Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the days of the GDP and PCE releases.

If you'd like to start a 90-day free trial of our exclusive content, you can do so using this link. If you have any questions or would like to see samples of our past content, feel free to get in touch with us.

Summary: PCE Nowcasts

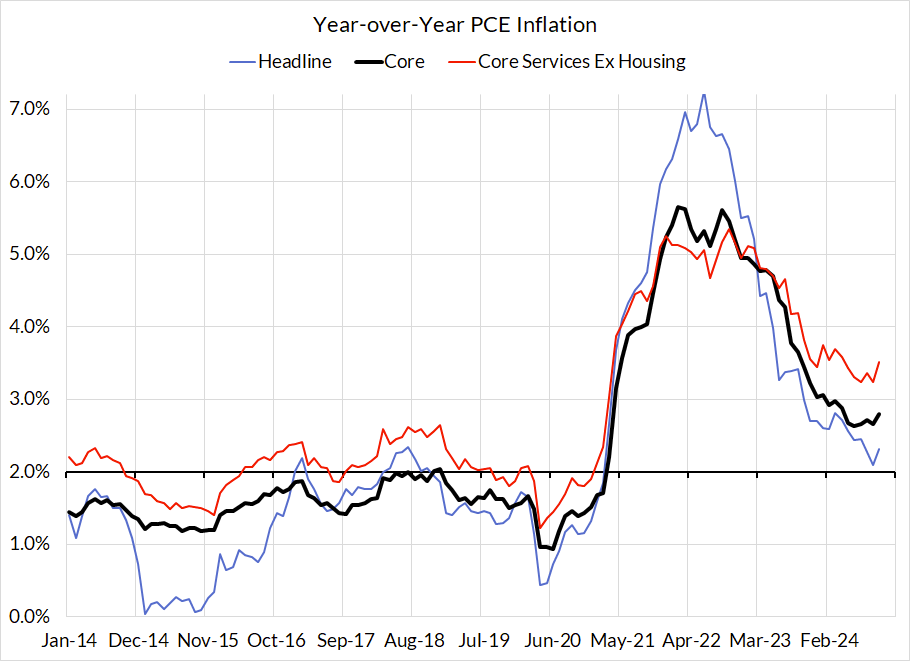

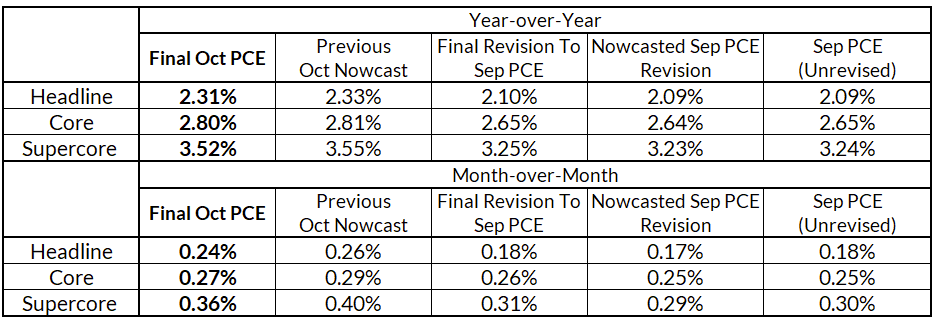

Our month-over-month nowcast for Core PCE were 2 basis points too high while our corresponding year-over-year nowcasts were just a basis point on the high side. All in all, we learned very little from the final release of the PCE data relative to what we learned after the October PPI release. The vast majority of the inflation overshoot stems from (1) housing lags, (2) equity market effects on financial service prices, and (3) and components that use wage-based input cost indices. We continue our baseline scenario that the Fed will cut only one more time over the next two meetings, with a bias towards a December cut and a January 2025 "pause."

Discussion

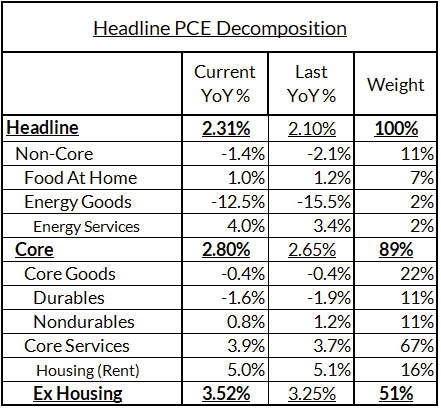

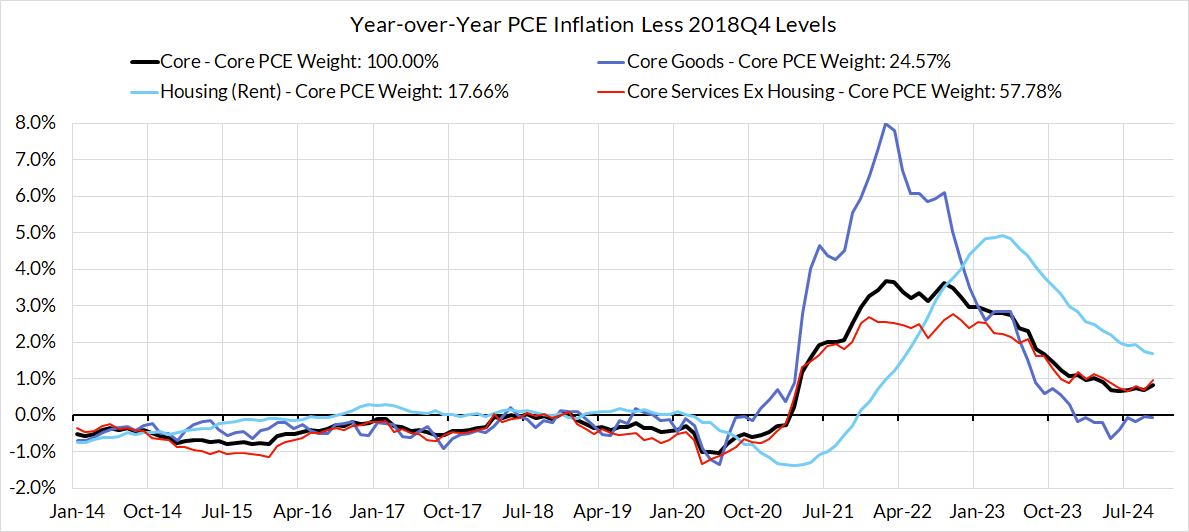

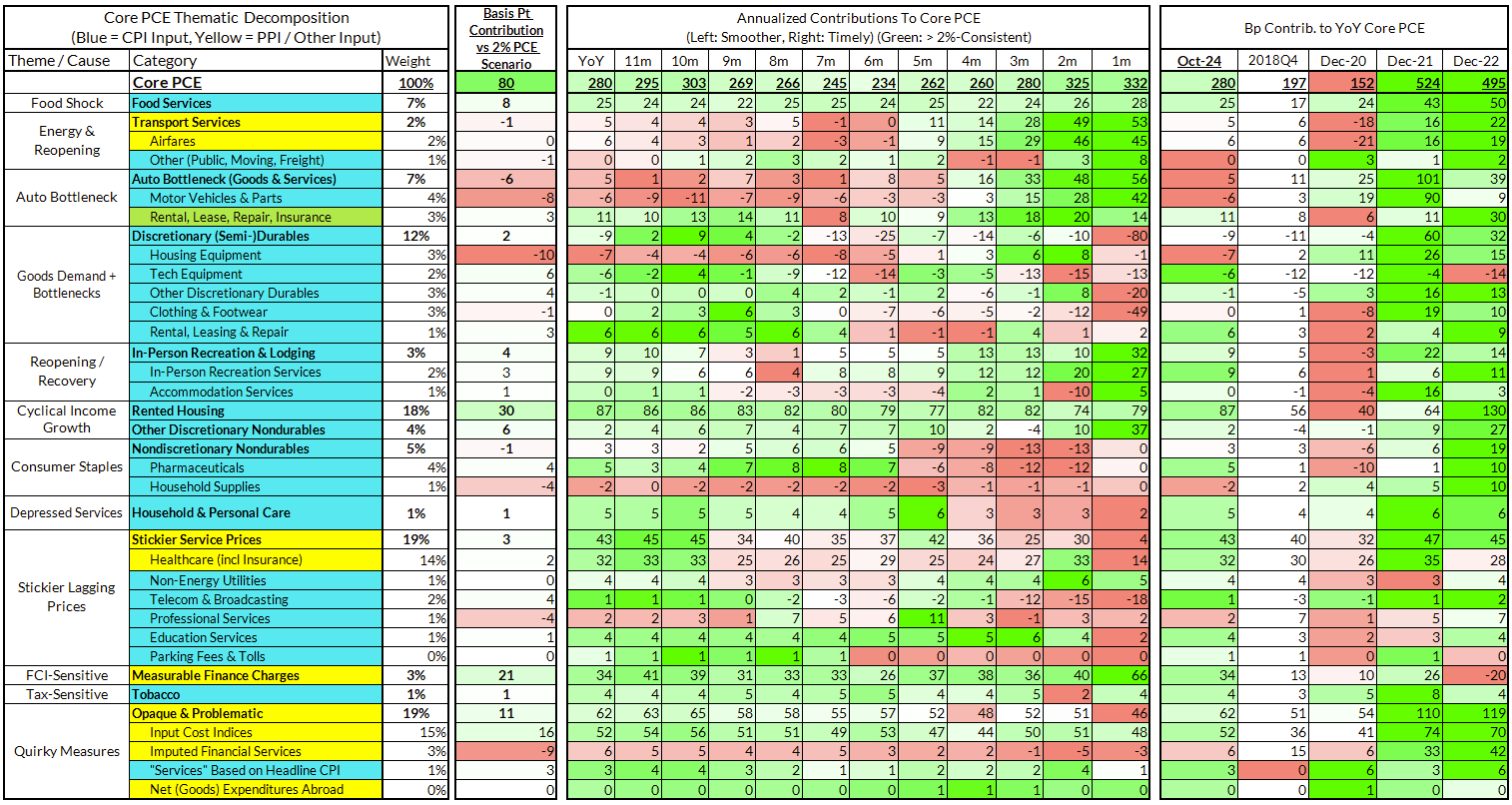

Core PCE is now running at a 2.80% year-over-year pace, 80 basis points above the Fed's target. There are three key contributors to the overshoot (67 out of 80 basis points):

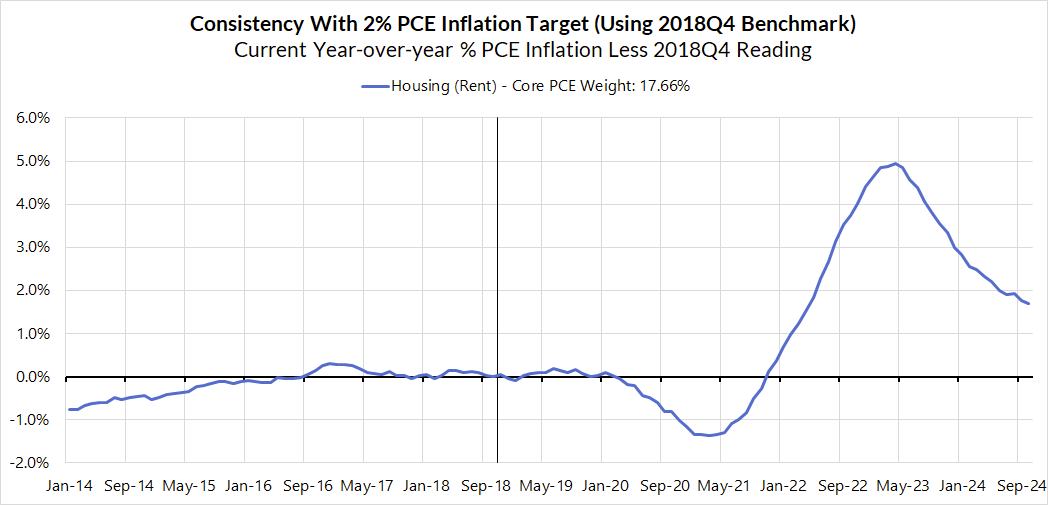

- Housing (30bp overshoot contribution): The lags in housing inflation have meant that housing inflation has remained elevated for a longer period of time relative to the more tepid rates of market rent inflation in the past couple of years would imply.

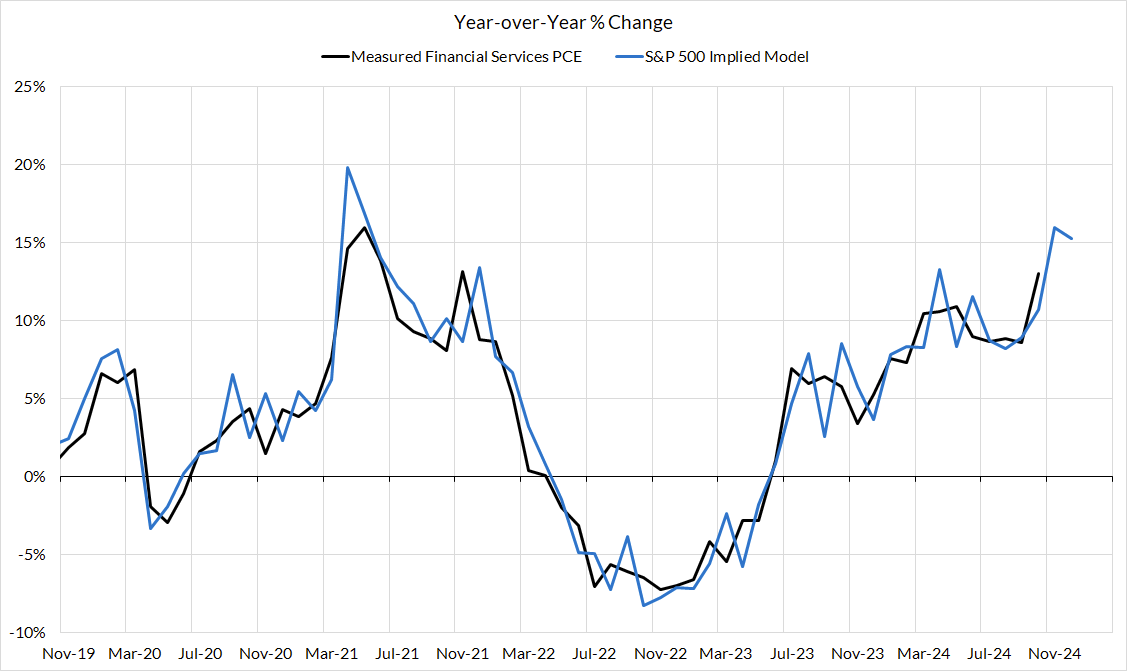

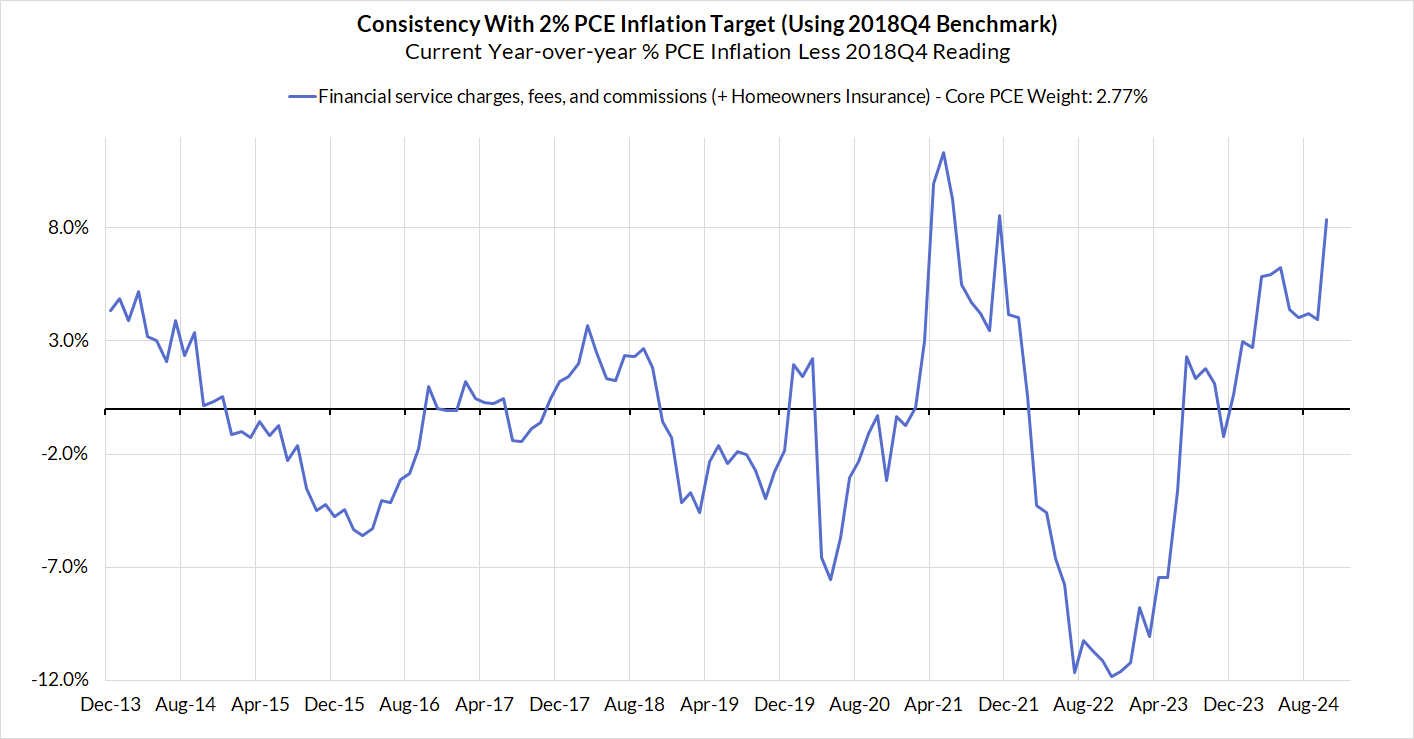

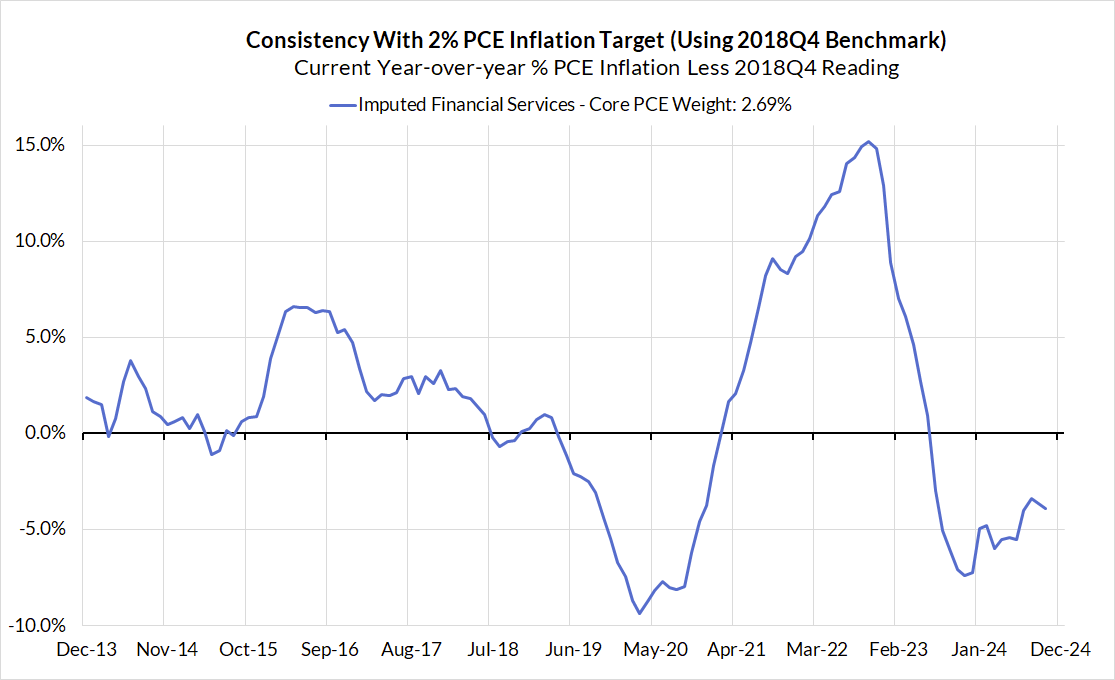

- Equity market effects (21bp overshoot contribution): The directly observed set of financial services prices in PCE are highly sensitive to equity market dynamics. In light of the impressive equity market run over the past 4-5 quarters, portfolio management inflation and measured financial services generally have run hotter than what would be consistent with the 2% inflation target and are likely to do so over the next two months as well. If the equity market runs sideways, or else corrects, the greater the odds of achieving 2% Core PCE. A continued run-up in the equity market would make it more difficult for the Fed to hit its inflation goals in the near term. The equity market effect tends to lag realized equity market dynamics by 1-2 months.

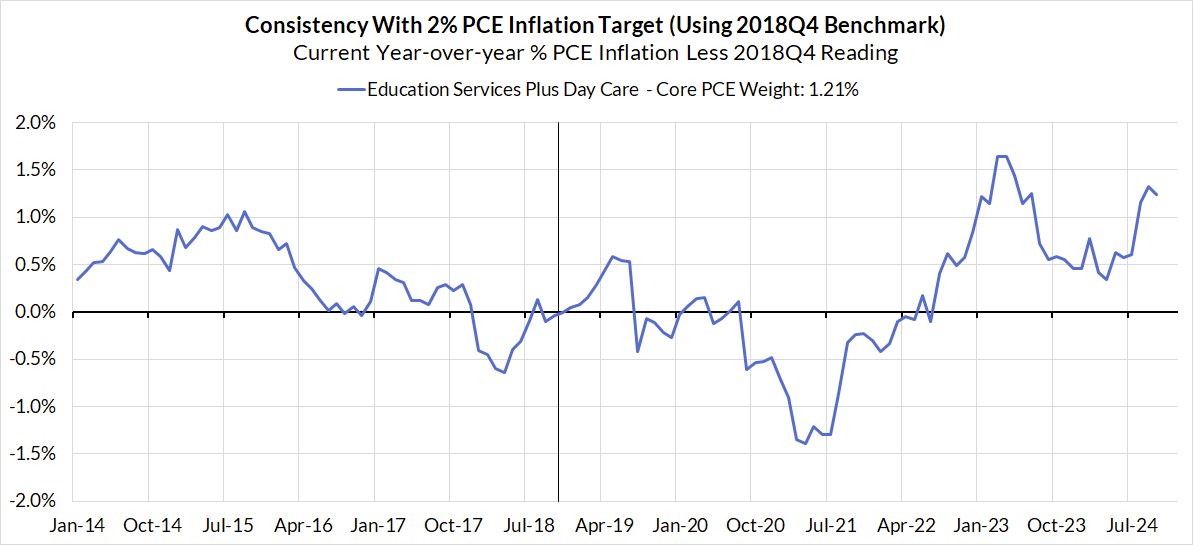

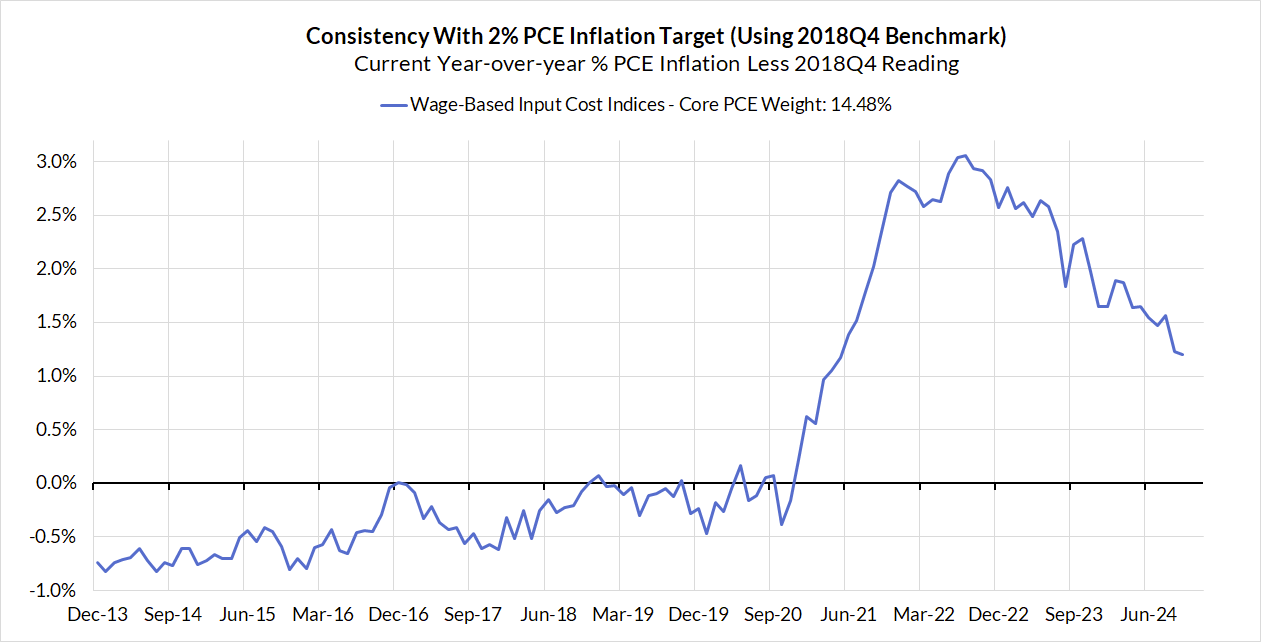

- Wage-based input cost indices (16bp overshoot contribution): There are also a number of PCE components for which no market price is visible and the "price" is actually an input cost index heavily weighted to wages. These components are still growing faster than what would normally be consistent with the 2% inflation target but, like wages, these measures are cooling (with a lag to wages).

We see increased probability of a "hot run" for Core PCE given (1) what has already transpired in September and October, (2) scope for a hot November and December driven by equity market effects, and (3) residual seasonality and anticipatory tariff effects keeping goods pricing strong in Q1 (as we saw in the last few years post-pandemic, at least partially in response to supply chain bottlenecks). There is a very realistic scenario in which the Fed is looking at a less-than-pretty picture of short-run annualized rates of inflation come spring 2025. The Fed will need to be deliberate in its messaging and capable of better contextualizing some of the quirky and lagging dynamics within the inflation data.

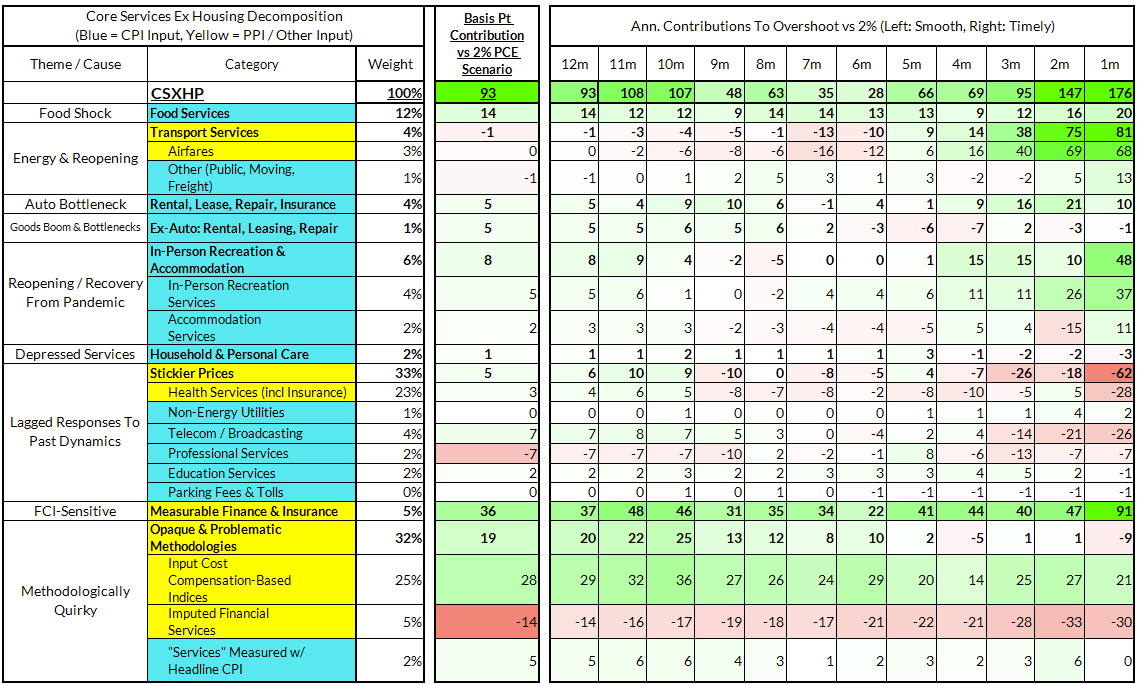

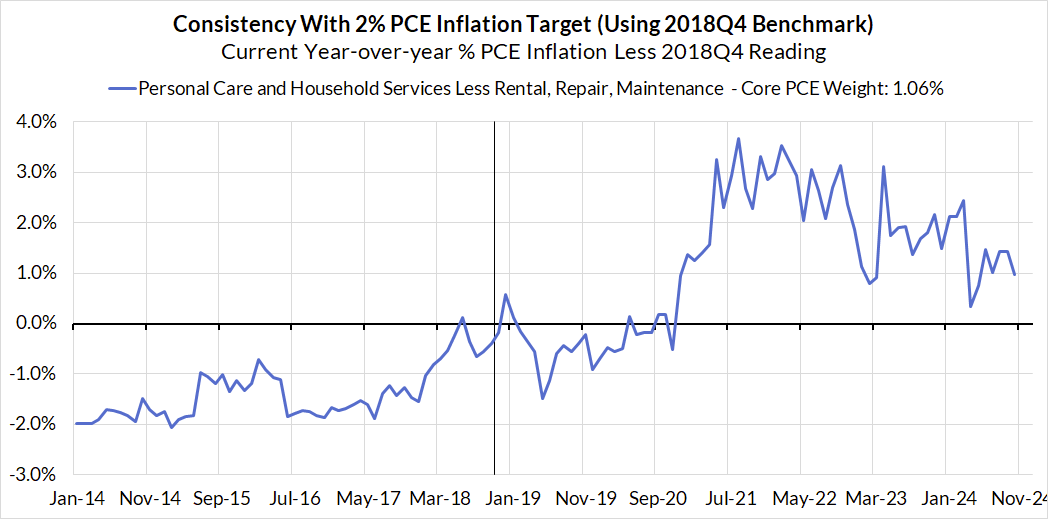

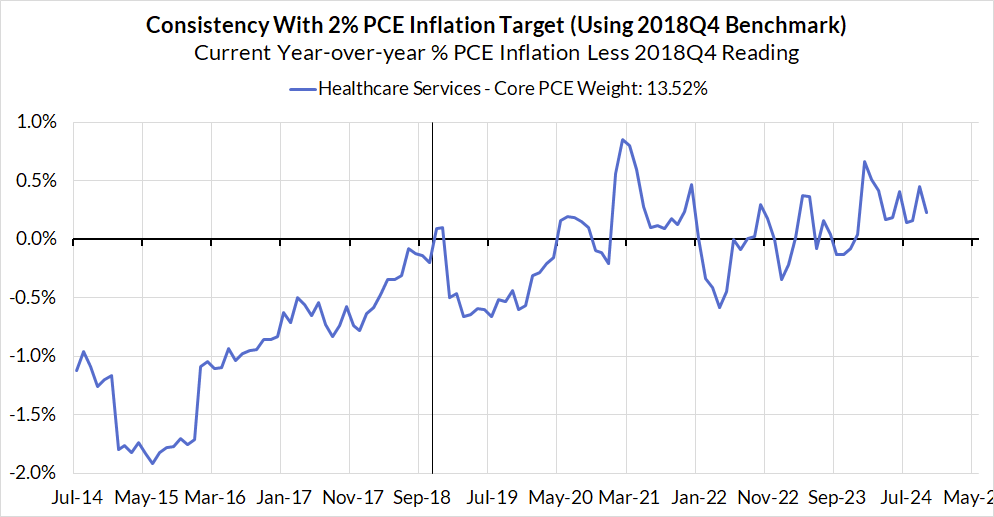

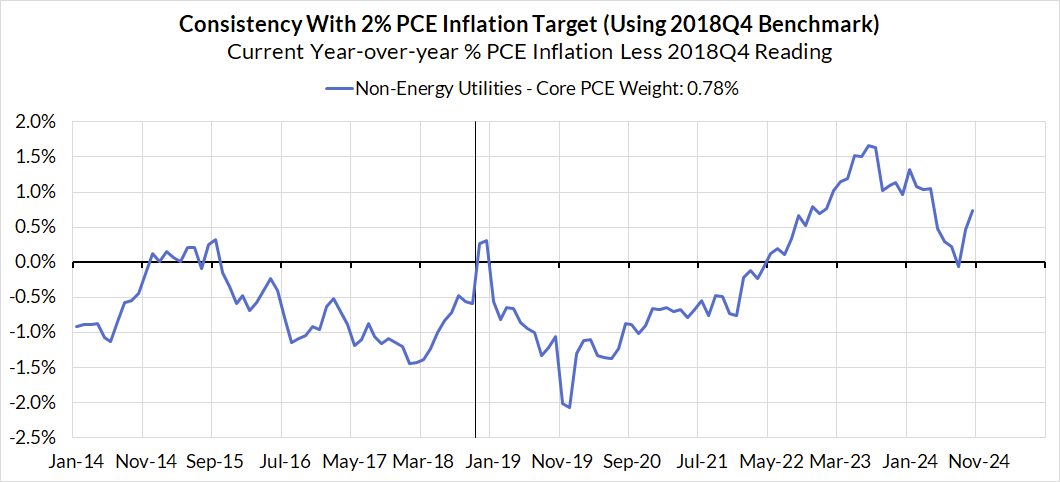

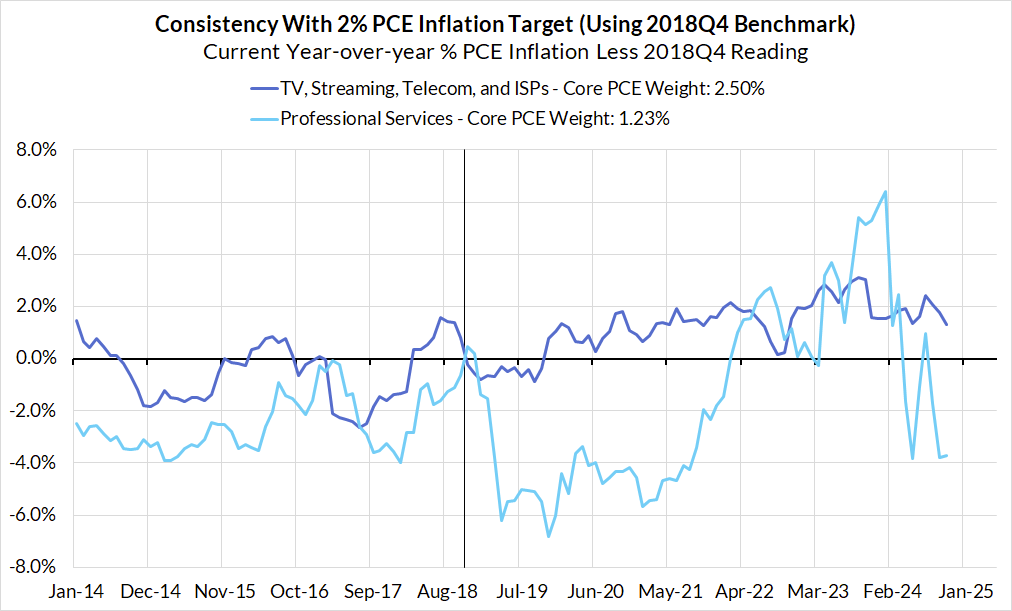

Inflation Overshoots At The Component Level

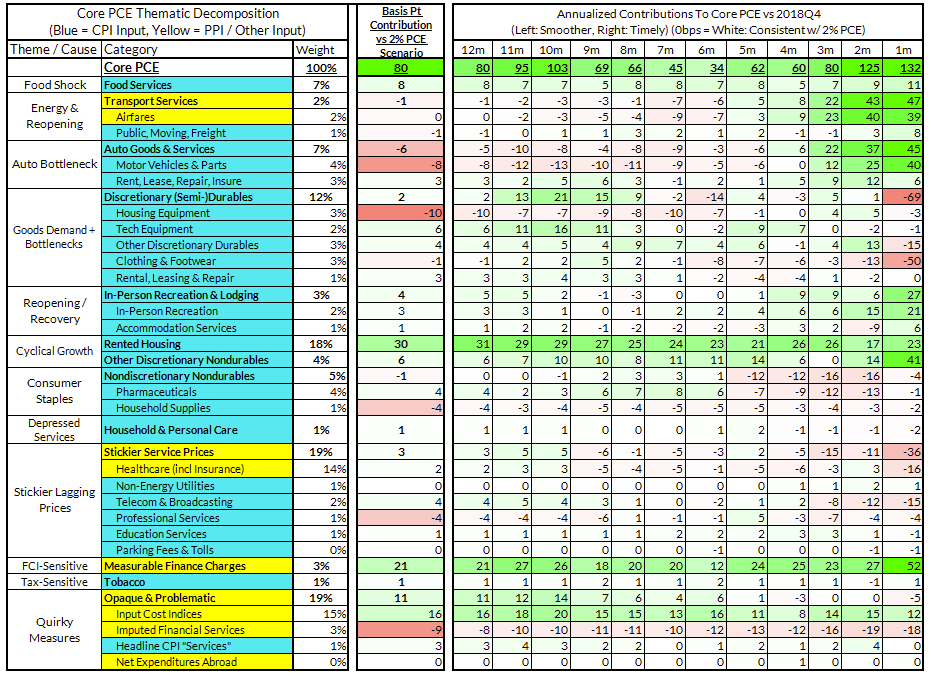

For the Detail-Oriented: Core PCE Heatmaps

Right now Core PCE (PCE less food products and energy) is running at a 2.80% year-over-year pace as of October, 80basis points above the Fed's 2% inflation target for PCE. That projected overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22. Rent dynamics are contributing 30 basis points to the 80 basis point Core PCE overshoot.

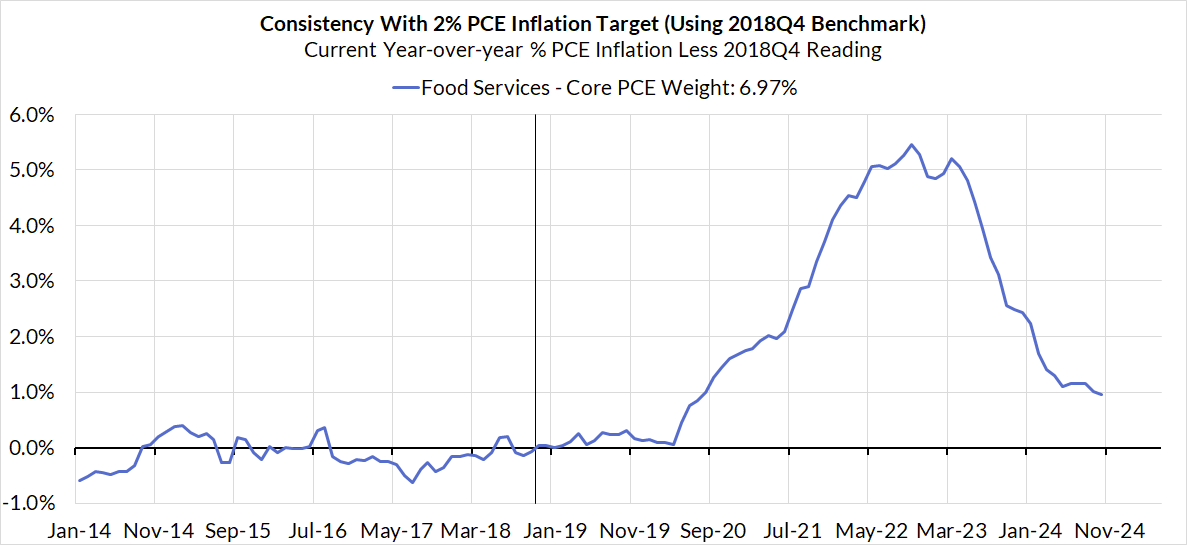

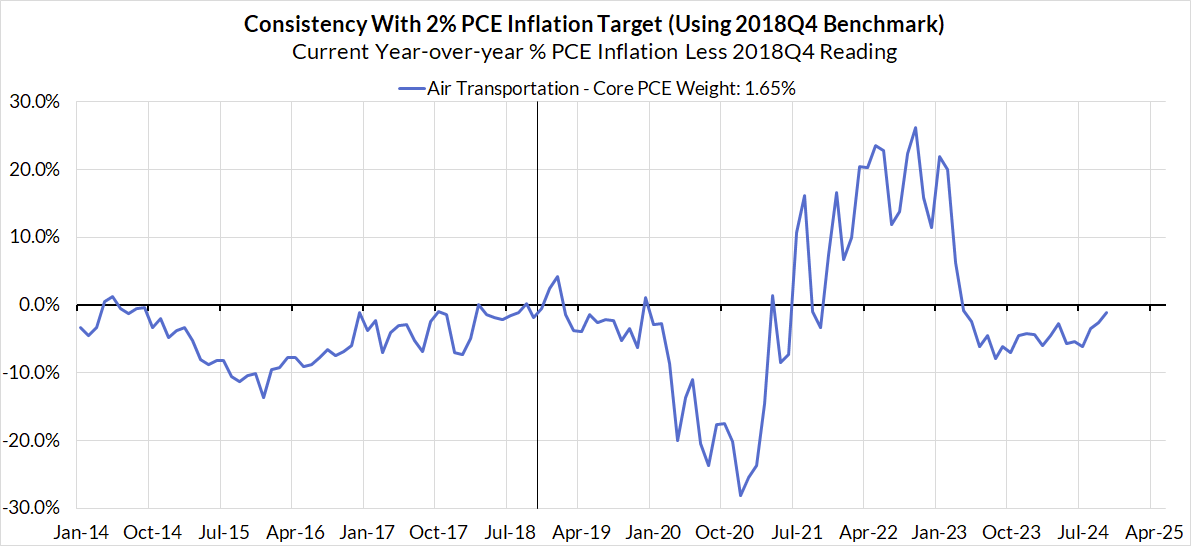

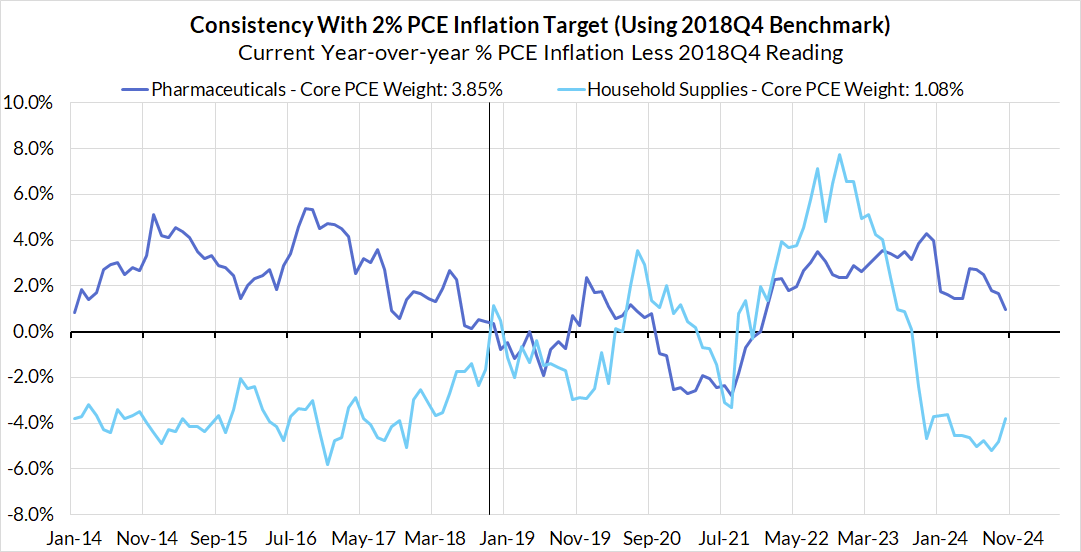

There are other contributors to the overshoot:

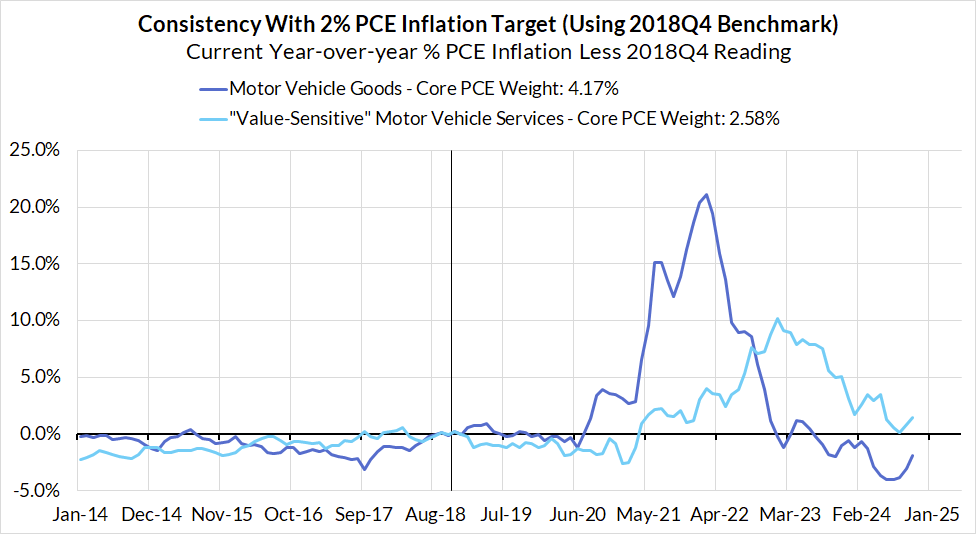

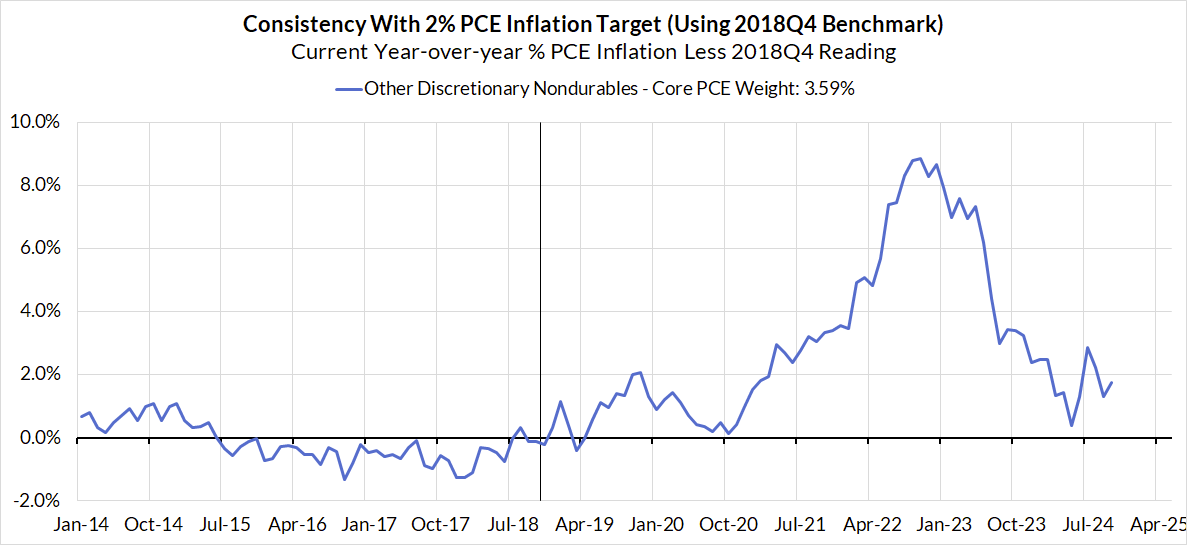

- Some more supply-driven (food inputs likely adding 8 basis points to the overshoot, unwinding motor vehicle bottlenecks now likely subtracting 6 basis points after being a substantial contributor)

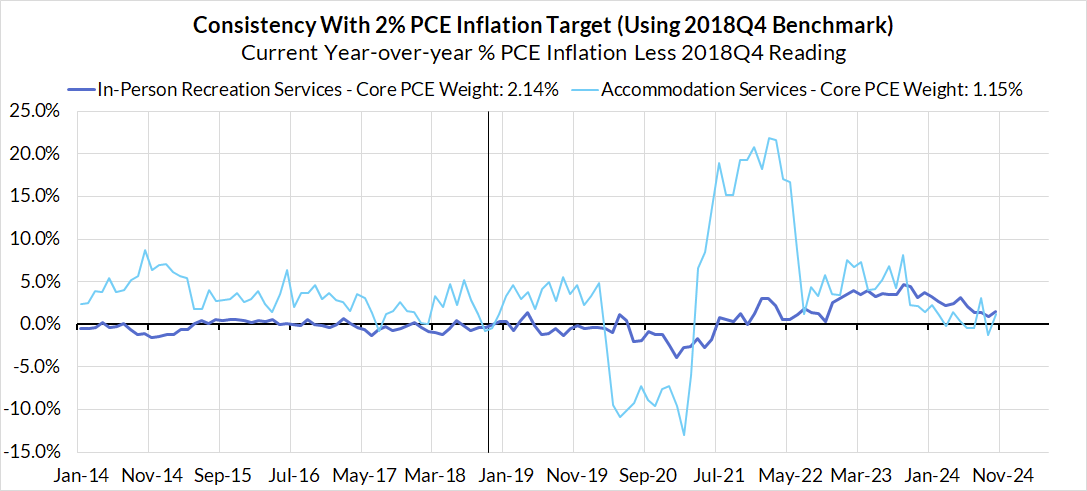

- Some more demand-driven (in-person recreation services likely adding 4 basis points to the overshoot)

Some oddball segments have offsetting effects (measured financial service charges now likely adding 21 basis points, while contributions from input cost indices are adding 16 basis points to Core PCE vs 2%-consistent outcomes).

The subsequent heatmap below gives you a sense of the overshoot on shorter annualized run-rates. October monthly annualized Core PCE ran at a 3.32% annualized pace, a 132 basis point overshoot vs 2% target inflation.

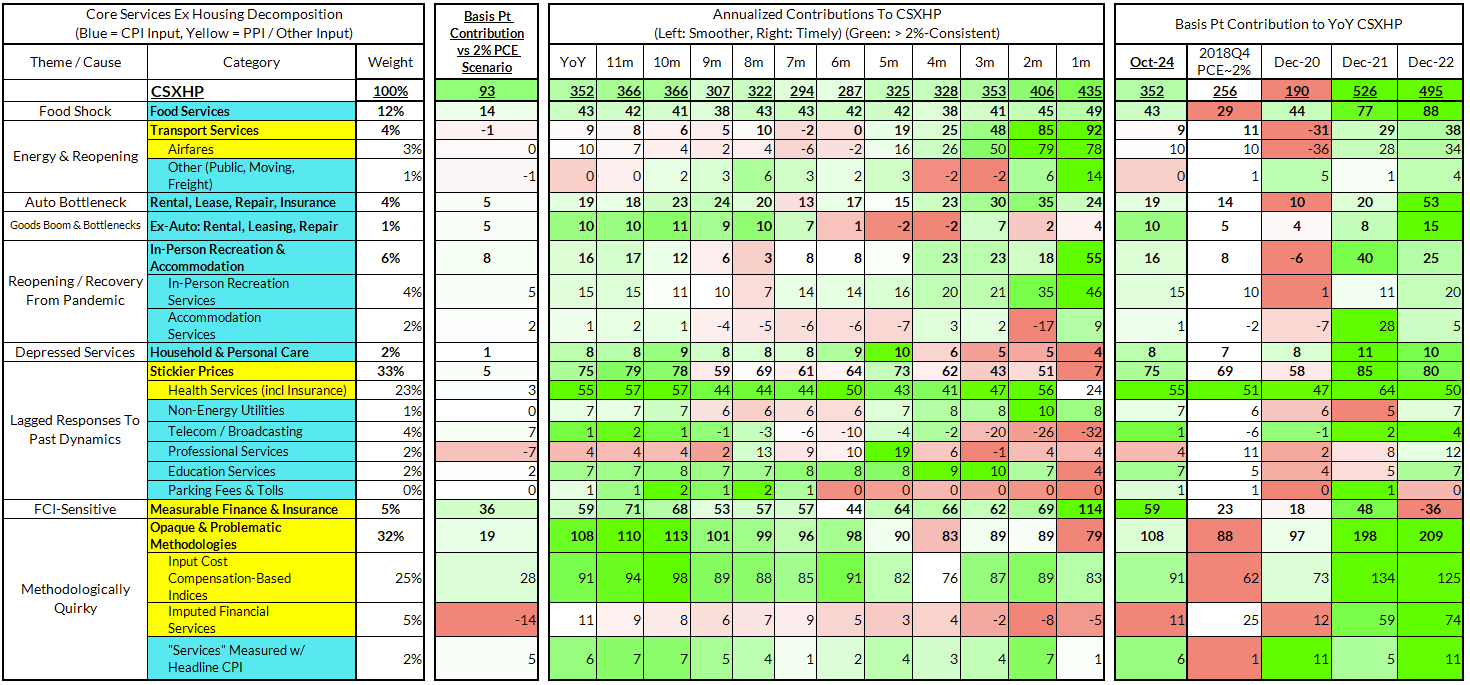

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The October growth rate in "Core Services Ex Housing" ('Supercore') PCE is running at a 3.52% year-over-year pace, a 93 basis point overshoot versus the ~2.59% run rate that coincided with ~2% headline and Core PCE.

October monthly supercore ran at a 4.35% annualized rate, a 176 basis point annualized overshoot of what would be consistent with 2% Headline and Core PCE.