Headline CPI: Modest upside risk vs. forecasting consensus

- Consensus: 0.6% month-over-month, 7.9% year-over-year

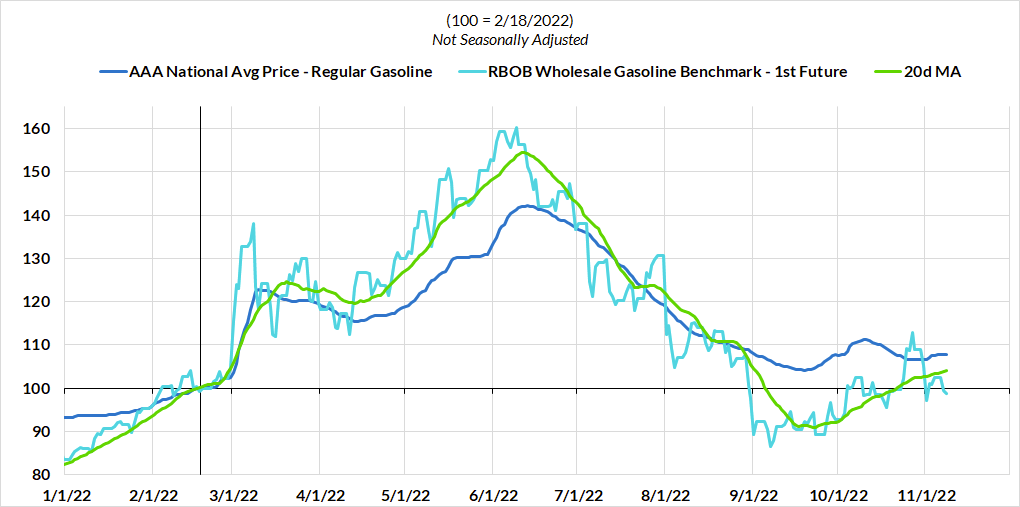

- Gasoline prices did not play a major role in October, with only a minor non-seasonally-adjusted increase from September to October at the retail level.

- Energy services inflation should be more moderate given the correction in natural gas prices in October, but electricity prices can still outperform as rates are reset with a lag relative to dynamics in spot natural gas prices earlier this year.

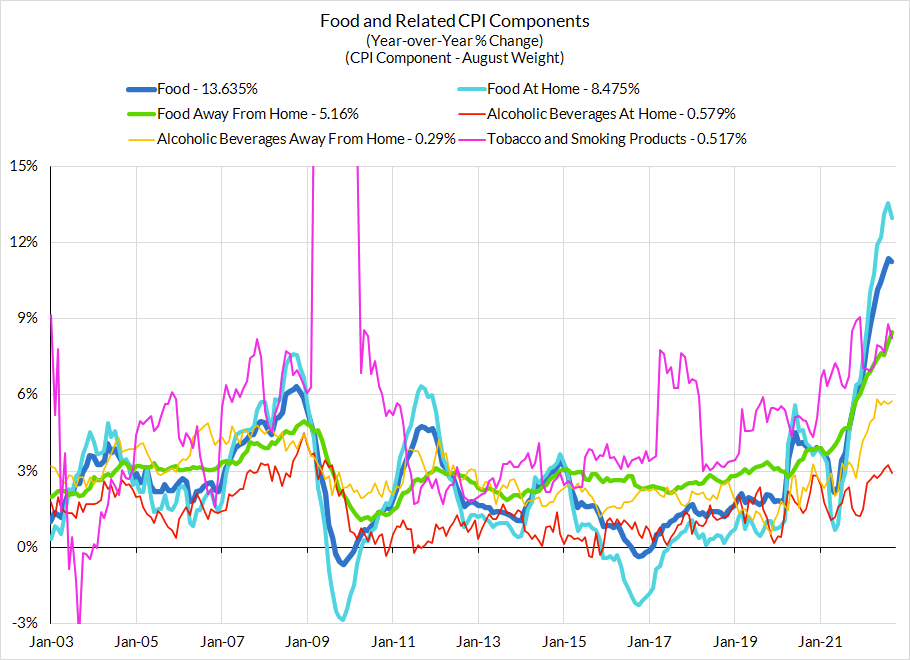

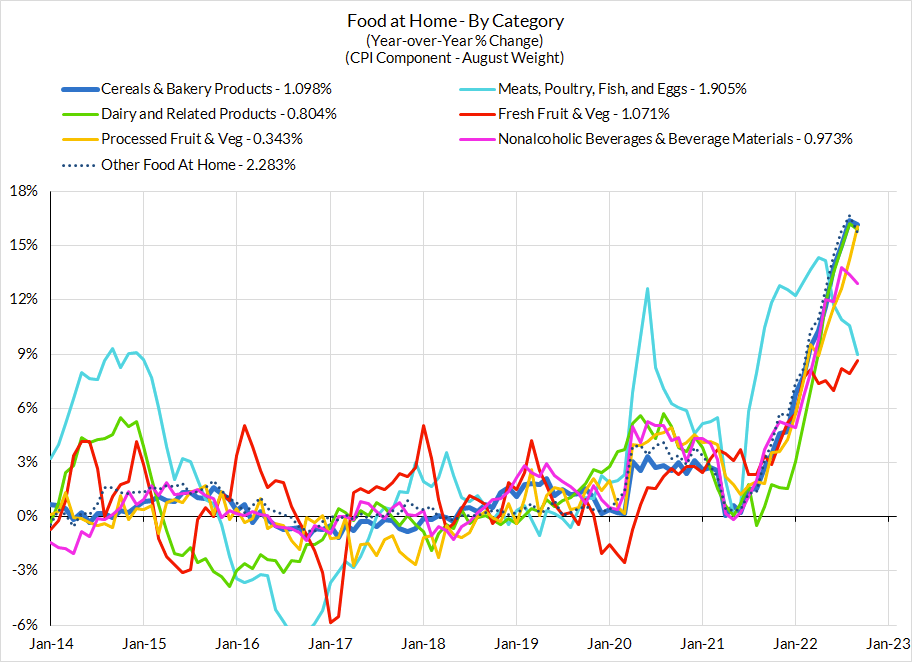

- Food inflation is still running hot, with pricing pressures still visible across services, fresh and manufactured products. While demand for leisure has likely lifted up food service prices, the Ukraine shock to food supply chains is likely also playing a major role.

Core CPI: Risks are elevated in both directions relative to consensus forecast. Rent can still be strong enough to drive upside surprises, while used car price declines now have growing potential to drag down individual CPI readings substantially (should they overcome the lags between private and public data, wholesale and retail).

- Consensus: 0.5% month-over-month, 6.5% year-over-year

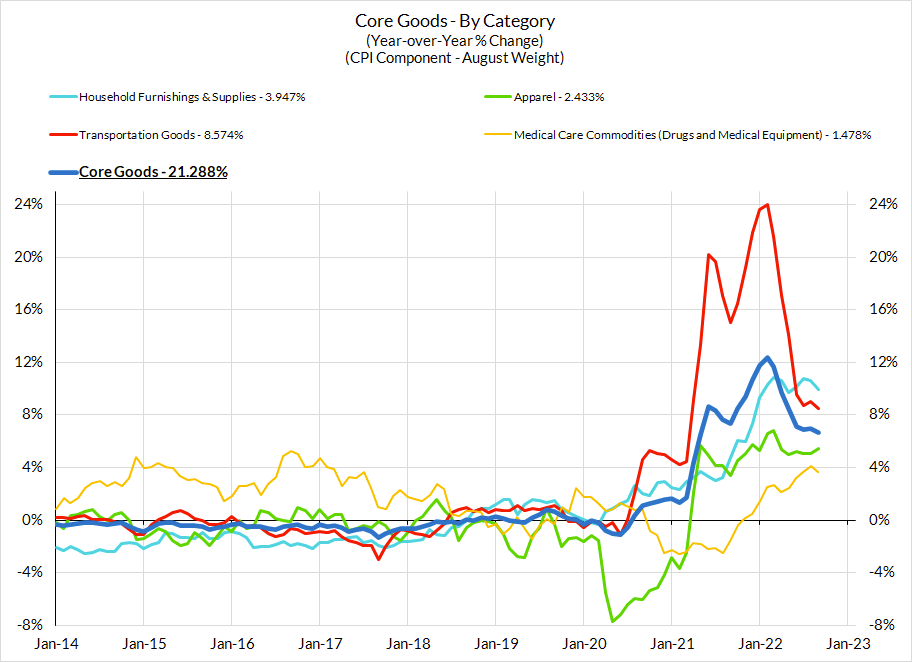

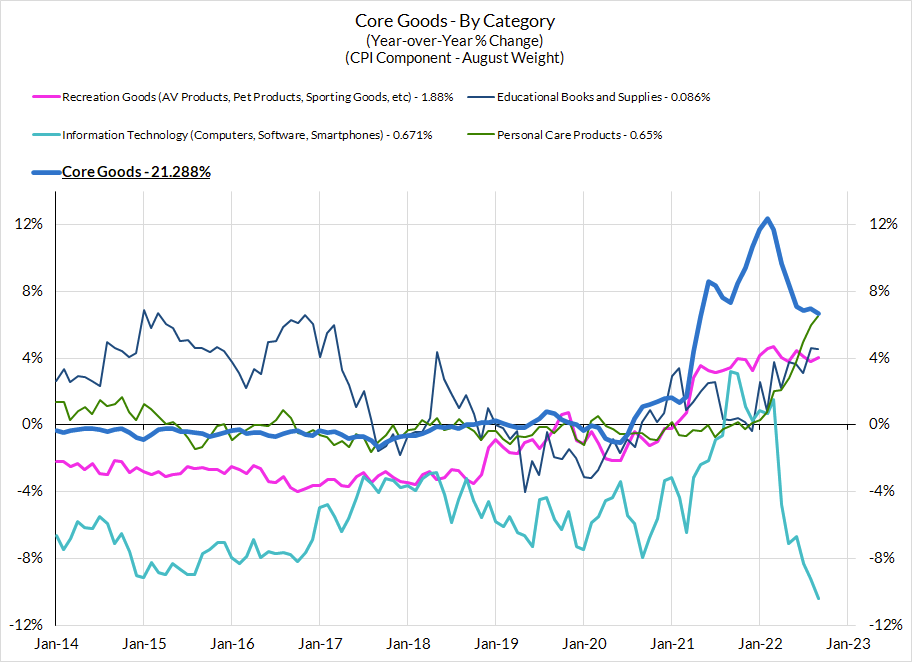

- Core Goods: Downside risk scenarios to core inflation hinge primarily on deeper declines in goods prices. The CPI data is starting to nudge in this direction, but slower than what we would have otherwise expected. Core goods prices were nearly unchanged in September, the lowest month-over-month print since March of this year and previous to that, February 2021. Prices have decelerated, but to get to more normalized CPI readings, core goods prices need to start declining at an elevated pace.

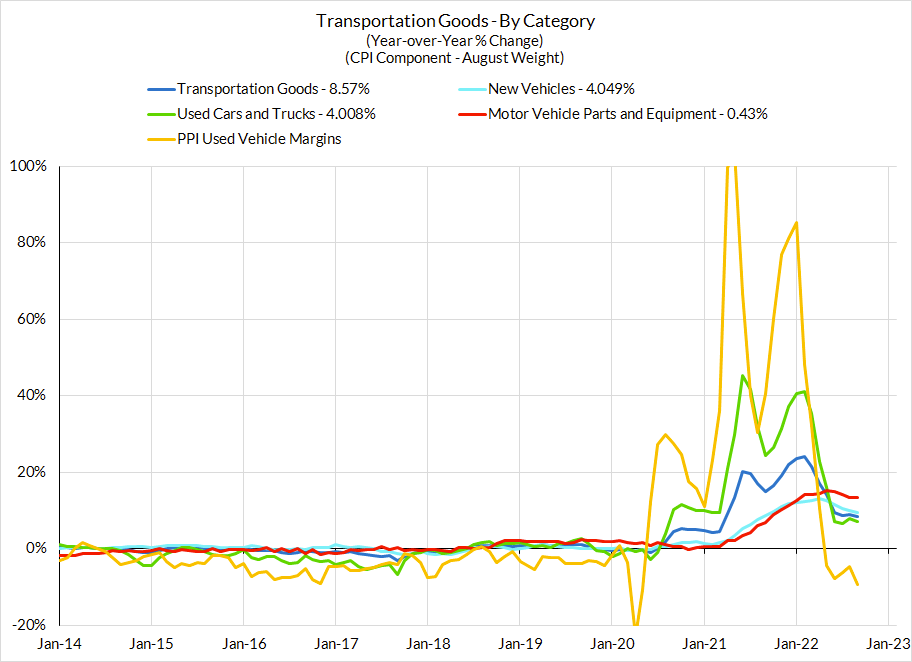

- Automobiles: Private weekly wholesale price data continues to show signs of prices capitulating at auctions, but the retail data is declining more slowly (arguably a similar result to when consumers began to see gasoline prices decline later than what was visible at the wholesale level). We should soon see prices decline at an elevated pace given what we already know from the wholesale data and how substantially prices overshot to the upside in 2021-22. Relief here seems to be a function of help from the supply and demand side but it's worth noting that new vehicle sales actually jumped in October and production is beginning to recover.

- Other Durable Goods and Apparel:We should also begin to see more relief in other categories where prices rapidly inflated, specifically household durable goods (furnishings, furniture, tools) and apparel. The former should be aided by rapidly contracting residential fixed investment demand along with a more favorable supply-side picture. Apparel pricing declines are most likely to materialize before and after the holiday season as retailers seek to clear elevated levels of inventory.

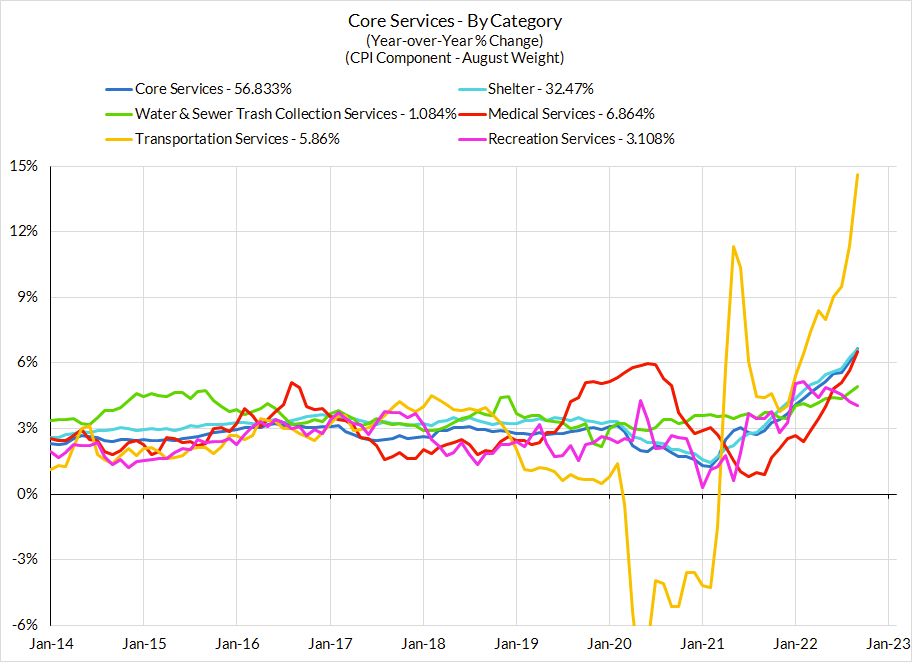

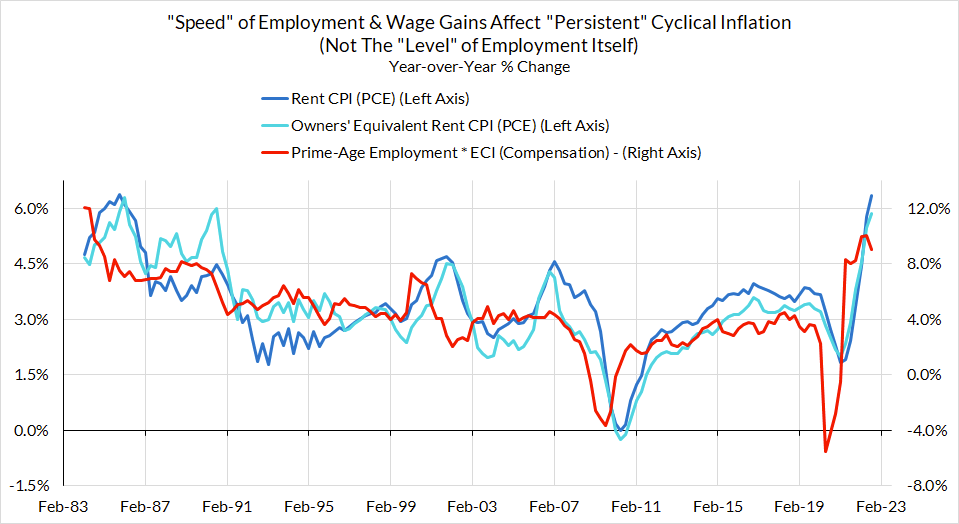

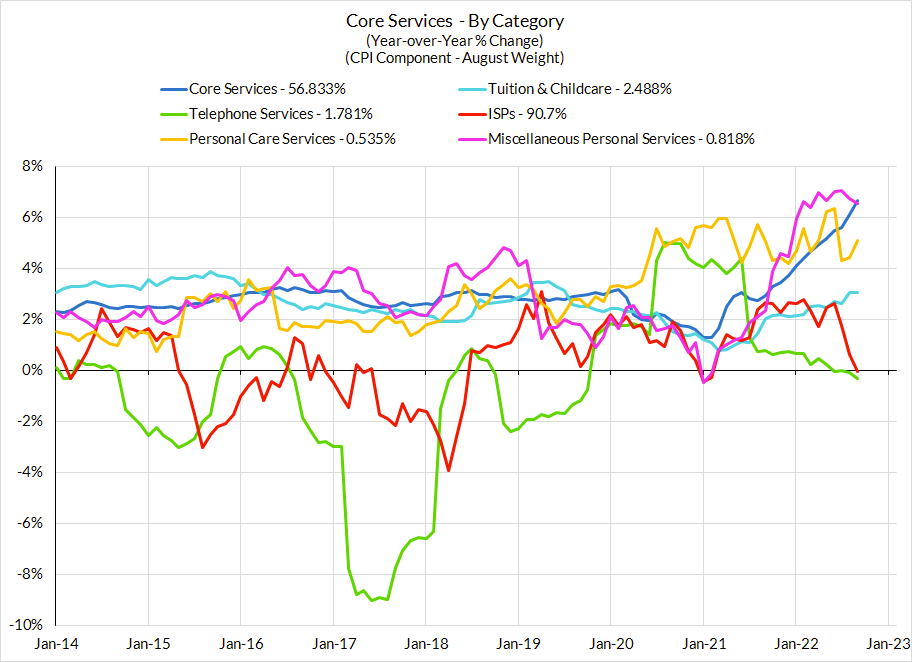

- Services Are A Mixed Bag, But Rent Can Still Swamp: Rent inflation was historically strong in September and given how the methodology of rent CPI lends itself to autocorrelation and stickiness...it will probably be especially strong in October too. That alone has the capacity to CPI readings past the forecasting consensus. On the bright side, there appears to be greater appreciation for the fact that rent CPI does lag labor market and market-rent dynamics, both of which are now showing signs of deceleration and normalization after a one-time reopening/recovery surge.

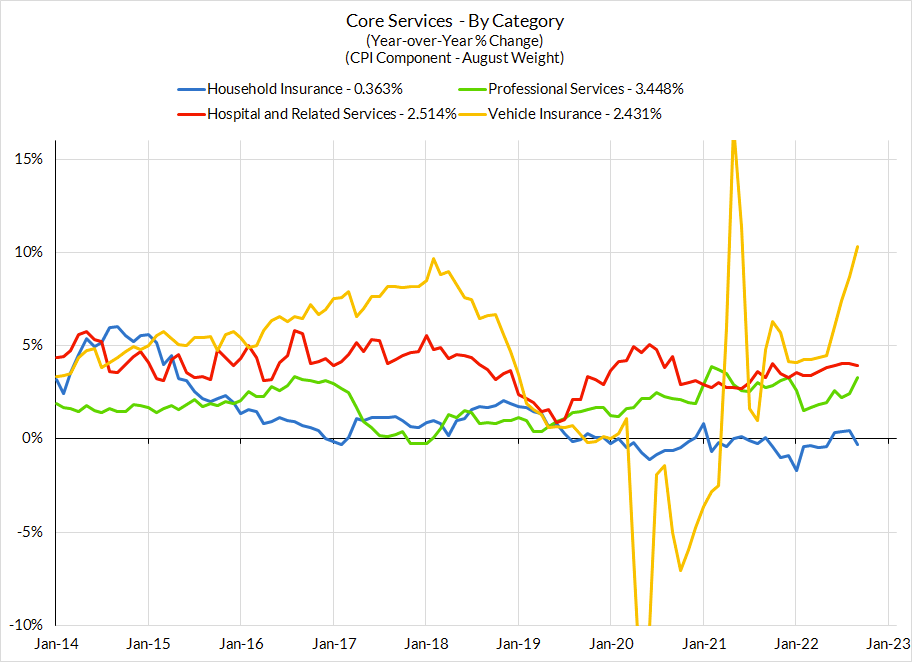

- Health Insurance Disinflation? What has been a sneaky huge inflationary tailwind to core services CPI inflation (but not its PCE analogue) is the health insurance CPI. Due to some quirky methodology that you should listen to Omair Sharif explain on Odd Lots, health insurance was a steady contributor to inflation acceleration in 2022 but is likely to correct downwards over the subsequent 12 months as updated source data resets the trend here.

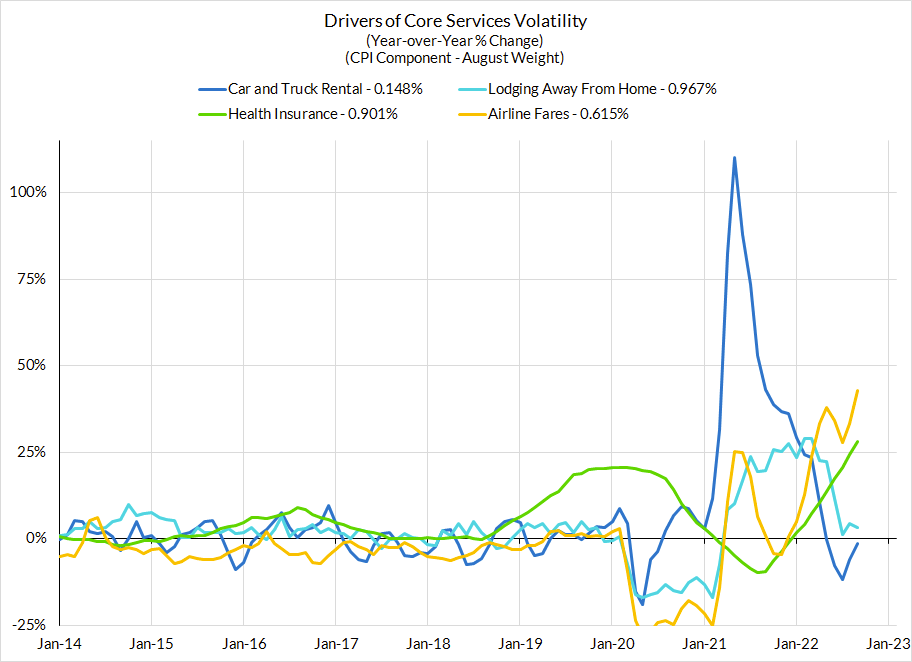

- Relief From Other Services? Airfares, lodging, and vehicle insurance were all substantial contributors to inflation over the past 12 months but are showing increasing signs of normalization over the coming months. Meanwhile, car and truck rental rates are starting to decline and could still decline further if we begin to see used car prices fall substantially (and new car prices subsequently follow).

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints