Depending on who you ask, this week saw a “hawkish skip” or a “dovish pause” from the FOMC, who declined to raise rates above their current target range of 5% to 5.25%. Most of the week was covered by the Fed’s blackout period, however members Goolsbee, Barkin and Waller gave short statements following Powell’s statement and press conference this past Wednesday.

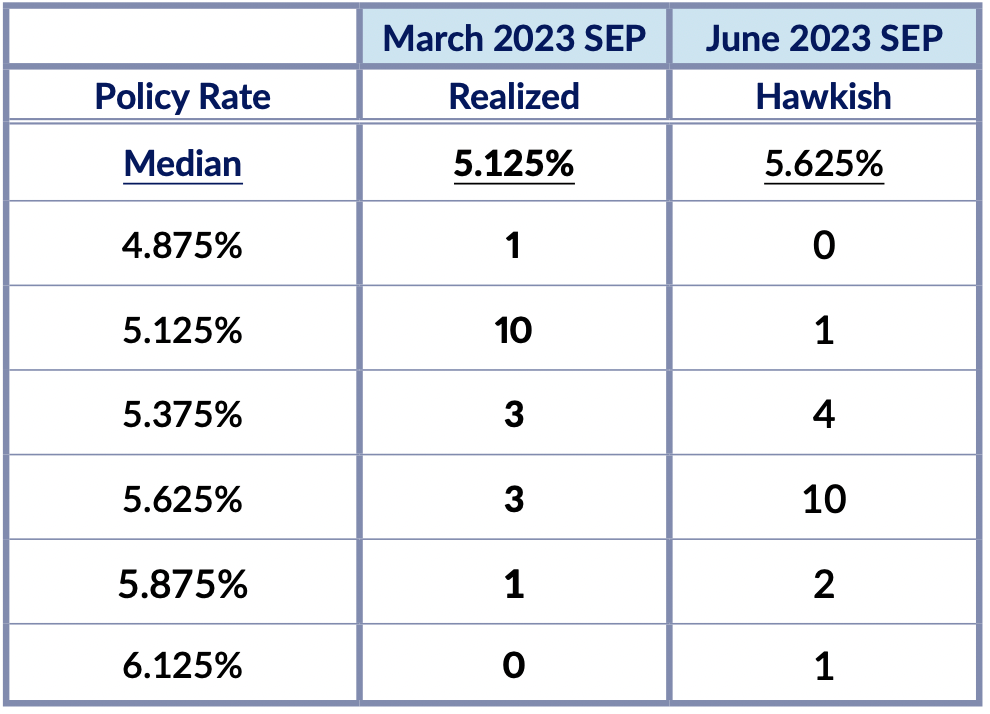

We also got the June Summary of Economic Projections, so now there is a whole new set of dots for everyone to argue over. In general, the dots came in slightly higher than expected, showing a median of 5.625% for 2023. Also interesting — the center of gravity for 2024 and 2025 year-end rates has drifted higher since the March SEP, a dynamic we flagged as likely in our FOMC precap.

Overall, our projection of the June SEP was largely accurate, and the divergences are informative. The differences between the realized and projected could be explained as follows: We had predicted that, in order for the FOMC to get to a unanimous statement of a pause or skip, they would have had to placate hawks in the committee by trading further rate hikes later this year; we had expected that that horse-trading would take the form of locking down one additional rate hike as this year’s base case, when in fact it seems to have taken the form of penciling in up to two additional rate hikes somewhere over the course of the next four meetings.

Summary Table

The full version of this Fedspeak Monitor is made available exclusively for our Premium Donors. To view the full version, sign up here for a 30-day free trial or contact us for more information.