Core-Cast is our model and publication series for nowcasting the Fed's Personal Consumption Expenditures (PCE) inflation gauges. We update our estimates from CPI, PPI, Import Price, and GDP data, along with previews and final recaps. If you'd like to become a MacroSuite subscriber to get all of our model updates before PCE is released, you can do so using this link. If you have any questions or would like to see samples of our past content, contact us here.

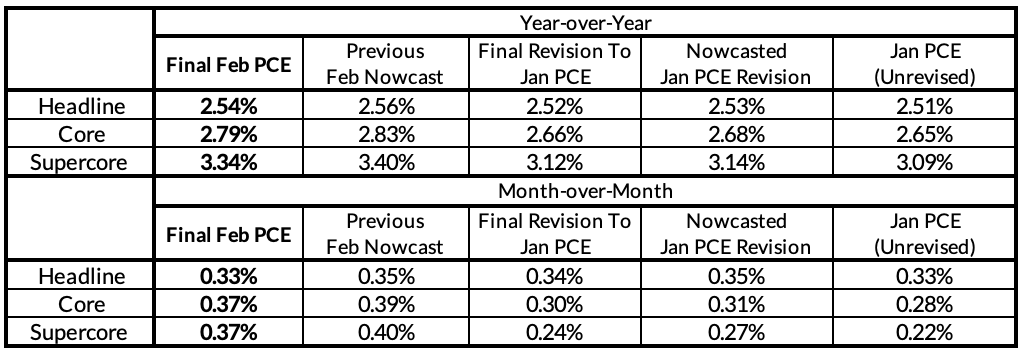

Summary: PCE Nowcasts

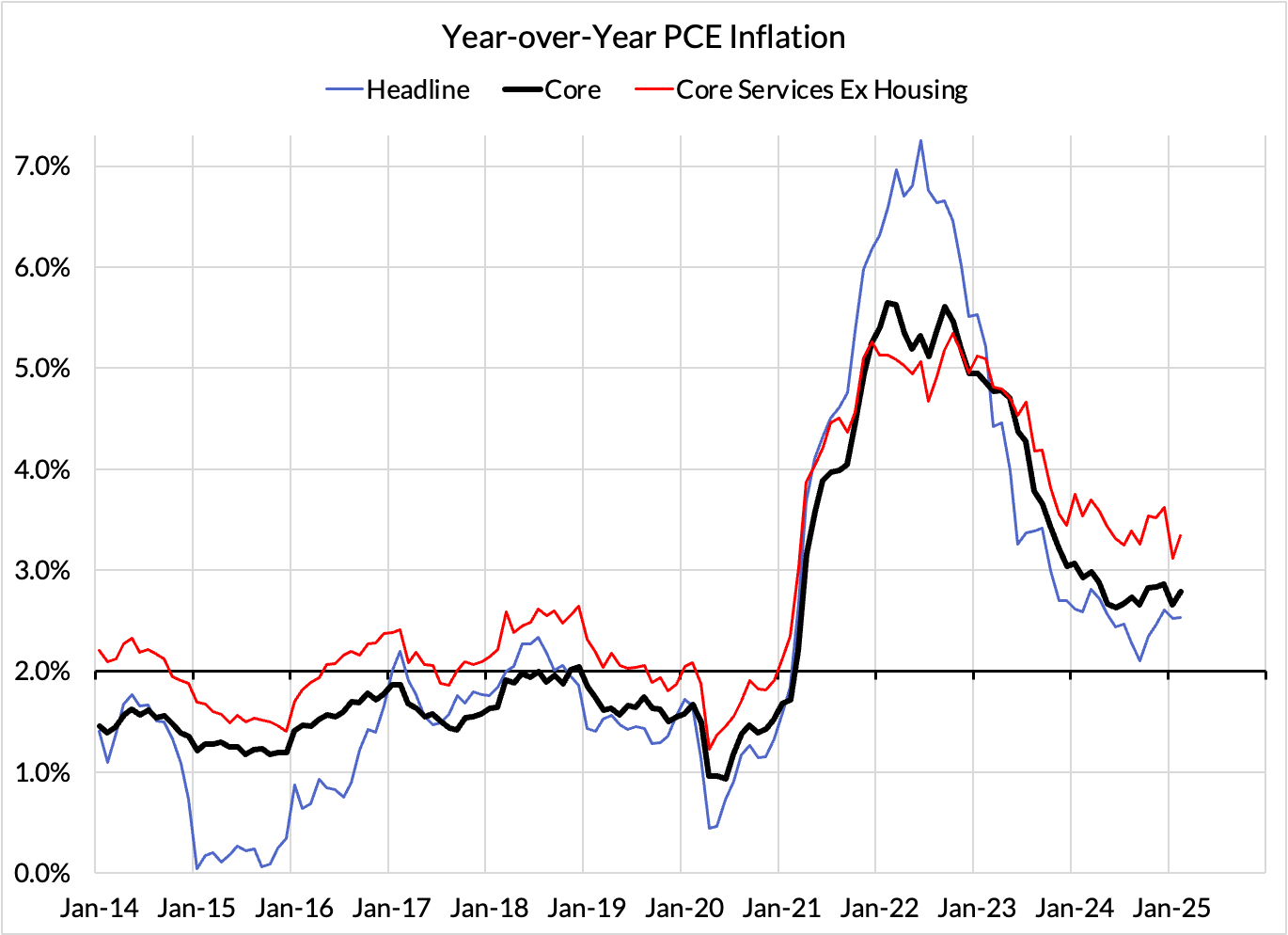

Our PCE Nowcasts were a touch high relative to what materialized but closer than most of the informed consensus in recognizing the likelihood of a 0.4% monthly reading. The data for February and the revisions for previous months bode poorly for how the Fed assesses the inflation outlook. We should get some short-term sources of relief in the coming months due to falling stock prices and a short-term reprieve in used car prices, but the effects of tariffs and tariff threats are poised to ramp up further over the next 2-4 months in the absence of a policy pivot.

Conditional on trade policy threats remaining on the table, it will require more financial market or labor market deterioration to catalyze an interest rate cut before the first half of this year. Our baseline view now only barely supports the case for a June interest rate cut, specifically because we anticipate some further deterioration. We fear the risks of a recession within the next 6 quarters are growing. Vulnerabilities are rising in part because interest rate sensitive sectors like housing and autos are likely to show more inelasticity if faced with trade-induced supply shocks in a more tepid economic backdrop.

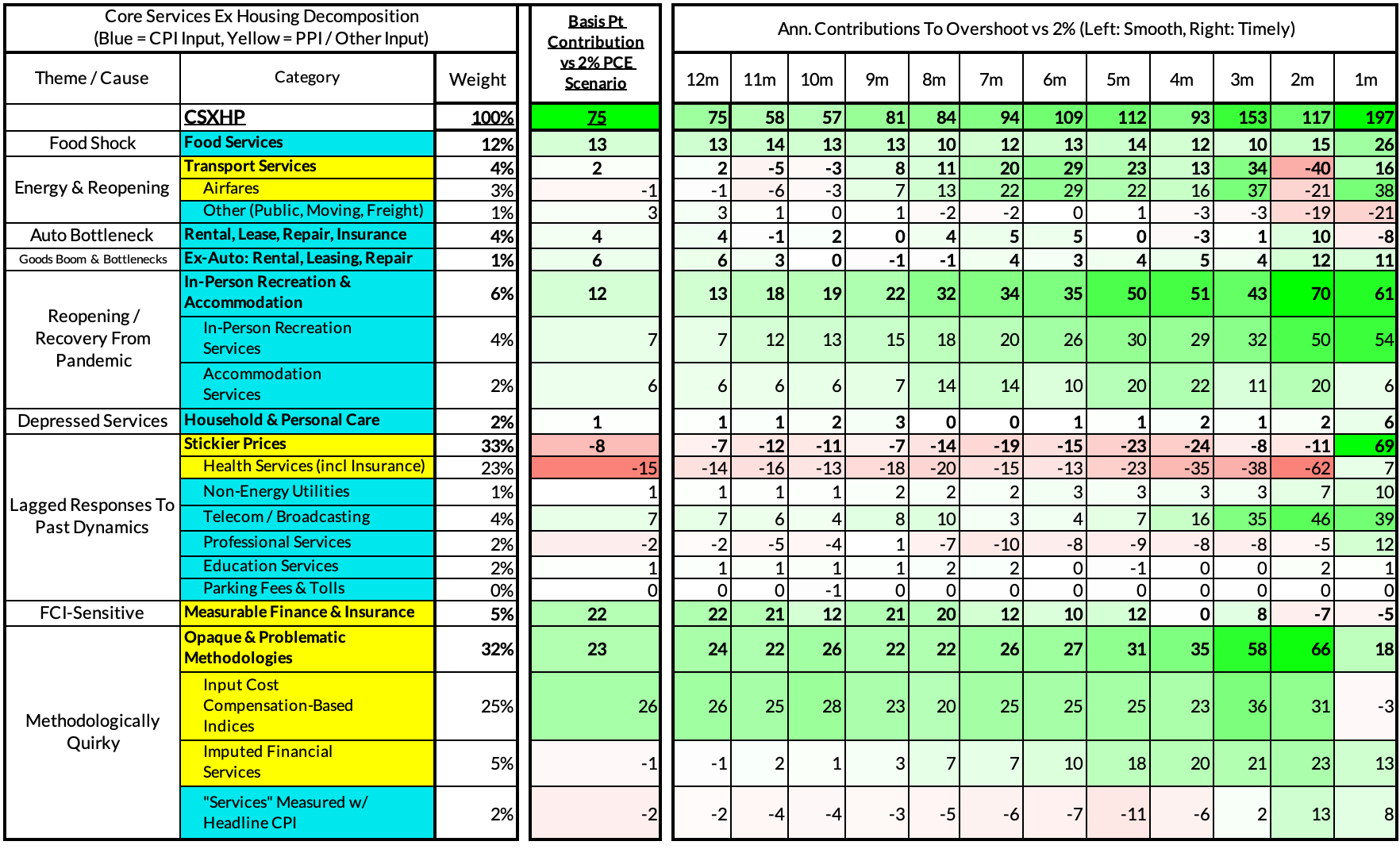

Inflation Overshoots At The Component Level

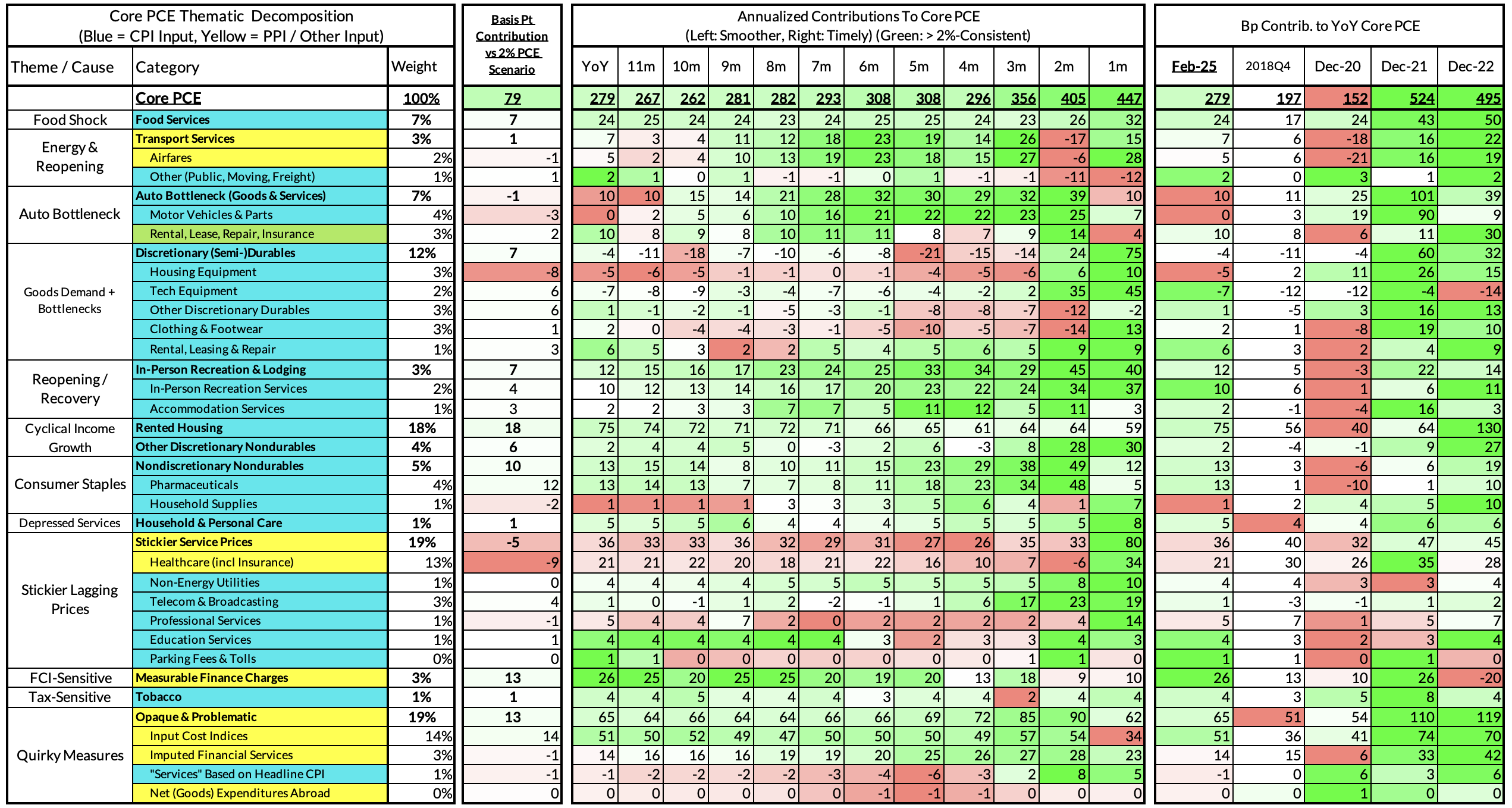

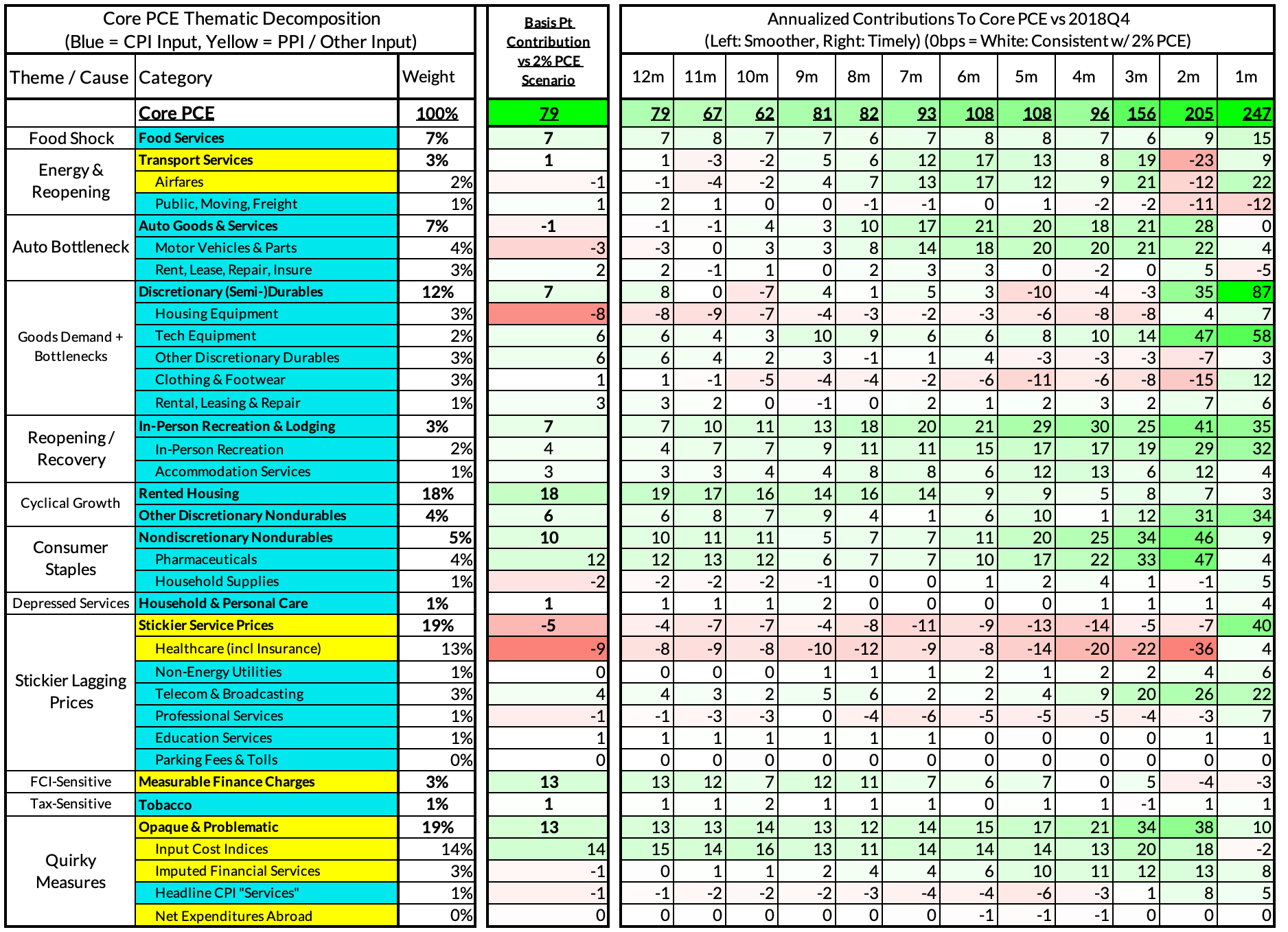

For the Detail-Oriented: Core PCE Heatmaps

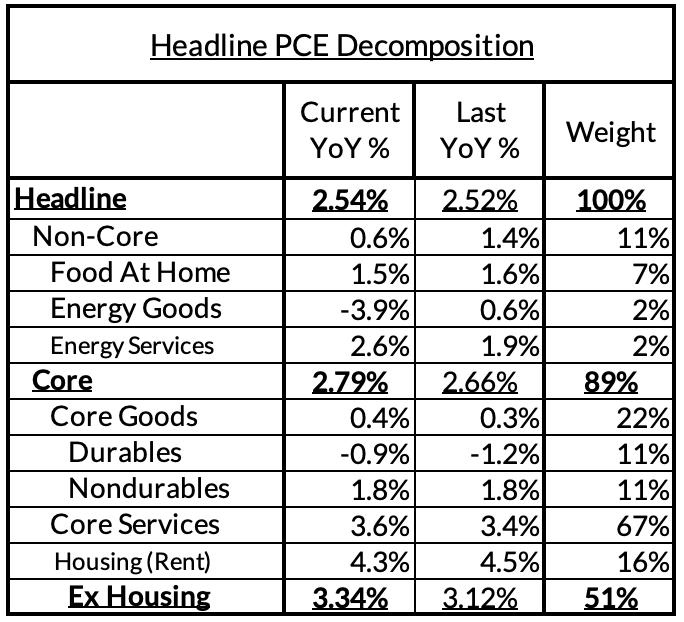

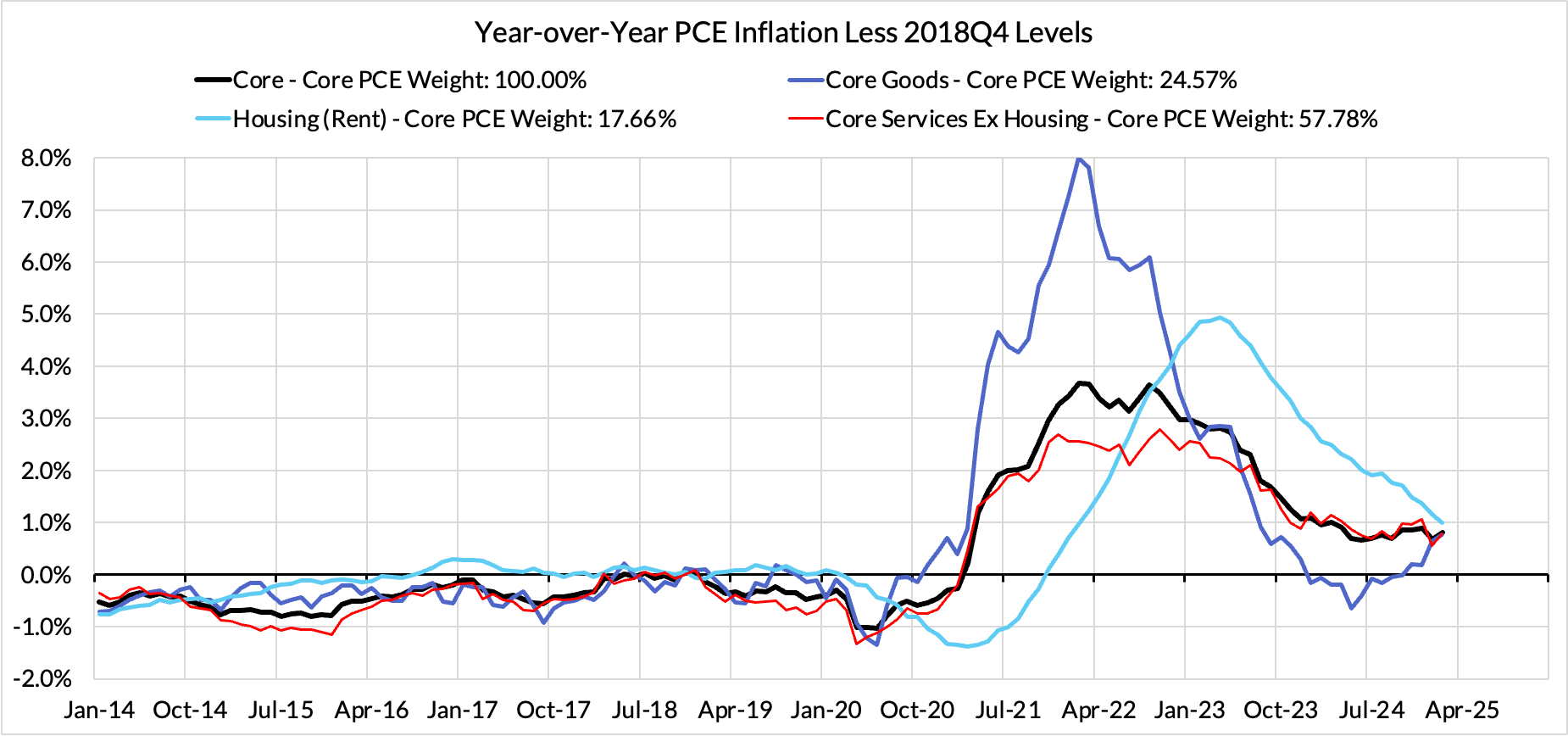

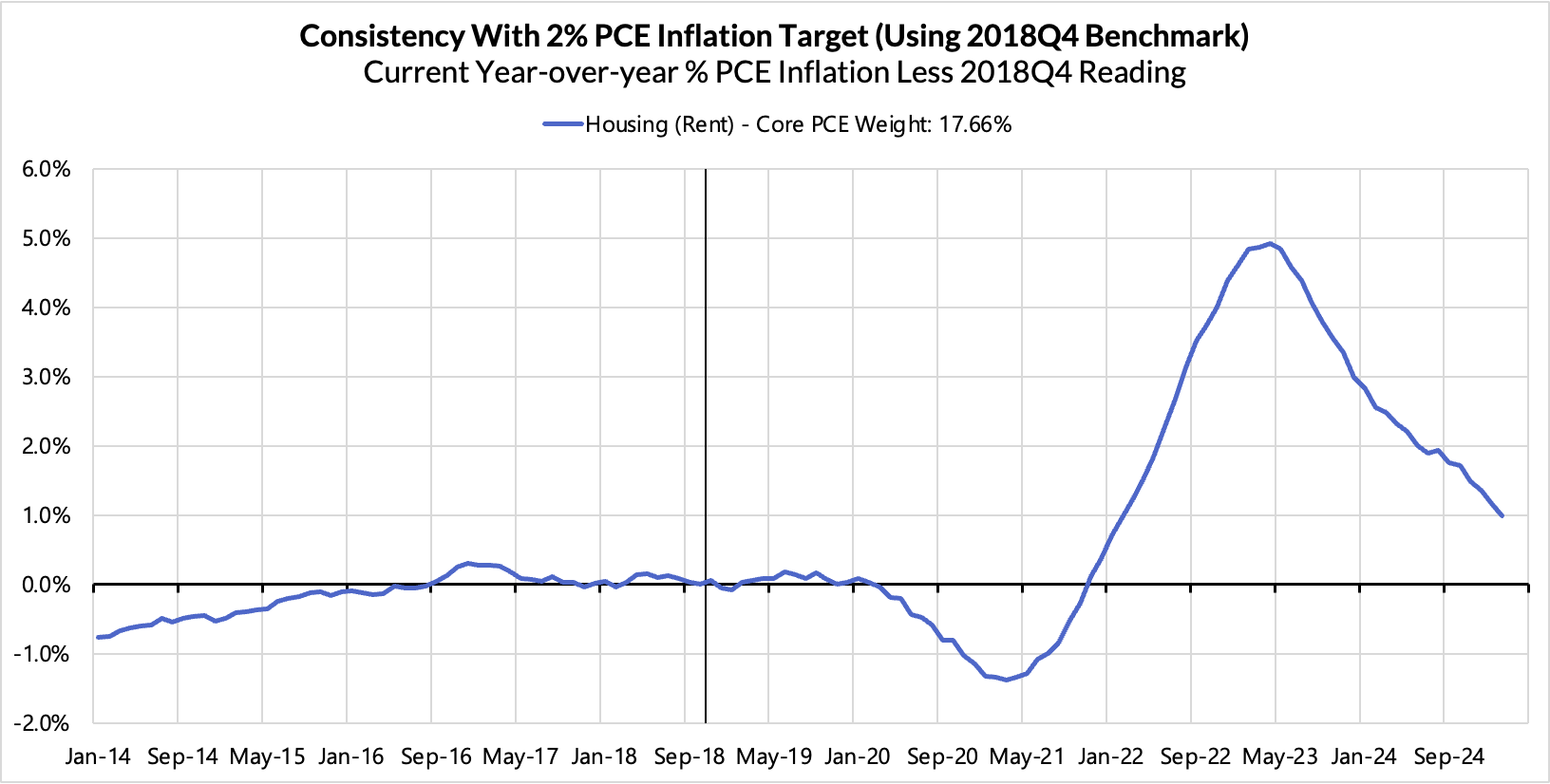

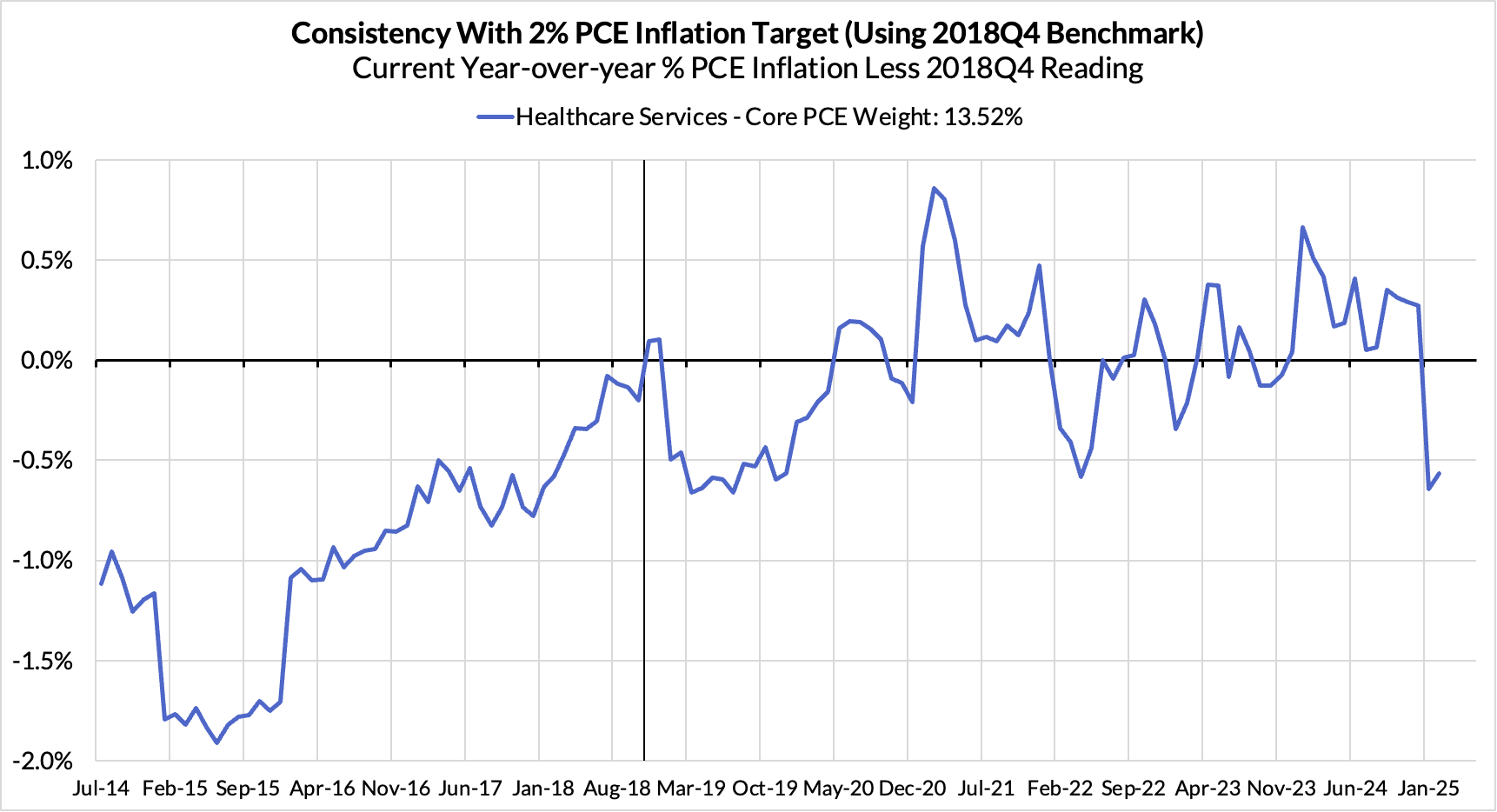

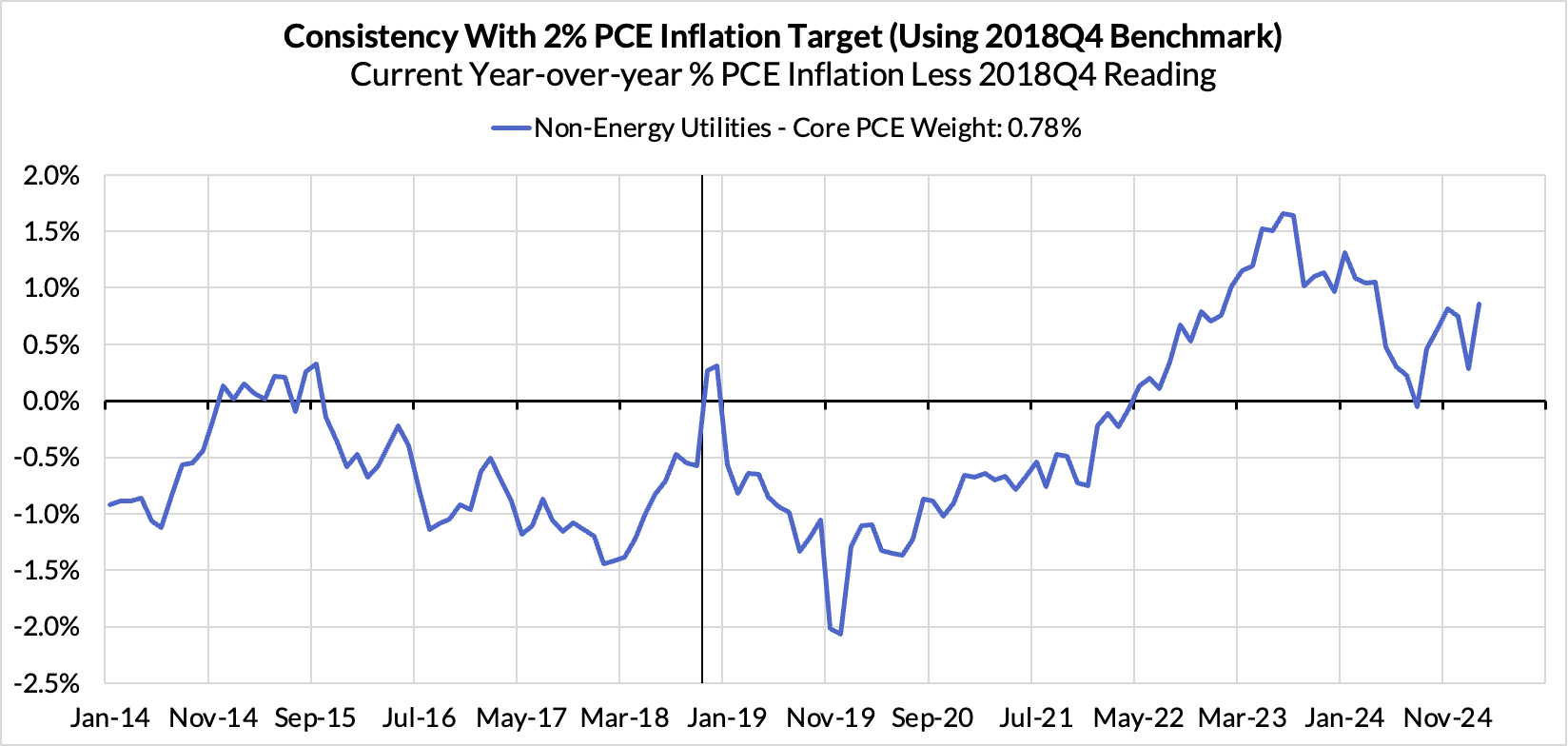

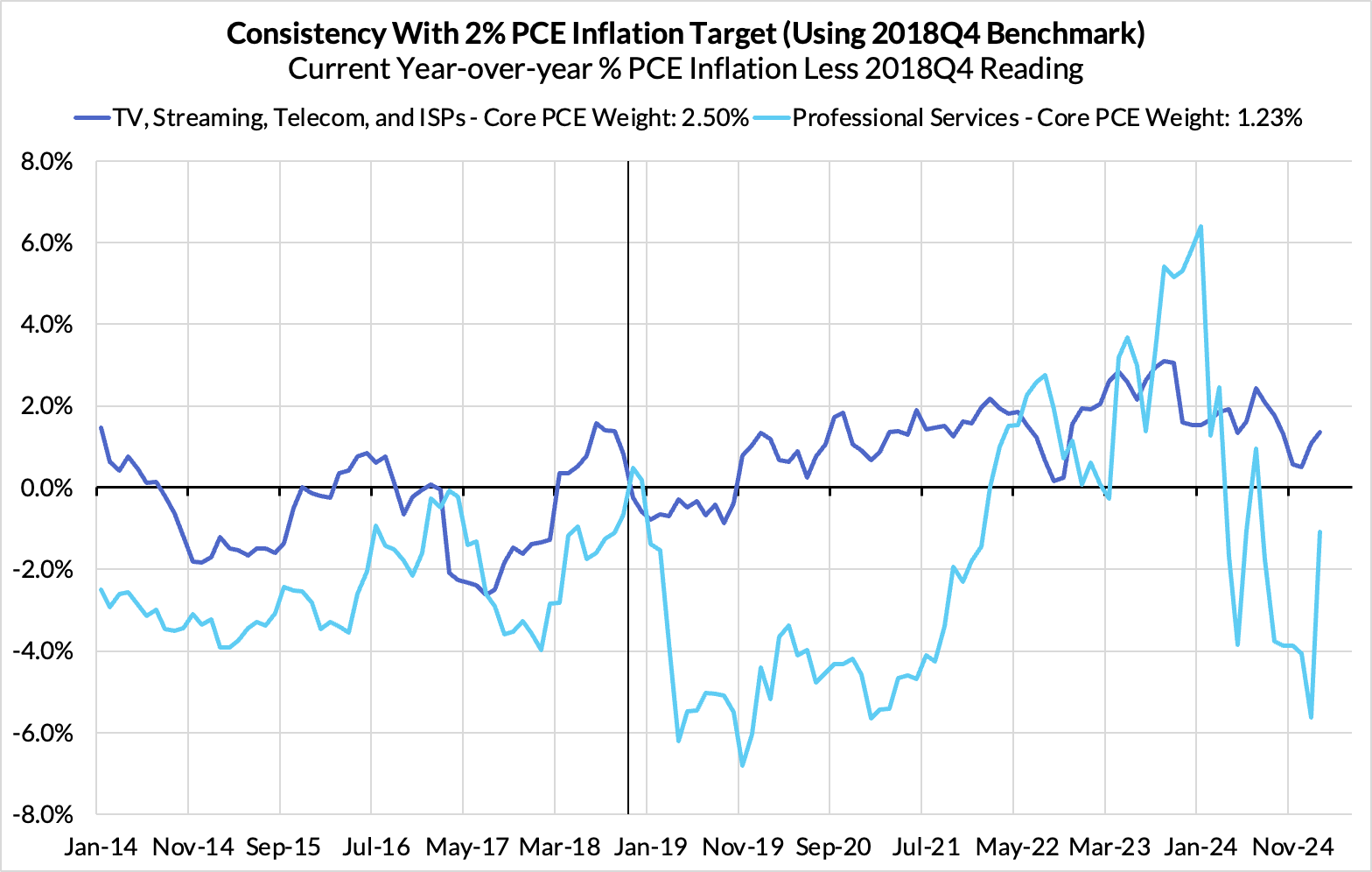

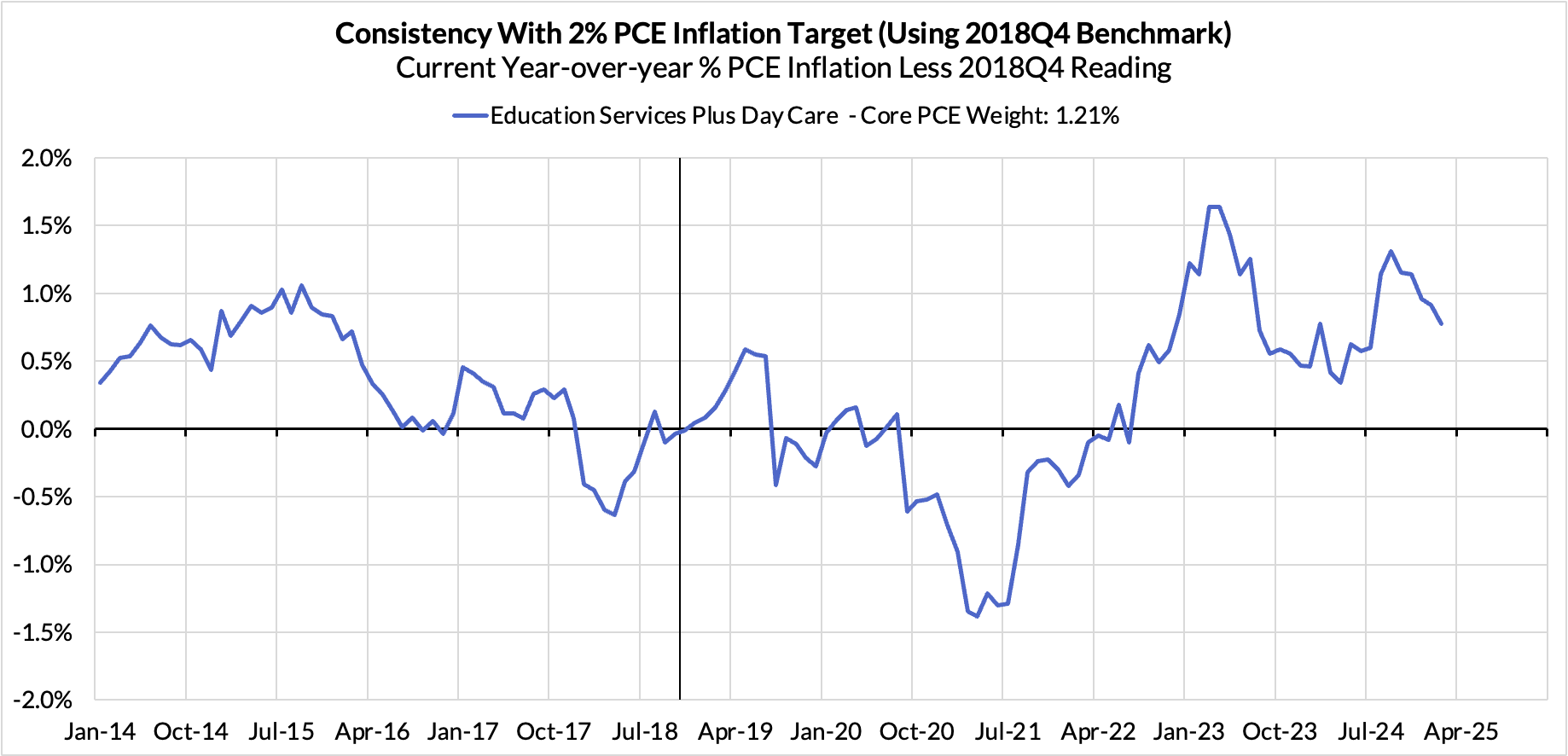

Right now Core PCE (PCE less food products and energy) is running at a 2.79% year-over-year pace as of February, 79 basis points above the Fed's 2% inflation target for PCE. That projected overshoot is still driven substantially by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22. Rent is on track to contribute 18 basis points to the 79 basis point Core PCE overshoot.

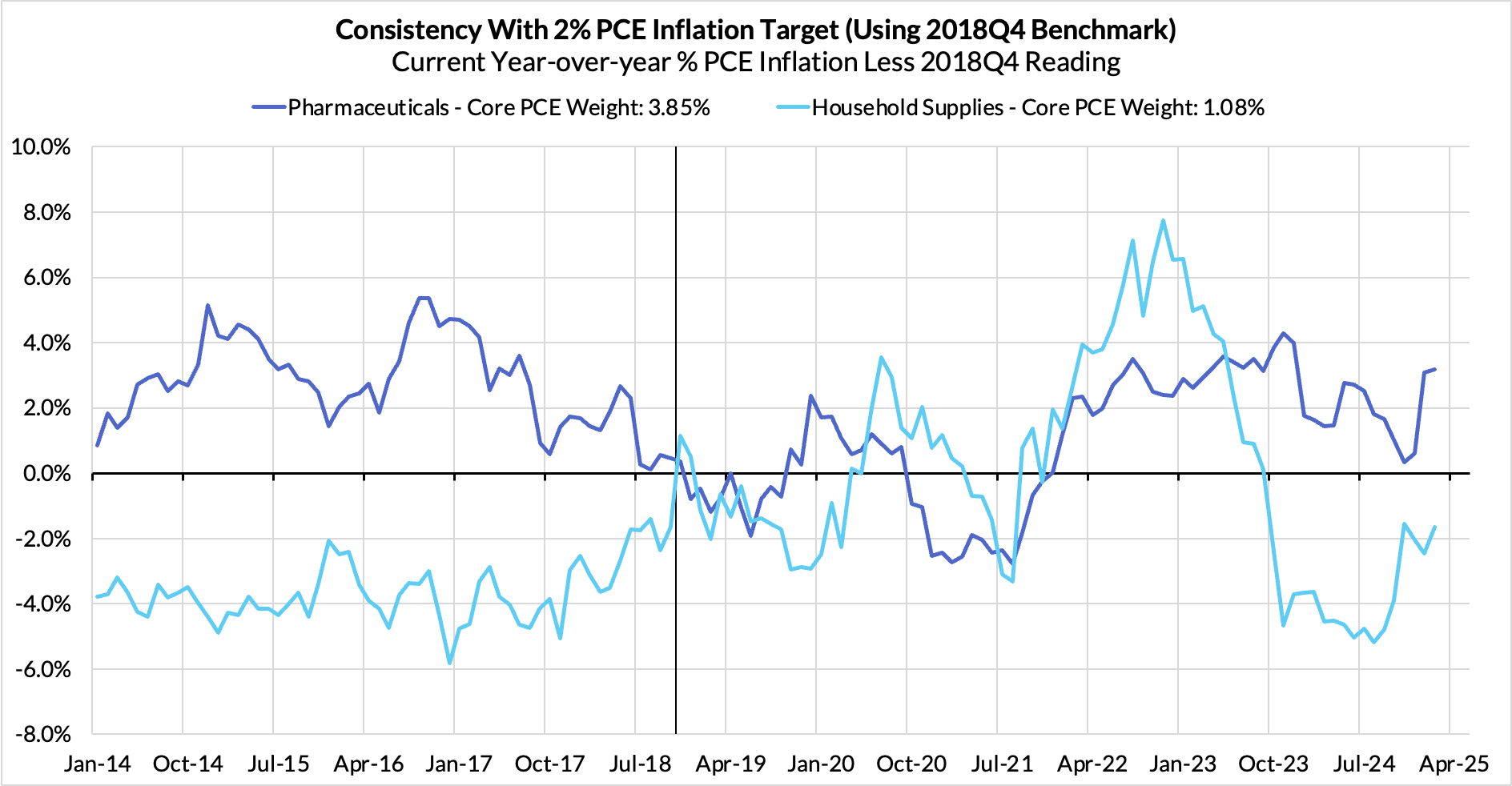

There are other contributors to the overshoot:

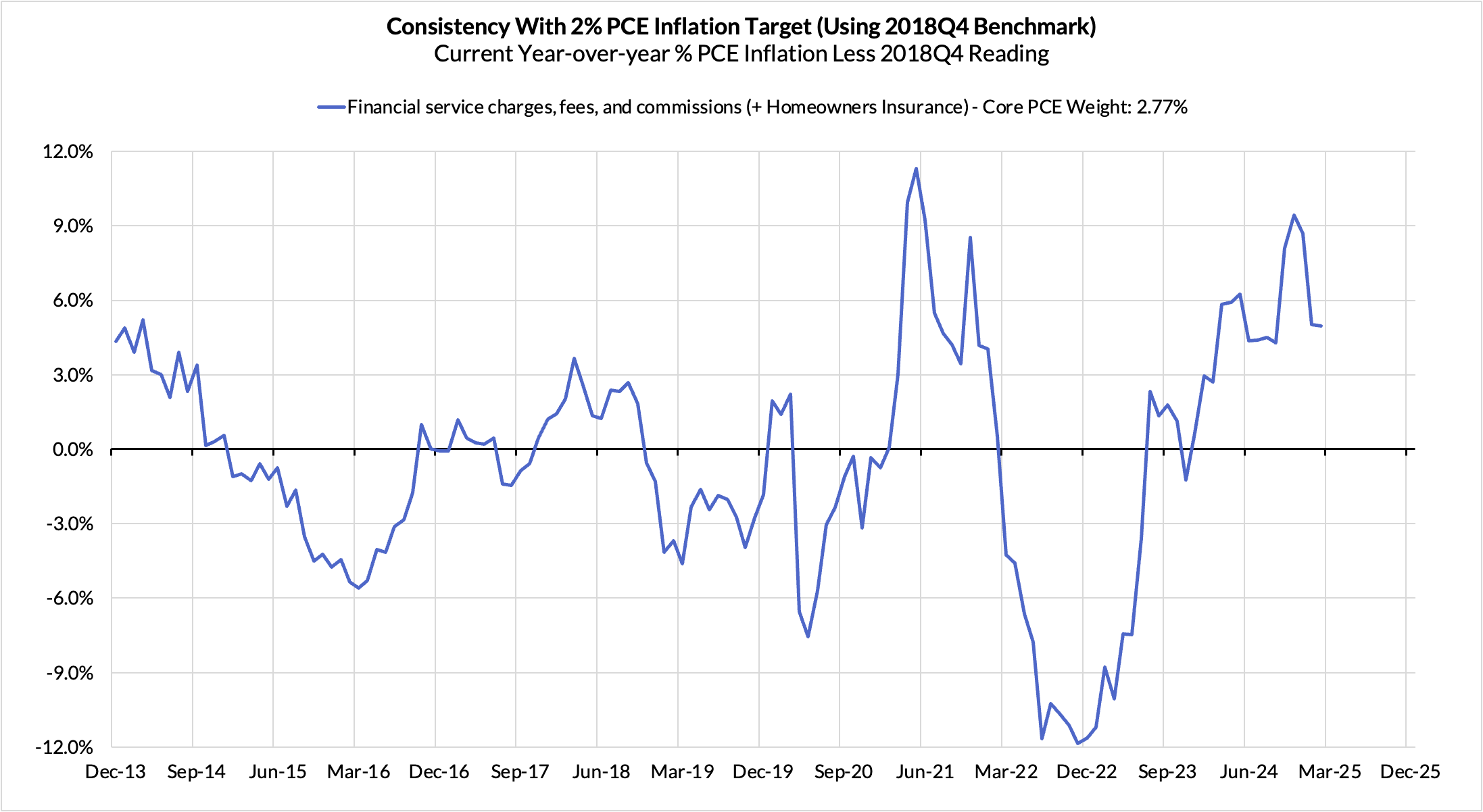

- Measured financial service charges are now adding 13 basis points due to the strong equity market performance over the past 12 months

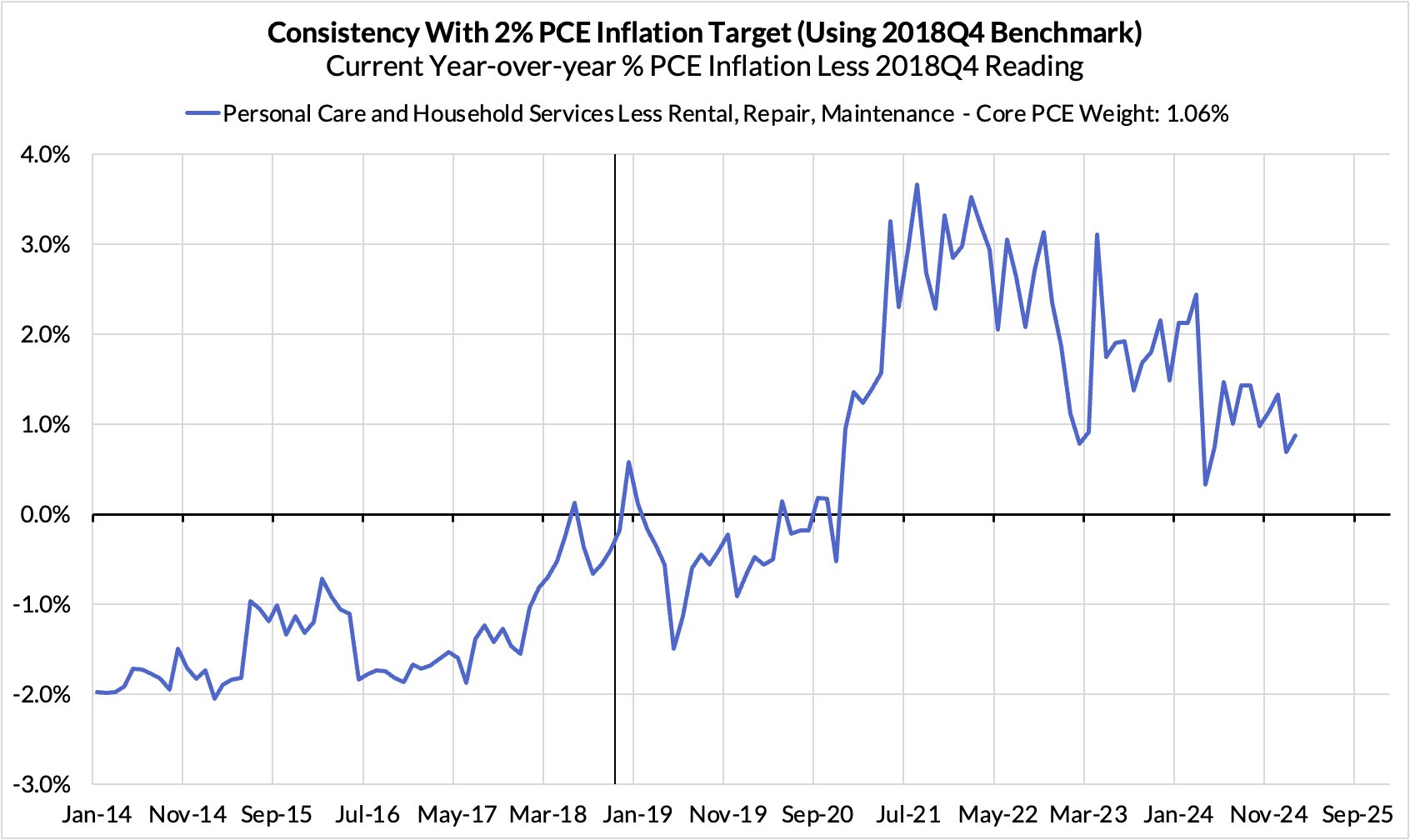

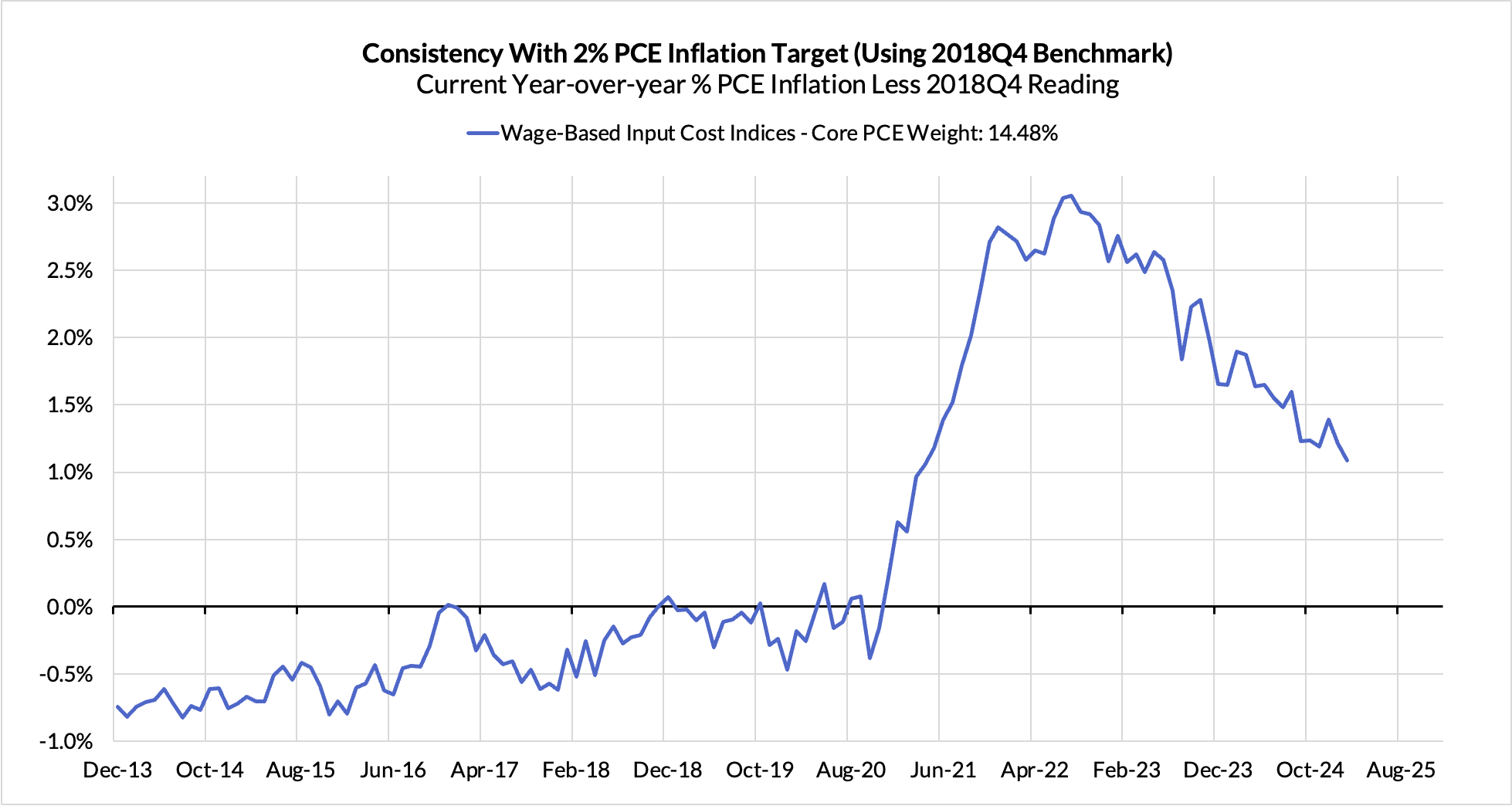

- Contributions from input cost indices (wages in specific sectors where market prices don't exist) are now adding 14 basis points to the overshoot

- Food inputs are adding 7 basis points to the overshoot

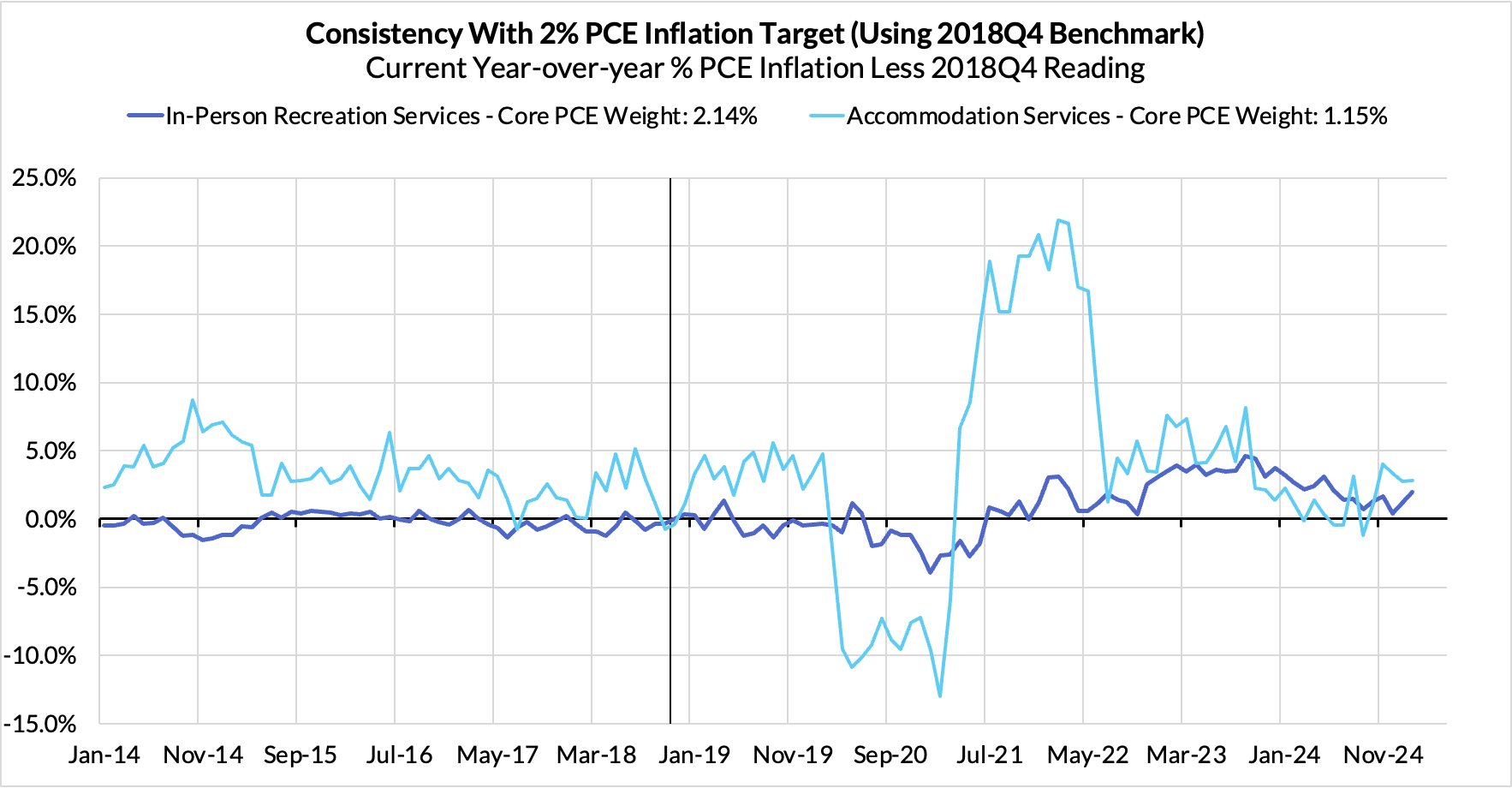

- In-person recreation and lodging services are contributing 7 basis points

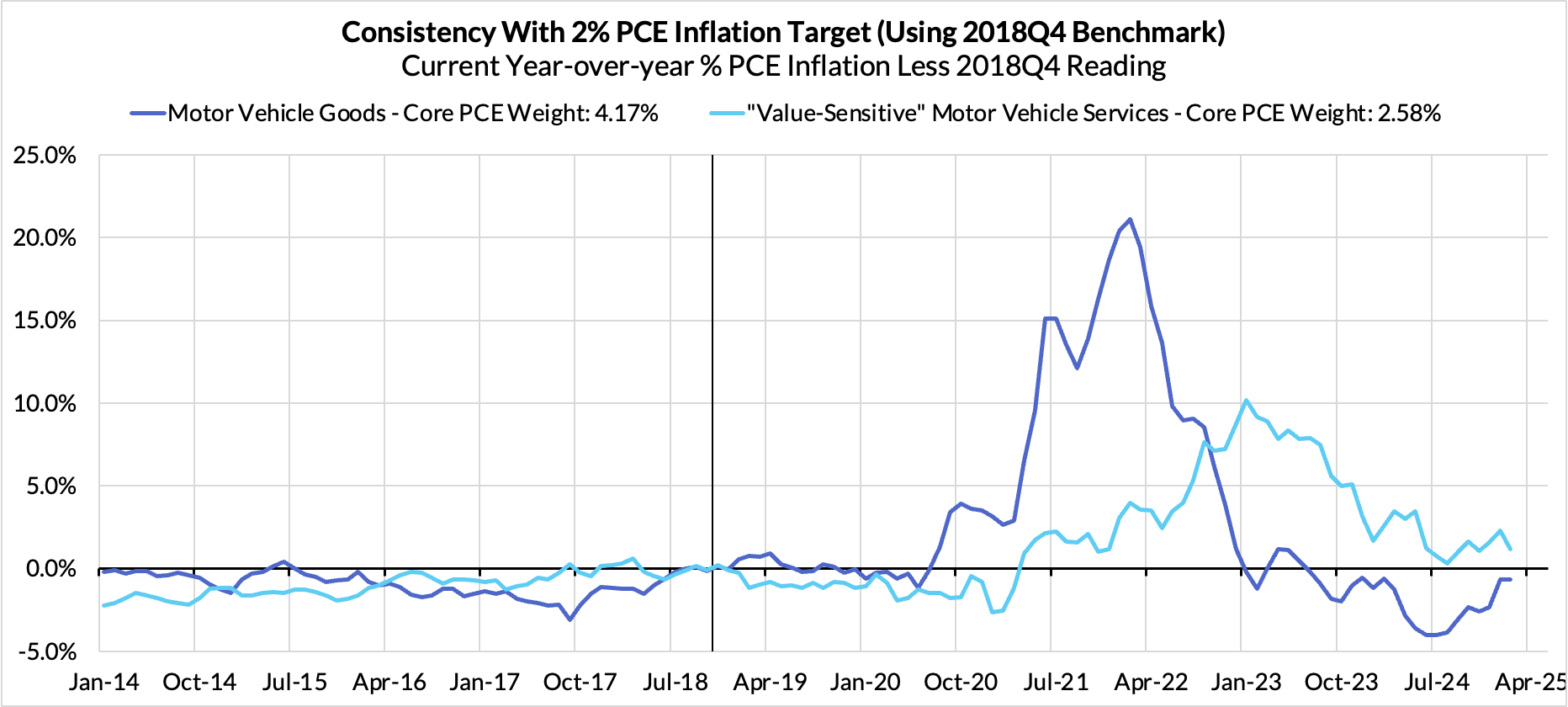

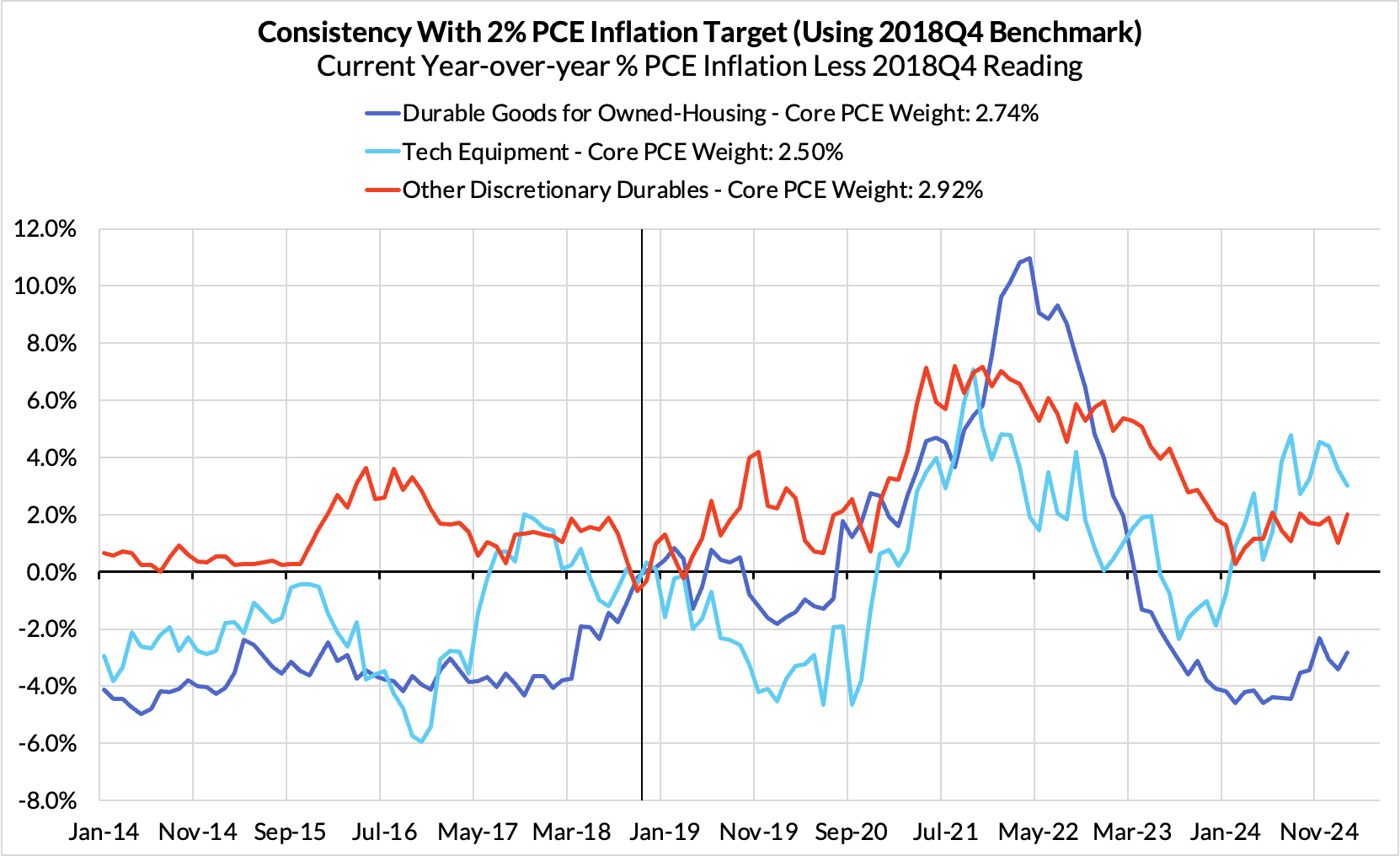

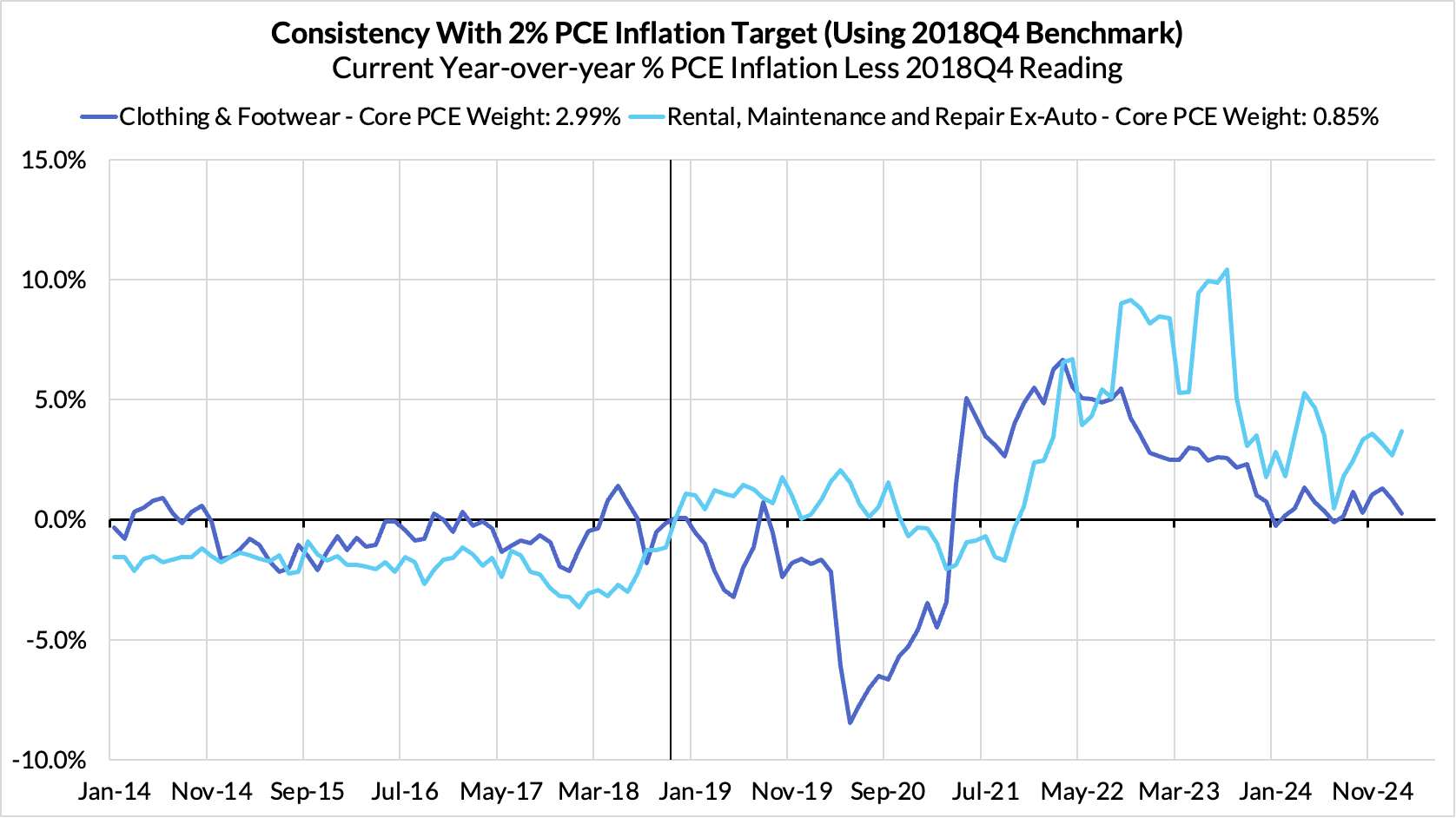

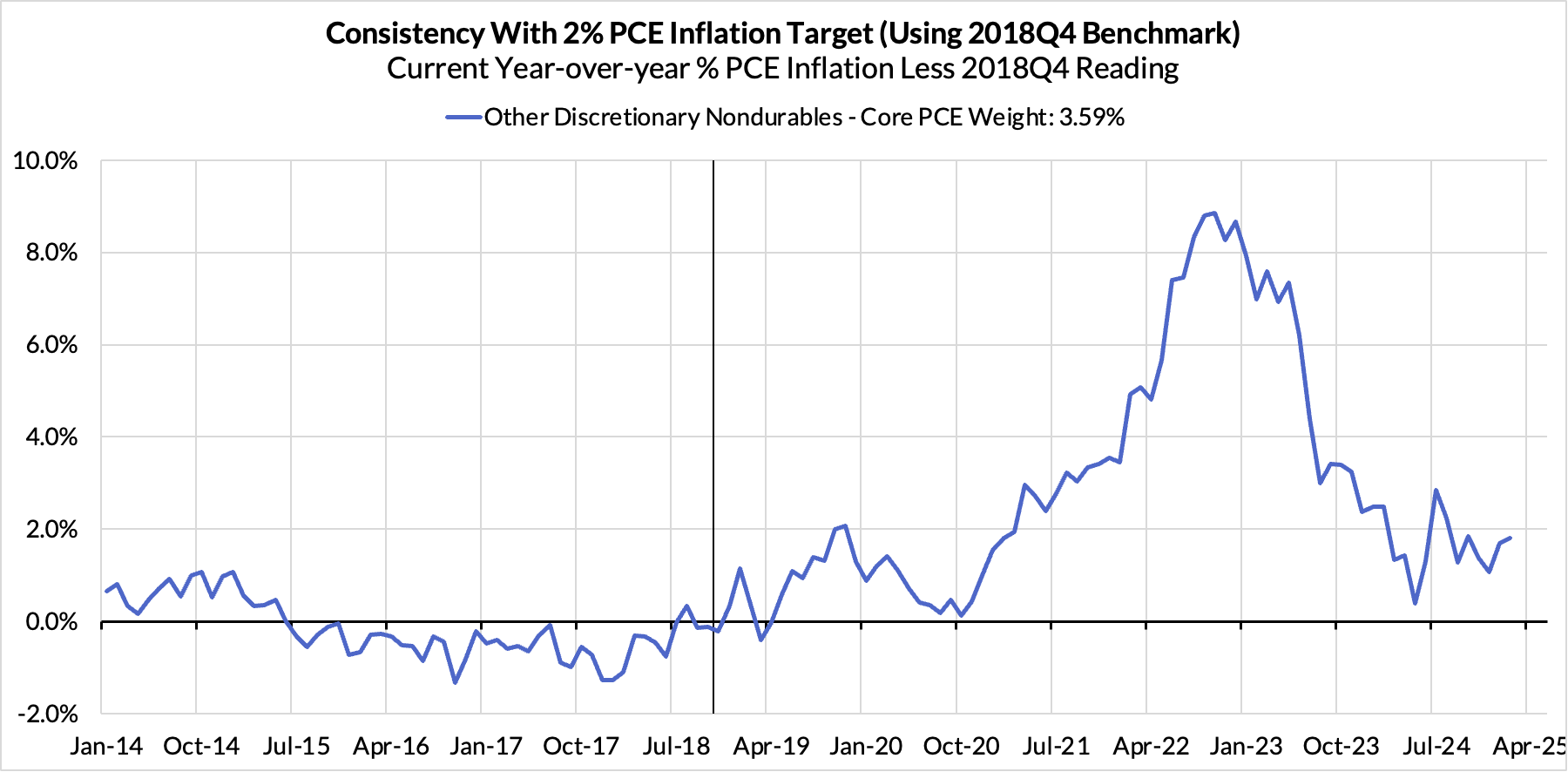

- Discretionary goods and adjacent services are adding 13 basis points

The final heatmap below gives you a sense of the overshoot on shorter annualized run-rates. February monthly annualized Core PCE ran at a 4.47% annualized pace, a 247 basis point overshoot vs 2% target inflation.

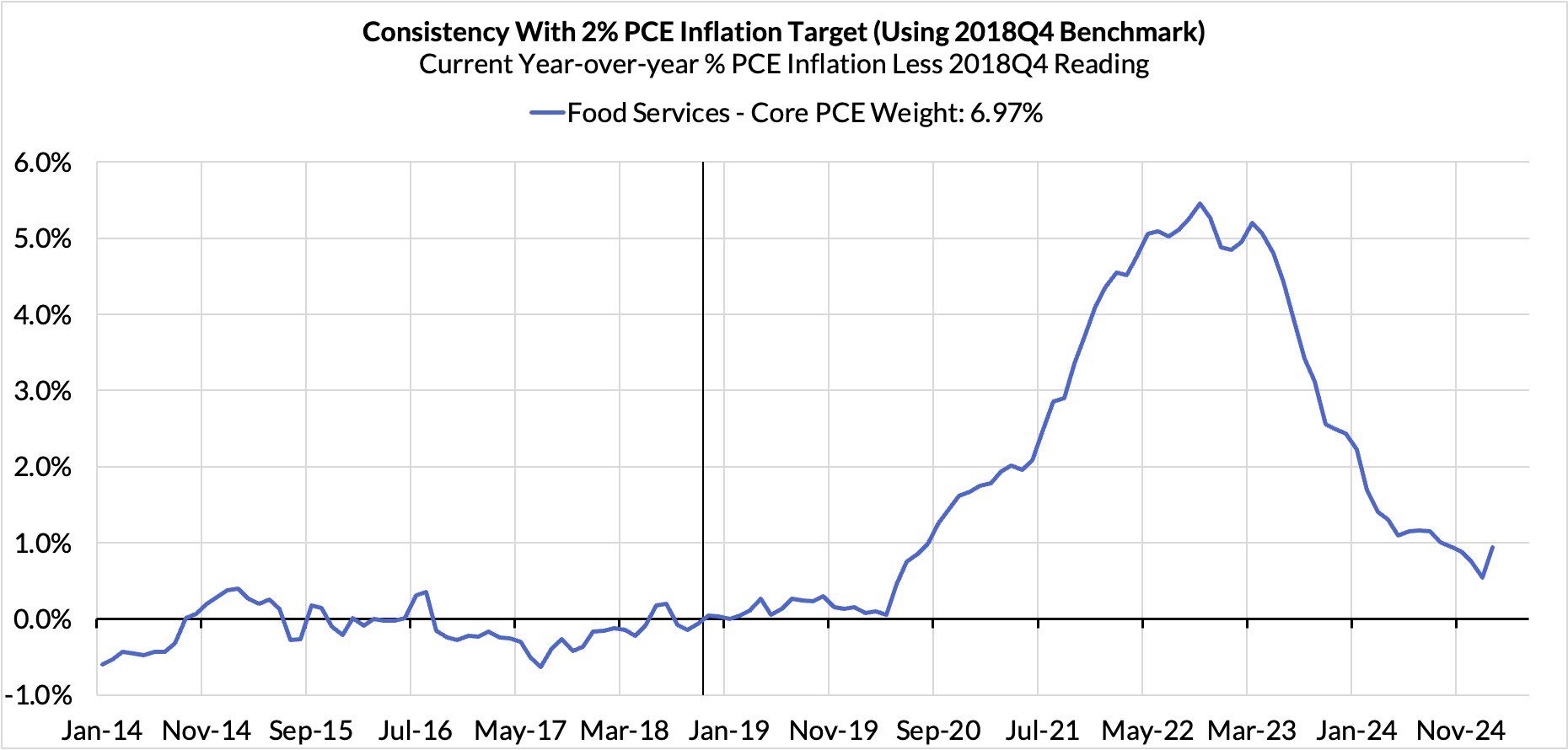

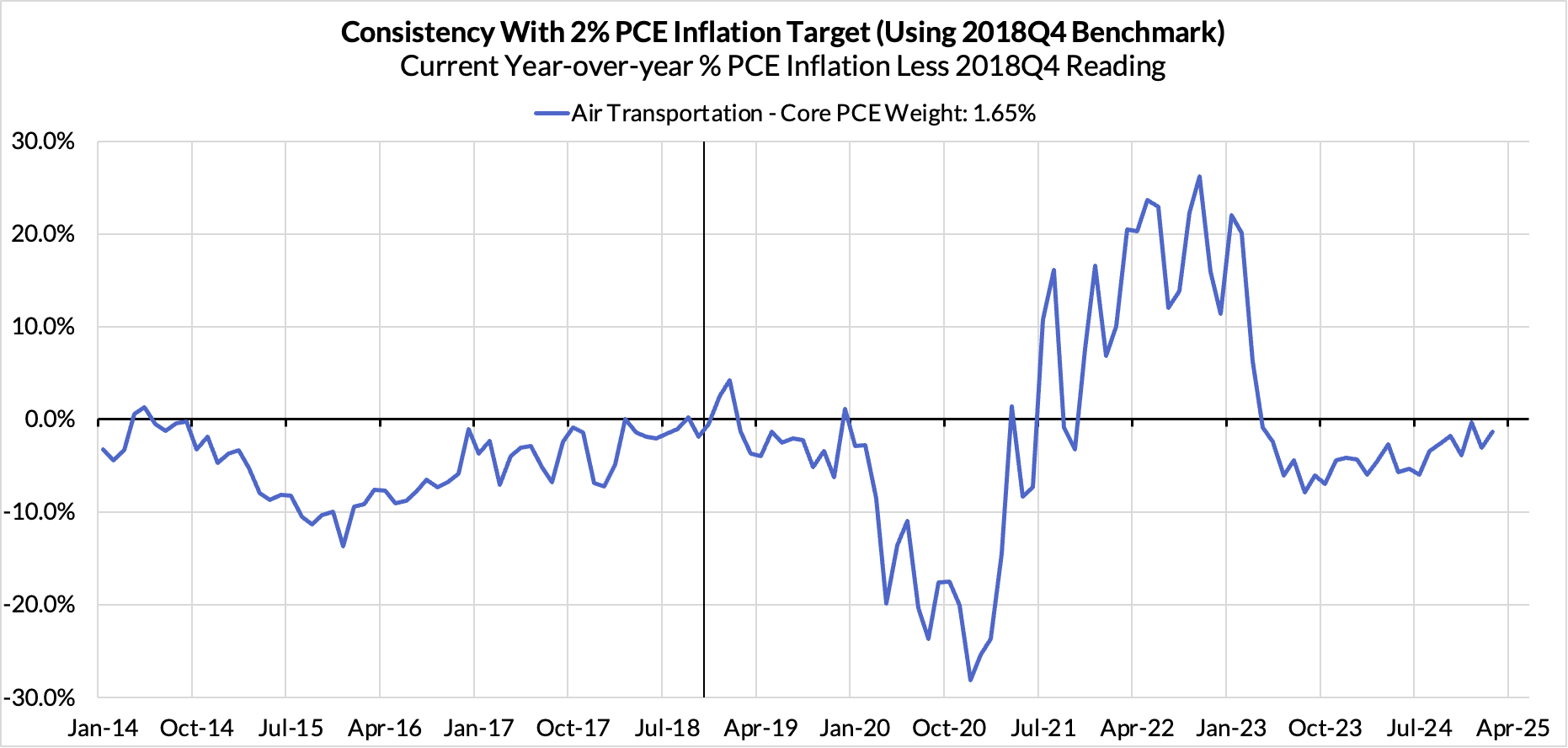

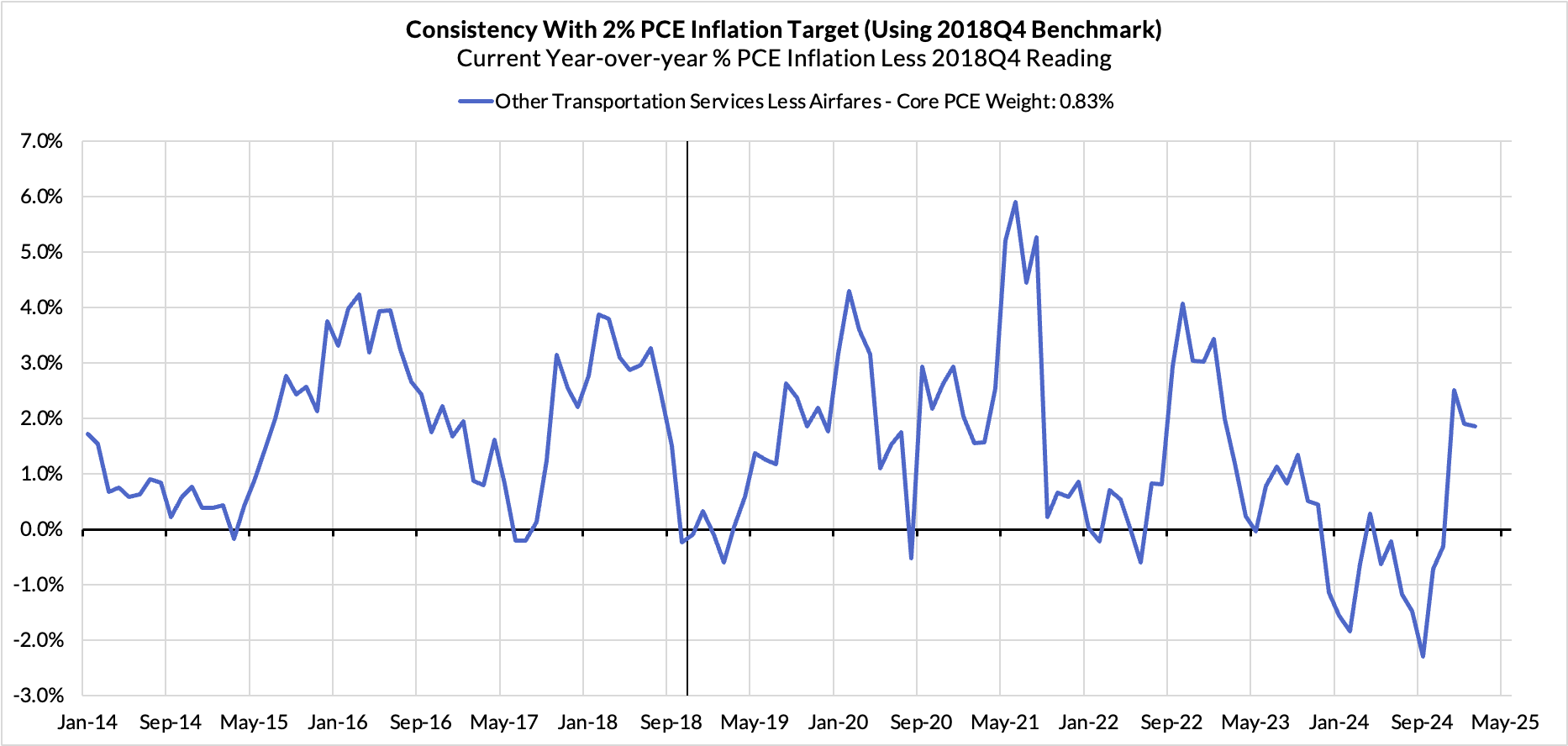

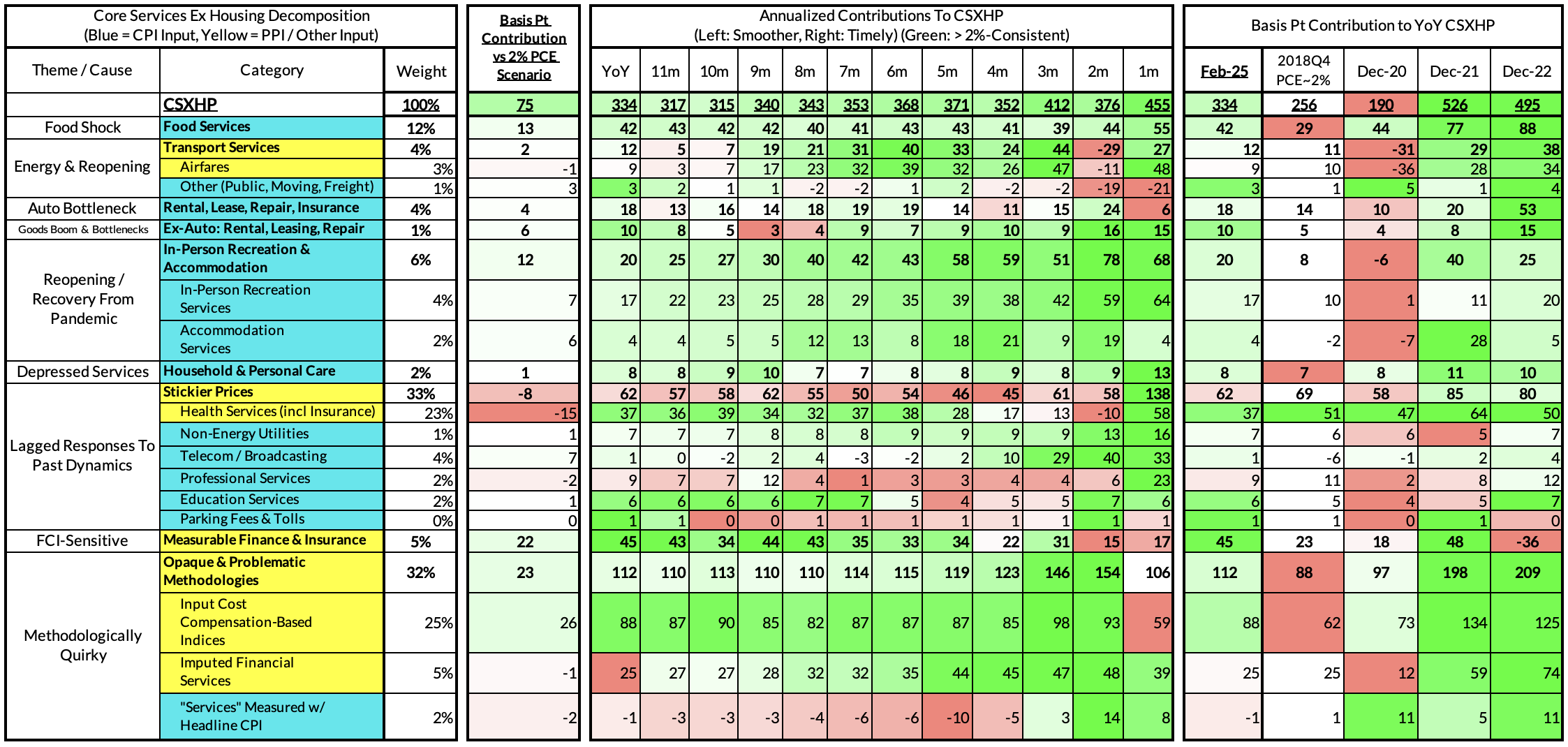

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The February growth rate in "Core Services Ex Housing" ('Supercore') PCE is running at a 3.34% year-over-year pace, a 75 basis point overshoot versus the ~2.59% run rate that coincided with ~2% headline and Core PCE.

February monthly supercore ran at a 4.55% annualized rate, a 197 basis point annualized undershoot of what would be consistent with 2% Headline and Core PCE.