This preview was published two business days ago for our Premium Donor distribution. Consider subscribing if you would like to support our public research and advocacy work, and receive early access to our data release previews.

Baseline View:

What the data tell us to expect this Friday — softer nonfarm payroll growth, a lower unemployment rate and a wage print that will give us an ok first-read on Q1 wage growth ahead of the more robust Employment Cost Index release later this month.

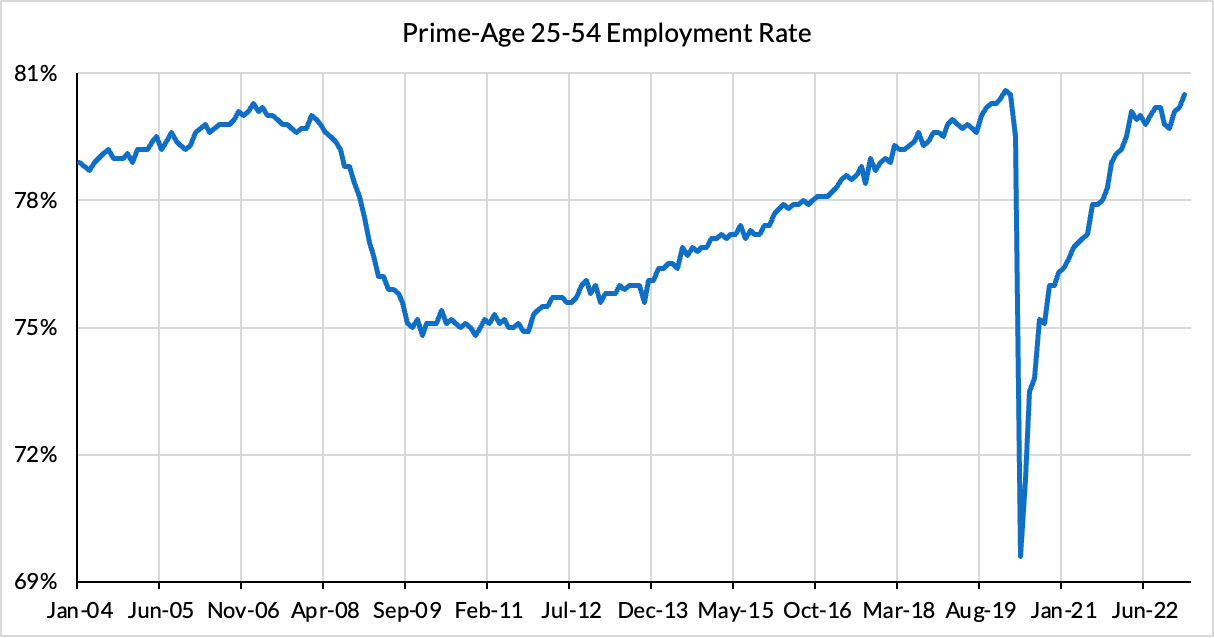

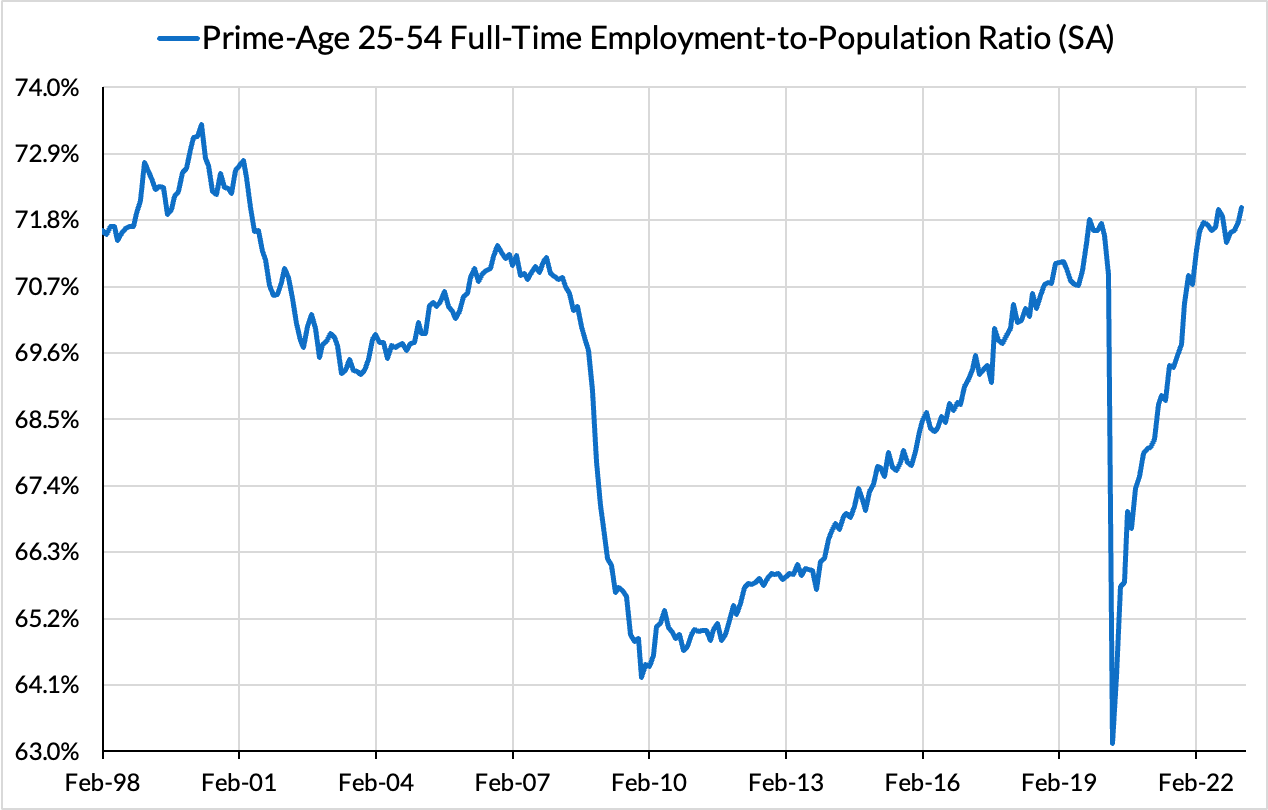

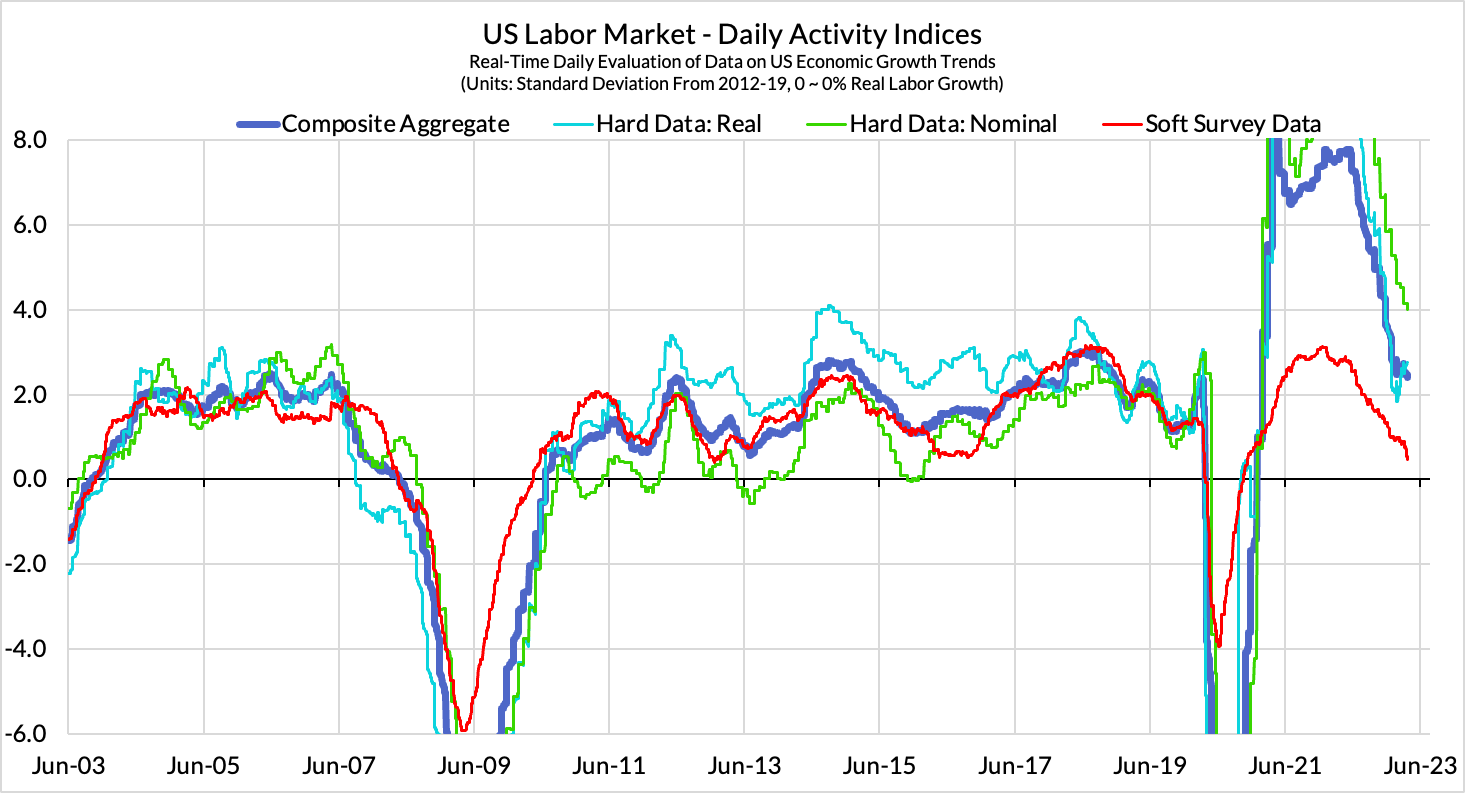

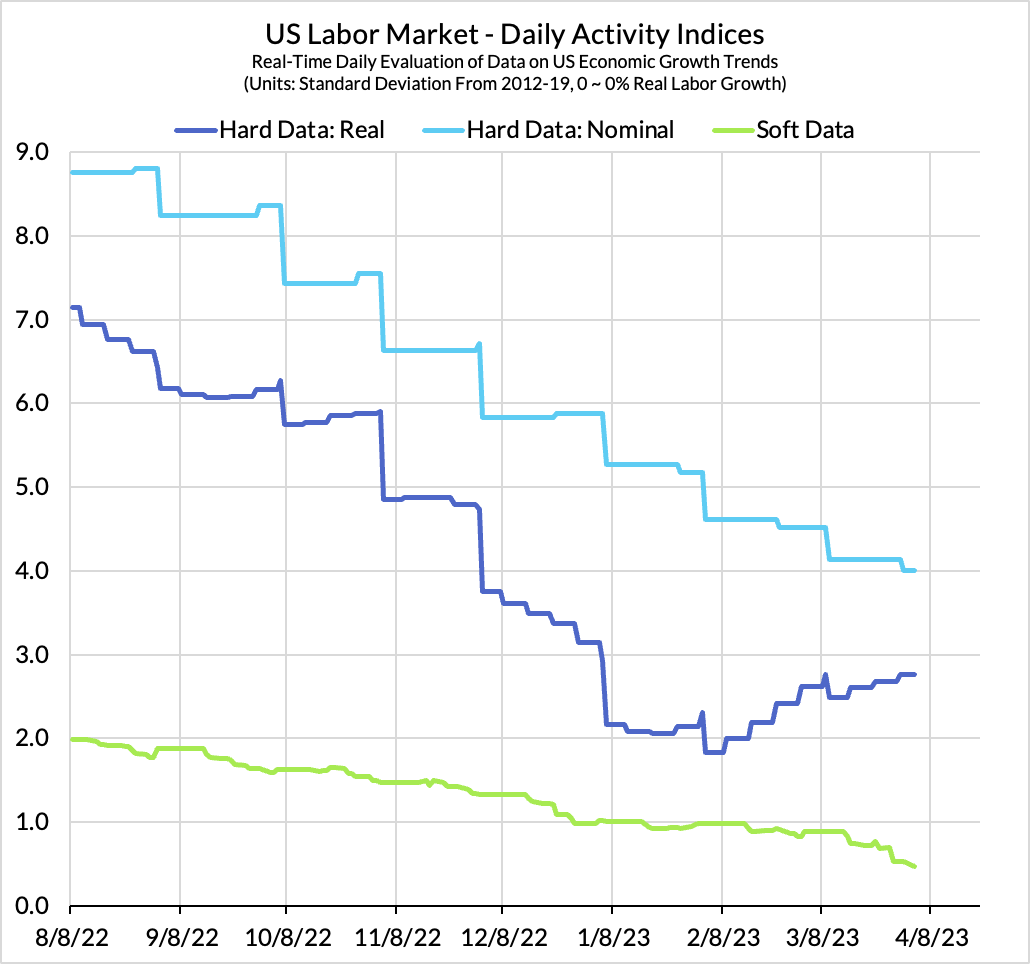

- Nonfarm payroll growth should cool substantially from a white-hot 408k average across January and February; moderate downside risks vs 240k consensus (our baseline: 150k-200k). We saw less giveback in February than consensus (or ourselves) anticipated. While residual seasonality likely did push up January payroll growth, the surprising strength in February confirms underlying strength. We see two offsetting dynamics that leave our baseline view unchanged: A) there is high inertia in the hard data, including nonfarm payrolls, household survey, jobless claims, and B) the soft business survey data keeps pointing to ongoing hiring slowdown. The latter dynamic seems concerning but it may take time to show up in the hard data.

- The unemployment rate is more likely to fall from 3.6% (consensus) to 3.5% (baseline) than rise to 3.7%. The unrounded unemployment rate is 3.57% rate and total jobless claims continues to marginally fall. The household survey has also lagged the gains in the establishment survey (used for calculating nonfarm payrolls).

- We will get a preliminary view of Q1 wage growth from which to handicap ECI later this month: Average hourly earnings (AHE) releases are choppy month to month and generally not a great guide for wage trends as a result. But we will have a full quarter's worth of average hourly earnings data from which to back out an ok Employment Cost Index estimatea (though AHE will be subsequently revised).

Policy Risks:

- Hawkish: While stronger wage growth might stoke headlines about Fed hawkishness, it's usually too noisy for the Fed's reaction function (they tend to wait for ECI before revising views). The fundamental risk in this report will stem from the unemployment rate falling back to 3.5%, which further motivates hikes beyond 5.125%. The Fed's projections in March basically assumed a deeper 2023 recession as a result of turmoil in the banking sector. But the actual data is much more resilient. The Fed may not fully admit it, but a rigid wage Phillips Curve understanding of wage growth underpins the views of many FOMC members and Fed staff. The lower the unemployment rate, the higher their baseline growth rate for wages and, by extension, service prices.

- Dovish: The biggest dovish game-changer from this release would be the prospect a monthly contraction in nonfarm payrolls, but that is still not consistent with all of the data we have now. Jobless claims have stayed solid and while survey data keeps showing a sharper slowdown, it also isn't signaling a contraction. If we did see soft wage growth in AHE, it would shade our ECI forecast marginally, and that might strengthen the case for the Fed to back off tightening (as it undermines their hyperbolic characterizations of labor market tightness).

Charts