Core-Cast is our real-time nowcasting model that tracks the Fed's preferred inflation gauges before and through their release date. Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but translation from CPI to PCE must be done with care. Meanwhile, Producer Price Index (PPI) input data is of increasing relevance to PCE Nowcasts. And occasionally (like this January), source import price index (IPI) data proves relevant. The associated heatmaps are dense, but they aim to give a holistic view of how individual inflation components and themes are performing relative to what transpires when inflation is running at 2%. If you are interested in more timely access to this content, feel free to reach out to us here.

Yesterday we received upside information from the PPI inputs to PCE, driven primarily by international flights (up 10.4%). But IPI data is also used for PCE prices of international flights and sent a very different signal (down 12.4%). The CPI analogue fell 2%. So what we have January airfare data across all available measures is a right mess. While today's data still leaves January with a hot PCE print (as we warned) and Q1 inflation upside risks remain.

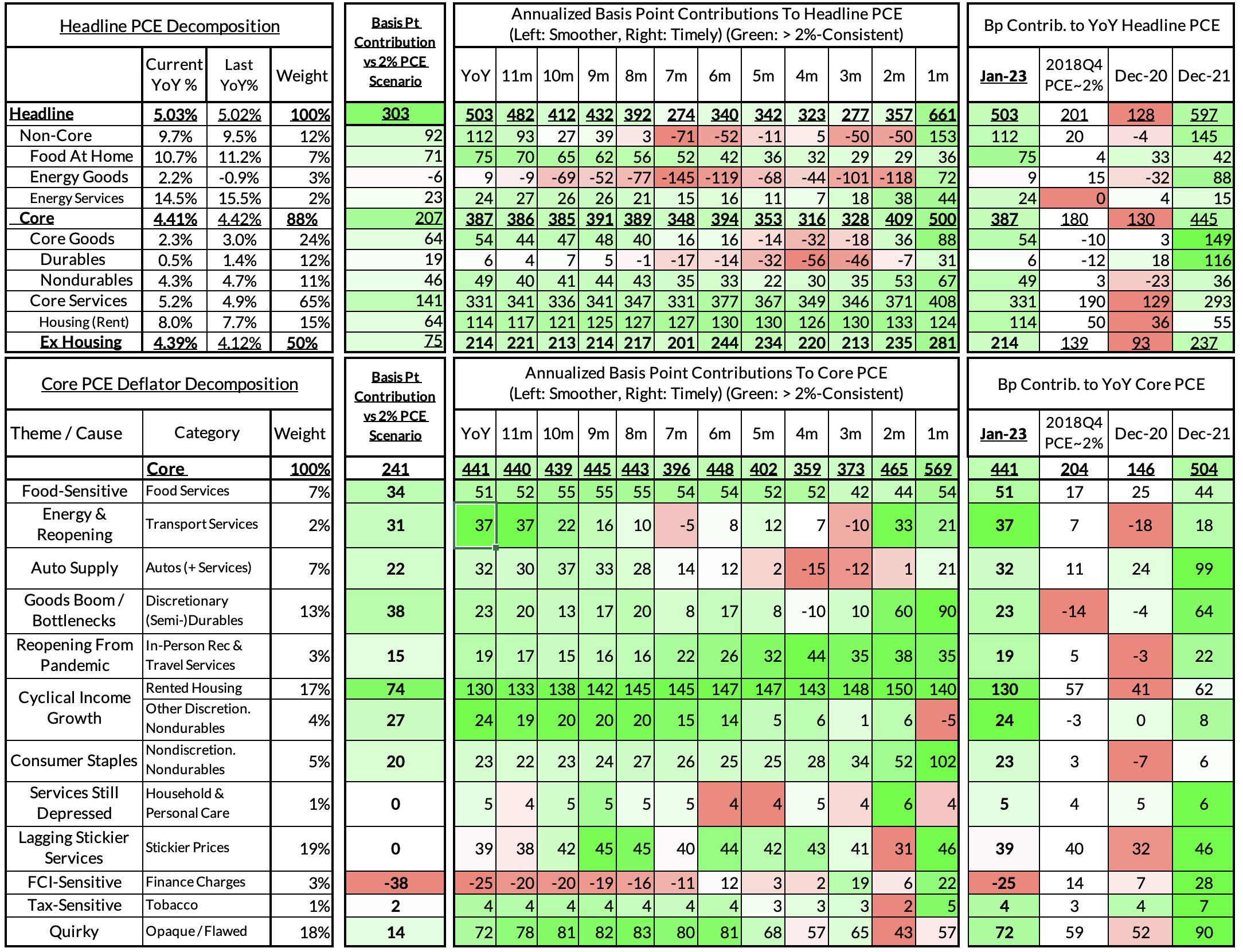

- Headline PCE is now on track to stay flat, from 5.02% year-over-year in December to 5.03% in January, as opposed to yesterday's implied 5.1% growth rate (now a 0.53% month-over-month increase)

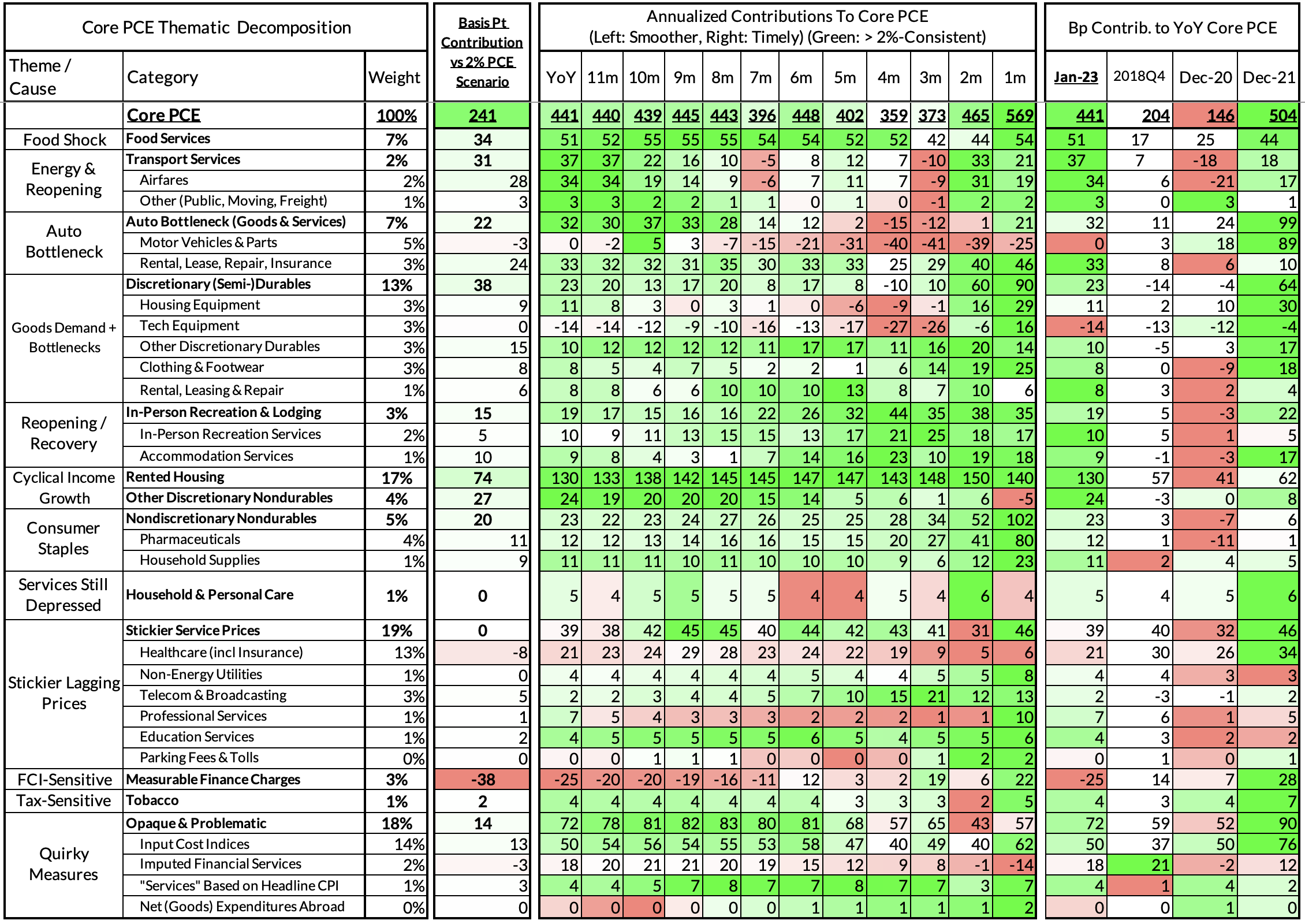

- Core PCE is still on track to stay virtually flat from 4.42% year-over-year in December to 4.41% in January. (0.46% month-over-month increase)

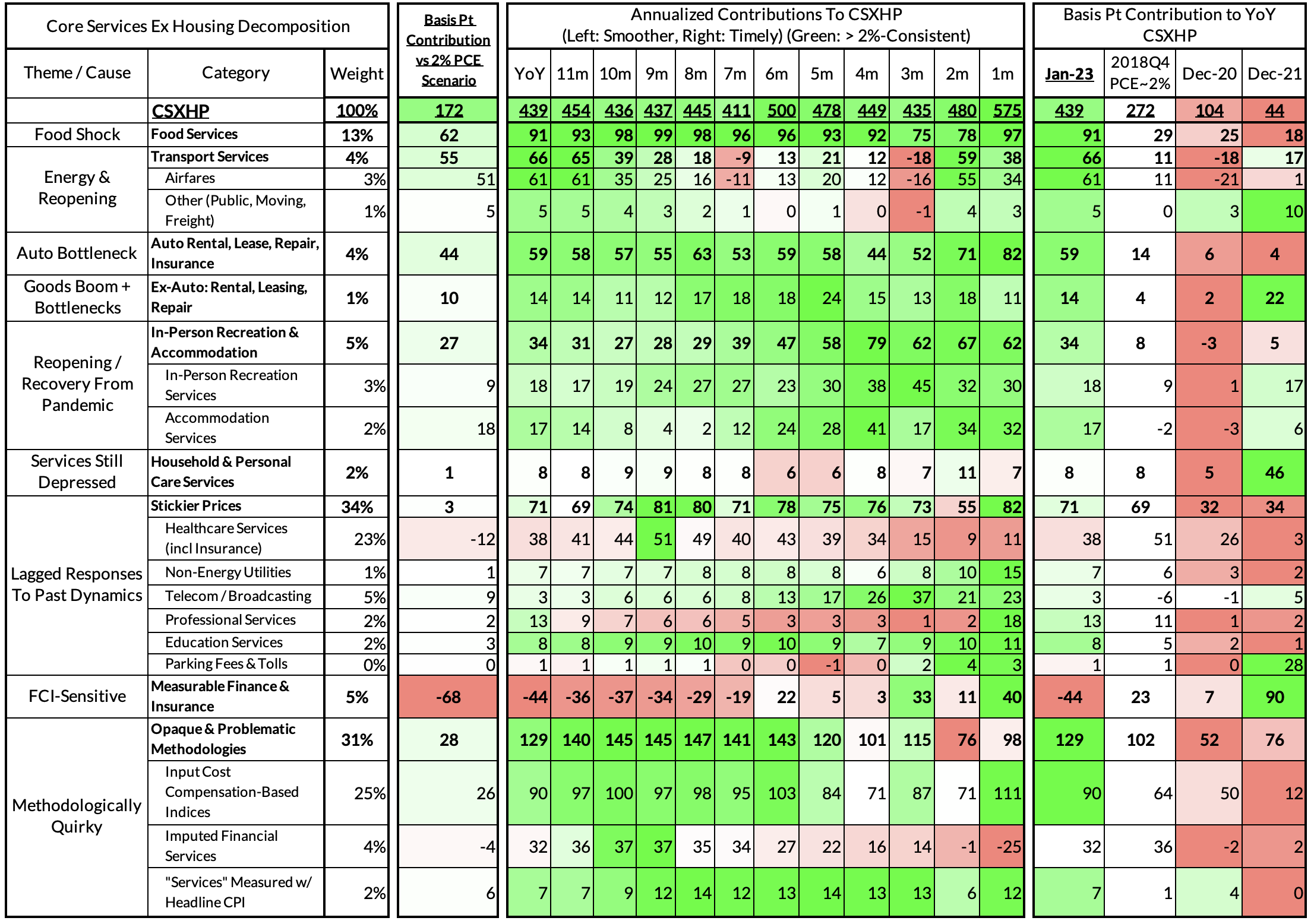

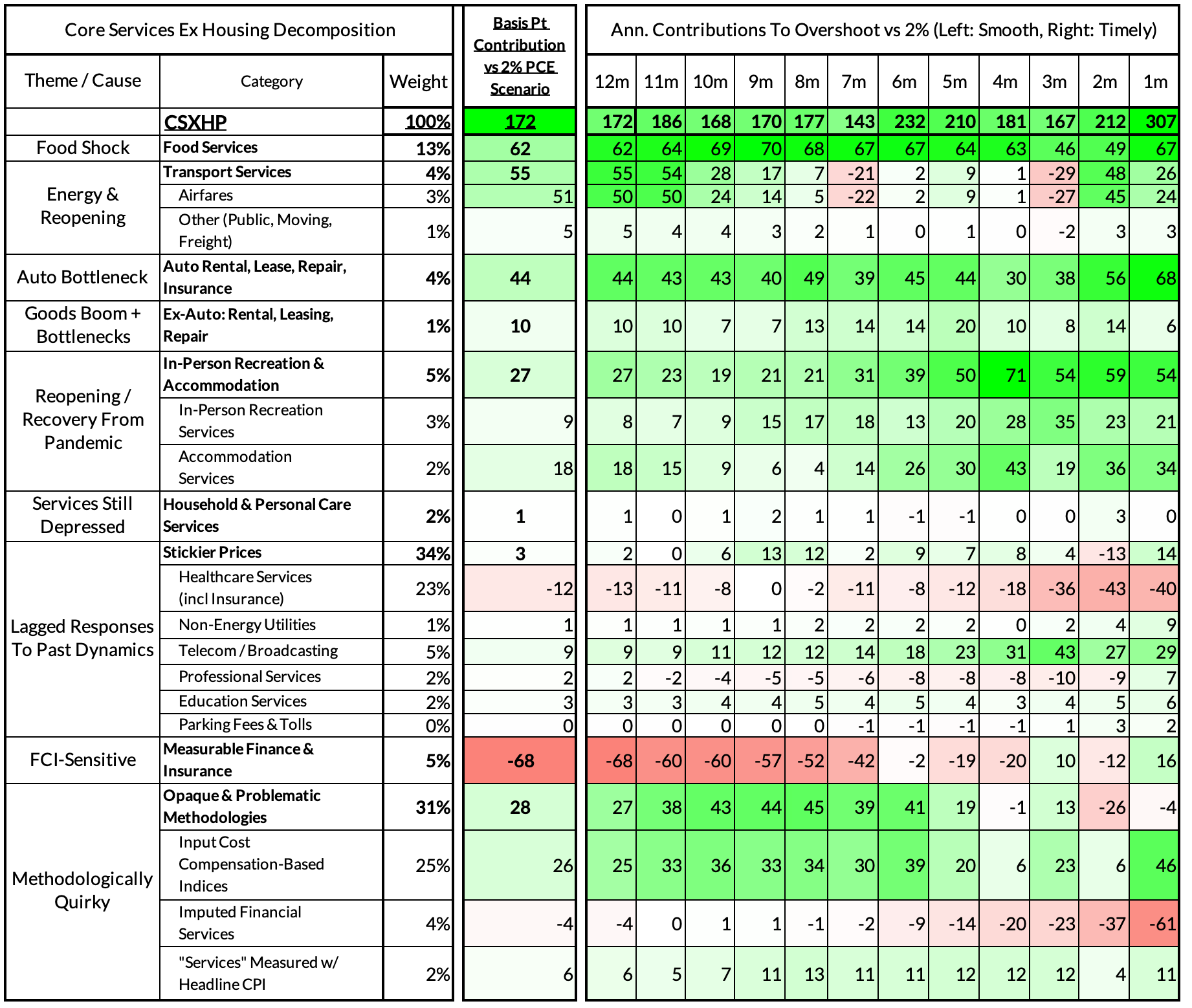

- Core Services Ex Housing PCE is on track to increase, though marginally less than yesterday implied, from 4.12% year-over-year in December to 4.39% in January. (0.47% month-over-month increase). This index is still most vulnerable to tracking error since it involves an outsized share of non-CPI non-PPI non-IPI inputs.

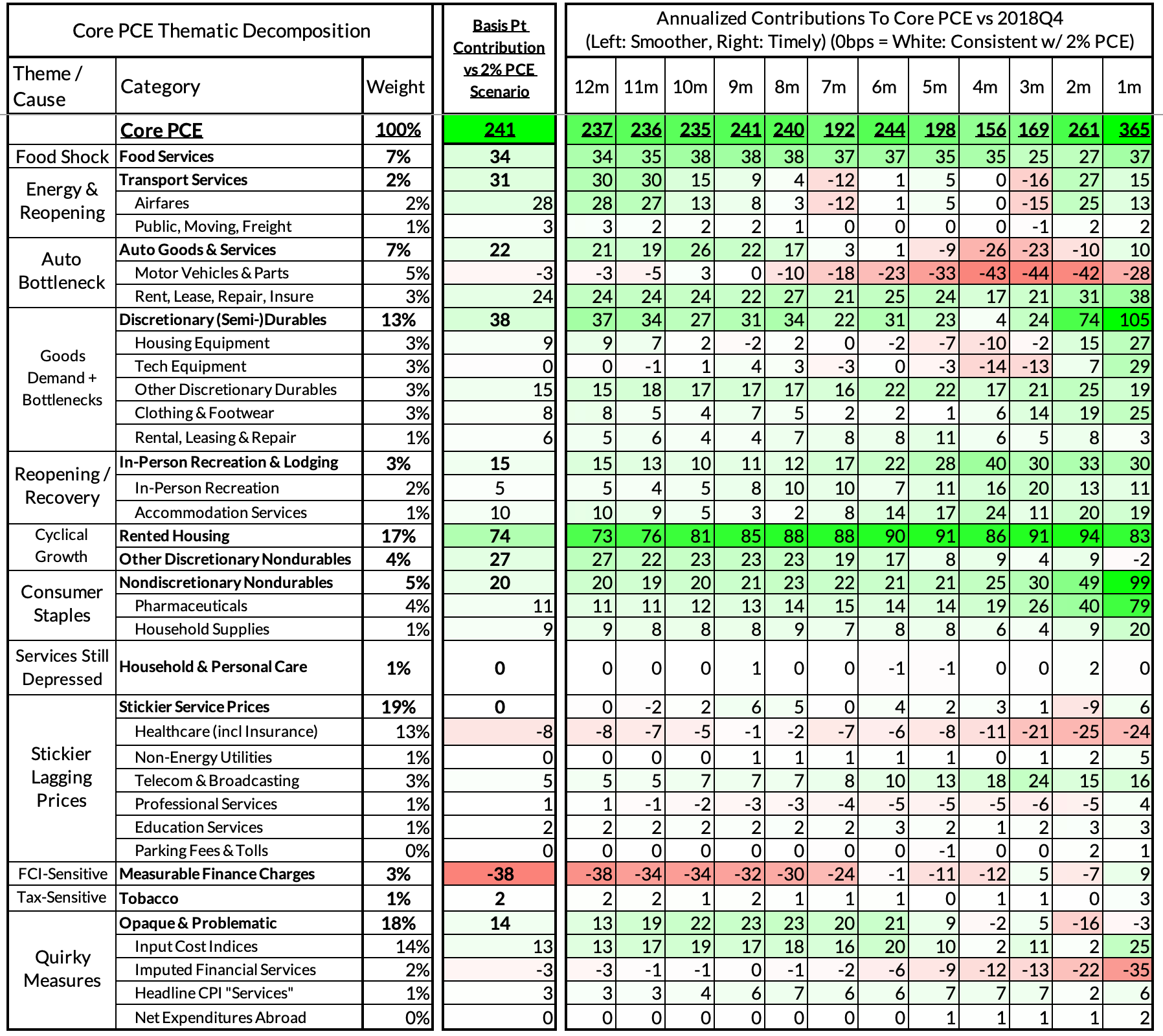

Core PCE Heatmaps

Core Services Ex Housing PCE Heatmaps