“You can take this as a sign of our commitment not to get behind.”

Jay Powell, Sept. 18th FOMC Press Conference

At today’s FOMC meeting, the Fed voted to cut the federal funds rate by 50 bps—a move usually reserved for recessions and crises. It was a decision that we predicted and supported. By a thin margin, the median projection of the Committee was for an additional 50 bps of cuts in 2024. In the press conference, Powell emphasized the Committee’s commitment to avoiding a recession and achieving a soft landing.

The outsized move and the tone of Powell’s comments demonstrate a change in the Committee’s attitude towards unemployment risk. In part this reflects a change in their assessment of where the economy is and how much the risks have shifted towards unemployment, but it also reflects a welcome change in the way the Fed is approaching risk management.

The Fed has grown far more concerned about unemployment risk than they were at previous meetings, perhaps more than they are willing to openly admit. In the September Summary of Economic Projections, Committee members generally see the unemployment rate headed somewhere between 4.2 to 4.5% by the end of this year and staying there throughout 2025. This is a substantially worse path than projected at the June meeting. Committee members will surely be aware that a scenario where the labor market just gets a little bit worse for a short period of time before rebounding is not something that has a lot of precedent in the historical record.

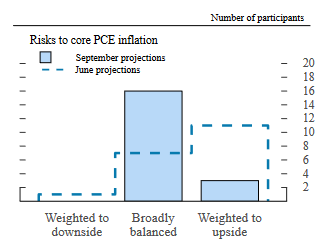

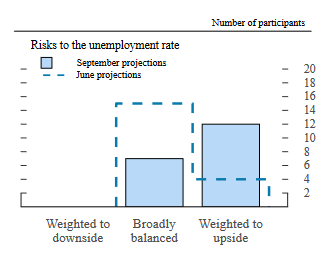

We can find confirmation of this buried deeper in the SEP, where members are asked about their assessment of the risks to economic variables. Right now 16 of the 19 members see the risks to core PCE inflation as balanced, while 12 see the risks to unemployment as tilted to the upside. Jay Powell might have said in the press conference that “we think they [the risks to unemployment and inflation] are roughly balanced”, but that seems more like a projection of confidence than an honest admission of where the risks currently are.

While today’s decision partly reflects a change in the assessment of the economy there is also some real break with the past here that should be celebrated. By deciding to begin the path to rate normalization with a larger cut up front, a move usually not seen outside of recessions or financial crises, the Fed has wisely decided to take defending full employment seriously. The outsized move demonstrates that they are willing to be proactive, not reactive, towards unemployment and recession risk.

“The time to support the labor market is when it’s strong, and not when you begin to see layoffs.”

Jay Powell, Sept. 18th FOMC Press Conference

The endorsement of preemption is a stark contrast not only to the Fed’s historical attitude towards labor market risk, but also a contrast to how Committee members were talking about risk management less a few months ago. For example, two months ago, San Francisco Fed President Mary Daly actively rejected preemptive action to preserve the labor market: "Preemptive action when urgency isn't required is actually where you make mistakes.”

Ultimately, the Fed made the right call today. After erring by failing to cut in July, breaking with past Fed behavior with a 50 bps cut despite not actively seeing a recession goes a long way towards signaling that they see unemployment risks on the horizon and are prepared to take them seriously. We’re not out of the woods yet—achieving the soft landing will require continued communication of the Fed’s commitment to the full employment side of their dual mandate and a willingness to deliver larger or quicker cuts if the labor market continues to soften.