Core-Cast is our nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%.

Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the day of the PCE release.

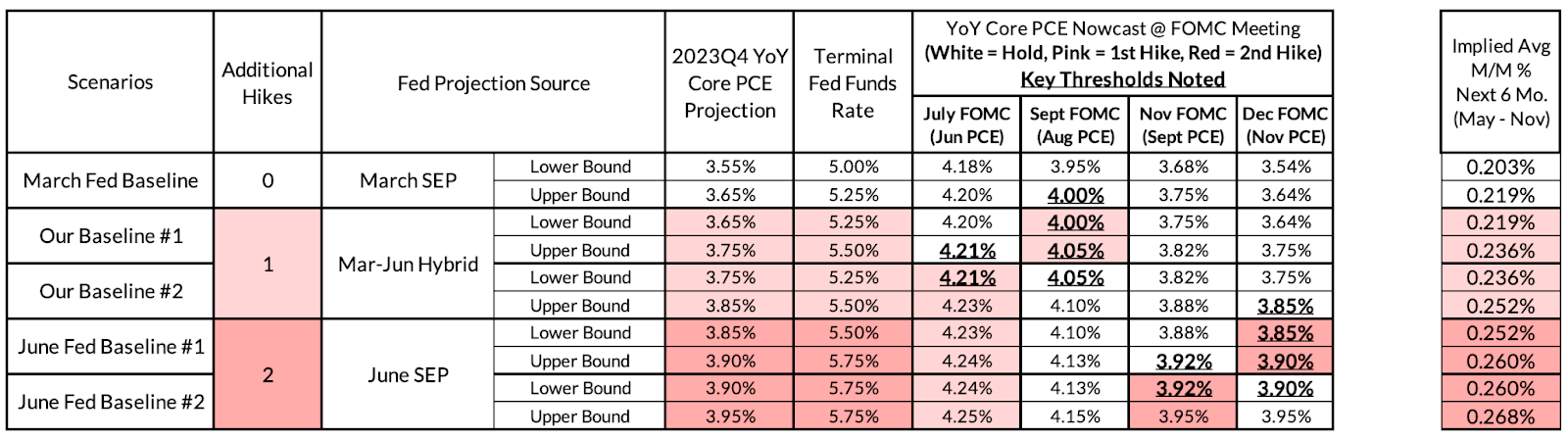

Summary: June PPI largely confirms June CPI implications for Core PCE, with only marginal upside filtering. Monthly Core and Core Services Ex Housing PCE is likely to be close to the Fed's 2% PCE inflation goals. Airfare PPI did not show the same downside as CPI (-0.5% vs -8.1%), healthcare services showed surprising downside, while vehicle insurance PPI spiked. The FOMC blackout period ends today, and so this is the last chance for Fed officials to publicly express any new perspective on the data before the July FOMC meeting. We do get one more bit of PCE inflation information in the blackout period: import price data on airfares (we will provide a shorter update here, likely in our Activity Updates). The Fed seems very keen to hike in July but we would note that the data is starting to show signs of underperforming what the Fed penciled in for inflation not just in June but even March too (when the Fed penciled in no additional hikes from here). At this point, a dogmatic July hike looks more likely than a data-dependent hold.

The full version of this Corecast installment is made available exclusively for our Premium Donors. To view the full version, sign up here for a 30-day free trial or contact us for more information.