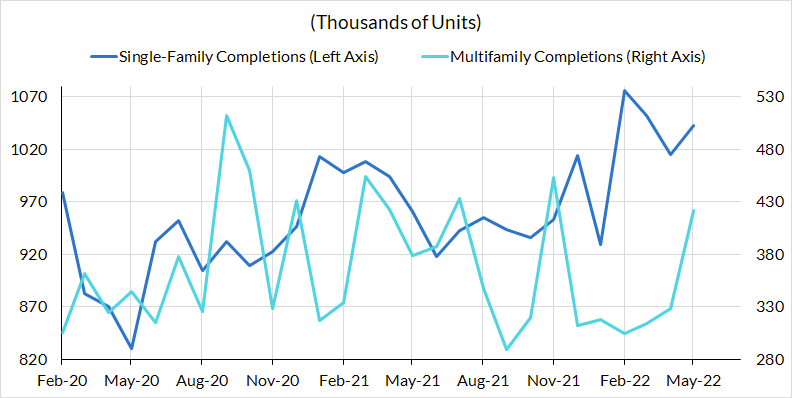

Just as housing unit completions began to pick up in May, the pipeline of new housing units has already begun to fade. Builders are getting rationally spooked by tighter financial conditions and its real economic implications. While higher mortgage rates reduce the demand for investment (a new housing structure), higher mortgage rates reduce the supply of consumable housing at the margin. To be clear, it is only consumable housing as a service that counts for inflation; the housing demand that the Fed directly cools is investment demand, not consumption demand.

Much of the attention on Fed tightening is about the relative judgment: how much can the Fed reduce demand relative to supply for the sake of achieving lower price inflation. Yet these relative judgments abstract from a harsher and more perverse reality: Fed tightening does not exclusively reduce demand; it weakens the supply-side in the process. If supply is to catch up to demand in key sectors without inflicting a serious loss of output and capacity, investment responses to current shortages need to be supported. The current policy mix actively harms those investment responses.

The Fed's current tightening campaign could still give rise to a variety of outcomes, including a disinflationary 'soft landing', a disinflationary recession, or, worst of all, a recession that still coincides with high inflation. But to understand the Fed's role in each of these scenarios, it's important to stay attentive to the causal mechanisms through which the Fed's policies affect the real economy.

The Fed's hikes can slow the demand-side through a few different channels, including lower employment, lower wages, lower consumption from would-be homeowners, and portfolio wealth effects. Supply-side channels are more routinely ignored due to erroneously assuming that the Fed neutrally "prints money", and thereby cannot have any effects on decisions to produce or expand capacity.

However, tighter Fed policy and financial conditions do have adverse effects on the supply-side. They directly raise the cost of funding fixed capital formation, risk intermediation, and inventory replenishment. While these effects are not the only ingredients relevant to supply-side responses, they do have meaningful marginal effects in identifiable cases. Congress and the White House should understand that leaning exclusively on Fed policy to tame inflation risks weaker employment, investment and capacity over time. If they want to avoid the collateral damage at stake right now, they should be considering policies that deliver more direct disinflationary assists and secure a more resilient investment trajectory in cyclically-sensitive commodities.

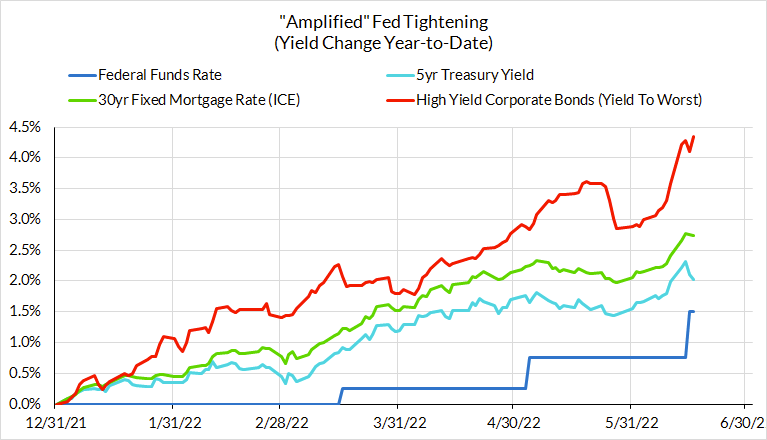

The Fed's actions reflect a concerted effort to raise long-term interest rates—by signaling faster future hikes—and interest rate volatility, as evidenced by their rapid pivot to a 75bp hike last week. These efforts have translated into amplified tightening of financial conditions. The Fed has increased its benchmark interest rate 150 basis points this year, but mortgage rates are up over 270 basis points, and high yield corporate bond yields are up 430 basis points, consistent with elevated risk of a recessionary default cycle. This is what we mean by "amplified Fed tightening."

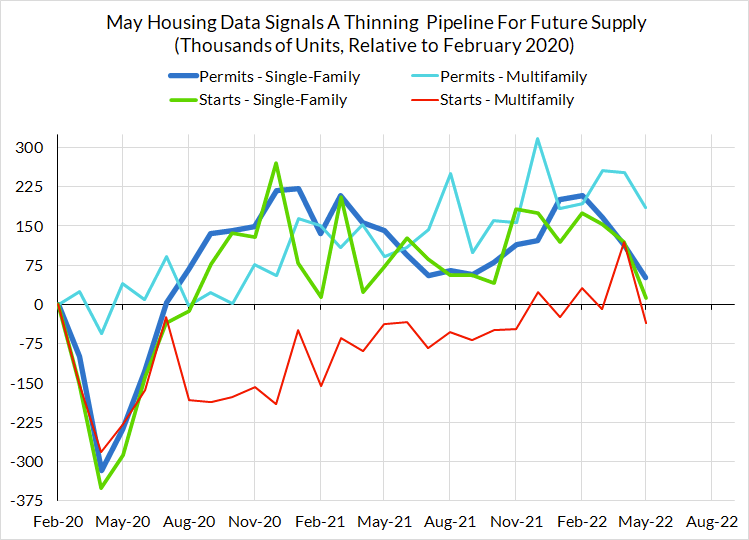

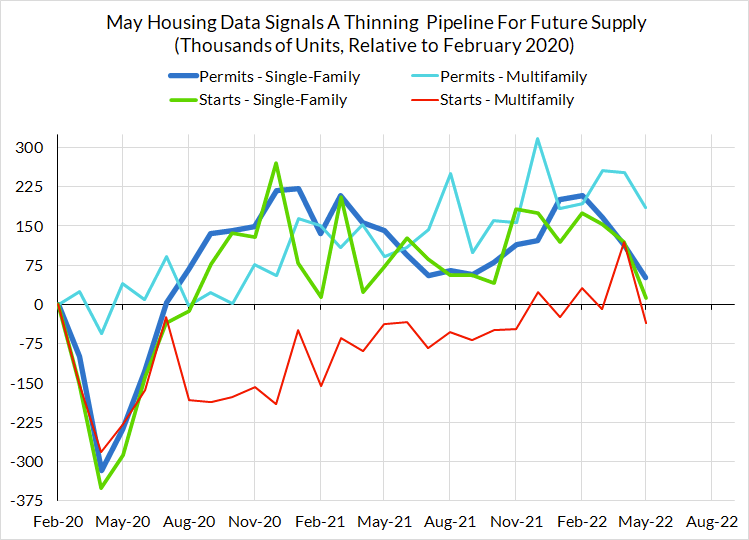

And these dynamics are not merely limited to financial markets; they have impacts on decisionmakers within the real economy. Homebuilders are clearly seeing the writing on the wall. As mortgage rates have gone up, the inclination to build new construction has tangibly fallen. Just look at the residential building permits and starts data. Builders seem to be pulling back on plan to build both single-family housing units and (more commonly rented) multifamily housing units.

The housing sector that has ben dealing with a bottlenecked and dysfunctional supply chain, and it is now likely to see a cooler supply chain. Yet for firms that decided to invest in raising capacity to meet elevated housing demand, they are more likely to be left holding the bag. One can only wonder if they will be as willing to raise investment the next time they see an increase in residential construction activity. They may simply stand pat on investment while riding high prices for as long as they might last.

The shame of it all is that we just saw nascent signs of improvement in terms of housing completions, after a sluggish start to the year.

The Fed, the White House, and Congress ought to be paying attention. The Fed's relative effect on demand over supply often get misconstrued into outright claims about the Fed's effects on the supply side ('The Fed can't do anything about supply-side problems'). Changes to risk-free rates interact with financing costs, capital budgeting decisions, inventory replenishment, and risk intermediation costs. That the supply-side effects are typically lower than the demand-side effects is not a reason to ignore them altogether. In the case of housing, they clearly are not negligible. Left to solve inflation on its own, the Fed will inflict collateral damage not just to employment and labor demand, but also to capital formation and investment demand. That will diminish the capacity to supply consumption goods and services in the future.

Taking these issues seriously would require greater emphasis on policies that help avoid the collateral damage to the supply-side that is already in train. We've been fairly prolific regarding what the White House could do to ensure a more elastic and resilient response from the US energy industry while still balancing against regulatory and climate interests. Comparable policies, with Congress' help, should be pursued to insure and accelerate investments tied to the housing supply chain and residential construction.

If supply is to catch up to demand, policy should be geared to avoiding active harm to the supply-side. The current policy mix falls well-short of that basic goal.