At Employ America, we have argued that shortages of physical productive capacity played a major role in the inflation seen during and after the recovery from the pandemic recession. In order to analyze the impacts of shortages and their resolution, we have been tracking reported shortages and comparing them to indices of industrial production and prices faced by producers. How the path of investment and production evolves after a period of reported shortages is likely to be highly suggestive for the path of a number of other important economic dynamics, most especially the labor market and increasingly relevant energy transition dynamics.

In today’s report, we see a few key takeaways:

- Automobiles still remain an inflation risk.

- Increased production in Machinery, despite rising prices and shortages in upstream Metals and materials, suggest demand for capital goods remains strong in response to pandemic-era shortages.

- The real capex boom is related to agriculture, construction, and manufacturing; oilfield capex is only starting to tick up from depressed levels.

How To Read The Monitors

Below, we present two kinds of monitor.

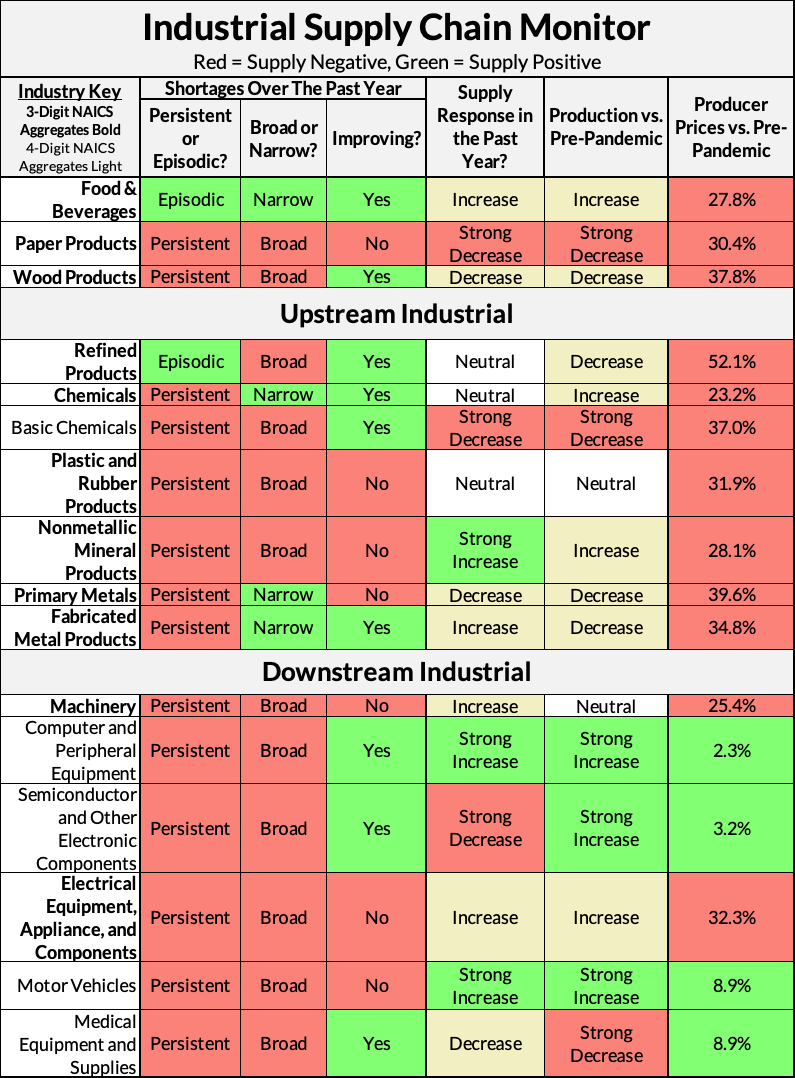

Headline Monitor

We present one headline monitor that summarizes the trends in shortages, industrial production and producer prices for a handful of key industries. These are further broken down into relatively upstream industrial processes, like chemical and primary metal production and relatively downstream industrial processes, like the production of machinery and electrical equipment. Despite this, the circular flow of production still means that the availability of some relatively downstream products – especially semiconductors – are important to upstream production processes and other downstream ones as well, especially automobiles in this case.

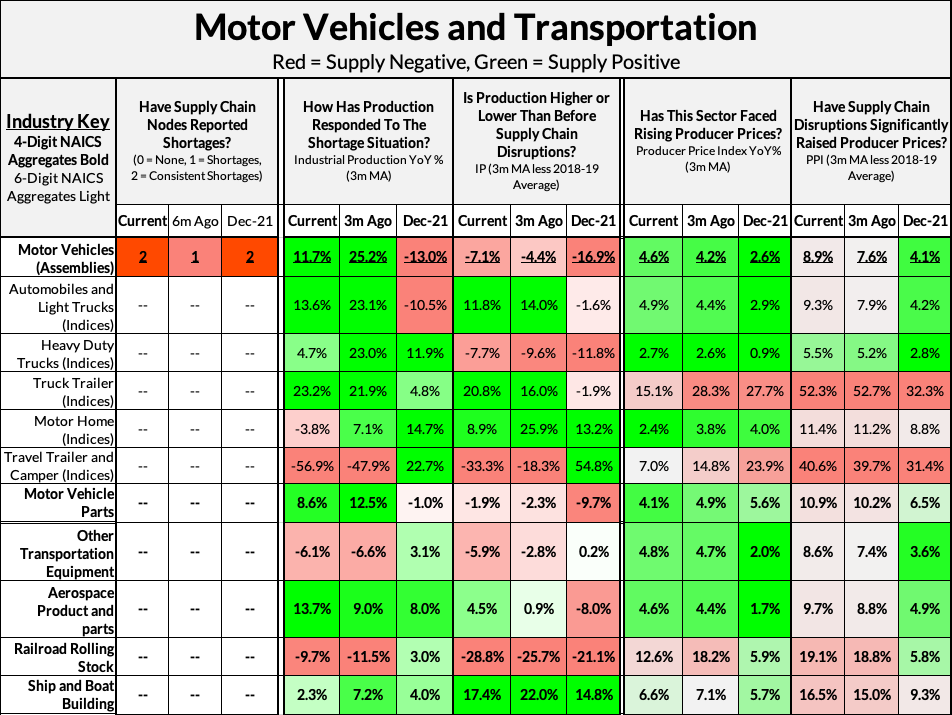

Detailed Monitors

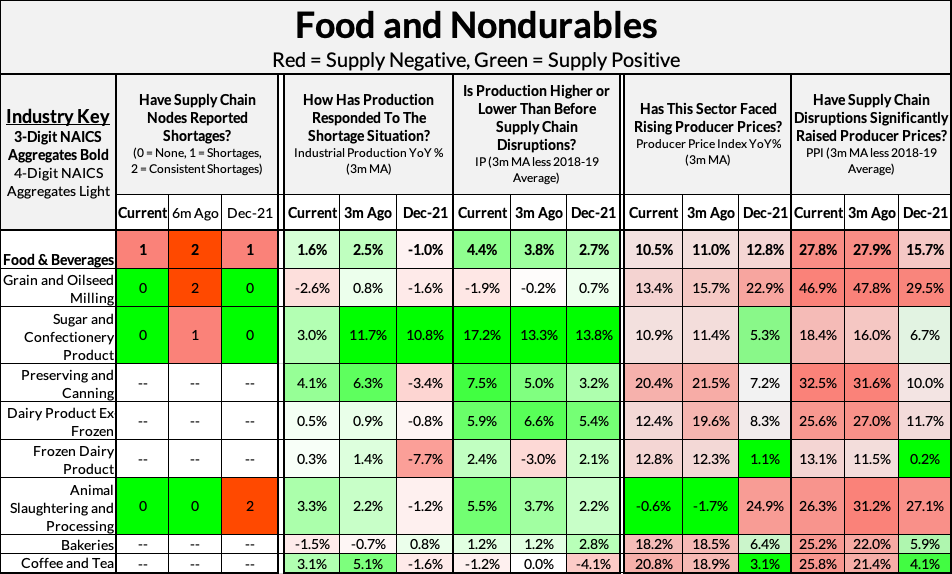

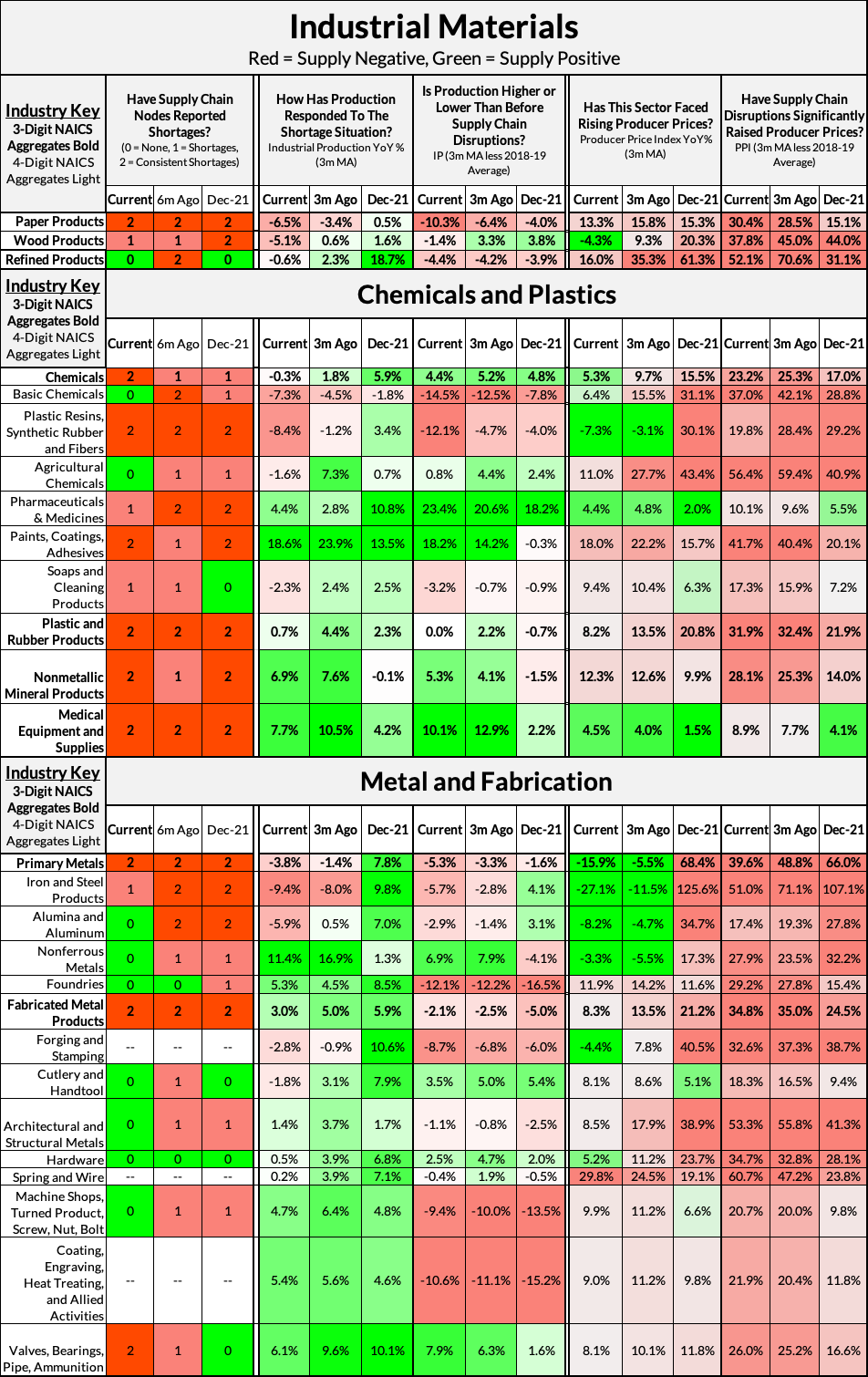

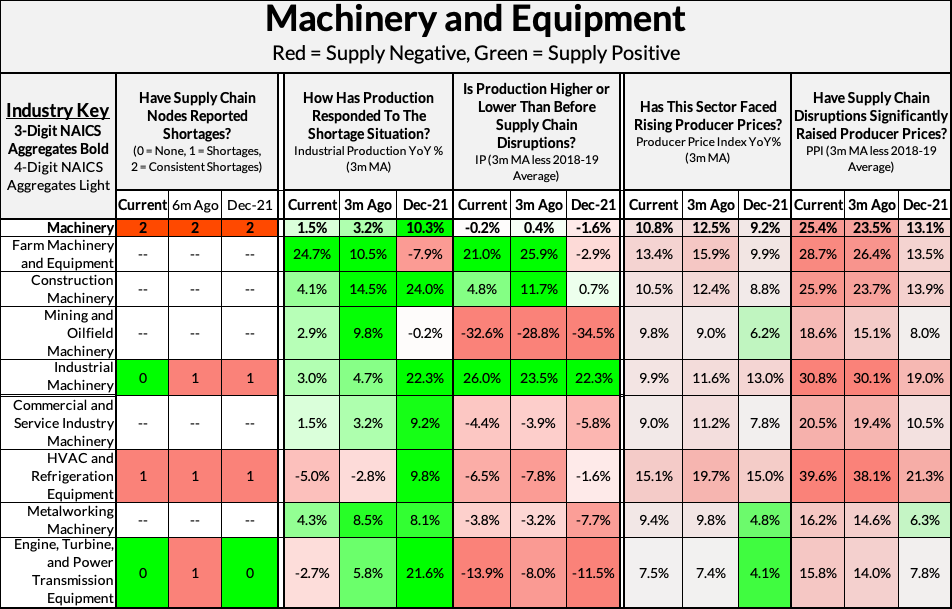

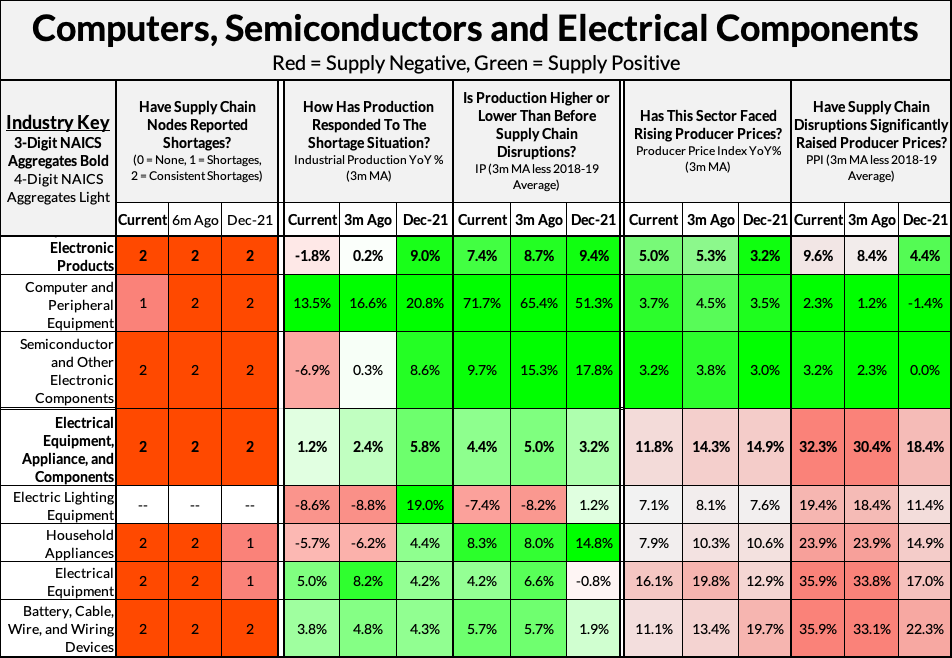

We present a series of detailed monitors, which will be iterated and adapted monthly to changing conditions, that show the changes in industrial production and producer prices for NAICS industries at the three, four and six-digit level over a range of time horizons. The goal of these monitors is to get a sense of the relationship between reported shortages, producer prices, and industrial production, so as to track industrial dynamics in close to real time, while contextualizing the relationship between the pre-pandemic and post-pandemic economy.

The monitor is broken up into three sections, the first (leftmost) column is a qualitative metric combining the duration and intensity of reported shortages. The center two-column group shows how industrial production has evolved over a range of timelines, while the right-most two-column group shows the same for producer prices.

In the center group, we are looking for increases in industrial production, so increasingly positive numbers are increasingly green, while increasingly negative numbers are increasingly red. Green means good and more production is usually good for supply. In the right-most group, we are looking for increasing costs as a challenge for bringing more supply online, so increasing numbers are increasingly red. Red means bad, higher producer prices are usually bad for supply.

Three Takeaways

- Automobiles still remain an inflation risk. Combined with continued shortages in semiconductors, which have been a key bottleneck for completed auto assemblies since mid-2020, Motor Vehicle Assemblies remain substantially depressed relative to pre-pandemic. This has left a sizable inventory hole, leading to substantial inflation in the price of new and used cars despite the fact that producer prices for motor vehicles have not risen by nearly as much as comparable Machinery subsectors. Pricing power is unlikely to diminish until more inventory makes it to market.

- Increased production in Machinery, despite rising prices and shortages in upstream Metals and materials, suggest demand for capital goods remains strong in response to pandemic-era shortages. This may prove a further inflation risk if firm margins need to adapt to pay off elevated capex costs in the future. Consistently “higher for longer” interest rates could compound this dynamic as well.

- Within Machinery, not every category is showing strength. The real capex boom is related to agriculture, construction, and manufacturing; oilfield capex is only starting to tick up from depressed levels. Industrial Machinery; Construction Machinery; and Farm Machinery have all seen substantial production increases. HVAC and Refrigeration Equipment; and Engine, Turbine and Power Transmission Equipment have all seen substantial production decreases. This will be a dynamic to watch as federal investment dollars appropriated by the Inflation Reduction Act begin to flow through the economy.

Headline Monitor

Detailed Monitors