By Alex Williams

As we noted earlier this week, the Fed and Chair Powell in particular have done an excellent job looking through hot inflation prints while fighting for a return to pre-pandemic employment. That this was codified through their forward guidance marked a major milestone, and some recent action in bond markets has been read as different players testing how the Fed understands the “Flexible” in its “Flexible Average Inflation Targeting” framework.

The Fed has made some indications that inflation has become more "broad-based," and the data will likely reflect this. However, it is key for commentators and policymakers to bear in mind that "transitory vs. persistent" is not the same debate as "narrow vs. broad-based." The speed of this recovery has meant that sectors that lost pricing power due to pandemic consumption effects can recover back to pre-pandemic trends sooner.

This month, like last month, is likely to see an elevated Consumer Price Index (CPI) reading. Many of the dynamics from last month still hold, but this month, we will take a look at some factors that suggest the composition of inflation may change, and the pace may slow, over subsequent months.

Continuing another trend from last month, private indicators of used car prices continue to lead CPI measures of used car prices, indicating that used cars will continue to contribute to hot inflation prints for the time being.

Sales of new cars continue to be dramatically impacted by production bottlenecks as well, increasing prices paid and driving more buyers into the used car market, where they support high demand and high prices.

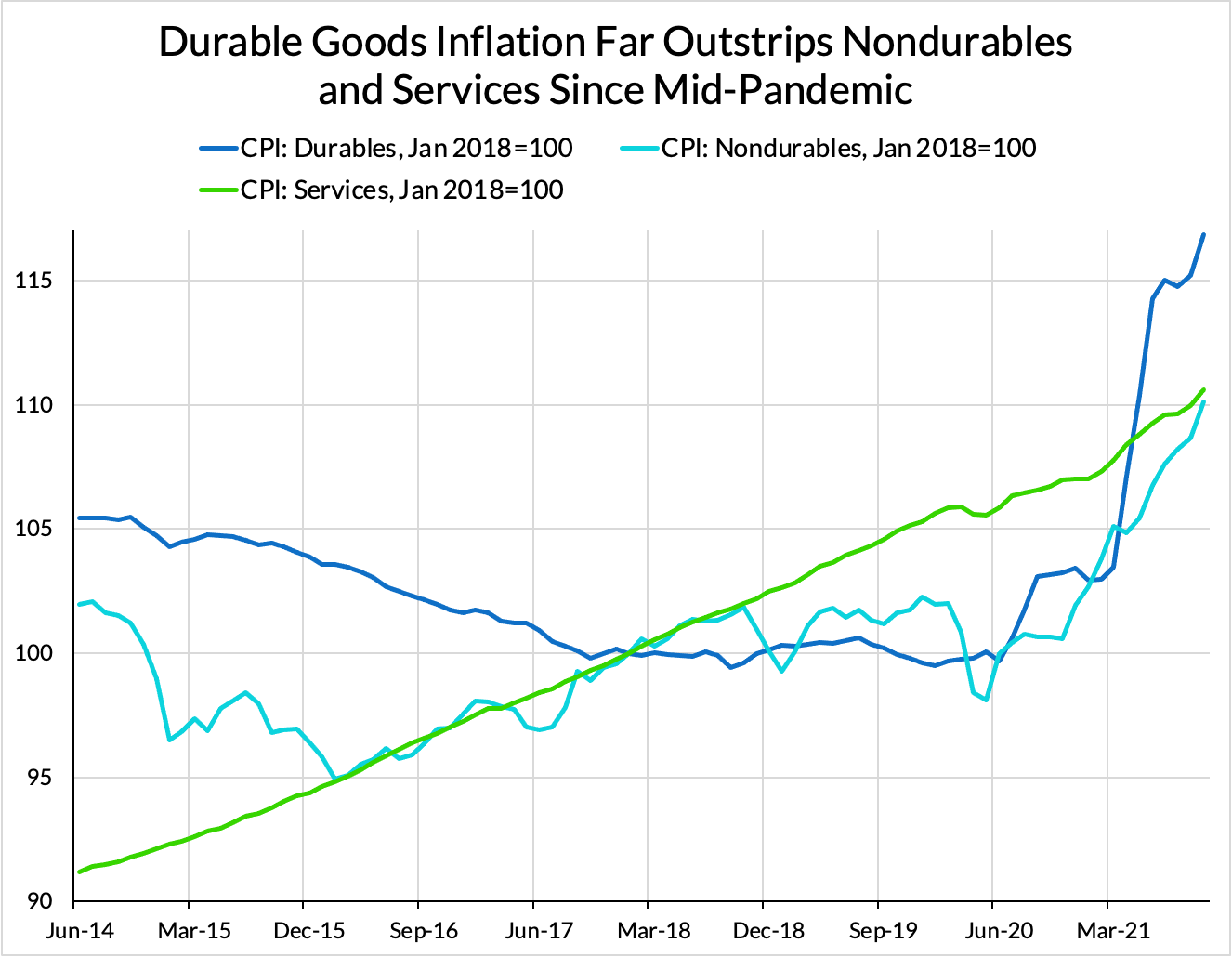

The elevated costs to producing goods relative to services is clearly visible in the CPI data, indicating that the bulk of the inflation overshoot has been driven by durable goods prices (even as service prices are starting to reflect a stronger recovery from the pandemic). It is important to distinguish between the kind of supply chain challenges plaguing the production of various durable goods prices from crude "labor supply shortage" claims that continue to linger in the macro policy discourse. Whether we are talking about microchips for automobiles, container chassis for port throughput, primary metals like steel and aluminum, or propylene oxide for mattress furniture foam, these shortages stem from capital-intensive and import-intensive bottlenecks; they take time and investment to fully resolve, not necessarily more domestic labor.

Even for those services that are not the subject of abnormal bottlenecks (and typically the most cyclical), these prices are ultimately a function of demand, more so than the supply of construction workers. Gross prime-age employment earnings growth aligns with rent CPI inflation dynamics quite cleanly, whereas construction wage growth does not.

Some services highly proximate to reopening dynamics have already recovered pre-pandemic levels, but others still have some way to go, reinforcing the idea that the composition of inflation will likely shift, even if inflation remains elevated over the near term.

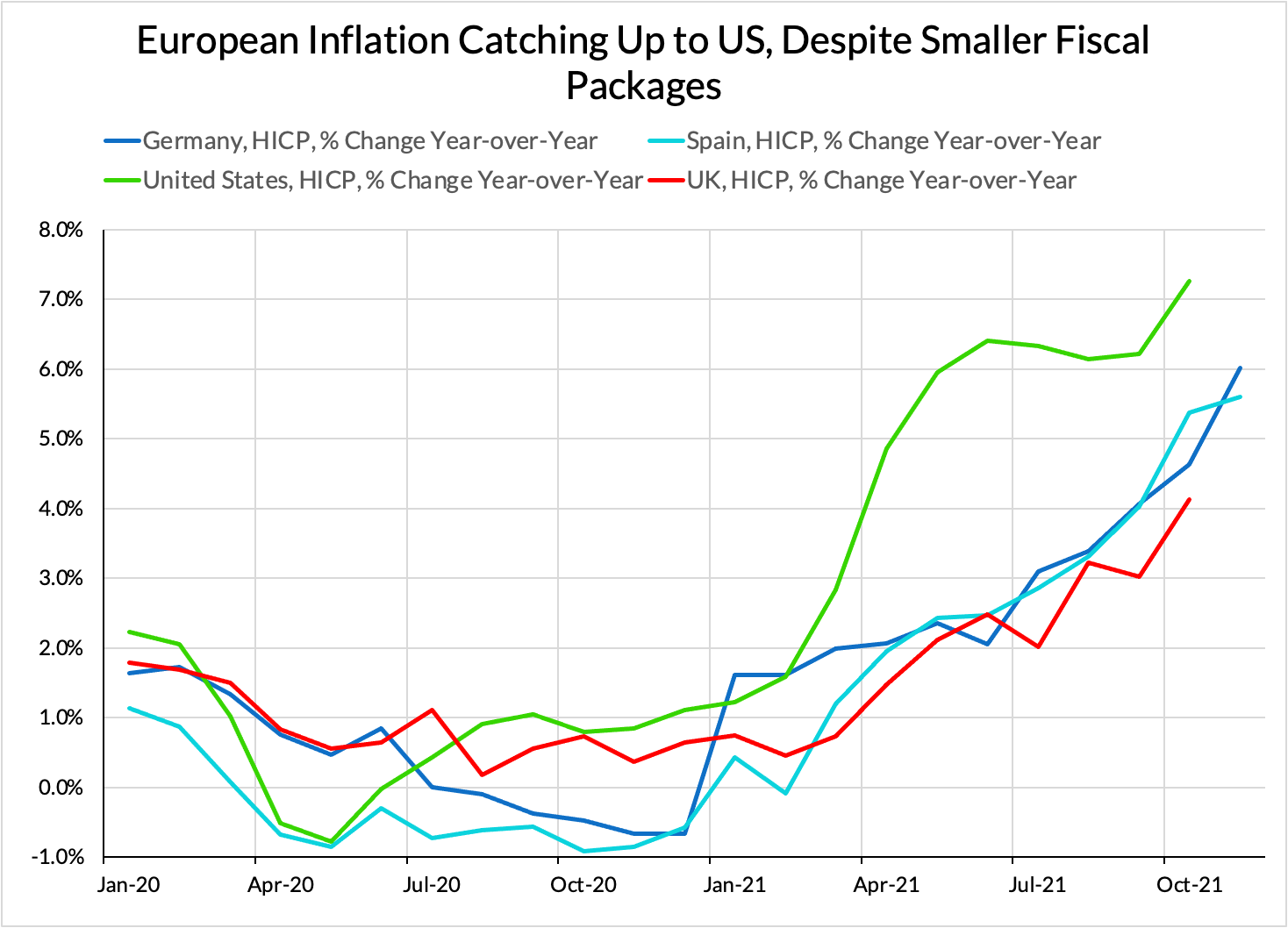

The situation is impressively similar across countries. Much of Europe is seeing a rapid acceleration in inflation right now, just as US is experiencing its inflationary surge. Germany is seeing 6% year-over-year inflation, as of November, with a 0.5% month-over-month increase most recently. Spanish HICP inflation is running at a "cooler" 5.6% as of November. Despite engaging in more fiscal stimulus than its European peers, the UK has thus far seen a relatively "benign" 4.2% year-over-year rate of inflation, but here too the pace of inflation is accelerating. We will get the UK's November inflation data later next week.

Given the increasing coincidence of inflation acceleration across advanced economies, it's pretty clear that the dominant inflation dynamic right now has a global factor, though the individual capacity constraints that have bound across economies does vary. The global chip shortage and automakers' shutdowns have mattered more to the US economy, while Spain's lack of natural gas storage has been idiosyncratically challenging.

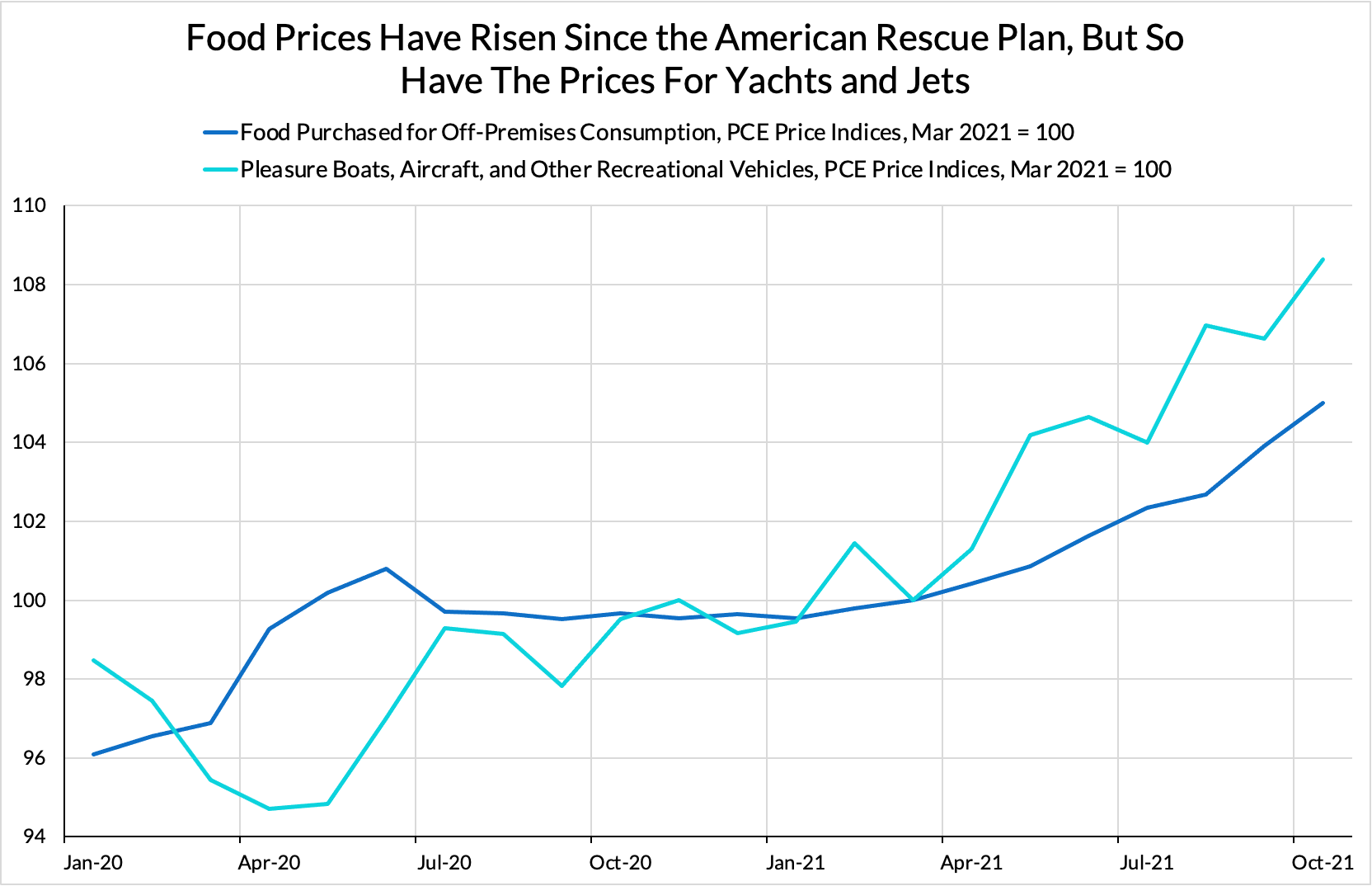

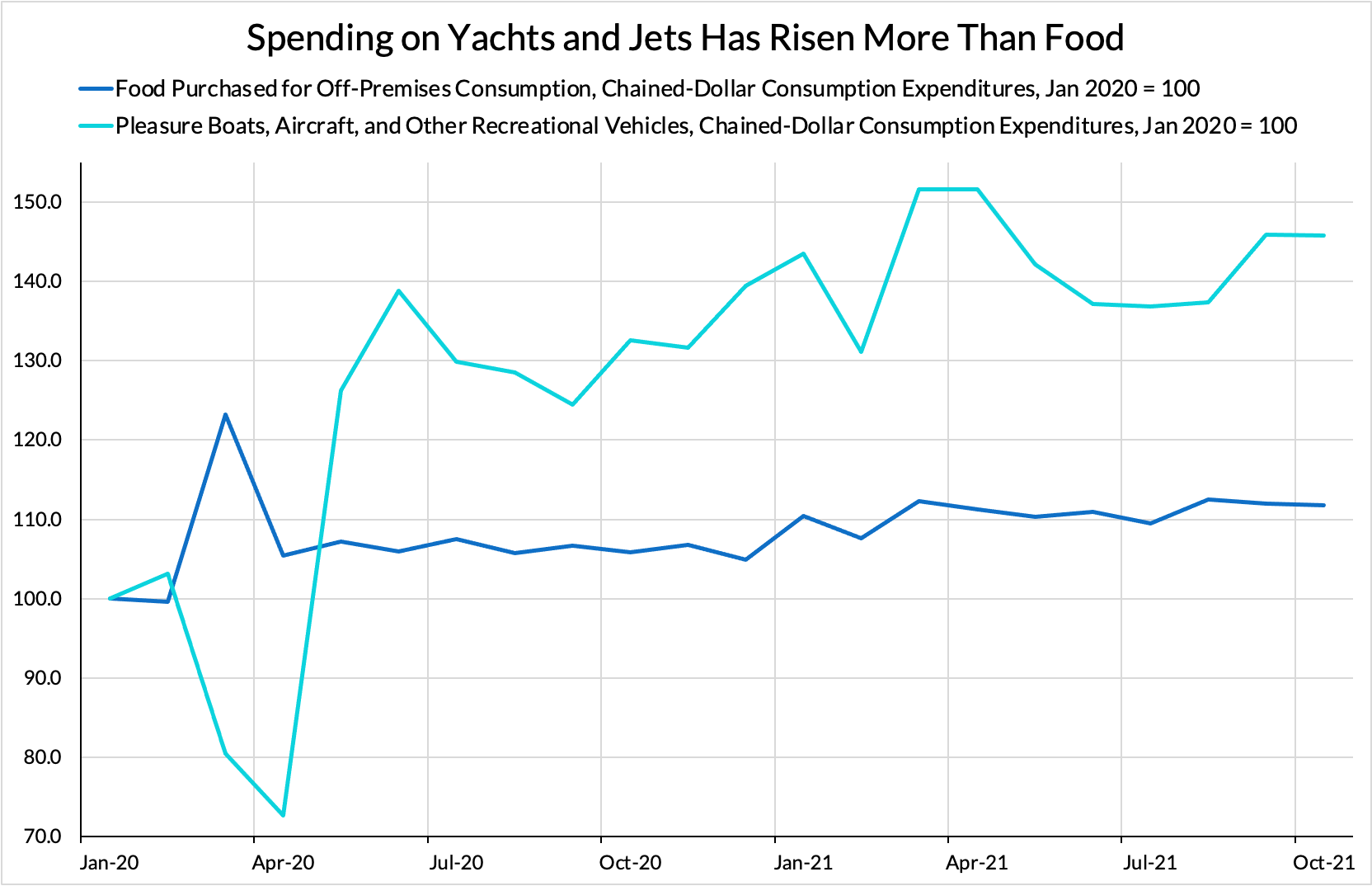

Fiscal policy in the United States has certainly supported demand, and by extension, certain inflationary dynamics. Food consumption has shifted higher and so too have food prices. On the other hand, nominal and real spending on private jets and yachts are also much higher, and so too are their prices. It's reasonable to attribute strong spending on food to anti-poverty fiscal transfers (an inflationary cost that is completely worthwhile). It is a little silly to attribute strong spending on yachts and jets to fiscal policy.

That said, cross-country inflation differentials are driven by a variety of causes. Certain shortages bind more acutely based on the structure of the economy, methodologies vary at the component level, reopening policies vary, and price regulations (gasp!) vary. For the talk of US-Eurozone inflation differentials being wholly explainable by fiscal policy, it is odd that Germany has as much surplus inflation relative to the UK...despite engaging in substantially less fiscal policy.

Inflation is very likely to be on the stronger side for November. Whether it's rapidly recovering pricing power among pandemic-depressed services or capital-intensive bottlenecks in the supply chains of durable goods, these short-run inflationary difficulties tell us little about the ability to close the remainder of the recession-induced employment gap quickly (as was already noted in our post yesterday).