Note: Subscribers to MacroSuite receive our FOMC preview at the beginning of the blackout period before each FOMC meeting. A public version of the preview will be released closer to the meeting. If you're interested in becoming a MacroSuite subscriber, please reach out to macrosuite@employamerica.org

What To Expect:

The Fed faces risk from multiple directions and is experiencing a high level of uncertainty. We expect the Fed to, again, try to provide as little as possible concrete guidance about its policy trajectory other than to emphasize that there are a wide range of policy outcomes that are plausible. At this point, the last thing they want is to lock themselves into any particular path.

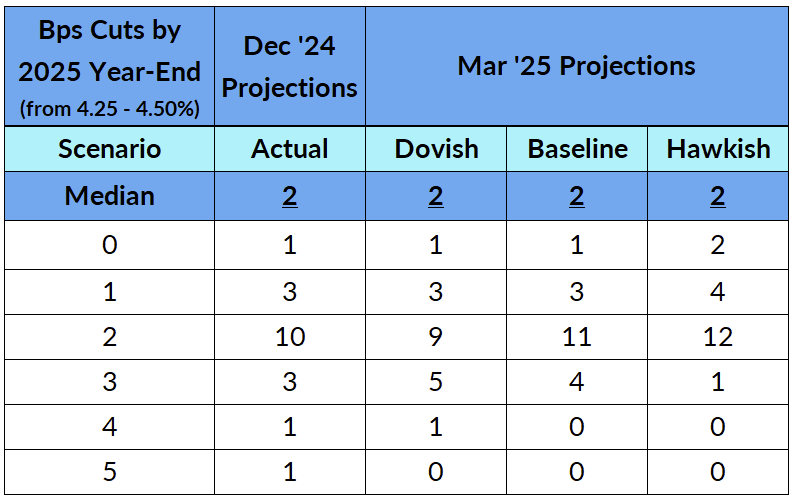

We get a new edition of the Summary of Economic Projections this meeting. Our baseline scenario sees the hawks mostly unchanged and the doves to consolidate towards two cuts for 2025. A two-cut projection keeps things maximally open, leaving ample room for both hawkish and dovish pivots. While there is a very obvious concern about the inflationary effect of tariffs, there has also been a noticeable concern around growth in the latest week of Fedspeak which limits the hawkish risk to the projections.

In a dovish scenario, we still some upwards movement amongst the doves, but growth concerns still keep six or more members (including Waller) at three or more cuts. A hawkish scenario sees most of the doves consolidate at two cuts.

Over the past few meetings, projections of the long-run interest rate have gradually drifted upwards. We expect this to continue given the recent upwards revision to productivity growth, since the conventional thinking is that higher productivity growth leads to a higher neutral rate.

Things we expect to hear from Powell at the press conference:

- The economy is still on solid footing, and this allows us ample time to wait for tariff policy certainty and assess the effects.

- We’re aware of signs of slowing but we’re not too concerned about it, although we’re ready to respond to it.

- We’re maintaining an eye on inflation expectations, especially long-term market expectations.

- Don’t put too much weight on the dots. There’s a large range of plausible outcomes.

Latest Fedspeak And Dot Projections

We are now including in our assessment of where each member stands on the long-run or neutral federal funds rate. In the interest of not providing false precision, we provide a rough estimate of the range where we think each member’s estimate of the long-run federal funds rate lies.

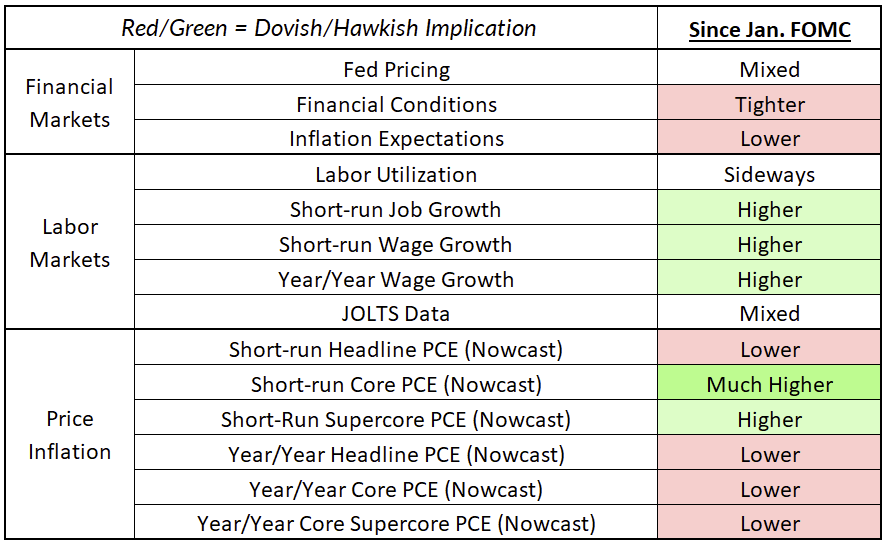

The Developments That Matter & What The Fed Thinks About Them

The labor market data has mostly moved sideways from the past meeting. The unemployment rate and prime-age employment are largely unchanged from the January meeting, wage growth continues to fluctuate around a 4% growth rate, and JOLTS measures were largely unchanged. The payrolls number looks strong and above what Fed officials believe to be the breakeven rate of job growth. While we are concerned about the sectoral composition of employment growth, Fed officials seem very confident in the strength of the labor market and think it gives them ample time to avoid adjusting monetary policy further from here.

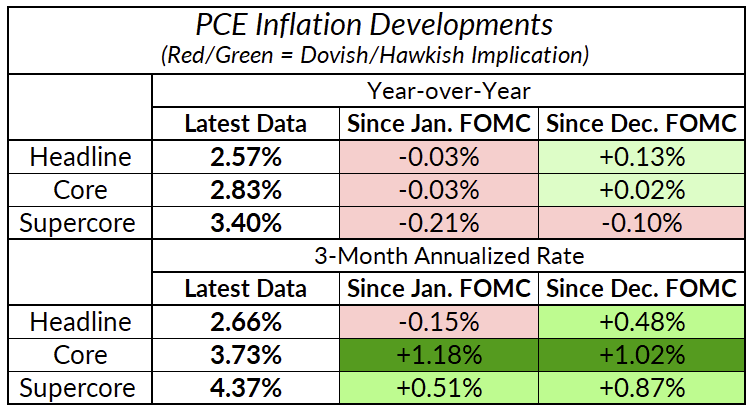

Meanwhile, inflation still remains elevated due to components that lag (housing, wage-index-based measures, and financial services components). With tariffs on the horizon, we don't think the February inflation data will matter much for the Fed for now, but it does push back our expectations of the first rate cut to June (and possibly July).

The big news in the past couple weeks has been the chaotic implementation (and non-implementation) of tariff policy. With tariffs of up to 25% on some goods going into effect on imports from Canada and Mexico (and more tariffs currently planned to go into effect in April) the Fed is going to want to see far more inflation data before they feel like they can cut rates further, even if February’s data cooperates. The potential size and scope of the tariffs has spooked members that would otherwise be more dovish at the moment.

- Goolsbee: “before the Fed can go back to cutting the rates, I feel and have expressed that we got to get a little dust out of the air” (2/24/25).

- Waller: “I favor looking through these effects when setting monetary policy to the best of our ability… waiting for economic uncertainty to dissipate is a recipe for policy paralysis” 2/17/25); later, ("It's very hard to eat a 25% tariff out of the profit margins… those are more the things where people start getting confused as to where there's a one-time price level [increase] or other things going on" 3/6/25)

- Bostic: “I'd be surprised if we got a lot of clarity before the late spring or into the summer” (3/5/25)

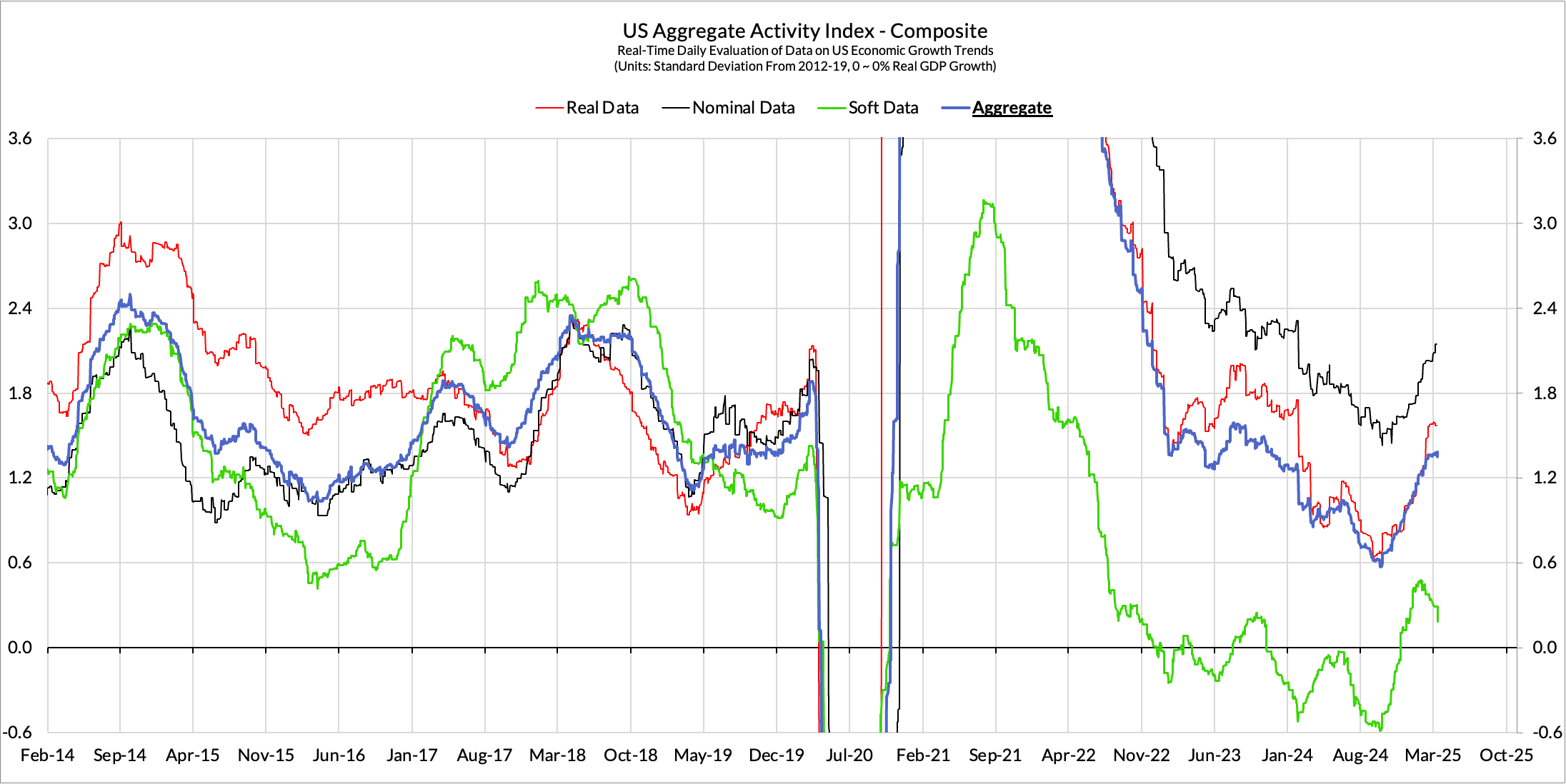

While the hard data remains fairly solid, the soft data has started to show some cracks. Homebuilder sentiment and consumer confidence dipped noticeably over the past couple of weeks. This doesn’t have any Fed members crying out for rate cuts yet, but they are starting to notice and talk about the possibility of cutting if activity slows. This past week of Fedspeak saw a noticeable uptick in attention paid to downside labor market and economic activity risk.

- Bowman: “I expect that the labor market and economic activity will become a larger factor in the FOMC's policy discussions.” (3/7/25)

- Waller: “we're seeing a lot of stuff in the soft data that suggests that maybe things are not gonna be quite as good on the real side of the economy.” (3/6/25)

- Williams: “Have to factor in how [do tariffs] affect economic activity — decisions by businesses to invest, consumers to spend” (3/4/25)

- Harker: “Unemployment still low, still getting growth, but there are threats to this. We're starting to see that confidence is starting to wane” (3/6/25)

- Daly: “Uncertainty surrounding the economy and economic policy is elevated. And economic research will tell you that uncertainty is a source of demand restraint.” (3/7/25)

- Musalem: “Recent data have been weaker than expected, especially consumer spending and housing market data, posing some downside risk to growth.” (3/3/25)

Finally, some measures of inflation expectations, most notably in the University of Michigan consumer survey and the NYFed’s business survey, have spiked. However, these readings are (a) generally short-term expectations and (b) survey-based measures. Market-based measures of long-term expectations have not spiked, and Fed officials have dismissed the survey measures.

- Waller: "I didn't pay much attention to [survey-based inflation expectations]... I personally have always looked at market pricing." (3/6/25)

- Goolsbee: "I value the market-based measures more than survey-based measures" (3/5/25)

- Powell: “Most measures of longer-term expectations remain stable and consistent with our 2 percent inflation goal.” (3/7/25)

- Williams: “"There is no sign of inflation expectations becoming unmoored at any forecast horizon relative to the pre-pandemic period" (3/7/25)

What We’re Thinking

With so much uncertainty on the horizon, the Fed would be right to keep its options as wide as possible. As Powell said on Friday, “the tails are fatter than you think.” It is important that the Fed apply this to labor market and growth risk as well. At this point, most of the discussion around tariff uncertainty revolves around what the effect of tariff policy will be on inflation. While that certainly is relevant for the Fed, we think there are a number of headwinds to the labor market that may arise over the course of this year.

The composition of job growth has narrowed to a set of mostly “acyclical” sectors. Cyclical sectors like goods manufacturing are adding little to job growth, and the one bright spot there—construction—can’t last forever as the housing market slows (residential construction employment was flat in February). The acyclical sectors currently keeping the labor market going are likely to slow later this year, as pandemic normalization dynamics dissipate, or face significant policy headwinds going forward. Government employment is the obvious one, but employment in education and healthcare is also susceptible to policy risk this year.

On Friday, Powell dismissed growth and labor market risks as mostly being driven by the soft data, arguing that vibes were not a good measure of the economy before. We think the downside labor market case deserves more attention. If those headwinds materialize before inflation, the Fed is going to be put in a very difficult position where they are trying to manage recession risk while inflation remains uncomfortably high.

How Has The Data Evolved Since Last FOMC?