the fact that we in fact did see a bounceback in headline and core retail sales should confirm underlying labor market strength and gross labor income growth. Such resilience may reflect even some reacceleration. That would have implications for how we think about Fed policy and inflation risks within our preferred monetary policy framework. If the income growth outlook is in fact strong and inflation risks remain elevated, the case for inducing additional financial conditions tightening is on sounder footing. But the trends right now are fuzzy and prudent to wait for more data (especially as we get beyond holiday season effects) before making that call. All of this data haze is all the more reason for the Fed to avoid strong guidance and take each interest rate decision one meeting at a time.