Journalists can pretty much pre-write their headlines given the spike in oil prices. Year-over-year headline inflation readings are set to make new highs, potentially breaching 8% based on the food and energy impulse from what we might call the "Putin shock" to key commodities.

At the same time, February should begin to mark some better news for "core" inflation relative to January; consensus (0.5% month-over-month) for February seems to be lagging realized inflation prints over the past 5 months but less tethered to the causes of that strong inflation patch we flagged. We noted that January had unique upside risk for reasons that materialized as we specified: a large subset of prices are only revised at the start of the calendar year, thus setting the stage for outsized impact. Perhaps there is reason to believe in a residual spillover effect for February, but the absence of this calendar-effect should reveal itself as a slower core inflation reading from the 0.6% month-over-month January print.

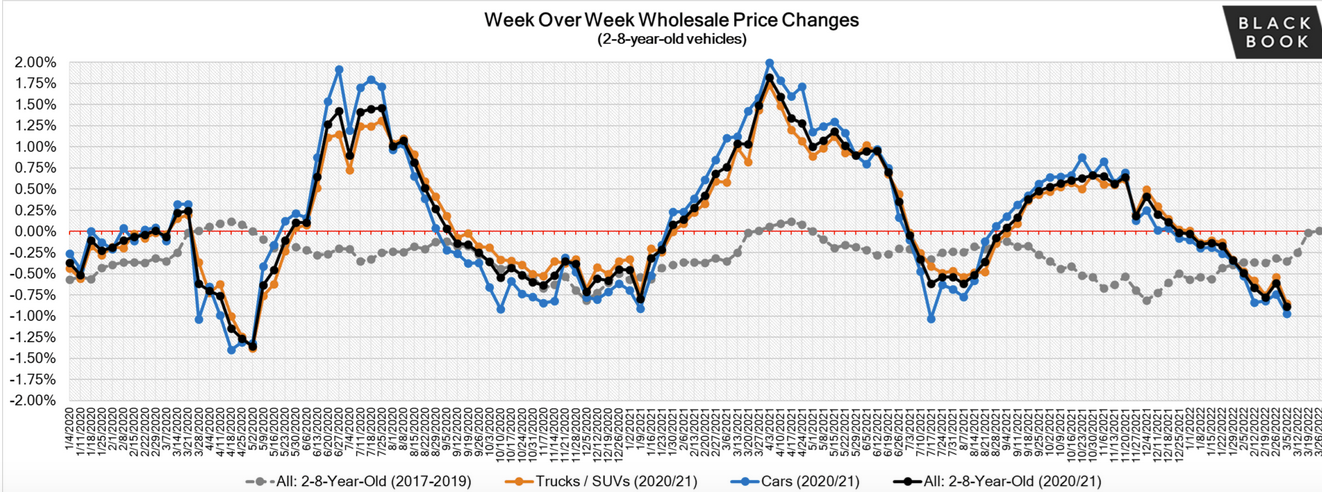

Core inflation in February should also begin to show some of the softness that is now growing more apparent in private used car price data. February is the peak month for wholesale used car sales, and the auctions this past month appear to be going poorly. The main driver here isn't the chip shortage; it is the dissipation of demand from rental car companies (who were buying back their liquidated fleets through much of 2021H2). Here's the latest data from Blackbook:

CPI data lags the Blackbook data by a couple months, and the Mannheim Used Vehicle Index a little less so, but both indicators are signaling some reprieve in from what was an exceptionally strong run in used cars CPI in 2021. We should see some of that reprieve show up tomorrow.

What we are dealing with now is an inflection point from one macroeconomic episode (the pandemic) to a new and very different episode (Russian commodity shock). Russia remains a linchpin producer of key commodities, most notably oil and gas but also base metals (e.g. palladium, nickel), agricultural commodities (e.g. wheat), and fertilizer. This shock is destined to hit the items that fall outside of "core" inflation measures (which exclude food and energy), but food and energy are generally consumed disproportionately by those at the lowest end of the income spectrum.

The net effect over the course of the year from this shock remains unknown, because the timeline of the shock (how long the war, sanctions, and self-sanctions last) is uncertain, but we can say a few obvious but still useful things.

- The primary effect of Russian commodities failing to be exported is inflationary. This should lift headline inflation readings and very likely will not have a 1:1 offsetting effect for the purpose of forecasting headline inflation readings. Inflation is going up because the volatile prices are going up; don't expect other categories of prices to fall correspondingly.

- The inflationary effect will primarily be felt in food and energy prices. Groceries, prices at the pump, and your utility bills will all be higher because of this shock. Food prices are not as globalized as energy prices but still are under strain now; Russia, Ukraine, and Belarus are responsible for substantial production of grains and fertilizers. Natural gas prices are also being pushed up by global factors (European shortage that is somewhat adjacent to the war in Ukraine).

- The effect of this shock on core (ex-food ex-energy) measures is less clear. The effects of food and energy costs on "core inflation" measures are more time-varying, and even the sign is not always obvious. Jet fuel prices sometimes drive the local variation in airfares (but not always). Other commodity inputs where Russia is a big player (metals) might prove more relevant for sectors that are trying to adopt 'greener' forms of production, but that is pure speculation at this stage. With household balance sheets stronger, firms might be tempted to push the envelope on passing those cost increases onto consumers. On the other hand, we know that food and energy are consumed by all households and as a share of total expenditures, disproportionately so for the poor. Given the inelastic nature of (some) food and energy demand, this price shock will also be an expenditure shock for liquidity-constrained households. The expenditure shock will detract from expenditures on other goods and services that are not commodity-intensive. This could create a disinflationary impulse within the goods and services represented in "core inflation" indices.

- The demand shock to core goods and services could pose recessionary risks if they drastically affect the hiring propensities of firms that produce such goods and services. Right now financial markets are signaling elevated recession risk right now. Employment and wages are recovering and growing briskly right now (thank goodness!). However, for a variety of reasons (e.g. endogenous slowdown from waning fiscal and reopening impulses, financial conditions tightening, the Russia shock), we are likely to see a slowdown in 2021. The Fed will need to stay adaptive and prudent in how they manage these cross-currents.

Quick estimates of equity risk premiums suggest that there's more tightening of financial conditions than what expected rate hikes are reflecting. CDX indices also implying 100bps of HY spread widening.

— Skanda Amarnath ( Neoliberal Sellout ) (@IrvingSwisher) March 8, 2022

Warrants marginal caution from Fed (mkt pricing in ~6 hikes in '22) https://t.co/HZs8PmpAOl pic.twitter.com/UHMjUYoWju