The data from the February labor market show continued labor market strength. Almost all employment-based indicators show improvement from the previous month, even as the general trend of wage growth is downwards.

The headline unemployment number rose from 3.4% to 3.6%, but this was due to a strong increase in the labor force participation rate–similar to what we previewed yesterday, and still coincided with sizable employment gains. The prime-age employment rate is back up to 80.5%, its as-reported pre-pandemic peak three years ago, with female prime-age employment and full-time prime-age employment surpassing pre-pandemic peaks. The establishment survey showed a respectable 311,000 jobs added in February.

The increase in labor force participation will be interpreted as an increase in people coming into the labor force, but it’s important to remember that stocks are determined by flows in both directions. The flow data show that the rate at which unemployed people are leaving the labor force fell significantly in February, erasing its steady increase over the past year and a half. This is as much about people staying in the labor force as people coming in.

Unlike last month, when we got Employment Cost Index data, we didn’t get much information about wages this month–just an update to average hourly earnings that will be subject to revisions. However, what we got this month suggests a continuation in the slowdown in wages: average hourly earnings grew at just a 2.9% annualized growth rate in February, down from 3.3% in January (which itself was revised down from 3.7%).

Given the strength in this jobs report and slowing average hourly earnings, the Fed’s decision in March of whether to go to a 50 bps hike will likely hinge on the CPI and PPI data next week. However, this month’s jobs data reinforces the case that we can still pursue disinflation without resorting to rising unemployment.

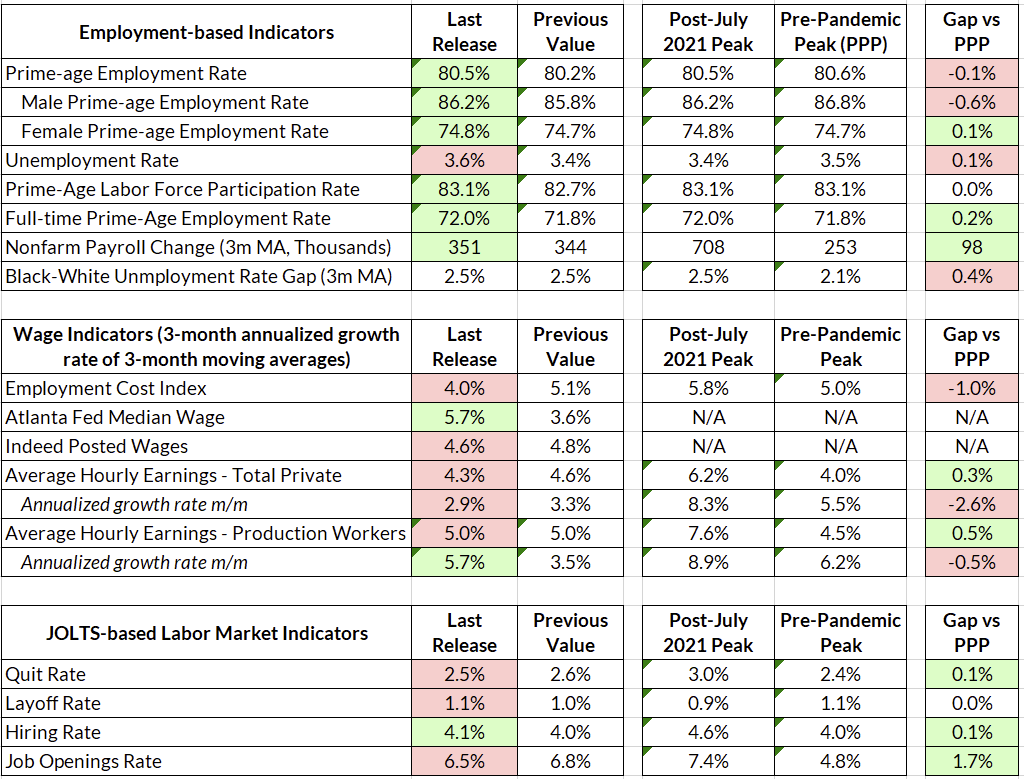

Labor Market Dashboard: February 2023

A Full Recovery

Almost exactly three years after the beginning of the pandemic, prime-age employment is back to its pre-pandemic level. The significance of that should not go unnoticed, especially in the context of the sluggish recovery from previous recessions. It took over twelve years for employment to fully recover from the Great Recession.

The picture looks even better when one looks at full-time prime-age employment, which is now beyond its pre-pandemic peak (72.0% vs. 71.8%):

The headline unemployment rate rose from 3.4% to 3.6%, but this appears to be mostly driven by participation rather than employment. The prime-age labor force participation rate is now back to its pre-pandemic peak of 83.1%, up from 82.7% last month:

This will probably be interpreted as an increase in the number of people returning to the labor force, brought back by a strong labor market. That is partially true. Looking at the flow data, it does look like the flow rate of labor force non-participants into employment since December has been elevated. However, the notable change in February is due to fewer people leaving the labor force from unemployment.

The flow rate of people from unemployment out of the labor force has been elevated for over a year, but February’s data erased nearly all of that increase. In other words, this month’s data was as much about people staying in the labor force as people entering the labor force. This data is admittedly noisy, so it will be interesting to keep an eye on this over the next few months.

Wage Deceleration Continues

One should never put too much weight on a single month’s data of average hourly earnings, since these numbers have shown to be subject to large revisions in future months. However, what we did get this month points towards further wage deceleration, similar to last month’s data. The annualized growth rate of average hourly earnings fell further to 2.9%. In addition, revisions to January’s data show that average hourly earnings grew 3.3% last month, down from the previously-reported 3.7%. If the Fed really believes that “core services ex-housing” inflation is really driven to wage growth, this should be tentatively promising on that front.

As I wrote after the JOLTS release this week, this wage deceleration is consistent with the gradual cooling of the labor market indicated by the steady reduction in quit and hiring rates, but not with the continued elevated level of the job-openings-to-unemployed ratio. At this point, the job openings data really is the one indicator that is out-of-step with the rest of the data, and the Fed needs to commit to a view:

At this point, the Fed needs to pick a side. Do they believe the job openings data, which suggest that there is some sort of structural shift in the Beveridge Curve that should lead one to believe that the “natural rate” of unemployment is substantially higher than before, and that we need to crush employment to bring the labor market “back into balance”? Or will they rely on the other labor market data, which have been pointing to a strong labor market that is steadily cooling?

Will the Fed Go to 50? Look to CPI and PPI.

At Powell’s Humphrey Hawkins testimony on Wednesday, he stressed that the decision to go to 50 bps was going to depend on the data between then and the Fed meeting in less than two weeks. In terms of what they will do, this report probably doesn’t change much, given the continued strength of the labor market. While the average hourly earnings slowdown might give them pause, they certainly understand the possibility of a headfake due to seasonality and revisions. They’ll be looking closely at the CPI and PPI data coming in next week.

That being said, this month’s report bolsters the case we made last month: disinflation is possible even amid labor market strength. The Fed need not threaten the incredible labor market recovery they helped engineer to bring down inflation.