"This year it will be difficult for us to take advantage of this low price…But we will continue to look for that low price into the future." - Secretary Jennifer Granholm on March 23, 2023

"We cannot sell and take in (crude oil) at the same time.” - Secretary Granholm on April 12, 2023

So goes the response to criticisms that DOE has not begun refilling the Strategic Petroleum Reserve, even as prices fall into President Biden’s refill range. But the Department of Energy can buy crude oil now for future physical delivery. Last year, it gave itself the ability to do just that through a fixed price contract that takes advantage of today’s relatively low prices.

The spot West Texas Intermediate crude oil price has returned back into the range ($67-$72) where the Biden Administration committed to repurchasing barrels for the Strategic Petroleum Reserve (SPR) back on October 18, 2022. Unfortunately, the Department of Energy (DOE) has shown precious-little intent to follow through on the White House’s commitments, routinely proving too unprepared at critical moments.

The DOE has trotted out the line that it cannot be buying crude oil while it is also selling crude oil (for Congressionally mandated reasons), but this is just flatly incorrect. The DOE specifically changed a regulation last year to make purchasing more nimble and flexible. With the new authority, the DOE can contractually repurchase (buy) crude oil now for delivery at a later date. That’s exactly what the DOE should be doing if crude oil prices stay durably in their current price range. DOE can buy crude oil now for physical delivery in late 2024, when Congressionally mandated sales are not an issue, and in a manner that aligns with any SPR maintenance constraints.

Energy market participants routinely engage in longer dated futures and forward contracts to physically sell and acquire crude oil. At just over 10% of the traded volumes of the most immediately available (and liquid) futures contract, the December 2024 futures contract for West Texas Intermediate crude oil is still routinely traded and should offer a sufficiently liquid point for the DOE to find a competitive offer. While DOE is not a market participant and is somewhat constrained, it has the flexibility to replicate market transactions. If the DOE is incapable of this–-even after a full six months since the President initiated his commitment—questions must be asked about DOE’s incompetence, or why it is wholly uninterested in carrying out a major presidential policy initiative.

When the President made his commitment to repurchase crude oil, there was no mention of logistical or operational constraints to repurchasing crude oil. The commitment was straightforward: when the price falls sufficiently, the DOE will intend to buy crude oil.

“The President is announcing that the Administration intends to repurchase crude oil for the SPR when prices are at or below about $67-$72 per barrel, adding to global demand when prices are around that range.”

If there were allegedly implied operational constraints to this plainly straightforward commitment, they fully dissolve in the subsequent sentence.

“As part of its commitment to ensure replenishment of the SPR, the DOE is finalizing a rule that will allow it to enter fixed price contracts through a competitive bid process for product delivered at a future date [emphasis added].”

The directive from President Biden should be clear: If the price falls to the range, DOE, within its reasonable constraints, must take steps towards repurchasing crude oil. This commitment does not narrowly envision that the DOE purchase crude oil on the spot market for immediate refill; other kinds of purchase transactions can also suffice. But action is necessary to give some credible and substantive effect to the President’s commitment, even if through a forward purchase transaction where crude oil is delivered at a later date. The DOE can still go ahead with Congressionally mandated sales of crude oil now and take care of SPR maintenance, all while still making a purchase transaction more immediately.

Charitably speaking, the DOE seems spooked by the failure of their pilot operational exercise in December where they failed to receive sufficiently competitive fixed price offers for February 2023 delivery. But there were three clear issues that the DOE should have learned by now:

- Period over which offers must remain open: Offers had to remain open for a substantial period of time (two weeks) where they were exposed to asymmetric volatility risk that was punitively expensive to hedge.

- Time horizon of the forward contract: The length of time was especially long in proportion to the relatively short time horizon of the transaction (~2 months). The 2-month future price of West Texas Intermediate crude oil is of very similar volatility to the spot price, whereas the 18-24 month future price is substantially more stable.

- Idiosyncratic liquidity and market-making costs: Counterparties would likely have faced additional liquidity costs associated with keeping an offer open over the turn of the calendar year. Hedging through options is costly enough but especially so over the turn of a calendar year, when the balance sheet available to support market-making transactions is typically more scarce. The DOE should try to avoid conducting such transactions at the end of calendar years and quarters.

All of these issues are better understood in retrospect but easily surmountable now. The DOE could either:

- Seek out a specific forward contract for December 2024 delivery that matches the precise crude oil quality and transportation considerations that serve the SPR, thereby pushing the cost of hedging and transportation costs fully onto SPR counterparties at the moment of contractual formation.

- Begin the repurchase process through the solicitation of an acquisition contract that looks virtually identical to a West Texas Intermediate long-dated futures contract for December 2024 settlement, thereby locking in the effective price signal. In this case, the DOE would wait until a later date to swap the grade of crude oil to their liking, along with last-mile transportation and logistics considerations.

Either option should be viable enough for the DOE to stand ready to begin taking purchasing actions right now. It’s a shame the DOE did not take sufficient advantage of the past six months to engage operational readiness exercises, but there is no time like the present.

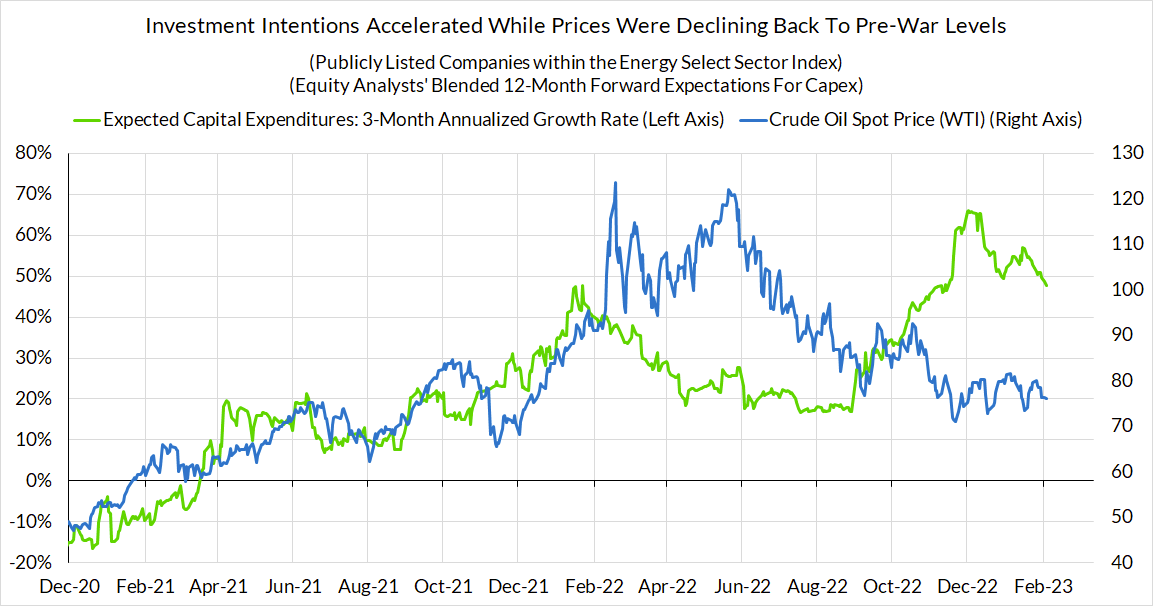

The DOE should not forget the substantive intent of the President’s stated commitment. It was not about getting the lowest price for taxpayers, but a price that was simultaneously good for taxpayers and ideal for stabilizing prices and investment over time.

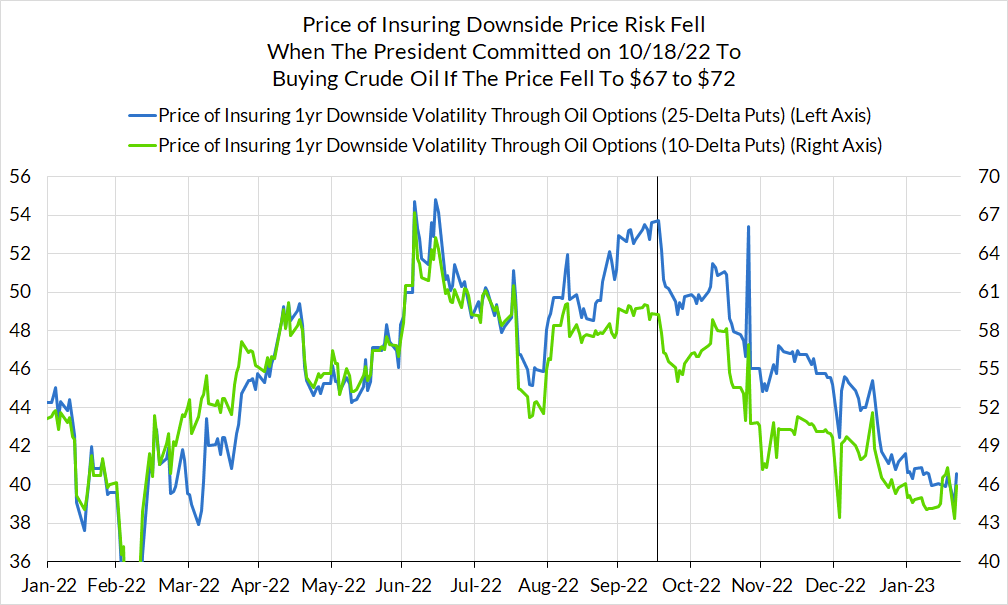

There are even clear pieces of evidence showing how the White House’s commitment helped to reduce the implied volatility for crude oil prices, and in the process raise investment at lower prices.

If DOE remains unprepared and uninterested in carrying out President Biden’s policy commitments, his credibility and the effect of the entire policy will be compromised.

To be clear, we have never criticized the DOE for not instantaneously pouncing on the first downtick in prices below $72.00. The SPR and its associated processes are not that nimble, and crude oil prices are simply too volatile. The initial downdraft following Silicon Valley Bank’s collapse could be chalked up to a speculative shakeout that ultimately reversed. But what has been glaringly obvious from Secretary Granholm’s excuses is the lack of preparedness if prices fall further or stay in the ($67-72) for sufficient duration.

The DOE should be readying itself to engage in a longer term forward purchase transaction. Right now.