If you enjoy our content and would like to support our work, we make additional content available for our donors. If you’re interested in gaining access to our Premium Donor distribution, please feel free to reach out to us here for more information.

What to Expect:

- Another 25 bp cut. While the prospect of a 25 bp cut looked precarious in the weeks leading up to this meeting, there have been enough dovish developments (the most recent being the soft-for-PCE PPI print last week) to solidify a 25 bp cut for December. Few of the Committee members have offered strong pushback against a December cut, and Chris Waller offered some tentative support for a 25 bp cut prior to the blackout period. Market are pricing in another cut with near-certainty.

- Hawkish talk about a pause in 2025 Q1. The flip side of the cut is that it will come with hawkish signals about the future rate path—the question is how hawkish, and what signals? Powell is going to get 100 bp of easing this year despite the fact that 12-month core PCE inflation will end the year higher than the median SEP projection in September and unemployment looking marginally better than the SEP projection. With one member (Bowman) already dissenting, the doves will have to negotiate hawkish signals in exchange for a cut this week. Besides an upwards movement in the 2025 dots, this probably also means that Powell will gesture towards a pause in January 2025, at least.

On top of that, there are other motivations to pause in Q1. The Committee will also be concerned about getting burned by high Q1 inflation readings for a third time in a row. With a new presidential administration incoming and high uncertainty around the trajectory of policies like tariffs, locking in rate cuts now and maintaining optionality in when to restart and how fast to cut in the future looks like the path of least regret. - Our baseline is for 3 cuts in 2025 but with significant asymmetry towards the hawkish side.

- The path to neutral shifts into low gear. With the target Federal Funds Rate ending the year at 4.25% to 4.50%, we are entering the range of what some of the more hawkish members would consider neutral or non-restrictive. This meeting will mark the start of the Fed’s “feeling out neutral” phase and Committee members across the board have indicated that this will involve a slower path of rate cuts.

Latest Fedspeak and Dot Projections

The Developments That Matter

Inflation

Since the last meeting, the Fed has seen nearly two months of inflation data (October and most of November). After last week’s inflation data, 12-month core PCE inflation is on track for 2.8% in November, and will overshoot the Fed’s projection of 2.6% from the September FOMC meeting.

Some of the inflation overshoot is attributable to “weird” parts of the PCE price index like equity performance and “price indices” that are just wage indices in disguise, but there are some genuinely concerning developments. Several components in the goods sector have seen sizable inflation gains in the past couple of months. It’s unclear how much of this is due to pull-forward ordering in anticipation of tariffs, early scheduling of Q1 repricing, or the dissipating effects of supply chain healing. If goods inflation is going to see less easing from supply chain healing in 2025, we could be in for a very bumpy ride.

On the bright side, we may finally start to see some relief from high housing inflation. Month-on-month owner’s equivalent rent inflation in November was finally within the range of pre-pandemic growth. It’s just one month, but it’s an encouraging sign.

Labor Market

The labor market looks to have avoided the worst of the Fed’s fears that motivated their 50 bp September cut. The unemployment rate, at 4.2%, is currently marginally below the Fed’s projection of 4.4% in the September SEP. Our latest assessment of the state of the labor market is that it’s “treading water,” but it’s not clear how long we can stay in this place.

While the past few months have been difficult to read due to hurricanes and strikes, it is clear that the labor market is not offering much heat at the moment. Job growth is historically strong but not unreasonable given recent immigration figures. Wage growth is nominally elevated but justified by the productivity numbers. Employment rates have fallen quite a bit in the past few months, although that may be attributable to residual seasonality. Hiring rates are still very low.

Key Fedspeak Since Last Meeting:

- Powell: "The economy is strong, and it's stronger than we thought it was going to be in September... we can afford to be a little more cautious as we feel out neutral."

- Waller: "I lean toward supporting a cut to the policy rate at our December meeting… cutting again will only mean that we aren't pressing on the brake pedal quite as hard."

- Bostic: "I do not view the recent bumpiness as a sign that progress toward price stability has completely stalled."

- Goolsbee: “"Barring some sign of actual overheating of the economy, I still feel comfortable saying.... rates have a far way to go down"

- Hammack: Says the current market pricing---25 bp by January and a "few" cuts in 2025---is consistent with her baseline view.

- Logan: "Among widely consulted models, point estimates of the... neutral fed funds rate of 2.74 to 4.60 percent."

- Kashkari: "Knowing what I know today, still considering a 25 bp cut in December, it's a reasonable debate for us to have."

- Williams: "The disinflationary process will continue. I think the labor market is now in balance; it’s not providing upward pressure on inflation."

- Daly: Says neutral is "closer to 3%" but they can "take our time" getting there.

- Musalem: Neutral rate could "plausibly lie between 3% and 4%" depending on productivity trends; "monetary policy rules suggest a federal funds rate between 4.3% and 5.4% for the fourth quarter of 2024."

What we’re thinking

Ever since the September FOMC meeting, the Committee has communicated a commitment to maintaining the strength of the labor market. Over the past few months, the strategy has coalesced into cutting quickly initially as insurance against labor market risk, and then slowing down as they feel out neutral. If that sounds familiar, perhaps you heard it first in our “Playbook” we released just over a year ago that called for the Fed to pursue exactly this strategy in 2024. Rate normalization may have begun later than we (and many others) expected, but the Fed has been running this playbook ever since.

Now that rate normalization is about to move into the next, slower phase, it is important that they do not predetermine the scale of normalization; that is, that they do not prematurely declare the neutral rate to be higher than before. As many FOMC members are saying, the neutral rate is highly uncertain right now.

As for what we’re paying attention to, we remain concerned about the dynamic effects of Fed policy on investment and future supply—and thereby future inflation. Monetary policy can constrain investment and impact productivity growth down the line, and the Committee needs to to be acutely aware of the supply-side effects of monetary policy. Housing, especially, is one place to be concerned about. Even as rent inflation cools, the lack of new housing construction could prove to be an inflationary threat in coming years.

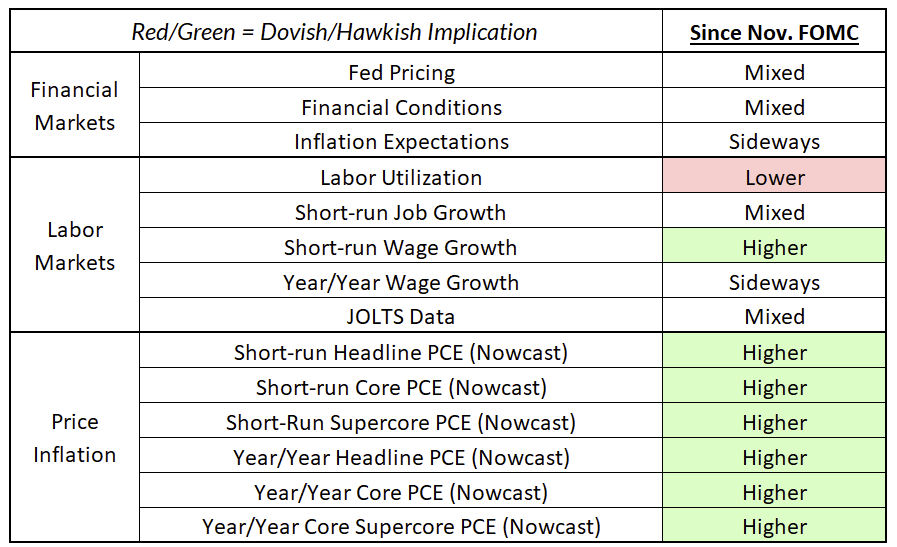

How Has The Data Evolved Since Last FOMC?