If you enjoy our content and would like to support our work, we make additional content available for our donors. If you’re interested in gaining access to our Premium Donor distribution, please feel free to reach out to us here for more information.

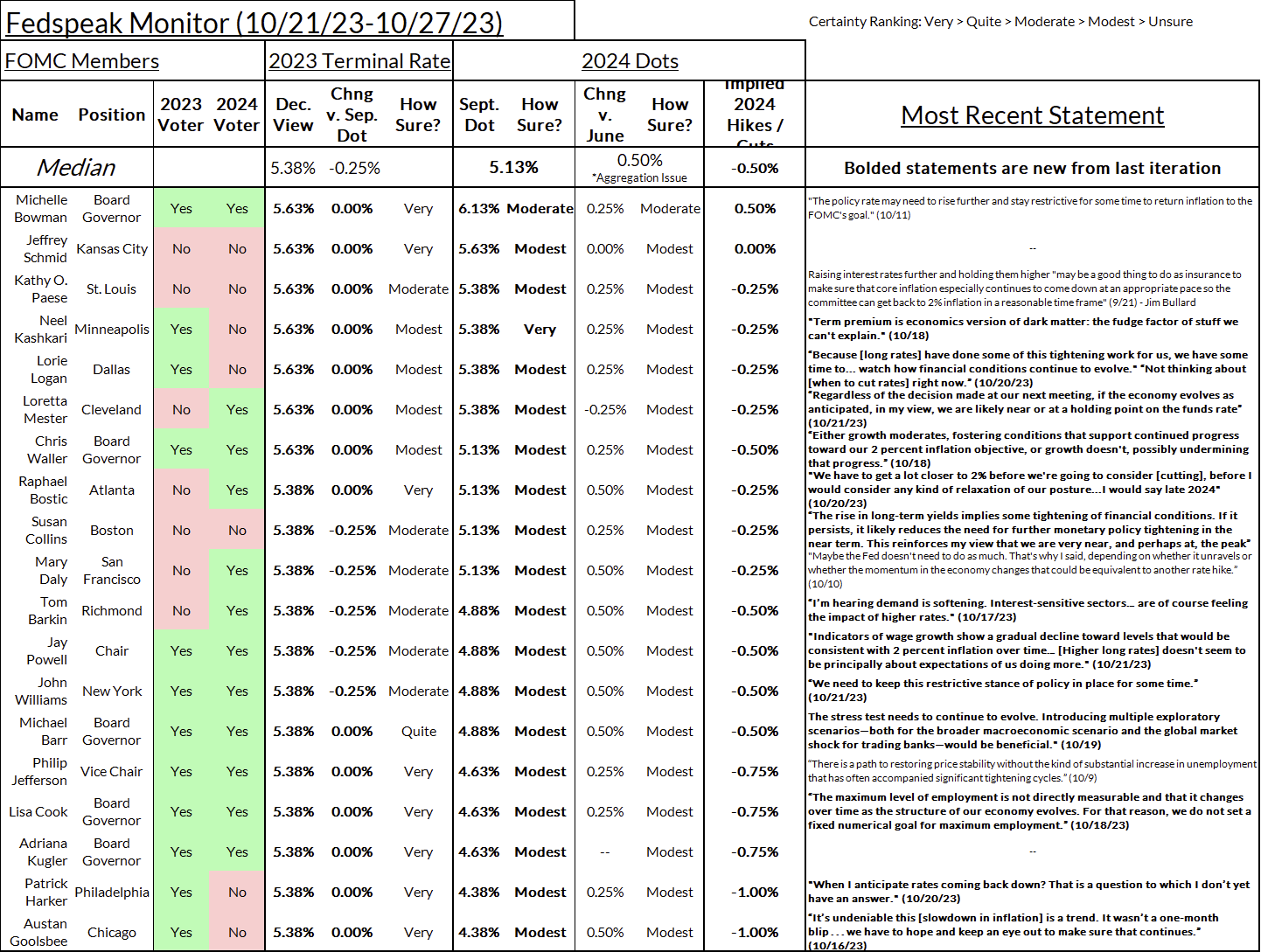

Latest Fedspeak and Our December Dot Projections

How Has The Data Evolved Since Last FOMC?

What to expect:

- A Hold: The Fed will leave its target range for the Federal Funds Rate at 5.25%-5.50%. The big news between the last meeting and this is the large raise in long yields, which has several committee members thinking that there will be less need to hike. The labor market is cooling across a number of measures, most notably quits and wage growth, and Powell has started to really acknowledge these indicators alongside the vacancy-to-unemployment rate. Core inflation continues to slow noticeably, and is currently on track to undershoot the 3.7% by end of 2023 projection at the last SEP.

- Ambiguity about the December Meeting. While our baseline case is for the Fed to hold through the end of the year, they won’t commit to it now and conduct policy mainly on the path of core PCE until the end of 2023, especially with a somewhat warm September core PCE print. Between the November and December meeting, there will be two months of jobs data (October and November), a month of PCE (October) and a good guess at November PCE (due to the availability of CPI and PPI by the morning of the Fed meeting), so the committee will feel an impulse to wait until the next meeting to signal anything. But barring unexpected heat in inflation, Fed officials have spent the last three weeks mostly concerned about the additional tightening that is happening from the raise in long yields.

- Growing recognition of labor market softening. Powell’s speech last week contained the most recognition of labor market softening we’ve seen from him yet, with Powell citing a wider variety of labor market indicators—quits, soft data, and the wage switcher premium—than the usual unemployment rate, payrolls, and job openings.

The Developments That Matter:

- Core PCE is Undershooting the September FOMC projection. The latest Core PCE 12-month growth rate came in at just under 3.7%, which was the end-of-year projection for core PCE at the September FOMC meeting. High inflation prints over the next two months could spur the Fed to hike, but so far inflation is cooperating more than was expected a few months ago.

- Growth confirmed robust—for now. Real GDP came in at 4.9% for Q3 2023, bolstered by strong personal consumption and residential investment. The prospect of high growth has worried some committee members—Waller last week said “either growth moderates, fostering conditions that support continued progress toward our 2 percent inflation objective, or growth doesn't, possibly undermining that progress”).

- Labor Markets continue to loosen with quit and hiring rates back to pre-pandemic levels, the job switcher premium at pre-pandemic levels, and nonfarm payrolls growth moderating. Prime-age employment rates have essentially plateaued for six months.

- A potential soft ECI print on Wednesday? The ECI will come out the morning of the second day of the meeting. There are hints in the non-profit institutions serving households data from the GDP release that ECI in health care will come in very soft, shading down aggregate ECI.

What we’re thinking

As we near the end of the hiking cycle, it’s time to start thinking about conditions for cutting rates next year. So far, committee members have mostly resisted saying anything about the rate path in 2024 (Bostic has said he doesn’t see any cuts until late 2024). Here are three key themes that the Fed should be taking into consideration when deciding when to cut next year:

- Worry about the Supply-Side. In our last Fed research roundup, we highlighted the growing evidence that tight monetary policy constrains the supply side, and can drag on growth and boost inflation in the medium term. Credit crunches have historically led to supply shocks that contributed to inflation. One clear area of concern is rental housing; multifamily starts have taken a nose-dive over the past few months, which raises concerns for rental inflation down the road. Investment in productive capacity is something the Fed should welcome, not be scared of.

- Don’t let the labor market deteriorate. The current SEP projects a slight increase in unemployment to 4.1%, up from its low of 3.5% this year. While that is no longer consistent with recession (as the SEP was earlier this year), a slow, contained increase in unemployment is not a common occurrence in history—typically unemployment rises significantly and quickly, and falls slowly over time. If we start to see hiring drop further or layoffs pick up, this should be interpreted as a warning sign.

- Don’t be Scared of Growth. Some Fed officials have pointed to strong economic growth as a reason to avoid cutting interest rates. As Claudia Sahm points out, recognizing what “trend growth” is is very difficult to do in real-time. This most recent bout of growth does not coincide with a corresponding increase in labor utilization, indicating that most of it is “productivity-driven.” To the extent the Fed believes that, for instance, wage growth is constrained by productivity growth, they should welcome this type of growth.