Summary: Today's FOMC Statement and press conference shows high continuity with the thinking reflected in the December FOMC meeting. The Fed does not appear to be impressed by the deceleration in wage growth in 2022H2 enough to explicitly rethink the inflation, unemployment, or interest rate outlook right now. Two more hikes this year remains the Fed's base case (terminal Fed Funds Rate: 5-5.25%), with risks likely skewed towards more than two hikes.

Decision: Today's 25bp hike aligned with consensus and market expectations.

- Our view: The outlook is looking increasingly balanced between downside labor income and upside inflationary risks. Given that the hike was already priced into financial conditions and embedded in the growth outlook, our preferred Fed framework would have yielded a corresponding course of action here.

Rate Guidance: Despite the opportunity to show more open-mindedness about the path for interest rates over coming meetings, the FOMC is continuing to signal high confidence that at least two more 25bp hikes are needed.

- If the FOMC were open to the possibility of ending rate hikes sooner, they could have chosen different lanugage from "ongoing rate increases" and "extent of future increases." They could have said "ongoing tightening" and "extent of future tightening" but they didn't. 2 additional hikes (March, May) seems closer to the floor than the ceiling for the FOMC's 2023 interest rate outlook.

- The Fed's hawkish tilt might be part of a cagey posturing to prevent risk premiums from compressing and financial conditions from easing further. Powell seemed to inadvertently divulge that he anticipates a "couple" of additional hikes, consistent with the December dots.

- Our view: With the outlook looking increasingly balanced, the Fed should be taking a meeting-by-meeting approach and avoid hard guidance. Only one more hike is priced into financial conditions and even that hike could prove less justified over the next six weeks.

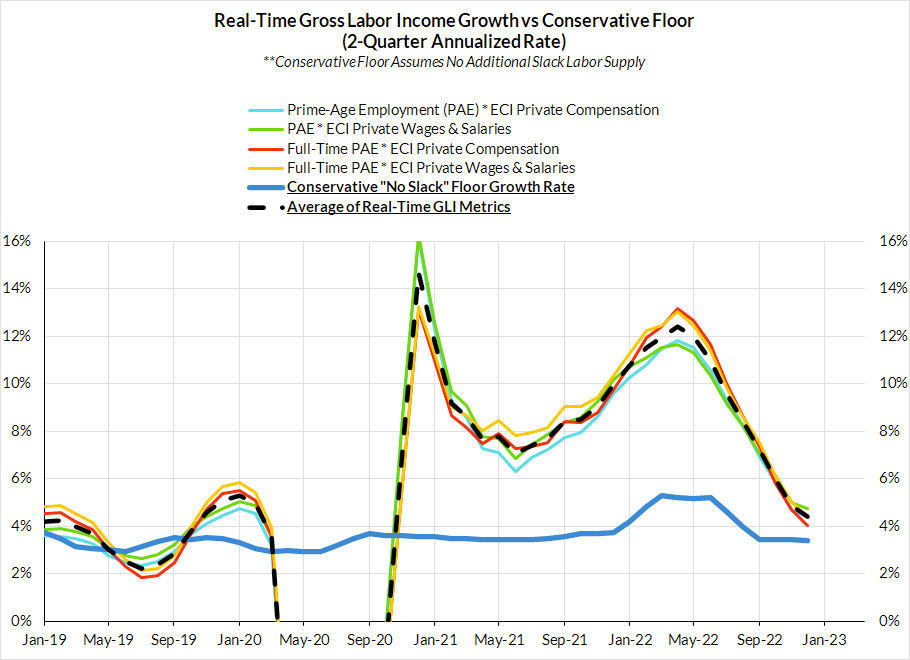

Chair Powell's Reasoning: We heard all of the major arguments we heard in December, but with the only surprise stemming from the elevated emphasis on goods disinflation over wage disinflation. The former only really got going in Q4, whereas ECI clearly shows sequential deceleration across both Q3 and Q4.

- Had Chair Powell emphasized the more robust pattern of decelerating wages over decelerating goods prices, he might have sounded more dovish. By the Fed's own assertions, isn't the challenge 'bringing the labor market back into balance?' The disproportionate emphasis on goods prices over wages is probably another tell that the Fed is intentionally trying to posture hawkishly.

- The Fed is still clinging to its belief in "Core Services Ex Housing PCE" as a suitable proxy for wage-caused inflation. We think there's a lot more going on in that price aggregate, and the Fed is inadvertently elevating problematic input cost indices in analytically flawed ways.

- The Washington Post's Rachel Siegel gave Chair Powell ample opportunity to walk back from the Phillips Curve reasoning that demands higher unemployment to tame wage growth and inflation. Despite further wage deceleration in Q4 and H2 in ECI and Average Hourly Earnings, Powell punted on whether recessionary unemployment rate increases are still 'necessary.' There are two more employment reports that might catalyze a further rethink here.

- Our view: Don't be fooled by Powell's words of optimism about bringing down inflation without damage to the labor market. For Powell as of December, "4.7 percent [unemployment] is still a strong labor market." As we noted, these types of increases in the unemployment rate are not something to trivialize. They have always yielded further recessionary pain that routinely go beyond the Fed's immediate control. So even if the unemployment rate starts ticking up and recession risks snowball, the Fed's current stance is that they will stay idle and only consider easing after it is too late. Not great.

Latest Fedspeak Before Feb FOMC Meeting

FOMC Member |

Latest Comments |

Comments as of Previous SEP |

|---|---|---|

Jerome Powell |

The Fed's tools work, and there is nothing wrong with our mandates. January 10, 2023 |

The Fed has been pretty aggressive, but it does not feel it appropriate to crash the economy and clean up afterwards. November 30, 2022 |

Lael Brainard |

More two-sided risks develop as we move deeper into restrictive territory and we're now in an environment where there are risks on both sides. January 19, 2023 |

Continued supply shocks may force central banks to tighten policy in order to manage risks. November 28, 2022 |

Michelle Bowman |

Allowing inflation to persist has far greater costs and risks. January 10, 2023 |

We are not seeing a significant impact on inflation reduction, they are still at high levels and i need to see our actions have an impact. December 1, 2022 |

Michael Barr |

It is a mistake to believe that changes in the pace of rate hikes indicate a shift in the Fed's commitment to a 2% inflation target. December 1, 2022 |

The Fed's policy rate will have to remain high for a long period of time. December 1, 2022 |

Lisa Cook |

Despite recent encouraging signs, inflation remains far too high and of great concern. January 6, 2023 |

Wage growth is above levels that are consistent with the Fed's 2% inflation target. November 30, 2022 |

Philip Jefferson |

Low inflation is critical to achieving long-term growth. November 17, 2022 |

Low inflation is critical to achieving long-term growth. November 17, 2022 |

Christopher Waller |

I favour a 25-basis-point rate hike at the upcoming meeting, followed by additional policy tightening. January 20, 2023 |

Rates still have a long way to go and will require increases into next year. November 16, 2022 |

President John Williams |

Us inflation remains too high, and the Fed has more work to do on rate hikes. January 19, 2023 |

The Fed has a long way to go with rate hikes. December 1, 2022 |