- July headline inflation is likely to come in roughly in line with the consensus forecast at 0.2% with the possibility of a mild downside surprise. Core inflation will likely be in line with forecasts as well at 0.5%, and is poised to cool further in coming months. The scale of the fall in gasoline prices is sufficient to drag down the monthly rate of headline CPI inflation by a full percentage point from June to July.

- Despite falling oil and gasoline costs, we may still see some upside in energy, especially as Europe begins to draw on winter natural gas storage and Asian buyers add to the global scramble for LNG supply.

- Rents are likely to continue growing at an elevated pace as a lagged response to the strong cyclical recovery from 2021Q2 to 2022Q1

- There is a lag from wholesale to retail data, such that it will likely only be in the August to September CPI that we begin to see the big potential for outsized deflation in used cars.

- Supply chains are beginning to heal, with lead time indices and inventory costs falling, and this creates larger downside inflation risk over the course of 2022H2.

Since the Russian invasion of Ukraine, energy markets have been in disarray. Sanctions have removed Russian refining capacity and potential oil production from global markets, while the withdrawal of natural gas from European supply lines has dramatically ratcheted up the cost of energy abroad. Domestically, rising oil prices and tightening refinery capacity have driven the price of gasoline continually higher throughout the spring. On the latter, we are beginning to see refined product spreads close as the price of oil falls, compressing inflation in two ways.

Falling gasoline prices should register for consumers, while falling diesel prices could limit some upside passthrough risks for retailers dependent on trucking logistics.

On the natural gas front, the loss of export capacity at Freeport was previously providing temporary price relief to US consumers at the cost of higher prices in Europe.

However, the outage at the Freeport LNG terminal is now expected to be reopened by October. EIA data is not released quickly enough for us to be able to see the exact impact of the Freeport closure on total exports yet, however, by the time we can, markets may already be pricing in its reopening. In terms of the CPI, natural gas prices impact the price of utility gas service as well as electricity, especially in areas of the country highly reliant on natural gas plants.

Although these costs may fall over the next few CPI readings, natural gas may prove a source of inflation this winter, with the Freeport plant coming back online exactly as European countries are looking to fill winter storage. While the Fed traditionally seeks to look through energy price movements, recent communications have made it clear that the Fed will be watching headline CPI, and thus energy prices, closely, through the end of the year.

Rent and OER will continue to grow at a robust month-over-month pace as a lagged response to the strong cyclical recovery in the labor market. While job growth is now slowing, it has yet to slow in the kind of precipitous manner that signals either recession or rapid disinflation in rent and OER. A more noticeable slow down in rent and OER is likely to materialize in early 2023.

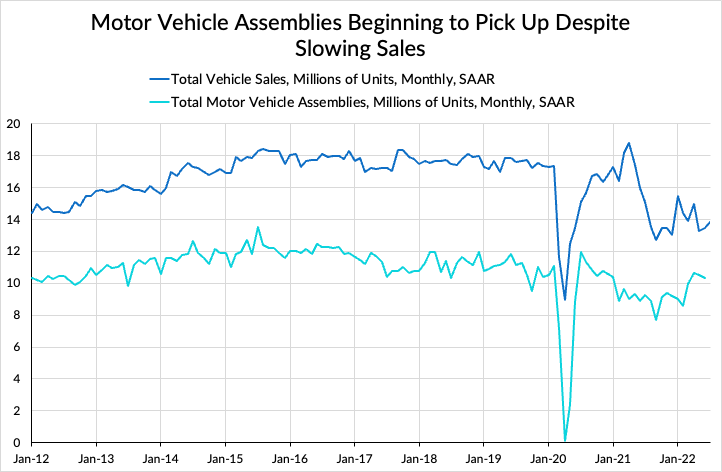

While automobiles – both used and new – have driven substantial inflation, recent high-frequency data sources show a market that may finally be cooling down more aggressively and more directly tied to the prospect of improving supply conditions.

Over the second quarter, we saw motor vehicle assemblies moving closer to historical rates, as chips became increasingly available. Nevertheless, sales and production remain depressed.

Outside of automobiles, several factors are setting the stage for softer inflation prints this fall. In general, these can all be traced back to supply chains beginning to sort themselves out after the most recent round of dislocations, namely renewed lockdowns in China and the energy price shock of the Ukraine war.

Inventory costs are beginning to fall at the same time as retailers are looking to unwind their inventory. Taken together, these suggest that the mad rush to keep retail stocks shelved that helped drive high and rising prices is abating.

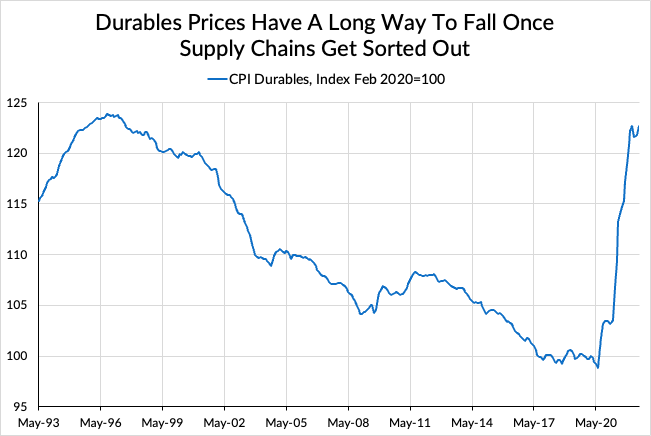

Given the trajectory of the durable goods CPI, there is a long way for these prices to fall in the event of a return to historical norms. With durable goods making up roughly 15% of the total CPI weighting, any kind of return towards trend could put substantial downside pressure on inflation readings later in the calendar year.

Recap of Forward-Looking Commentary on Inflation Data

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing...