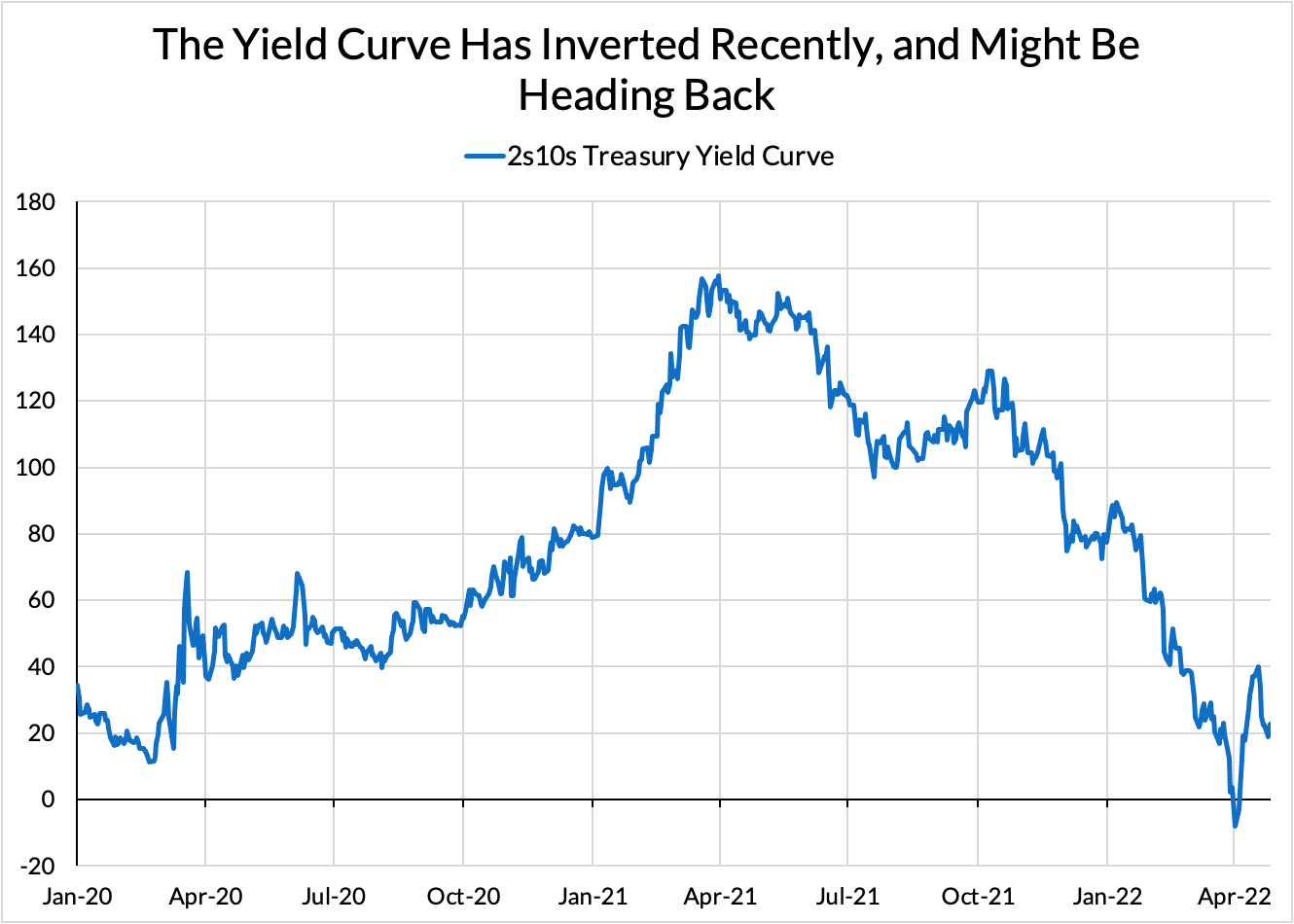

Recent movements in financial conditions suggest that growth is set to slow across the globe. For a Fed looking to hike rates against sustained domestic inflation, this situation may require a revision to the balance of risks involved in the choice of policy stance. Tightening global financial conditions may serve to reinforce policy tightening, and the Fed should be cognizant of the risk that hikes may have a stronger-than-expected impact in this period of elevated uncertainty.

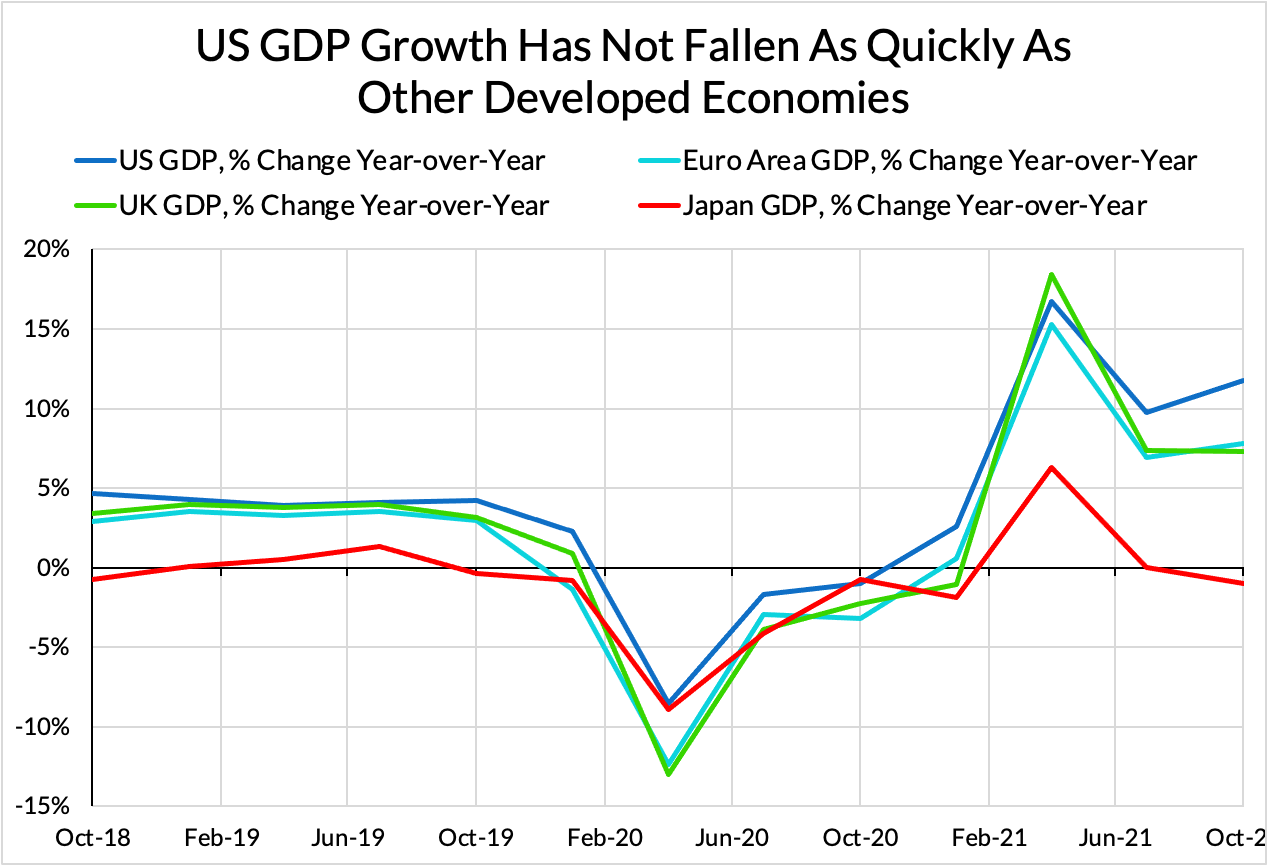

While conditions are set for a global slowdown in growth, certain dynamics will likely produce divergent growth patterns between the US and the rest of the world. The US – having pursued a more ambitious fiscal response to the pandemic – has been running at consistently higher growth rates than other developed and developing economies.

The US is also better-positioned to remain insulated from two dynamics liable to restrict economic growth in the rest of the world: weak Chinese demand and the shortages of materials and agricultural products.

It is hard to say with certainty what is happening in the Chinese economy, however, Covid-19 lockdowns and uncertainty in the real estate market have coincided with falling Chinese demand for material inputs, suggesting a worsening overall demand picture.

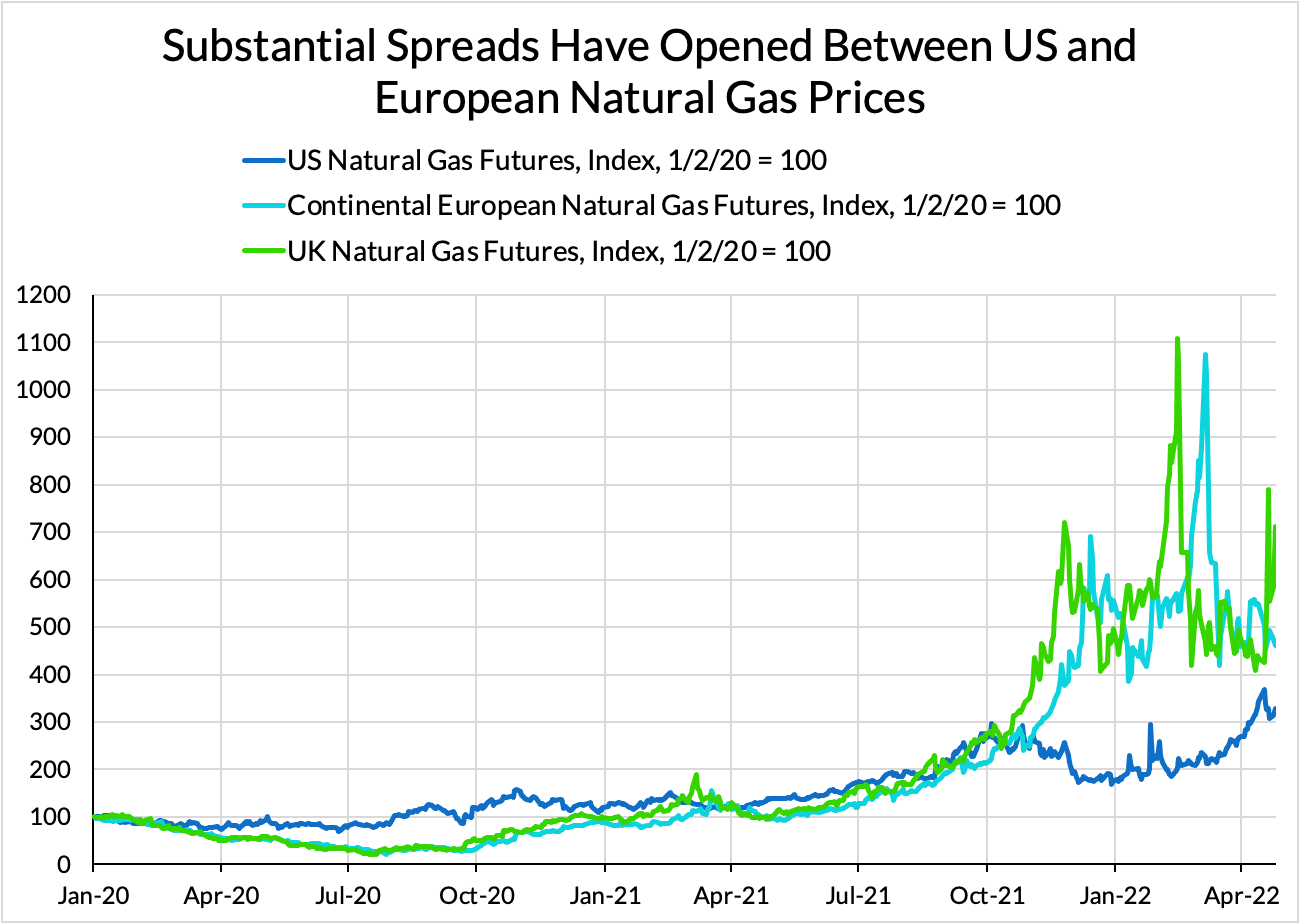

At the same time, Russia’s war in Ukraine has been steadily driving down the availability of a wide range of energy and food products, leading to substantial spreads between US and European energy costs. Natural gas expresses the situation well: tight global supply (which predated, but was nevertheless amplified by, the war in Ukraine) has led to disproportionate price increases and production disruptions in Europe, while US prices have risen as LNG export capacity expands to accommodate increased European demand, despite generally ample US supply.

While the impact of the global semiconductor shortage on auto production hit car-dependent American car-dependent consumers, the shortage of baseload generation and natural gas supplies has shown how many European economies have underinvested in energy security and resilience.

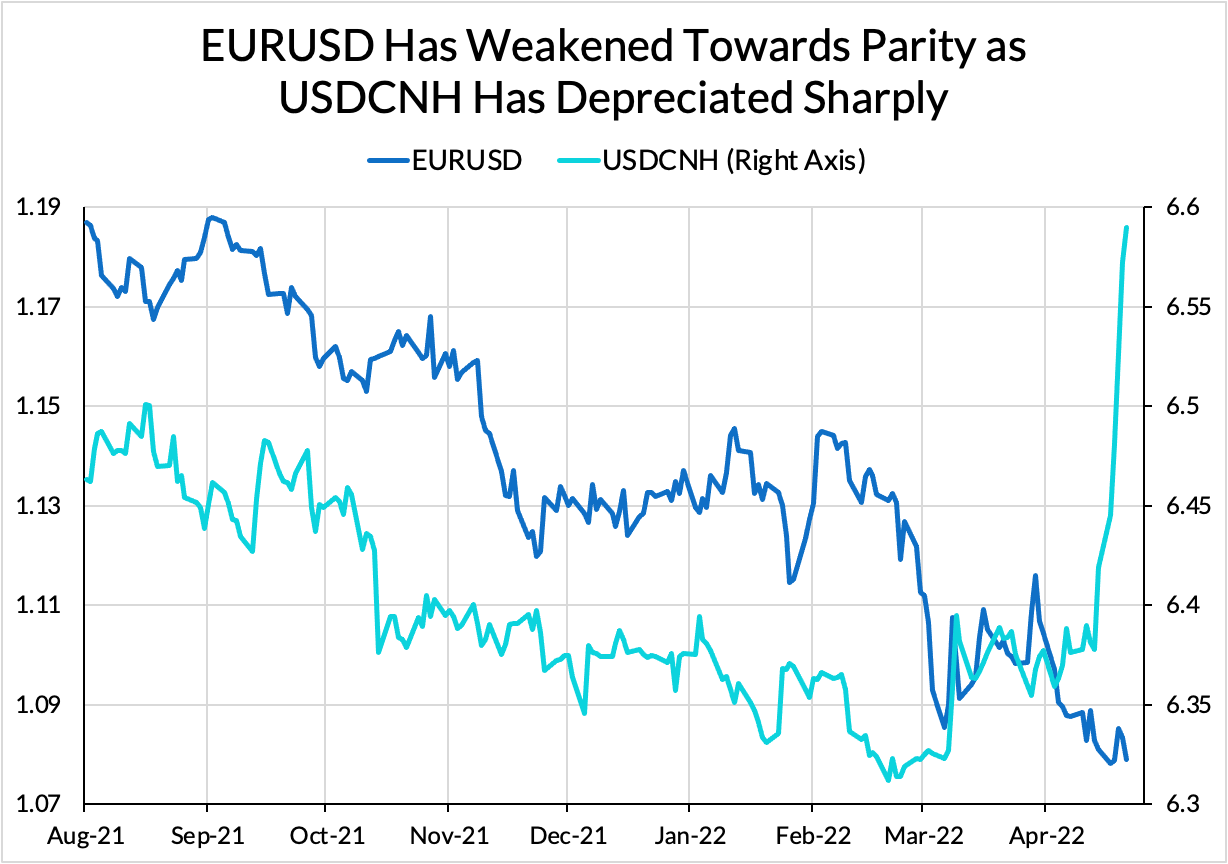

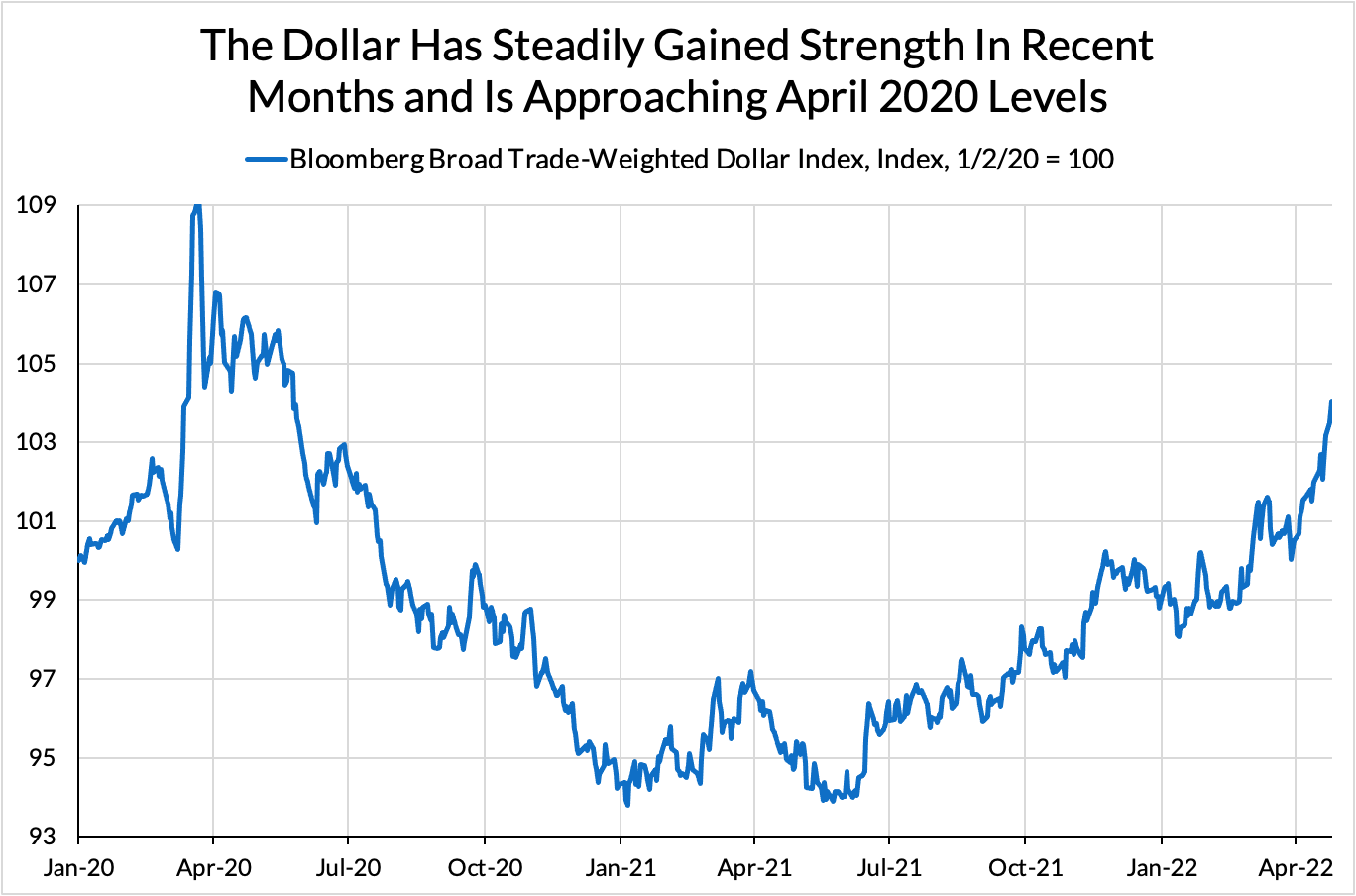

This divergence in global growth outlooks is among the drivers of sustained dollar appreciation recently. Central bank divergence, as proxied by interest rate differentials, falls short of a complete explanation. USDCNH has moved sharply higher, while EURUSD is the closest it has been to parity since the market gyrations that accompanied the initial round of lockdowns in March and April 2020.

Outside of these dynamics, the broad trade-weighted dollar index has continued to strengthen, even as commodity prices rose across the board.

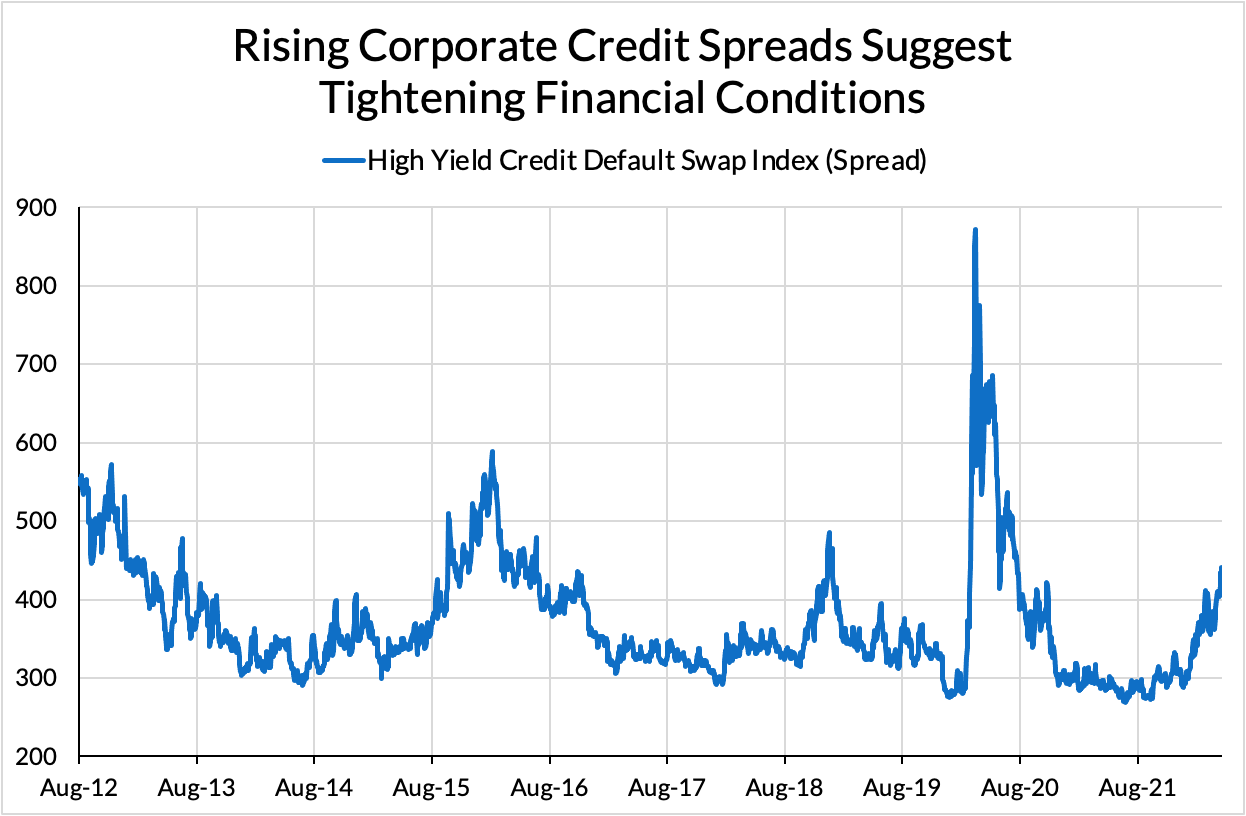

As we have argued at length, financial conditions are the fastest and most direct linkage between Fed policy and the economy at large, both domestically and globally. Tighter policy curbs household demand for consumption primarily by constraining the willingness of firms to hire and invest domestically. We can see some evidence of this already in widening credit spreads.

By providing a backdrop of slowing global growth and dollar appreciation, financial conditions are already doing some of the Fed’s work of slowing growth and cooling the inflation outlook. Policymakers should remain attuned to this shift in the balance of risks ahead of May’s FOMC meeting.