This is a delayed and truncated version of the monthly inflation preview we first share with MacroSuite subscribers.

Core-Cast is our nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%.

Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the day of the PCE release.

If you'd like to start a 90-day free trial of our exclusive content, you can do so using this link. If you have any questions or would like to see samples of our past content, feel free to get in touch with us.

Summary

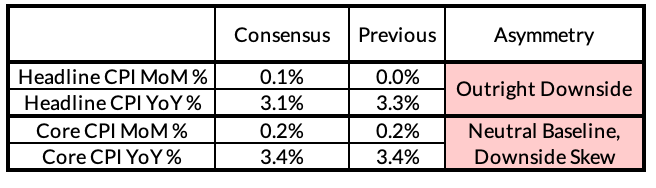

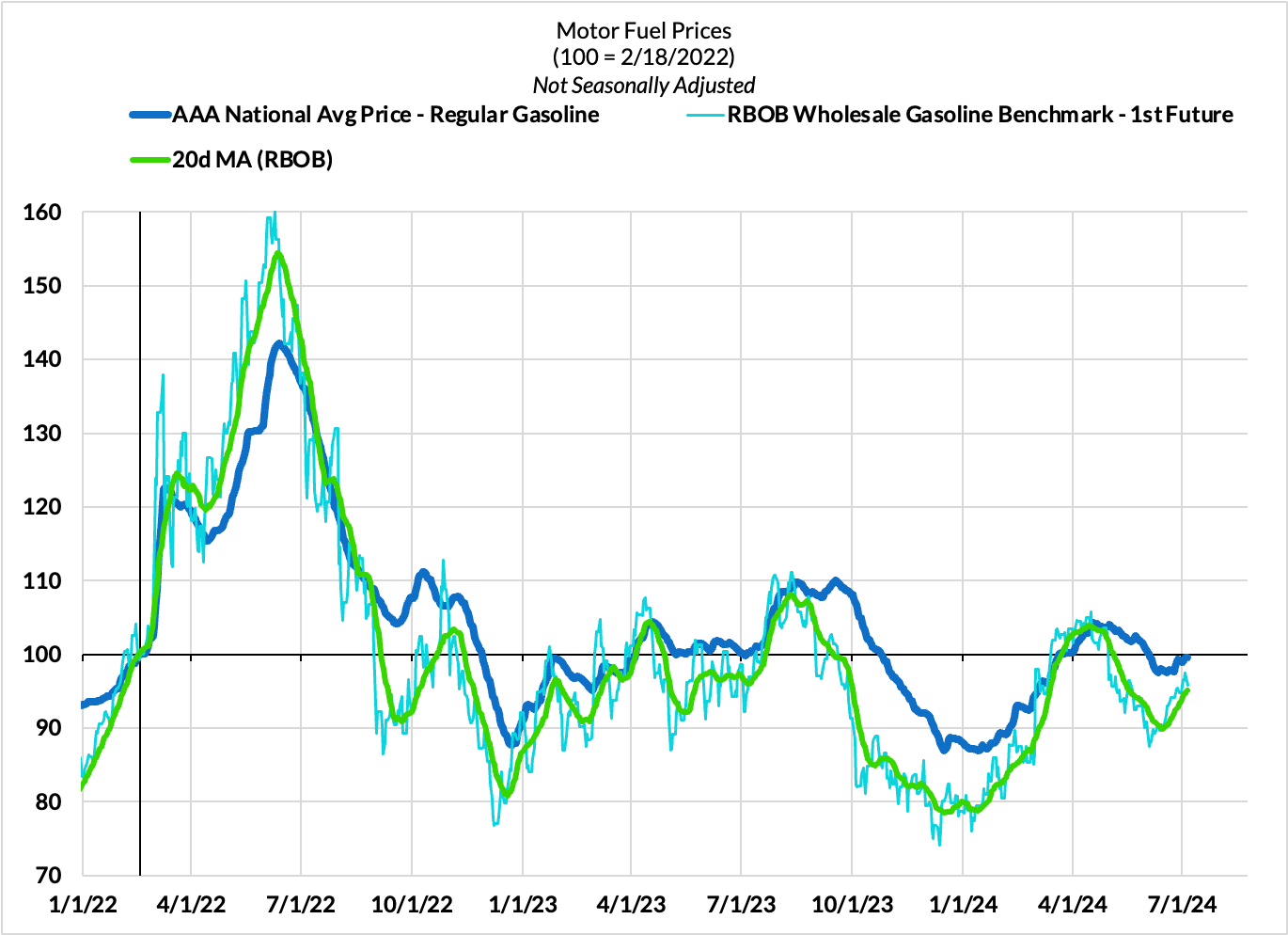

Our baseline modal forecast for Headline inflation is below consensus, as we expect only a marginal increase in June thanks to lower gasoline prices. Our forecast for Core CPI is more consistent with the forecasting consensus; we are currently at 19 basis points. Nevertheless, we suspect there is a greater chance of a downside surprise relative to forecasting consensus (0.2% rounded), with a number of chunky and uncertain downside catalysts potentially on the cards. A 0.1% Core CPI seems more likely than a 0.3% Core CPI, and should that materialize, the potential for a weak Core PCE reading (a 0.1% m/m reading or lower) will grow firmer.

Given the slowing labor market data revealed on Friday and combined with further signs of disinflation (May PCE came in soft as well, the Fed should be willing to consider a rate cut in July if the downside developments associated with our preview come to fruition. At the very least, such developments should force a more robust debate. But in practice, we suspect that a July cut is still a substantial reach and downside developments would only firm up a September cut.

Forecast Details

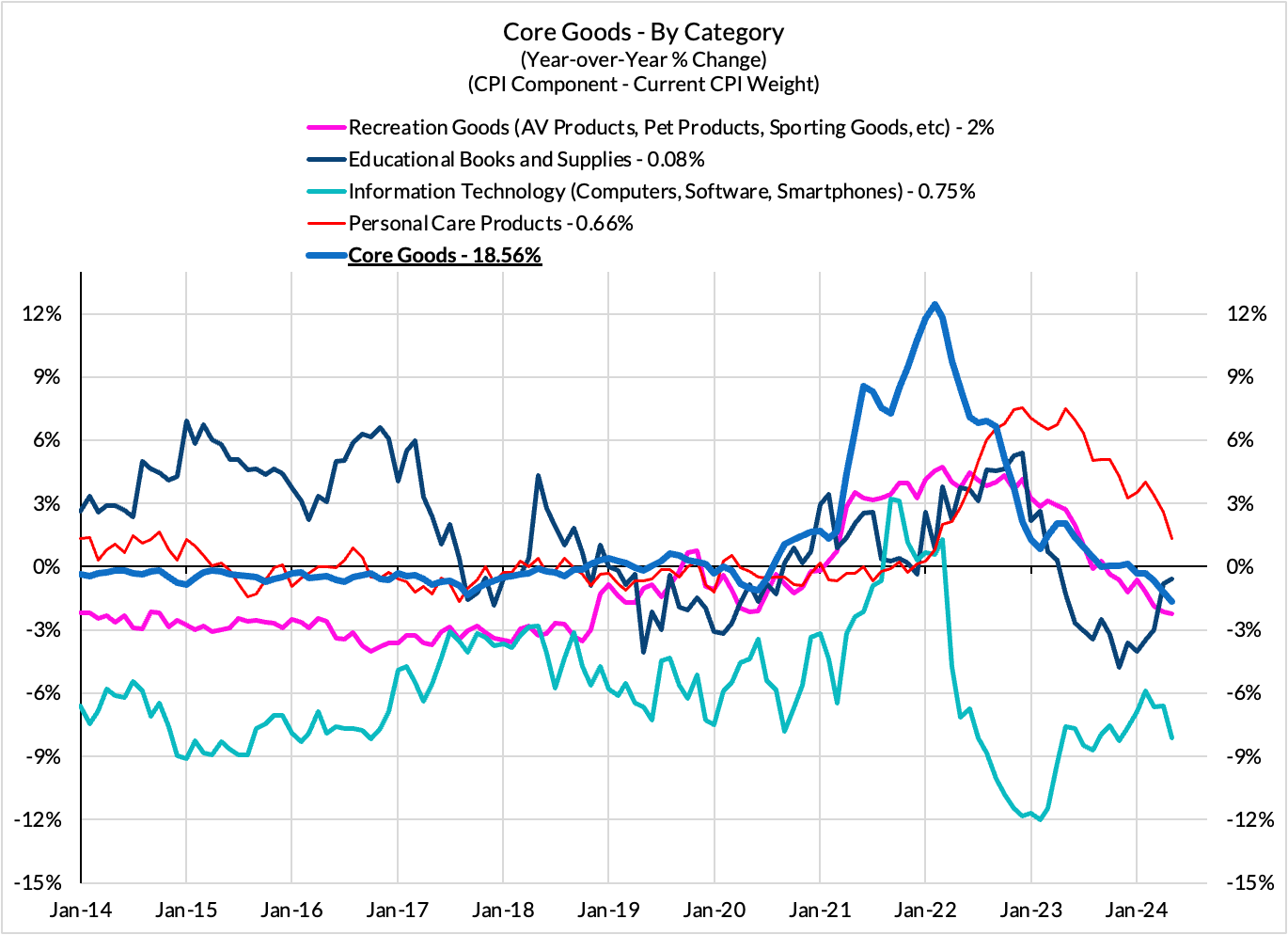

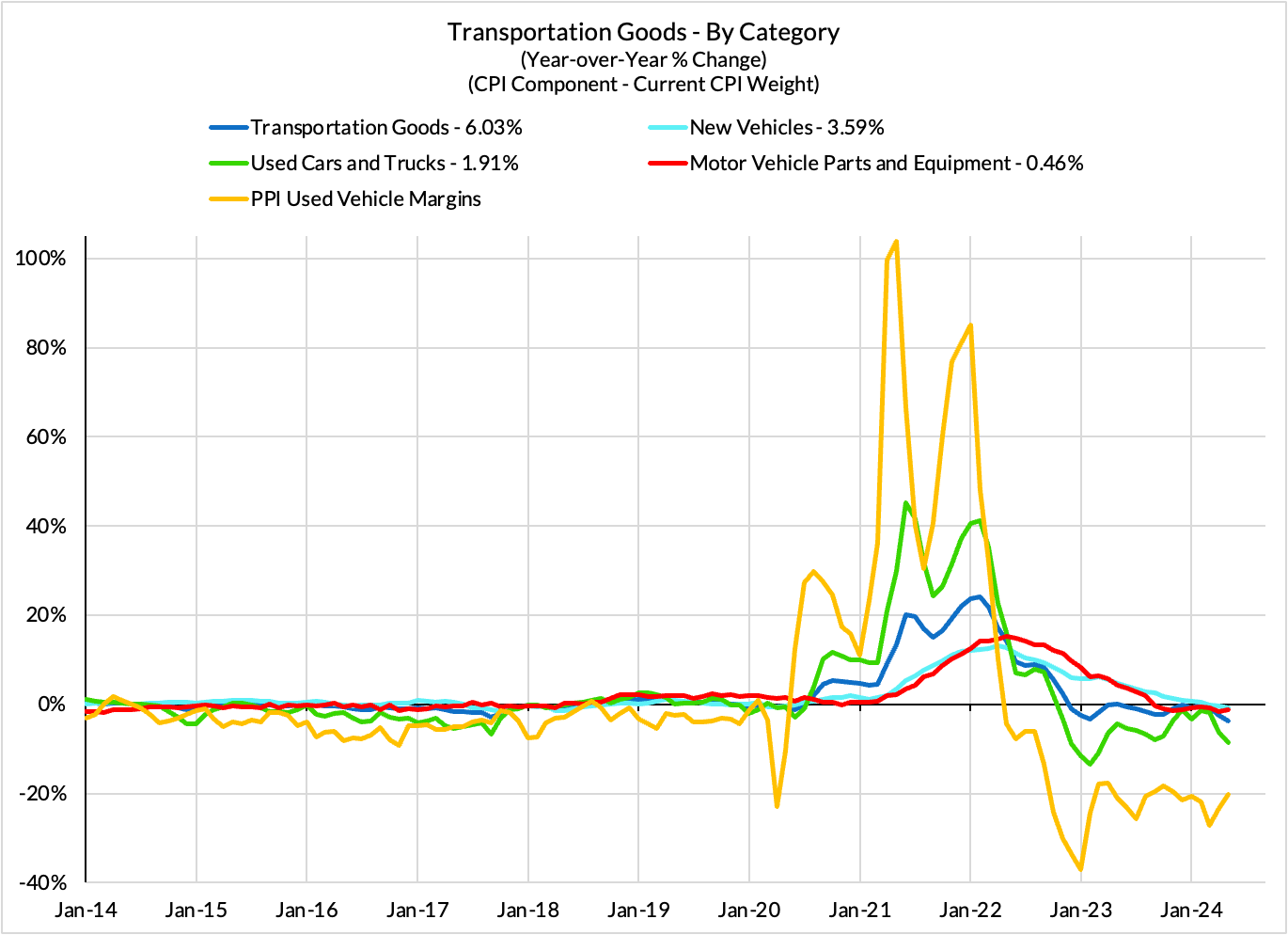

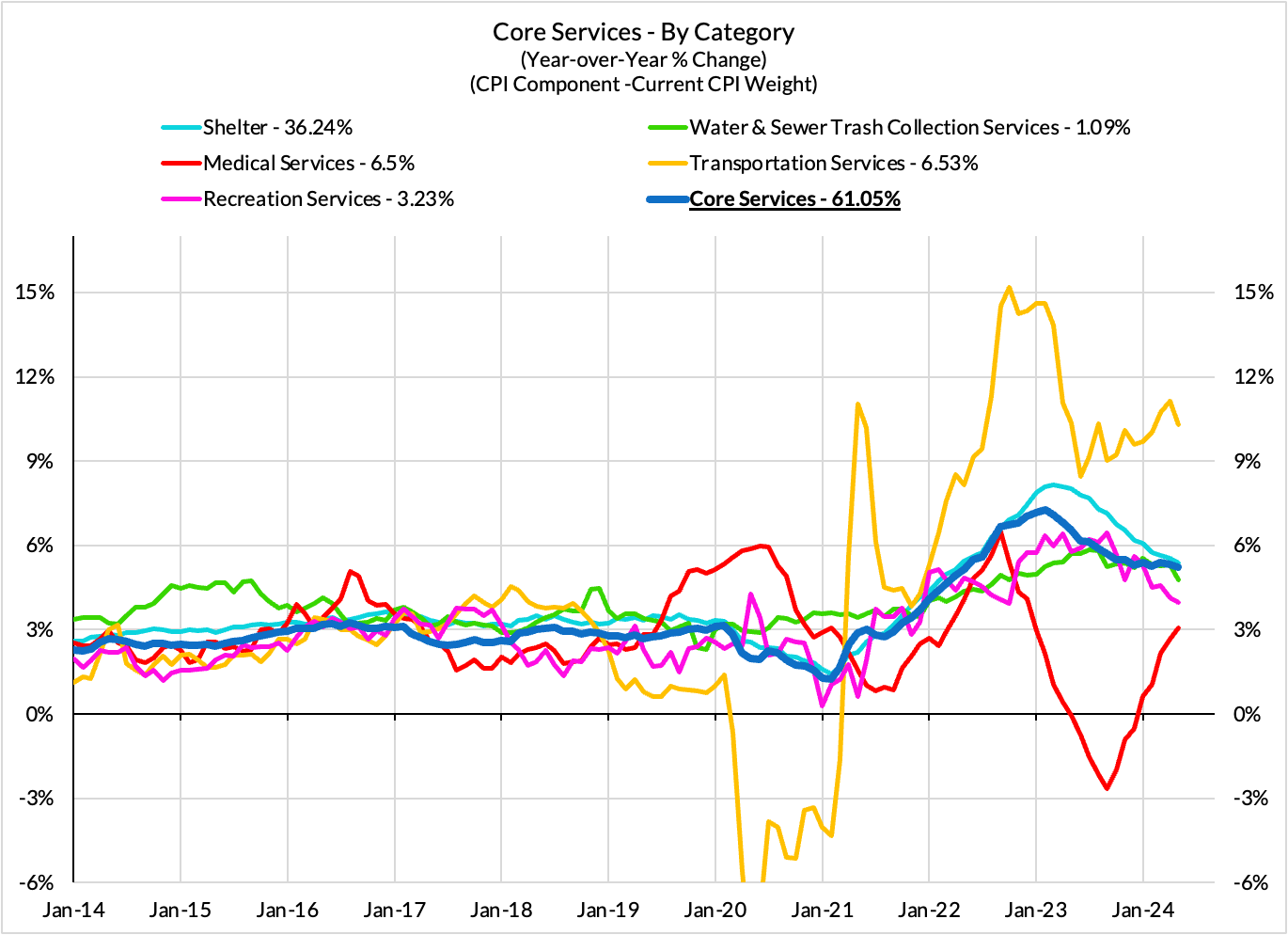

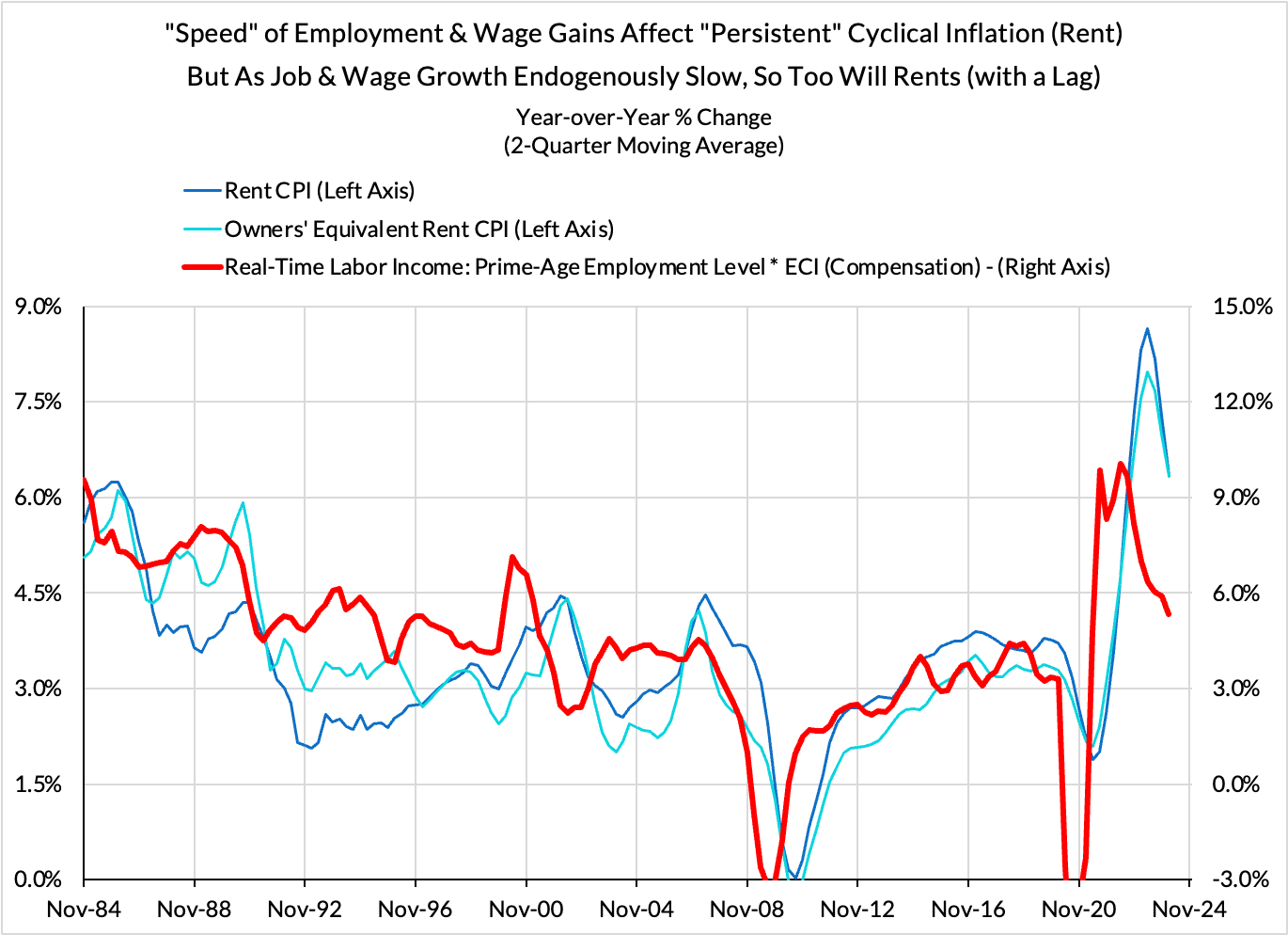

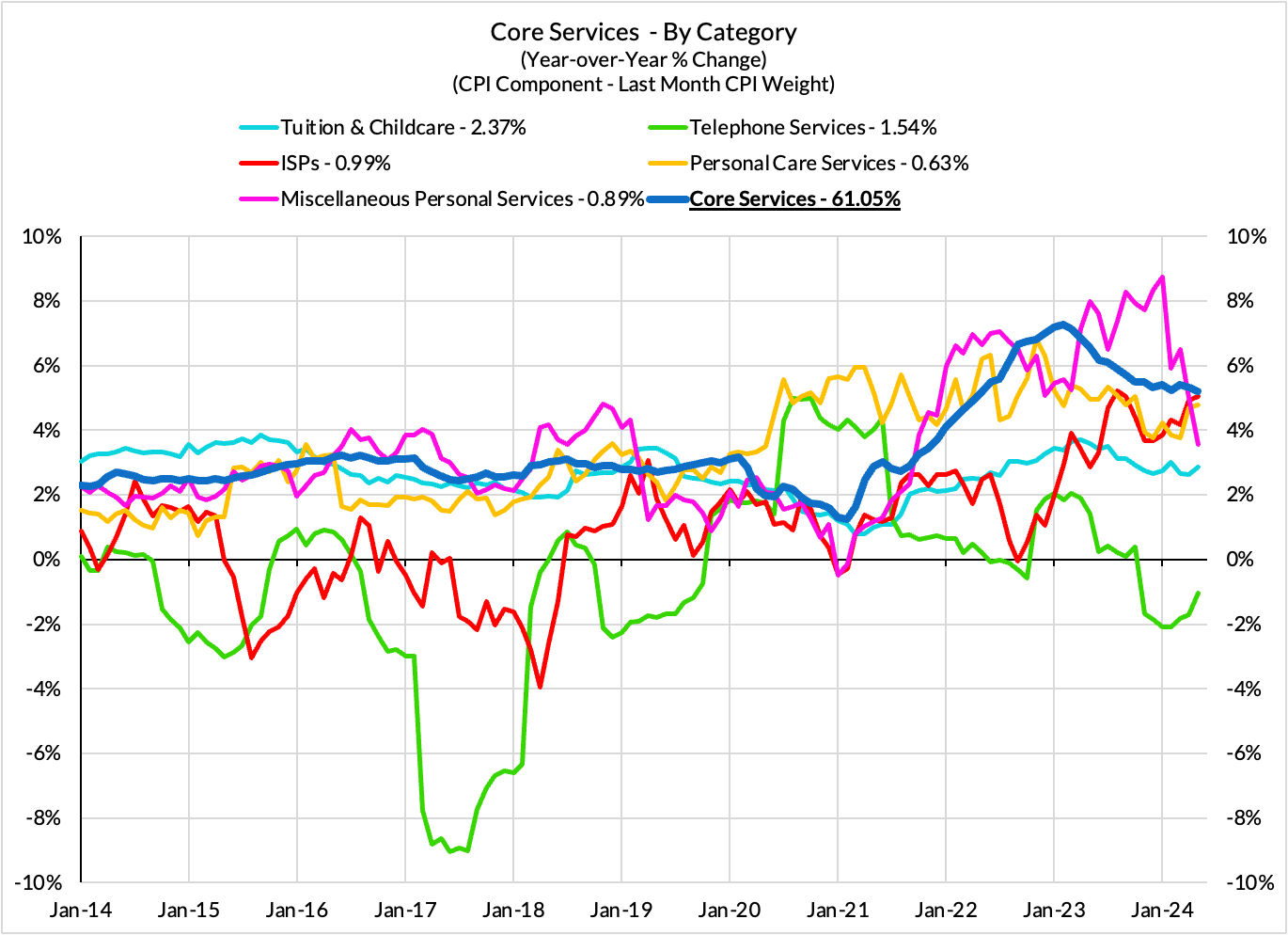

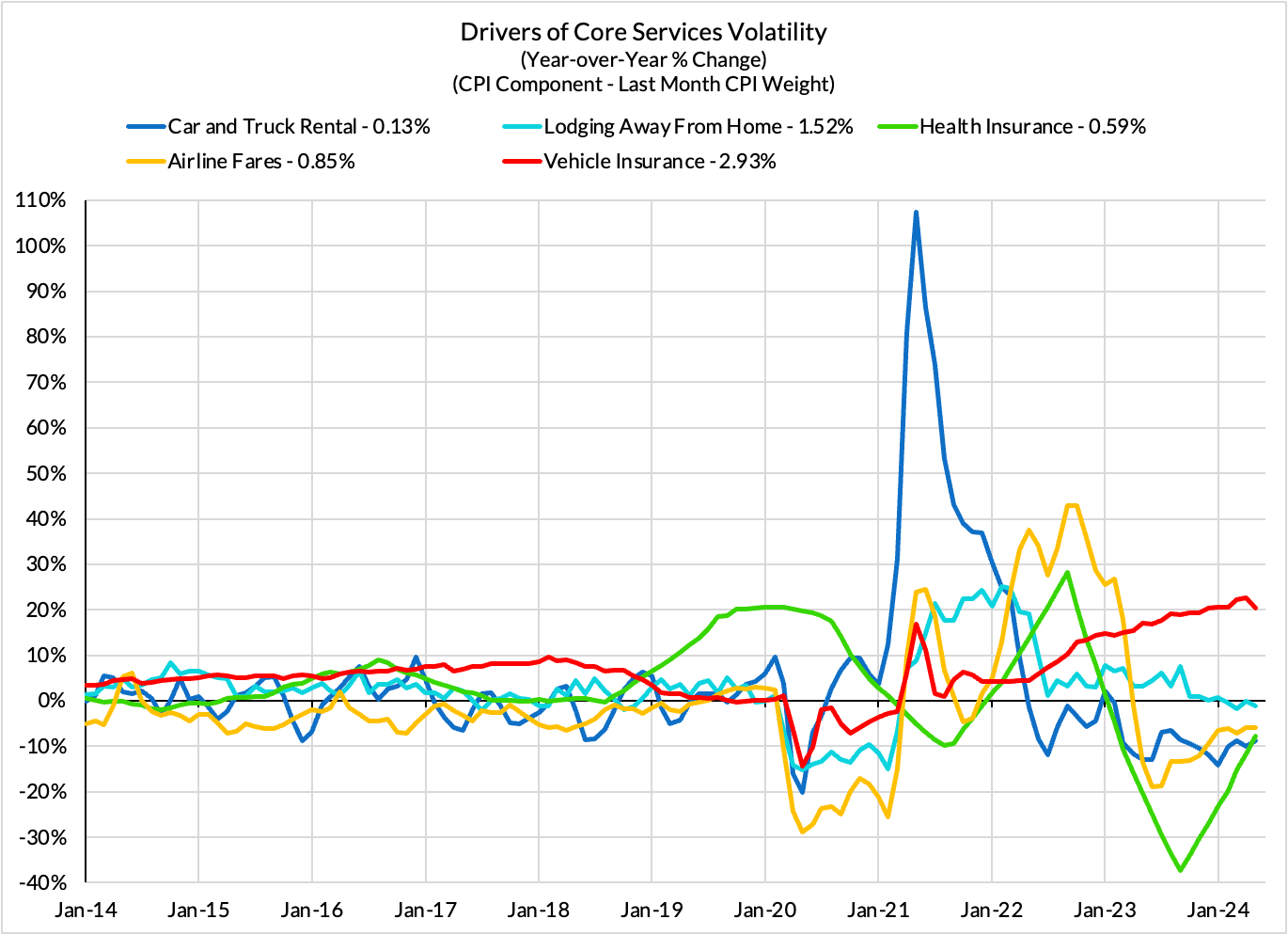

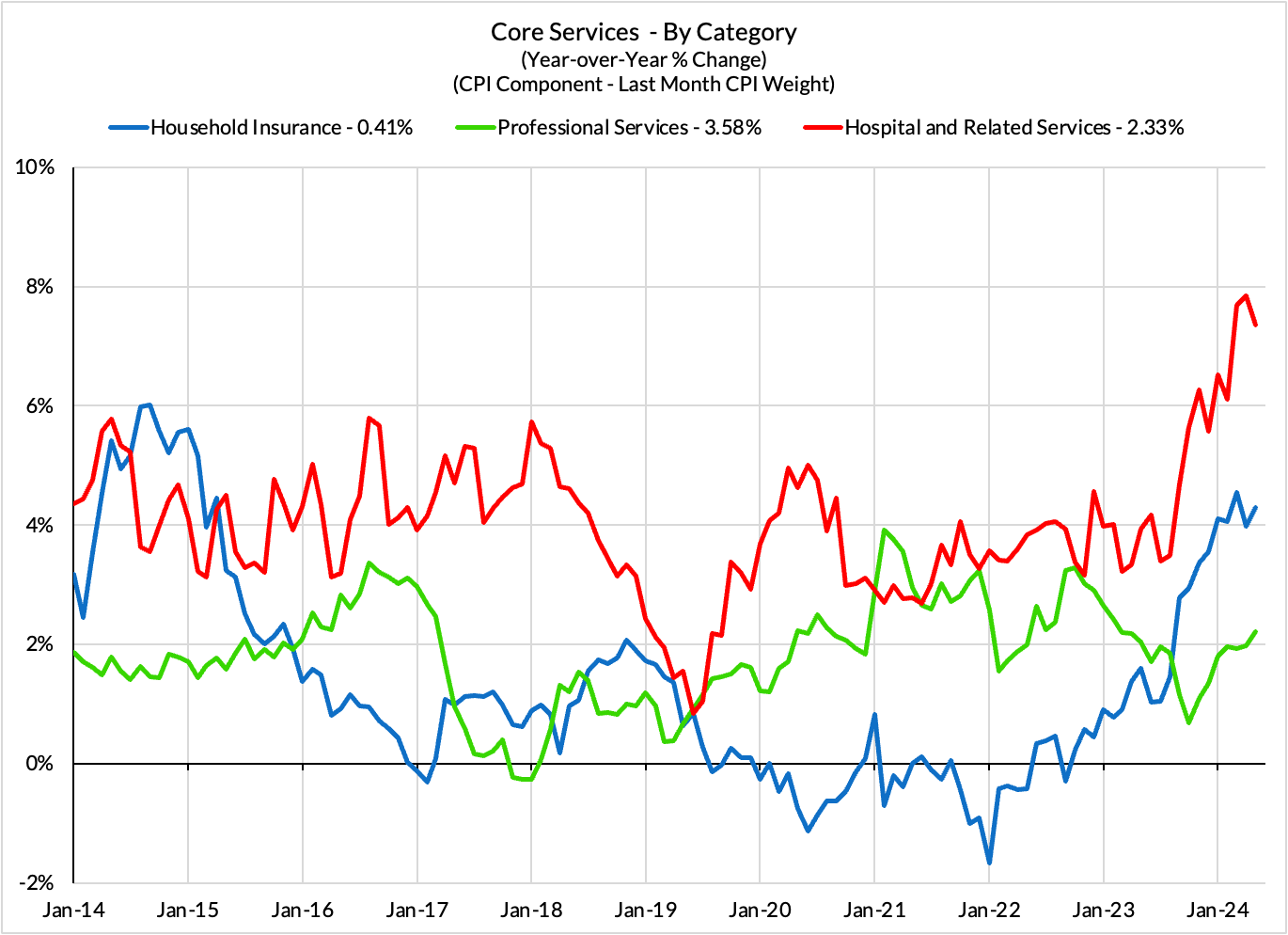

Our baseline forecast is for a softer Core CPI than in most recent months other than what materialized in May. Goods deflation is expected to broaden, and this time helped more noticeably by new and used vehicles but perhaps less so by apparel and information technology commodities. Services inflation is expected to slow further, but primarily led by decent step-downs in rent and OER (though we suspect the step-downs could be steeper whenever they do arrive). Core nonhousing services CPI is expected to only slow marginally, as we are reluctant to purely extrapolate from the vehicle insurance reading from May.

We see 5 segments where the data might show a bigger decline in June than we have penciled into our baseline forecast.

- New vehicles CPI, which are now falling at an accelerated pace and following market price declines that have been transpiring for over a year now.

- Used cars & trucks CPI, which are due for another multi-month period of sizable declines based on private sector data

- Vehicle insurance, where state regulators have been willing to allow prices to be set higher as the industry recoups lost margin as the cost of vehicles, parts and labor have gone up. We still feel too uncertain extrapolating from the sharp slowdown in May, but if it transpires, Core CPI can easily be lower than our baseline forecast. This segment is less Fed-relevant (Vehicle Insurance PPI/PCE comes with lower weight and less correlation to its CPI counterpart)

- Apparel prices, where we suspect residual seasonality will still put upward pressure, but the fundamental picture appears more deflationary.

- Rent and OER, where a combination of outlier readings in New York City last month dropping off and dissipating residual seasonality can reveal a sharper deceleration in month over month readings. Given what we know about the issue driving the OER spike in New York City, it's plausible that other MSAs are vulnerable to similar spikes but New York City has arguably been a lagging MSA for rent and OER dynamics. In subsequent months, there should be outright reversion as the imputation issues associated with single family detached units force a correction, but none of this should have strong bearing on the June CPI release.

CPI Charts

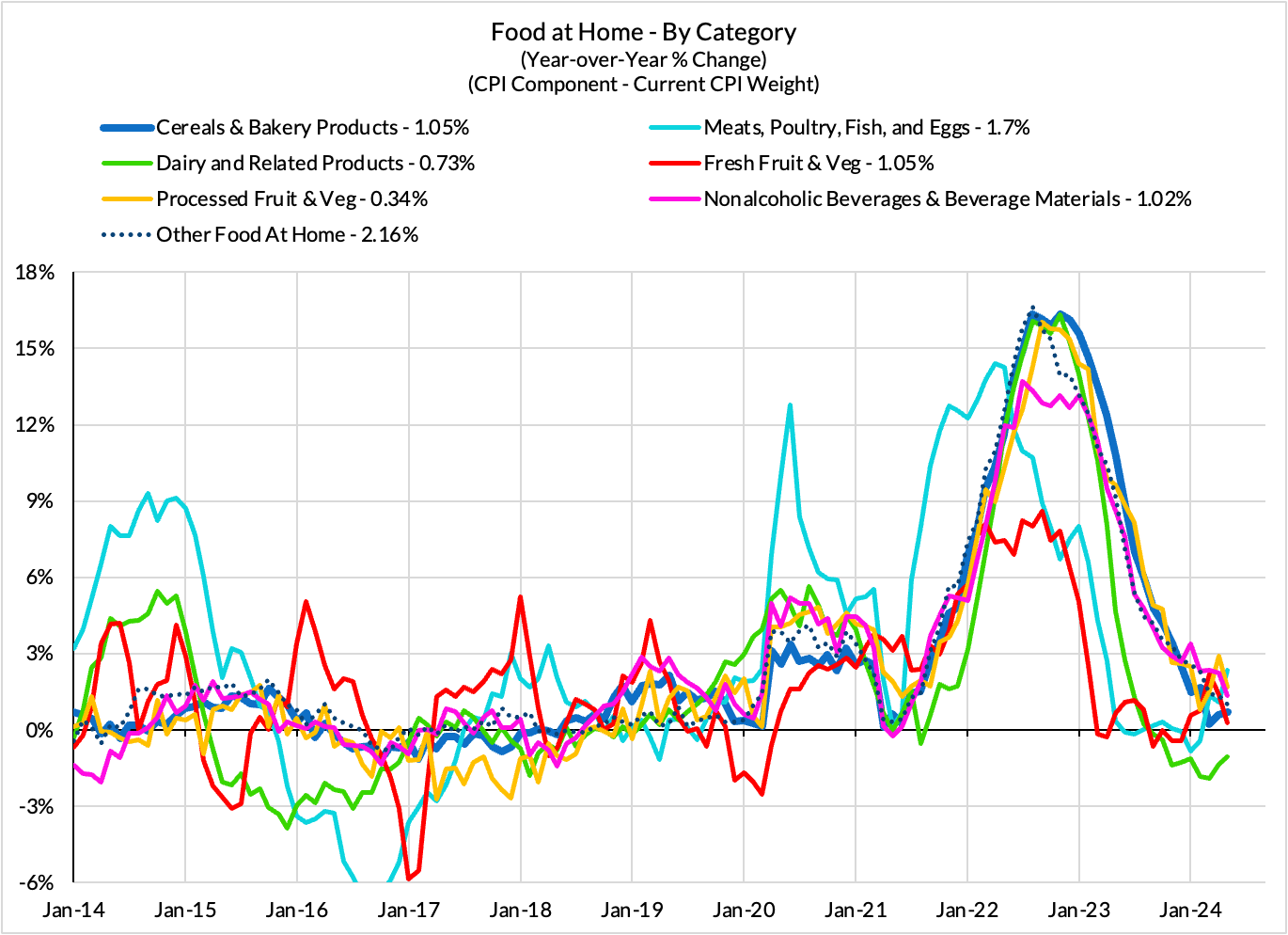

Non-Core CPI Components

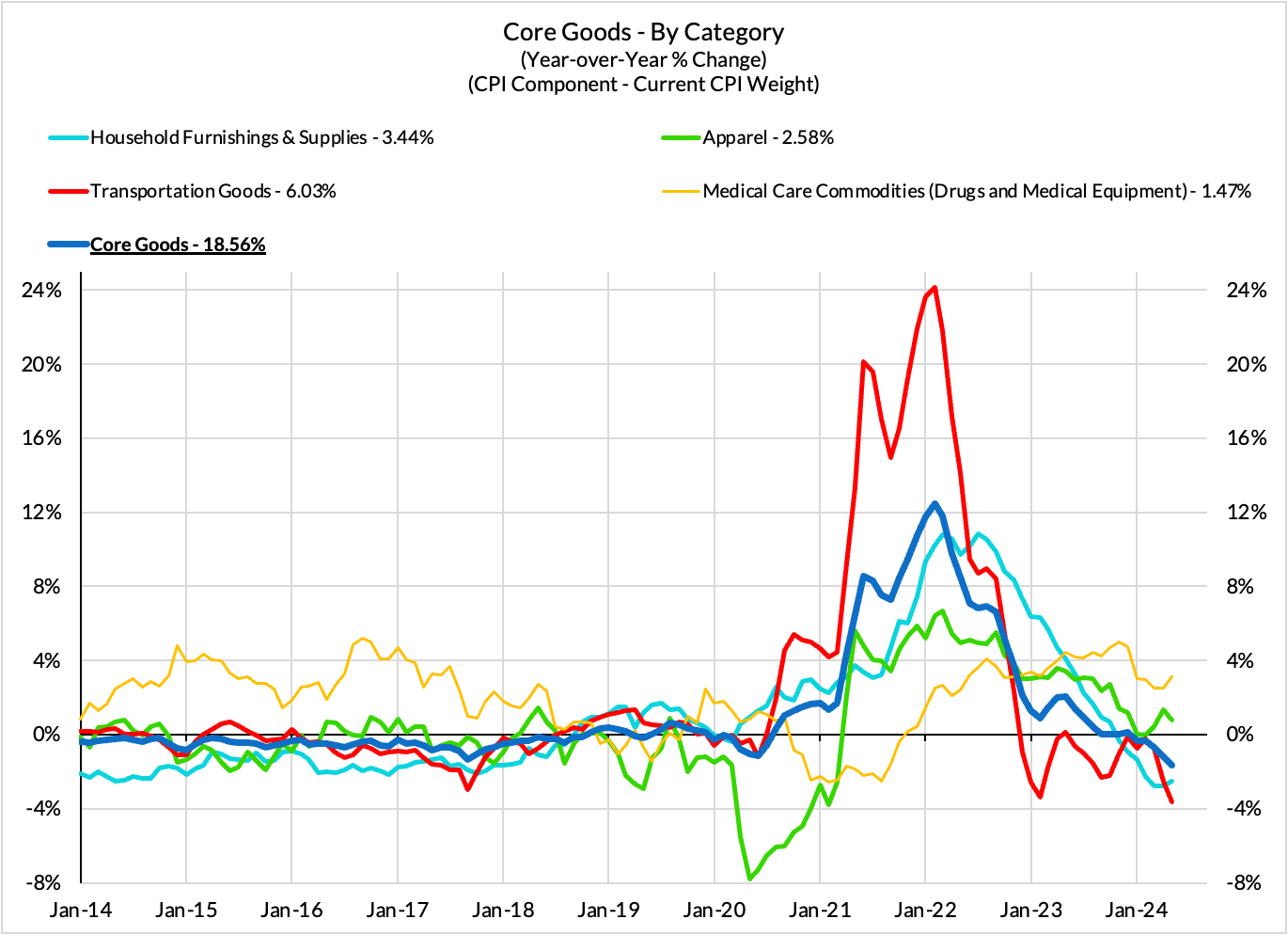

Core Goods CPI Components

Core Services CPI Components (Not All Feed Into Core PCE)

From The Last PCE Recap

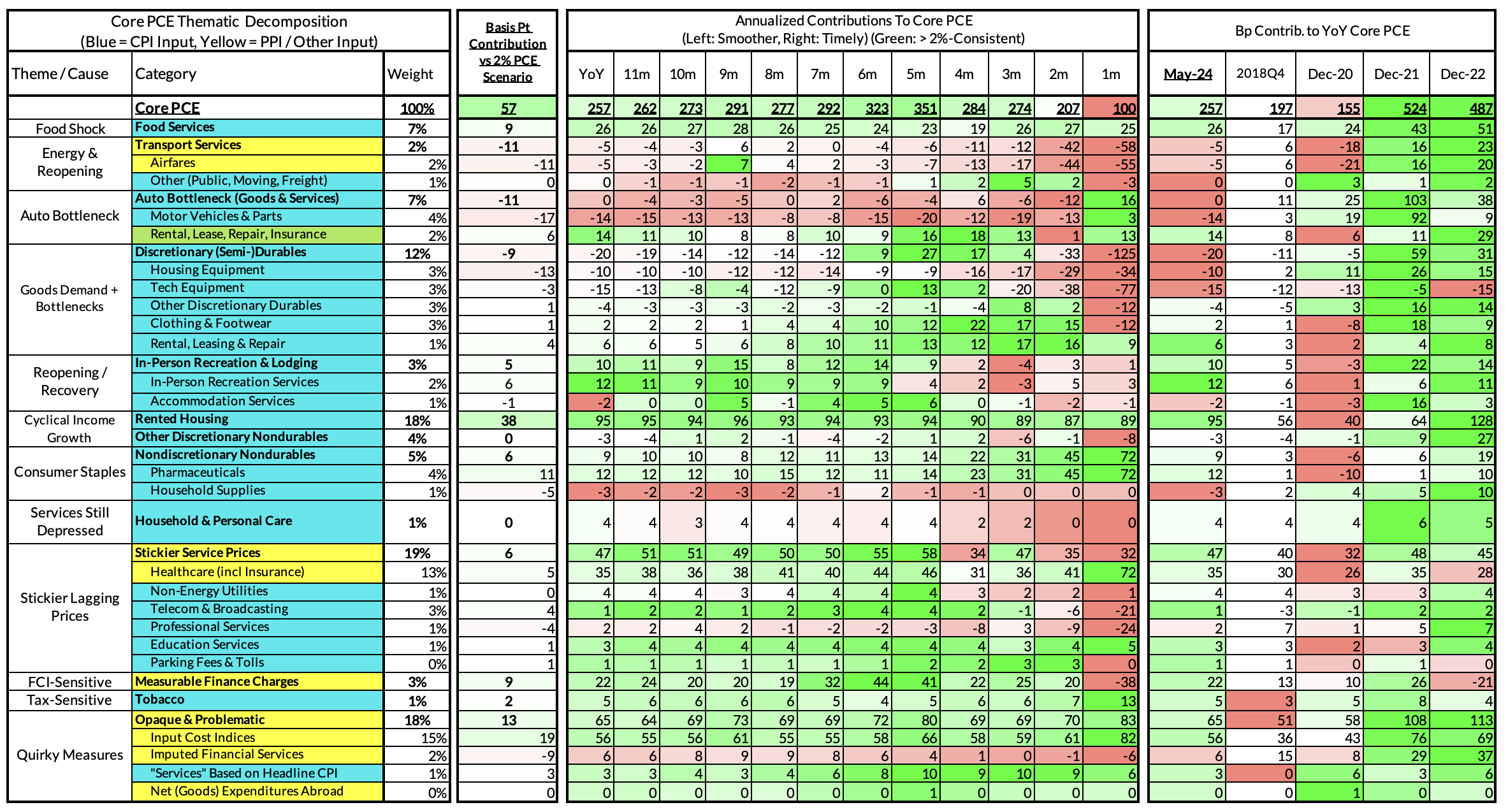

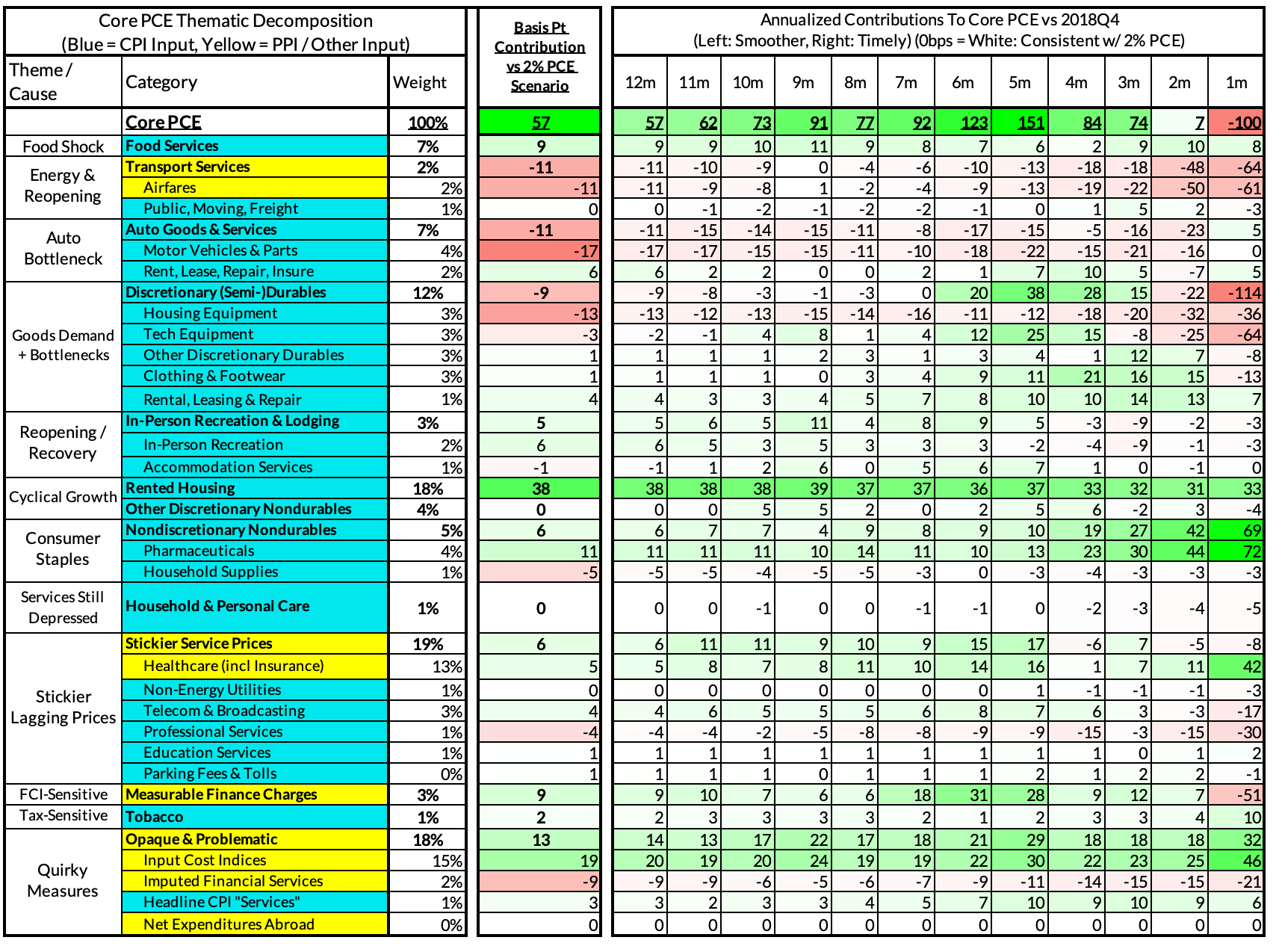

For the Detail-Oriented: Core PCE Heatmaps

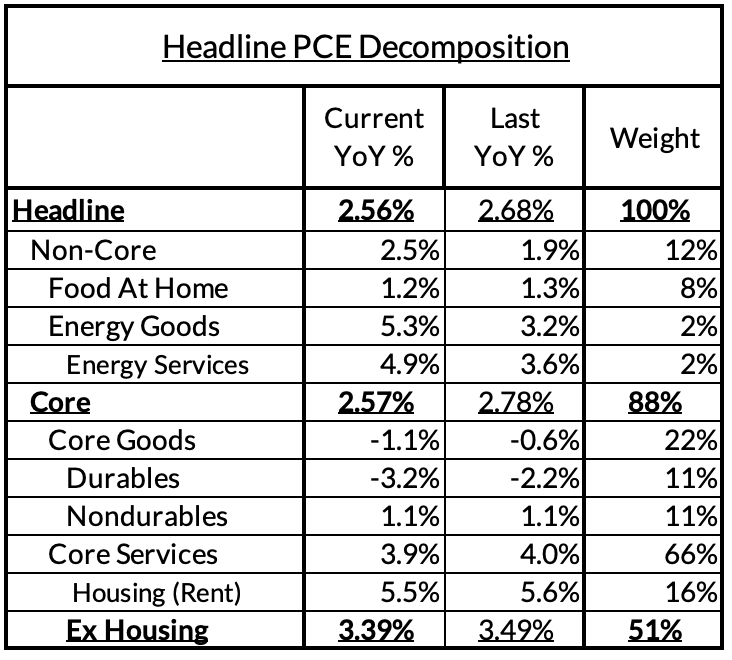

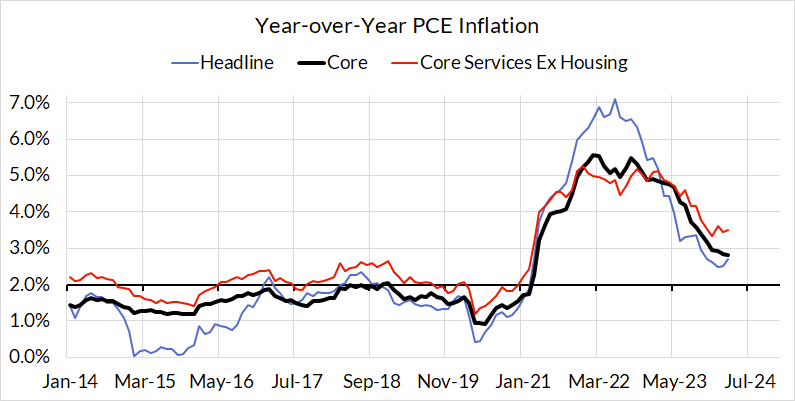

Core PCE (PCE less food products and energy) ran at a 2.57% year-over-year pace as of May, 57 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22. Rent is contributing 38 basis points to the 57 basis point core PCE overshoot.

There are other contributors to the overshoot:

- Some more supply-driven (food inputs likely added 9 basis points to the overshoot, motor vehicle bottleneck relief now subtracting 11 basis points)

- Some more demand-driven (in-person recreation and lodging services likely added 5 basis points to the overshoot)

- Some oddball segments have aggravating effects (measured financial service charges now likely adding 9 basis points, while contributions from input cost indices adding 19 basis points to Core PCE vs 2%-consistent outcomes).

The final heatmap below gives you a sense of the overshoot on shorter annualized run-rates. Monthly monthly annualized core PCE yielded a 100 basis point undershoot vs 2% target inflation (1.00% annualized).

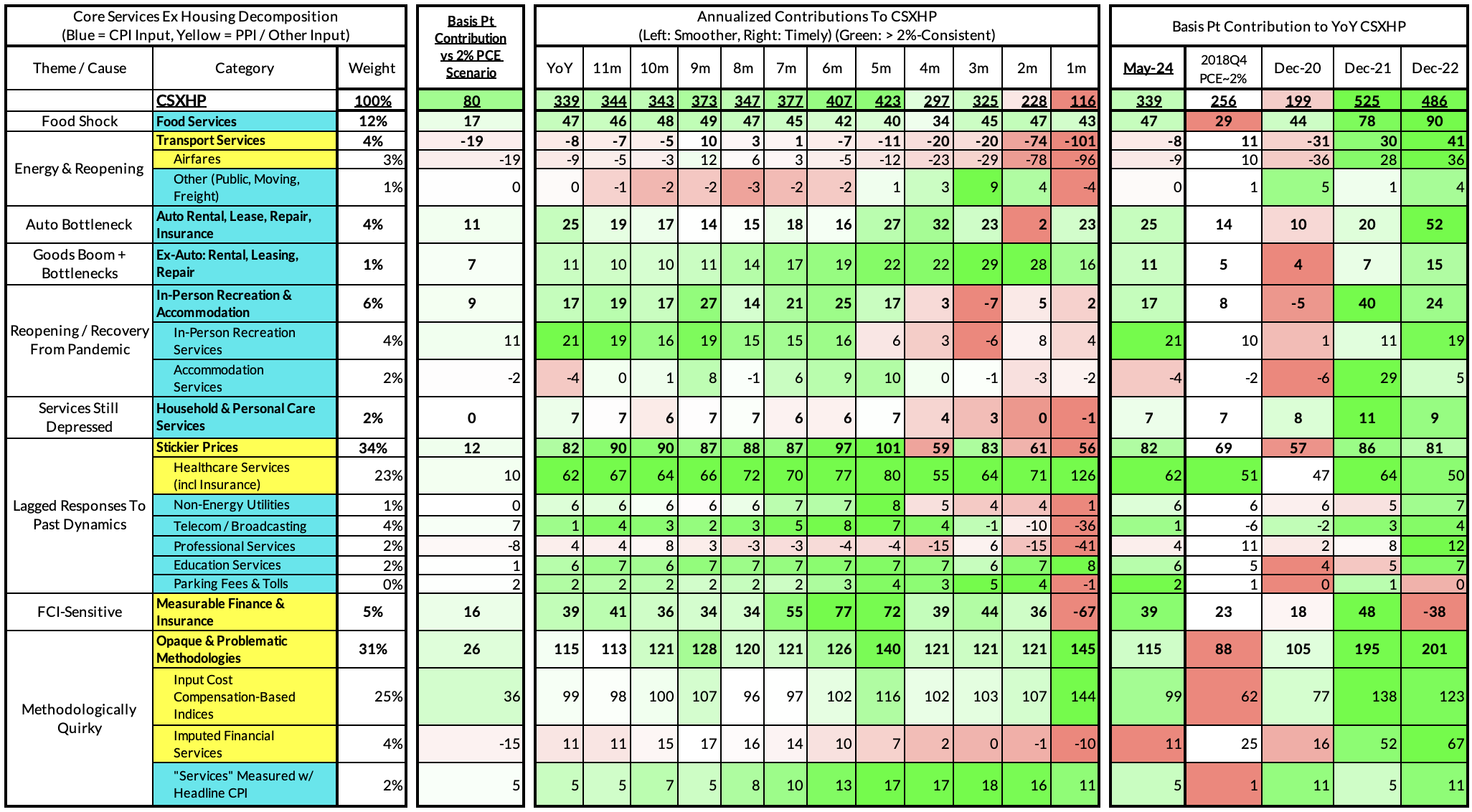

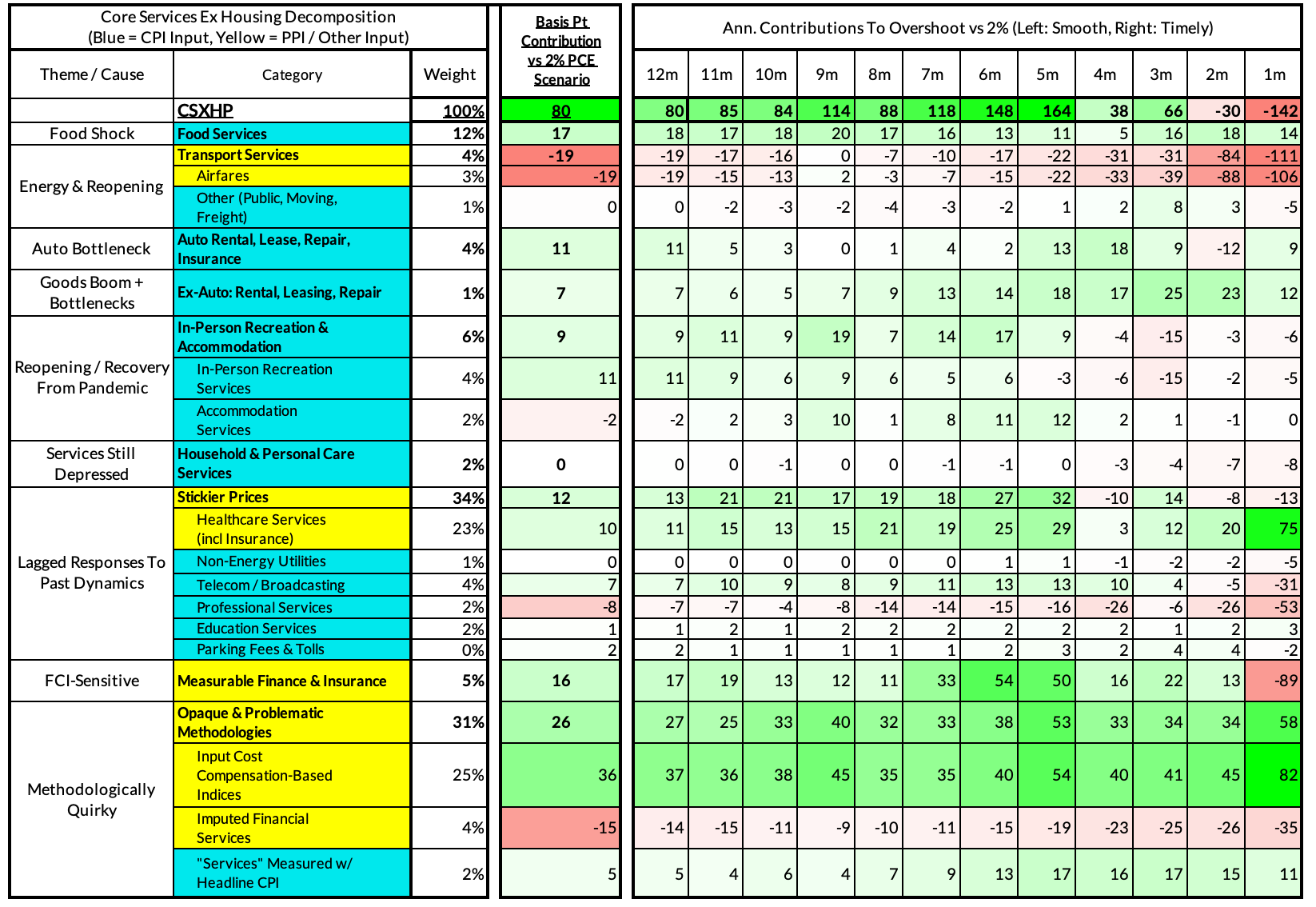

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The May growth rate in "Core Services Ex Housing" ('supercore') PCE ran at 3.39% year-over-year, an 80 basis point overshoot versus the ~2.59% run rate that coincided with ~2% headline and Core PCE.

April monthly supercore ran at a 1.16% annualized rate, a 142 basis point annualized undershoot of what would be consistent with 2% headline and core PCE.

Past Inflation Previews & Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me

- 12/12/22: November Inflation Preview: The Goods Deflation Cavalry Is Coming, But OER Can Upset An Optimistic Consensus Tomorrow

- 1/11/23: December Inflation Preview: Risks Skew To The Downside, But Upside Scenarios Remain Plausible

- 2/12/23: January Inflation Preview: Residual Seasonality & Stickier Services Pose Upside Risks

- 3/9/23: February Inflation Preview: Q1 Upside Risks Remain. Goods and Reopening-Sensitive Sectors Matter More Than Wages

- 4/8/23: March Inflation Preview: The Fed Seems Unaware We're Entering Another Automobile Inflation Storm

- 5/7/23: April Inflation Preview: Can PCE Silver Linings Overcome CPI Bite from the Used Cars Wolf and a "Slow Slowdown" in Rent CPI?

- 6/9/23: May Inflation Preview: Last Month of Used Cars Driving Upside Risk?

- 7/9/23: June Inflation Preview: The Path To The Fed's 2% PCE Goals Is Getting Clearer But Not Soon Enough To Forestall a July Hike

- 8/8/23: July Inflation Preview: Used Car Downside Can Hasten Path To 2% Core PCE Outcomes

- 9/12/23: August Inflation Preview: CPI Risks Growing More Balanced Even As PCE Risks Tilt More To The Downside

- 10/10/23: September (Pre-PPI) Inflation Preview: The Wedge Will Matter Again...Pulling Up CPI and Pushing Down PCE

- 11/13/23: October Inflation Preview: A Data Release That Can Dictate The Future of The Hiking (& Easing?) Cycles

- 12/11/23: November Inflation Preview: Headline Downside But Can Core PCE Keep A March "Normalization Cut" In Play?

- 1/10/24: December Inflation Preview: How Much More Disinflation Can Be "Banked" Before Q1 Begins?

- 2/9/24: January Inflation Preview: High Stakes Data Releases With Fat Tails On Both Sides

- 3/9/24: February Inflation Preview: Jan-Feb Residual Seasonality Poised To Stoke Upside & Headfake The Fed

- 4/9/24: March Inflation Preview: Relief Growing More Likely Over The Residual Seasonality Hump

- 5/10/24: April Inflation Preview: Tech, Stocks & Seasonals: What Went So Wrong (& Right) In Q1? What Does It Tell Us About Q2?

- 6/10/24: May Inflation Preview: Rent & OER Relief Are Poised To Add Downside Risk Throughout The Summer