This preview was originally released this past weekend to Premium Donors. If you would like to get the first look at this kind of content, please feel free to reach out to us here

Summary:

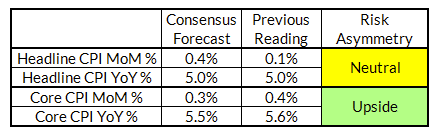

The risks for April (CPI) are tangibly to the upside, primarily because the upside risks coiling in used car prices have yet to pan out.

- Used cars almost singlehandedly sets the base-case for core CPI at 0.5% for the next two months. On top of this, excitement about rent disinflation are likely excessively embedded in the forecasting consensus.

- Rent CPI has begun decelerating but that process is likely to be bumpier, and April and May will likely be stronger than March.

- The potential saving grace for core inflation in these next two months will be the details of "Core Services Ex Housing PCE", which are substantially different from its CPI analog. Fewer sticky price "annual resets", food services, in-person services, and imputed financial services would be among the major drivers of a downside impact here (and will not be so obvious when core CPI comes out). If you want to track these details in real-time and gain a better understanding of what's driving Fed's key inflation gauges, consider reaching out to us here to become a Premium Donor to Employ America.

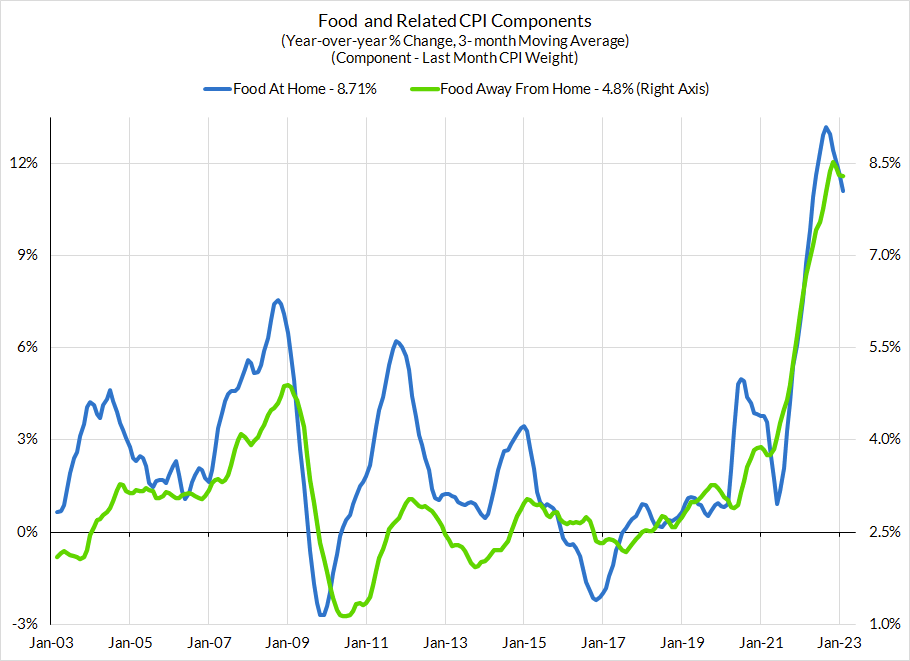

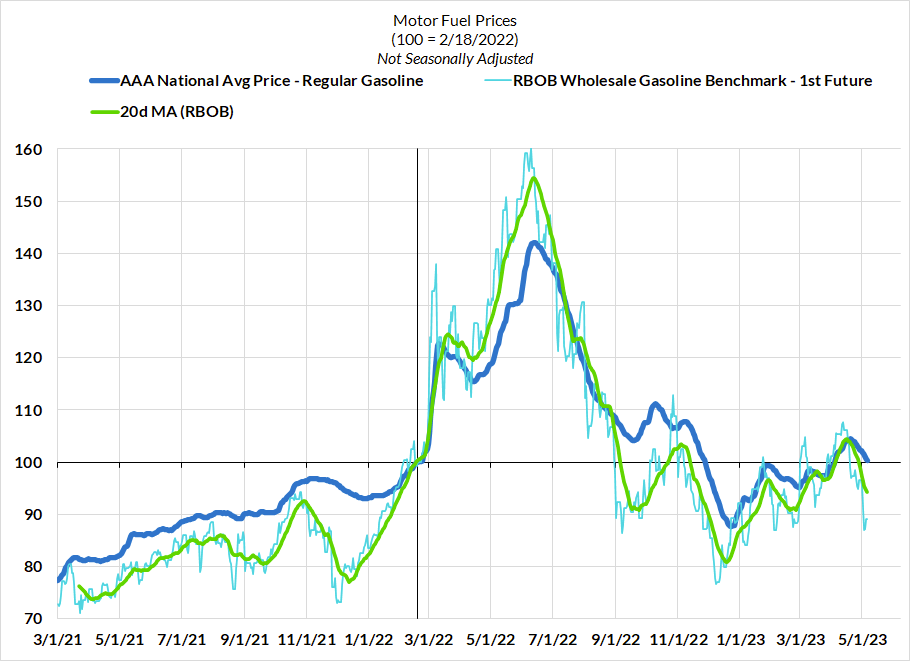

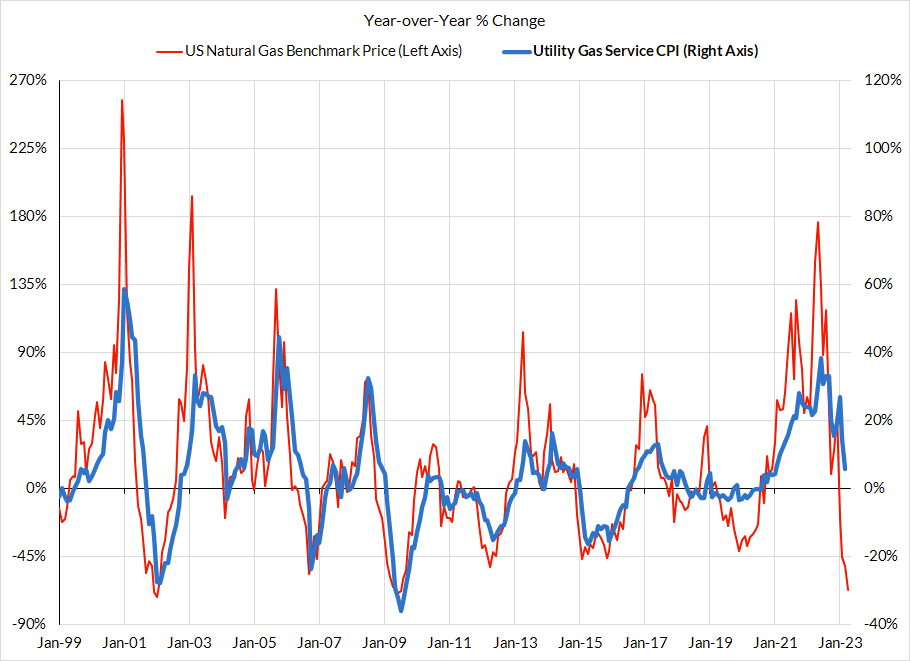

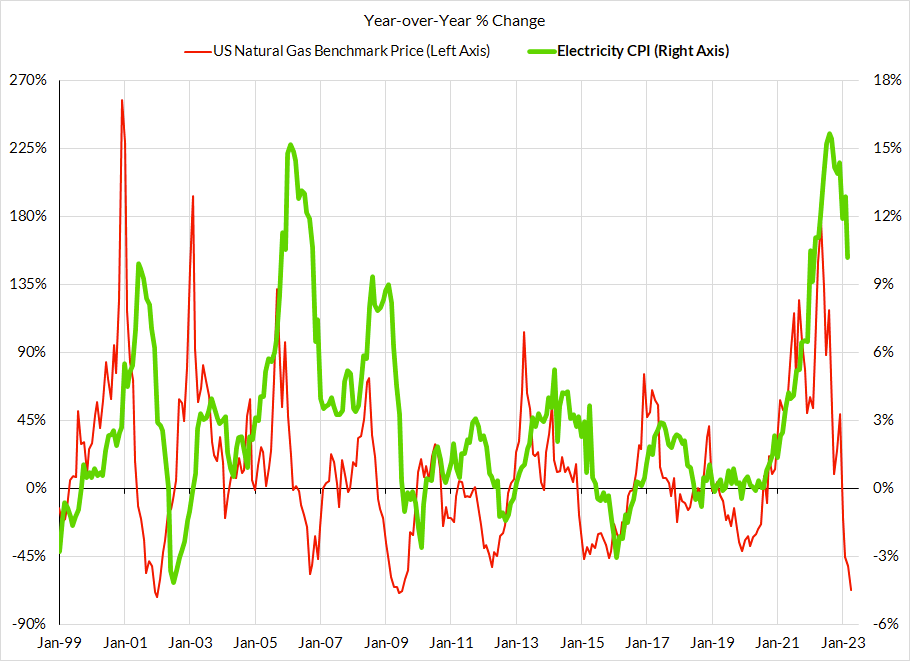

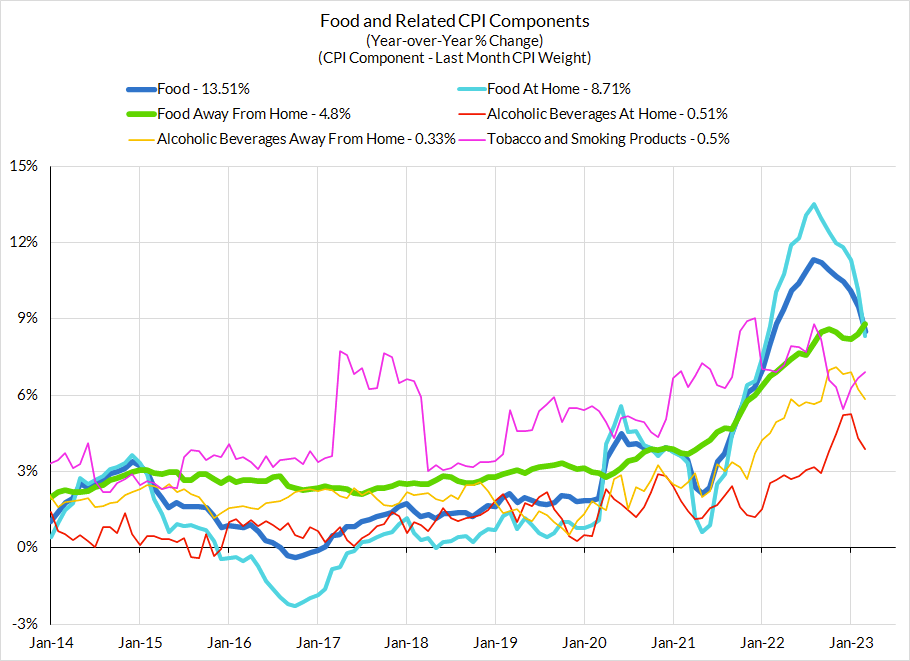

- For headline inflation, the major reason for neutrality is that disinflation in energy services, food, and food services (which are not always appreciated by the forecasting consensus) could serve as a meaningful offset. Food at home prices have already started decelerating and lower natural gas prices should still be passing through to energy services.

Key Dynamics Within Baseline (Upside) View:

Our upside inflation view could still push the Fed to consider additional hikes beyond 5.125% (as per the March edition of the FOMC's Summary of Economic Projections), but the Fed is now more likely to weigh these judgments against still-cascading turmoil among regional banks.

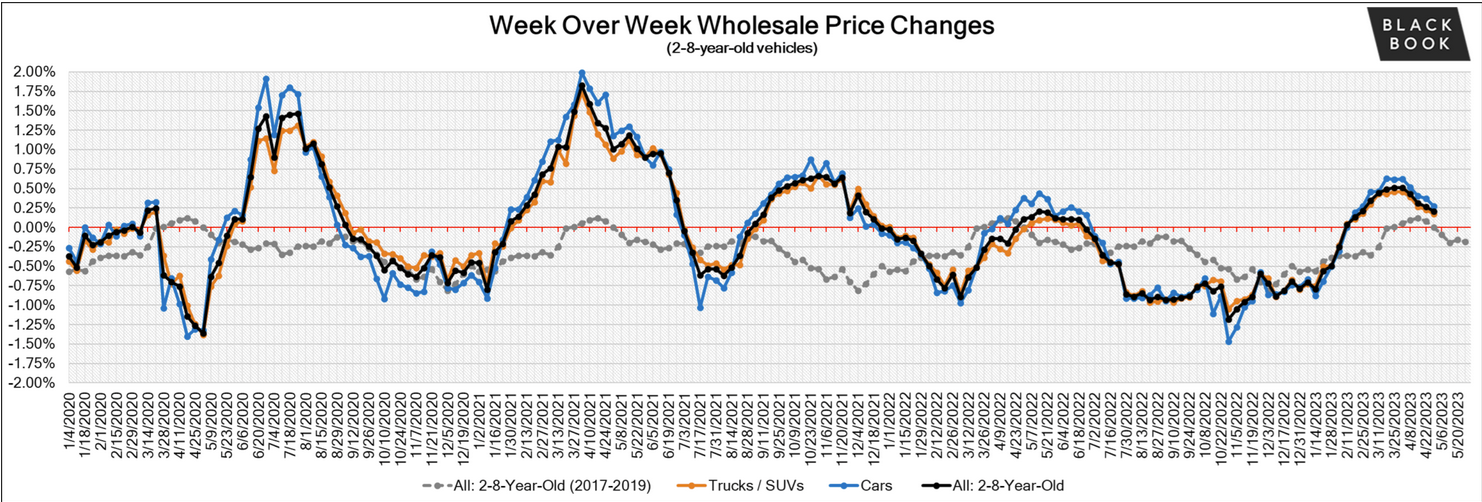

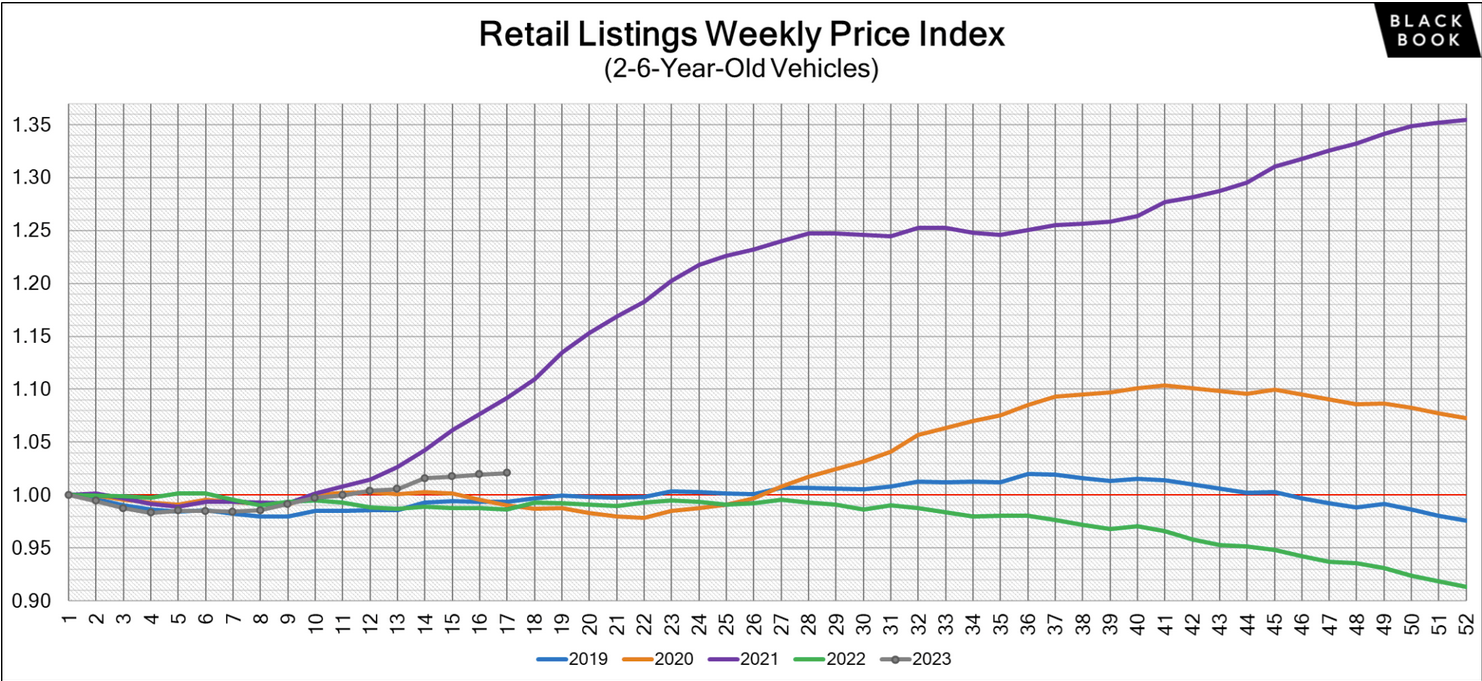

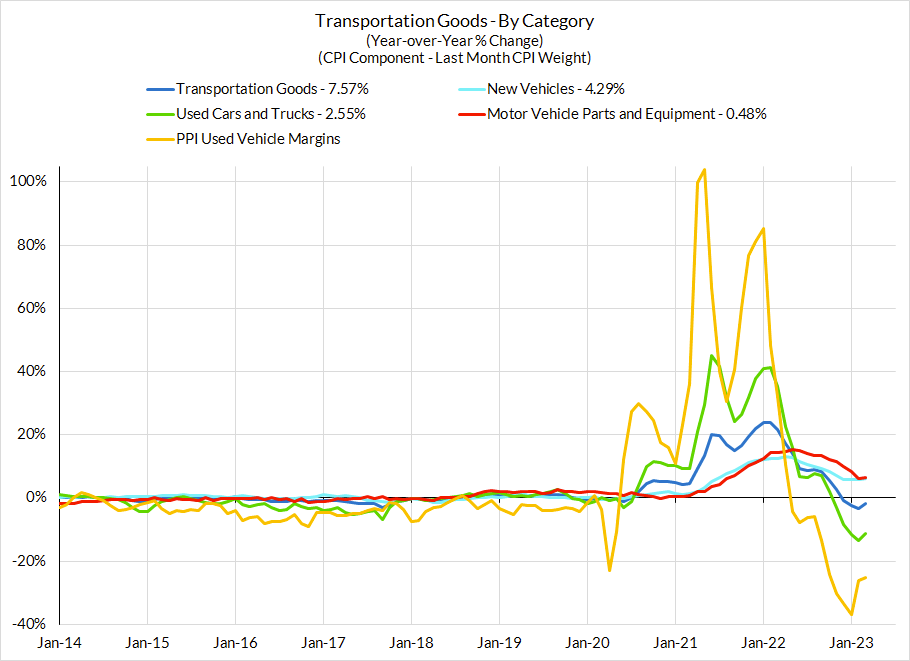

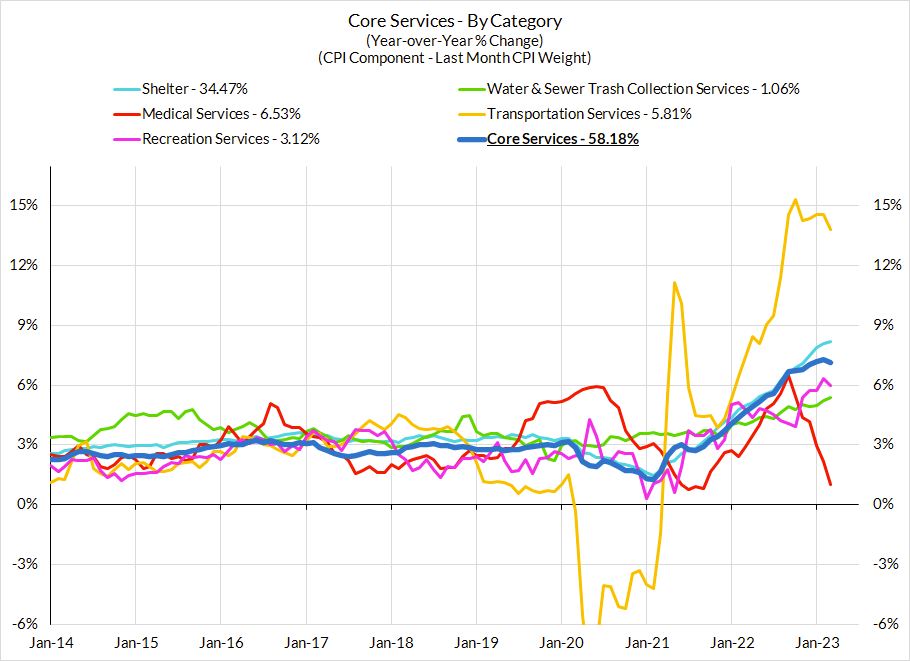

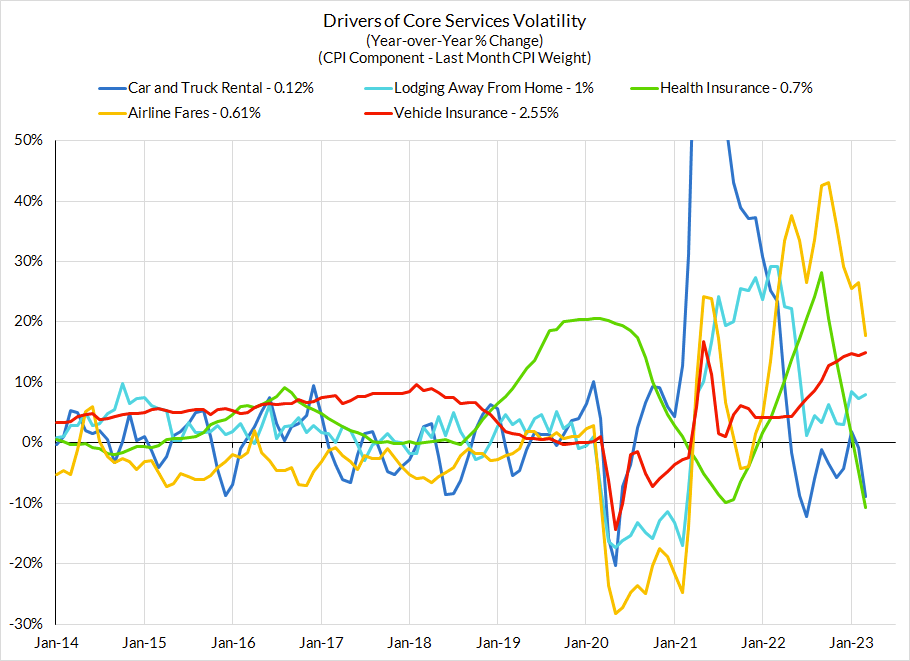

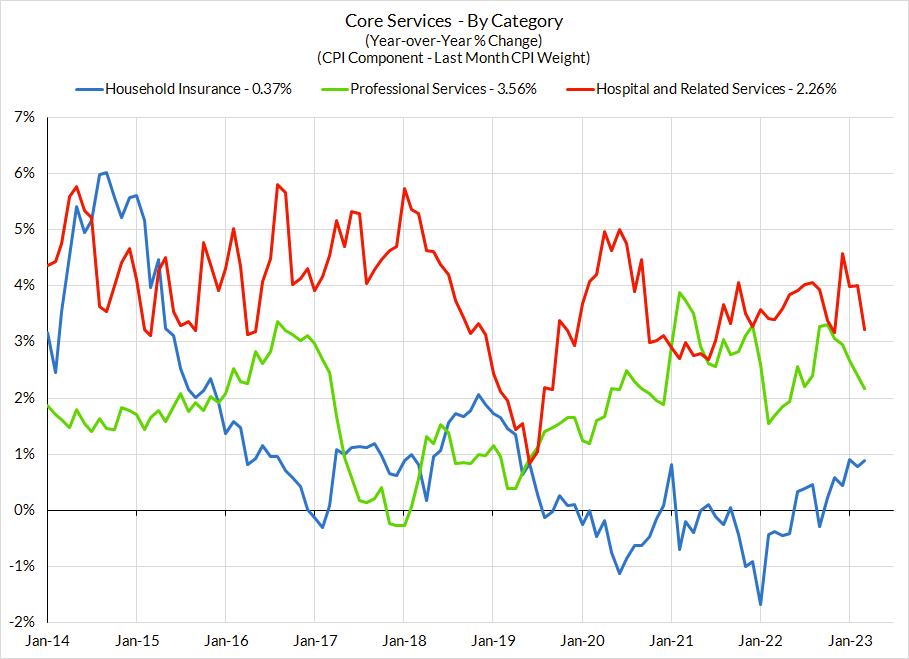

- From deflation to surge—the used car price swing will be aggressive over the next 2-3 months: We've been flagging the rise in wholesale and (later) retail used car prices for the past few months, and given the absence of CPI passthrough in prior months, it only sets the stage for firmer price increases in April and May. The lone silver lining is that this appears to be a dynamic that has now fully matured in the private sector data; the trends could shift back to deflation Q3, and potentially in a more sustained manner. Wholesale used car prices are beginning to decelerate thanks to 1) the beginning of a more sustained recovery in new car supply and 2) the end of the demand surge tied to tax refund season. Aside from Governor Lisa Cook, no FOMC member has reflected any awareness of this dynamic and how it will colors local trends in core inflation. Nor has any FOMC member thought about how the rise in motor vehicle values has moved value-sensitive services with a lag. Insurance is likely to run hot, and the risks remain tilted to the upside for rental, leasing, and repair over the short run.

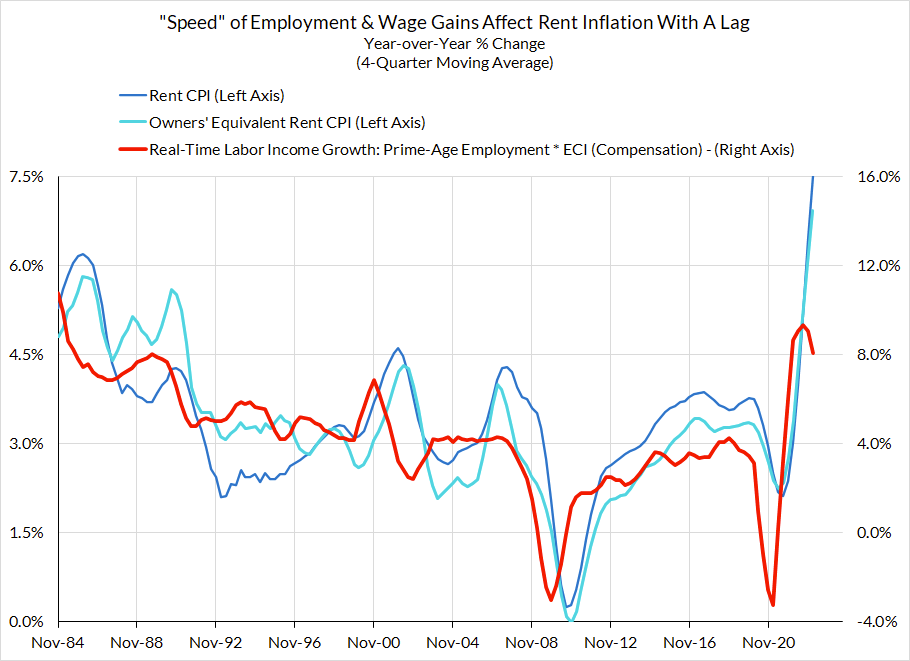

- Rent and OER will not disinflate quickly or smoothly: The CPI housing survey which is used for calculating rent and OER CPI uses a 6 month rolling window. The same set of units are surveyed in six month intervals. While March rent and OER did indeed confirm that the disinflationary process has finally begun, its downshift was likely exaggerated by a strong September 2022 rent and OER CPI print. Expect a lot of bumps in the next couple of quarters. It will take 12-15 months from here to get back to rent and OER monthly CPI prints consistent with the Fed's 2% headline and core PCE goals.

- Is more healthcare service price inflation lurking in PPI? After an encouraging January and February healthcare service PPI release, we learned in the March release that healthcare service inflation were actually much higher, especially after accounting for revisions. While government-payers are acting as a depressing factor on PPI inflation here, we may see more upside in April (or through revisions) to reflect the heightend costs private-payers reportedly face (hat tip to Omair Sharif for being the first to flag this dynamic).

- Some volatile components can still deliver upside: While less likely to do so in CPI, airfares still have local upside potential thanks to global/Asian reopening dynamics still in train (though these now need to be weighed against lower diesel prices). Likewise some discretionary goods seem poised to deflate at a slower pace from here, or even continue to show some upside.

Downside Inflation Scenario:

Most of the sources of potential encouragement for the Fed to stand pat at 5-5.25% are likely to require a finer-toothed comb than just looking at core CPI.

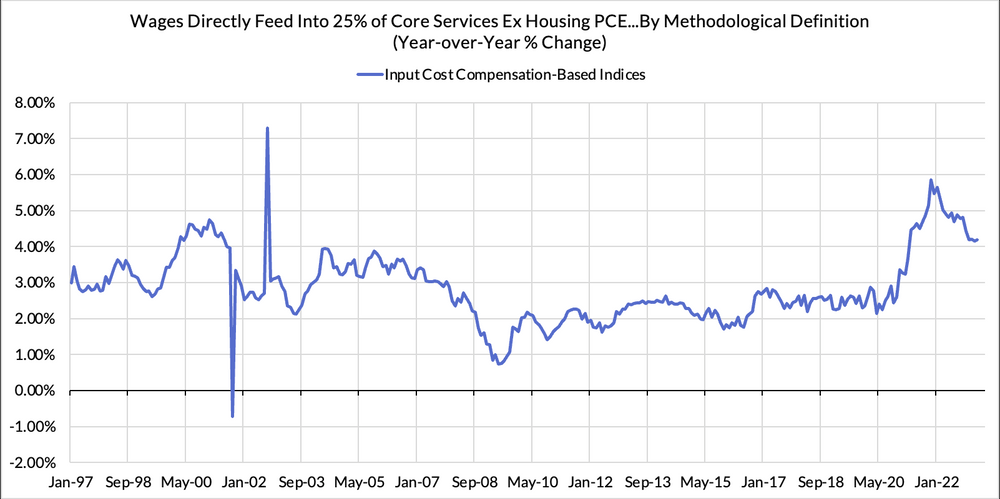

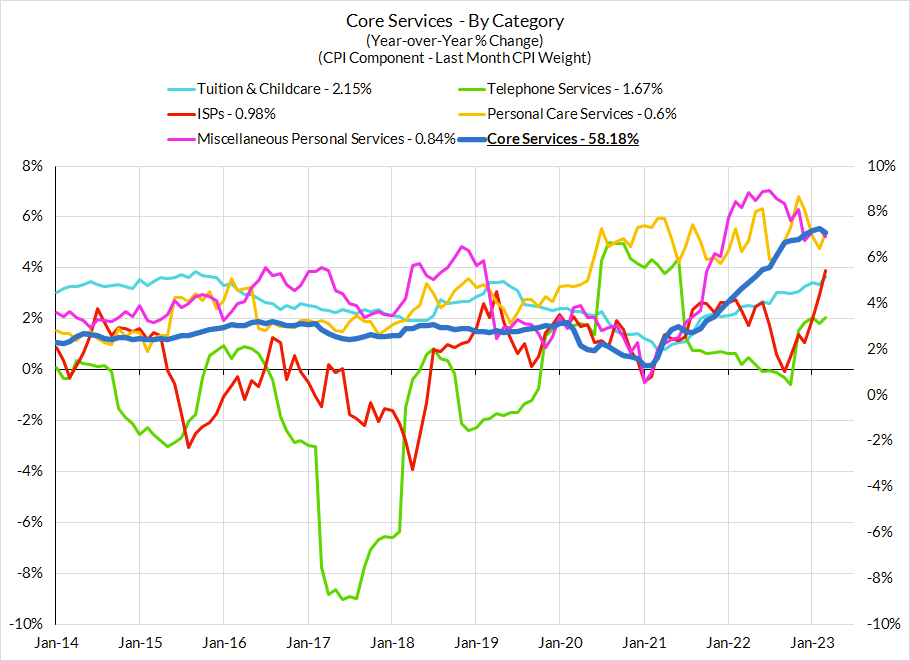

- Q2 might bring the end of "annual resets": Q1 has increasingly looked like a lagged reaction to the developments in the previous three quarters. A number of stickier prices (and even wages) tend to see more outsized amplification in Q1 as a result of "resetting" prices at the beginning of the calendar year. On the service side, we could begin to see some further easing in "in-person" recreation and travel-adjacent services, along with telecom and broadcasting. On the goods side, magazine subscriptions and prescription drugs were the kinds of "annual reset" dynamics in Q1 that cool off.

- Food services are not in Core CPI but are in Core PCE: Grocery store pricing saw encouraging deceleration over the past few months but we have not yet seen it truly pass through into food services. Restaurants and grocery stores are at least partial competition and share core commodity inputs. Along with decelerating wages in leisure and hospitality and the conclusion of 'annual resets', the conditions are increasingly ripe for food services deceleration from recent run rates.

- Rockets and feathers - when does commodity price deflation help? Watch airfares in PPI. In recent weeks and months, we've seen more signs of commodity price deflation, especially in jet fuel and diesel. Typically cost surges in such commodities can trigger massive upside in final prices ("rockets") but their decline takes longer to fully pass through to consumers ("feathers"). Over the course of 2023H2, lower diesel and jet fuel prices should be helpful to the core inflation outlook, but payoff in April seems premature. Remember that airfare inflation for PCE purposes comes from PPI, not CPI. We'll keep you posted there.

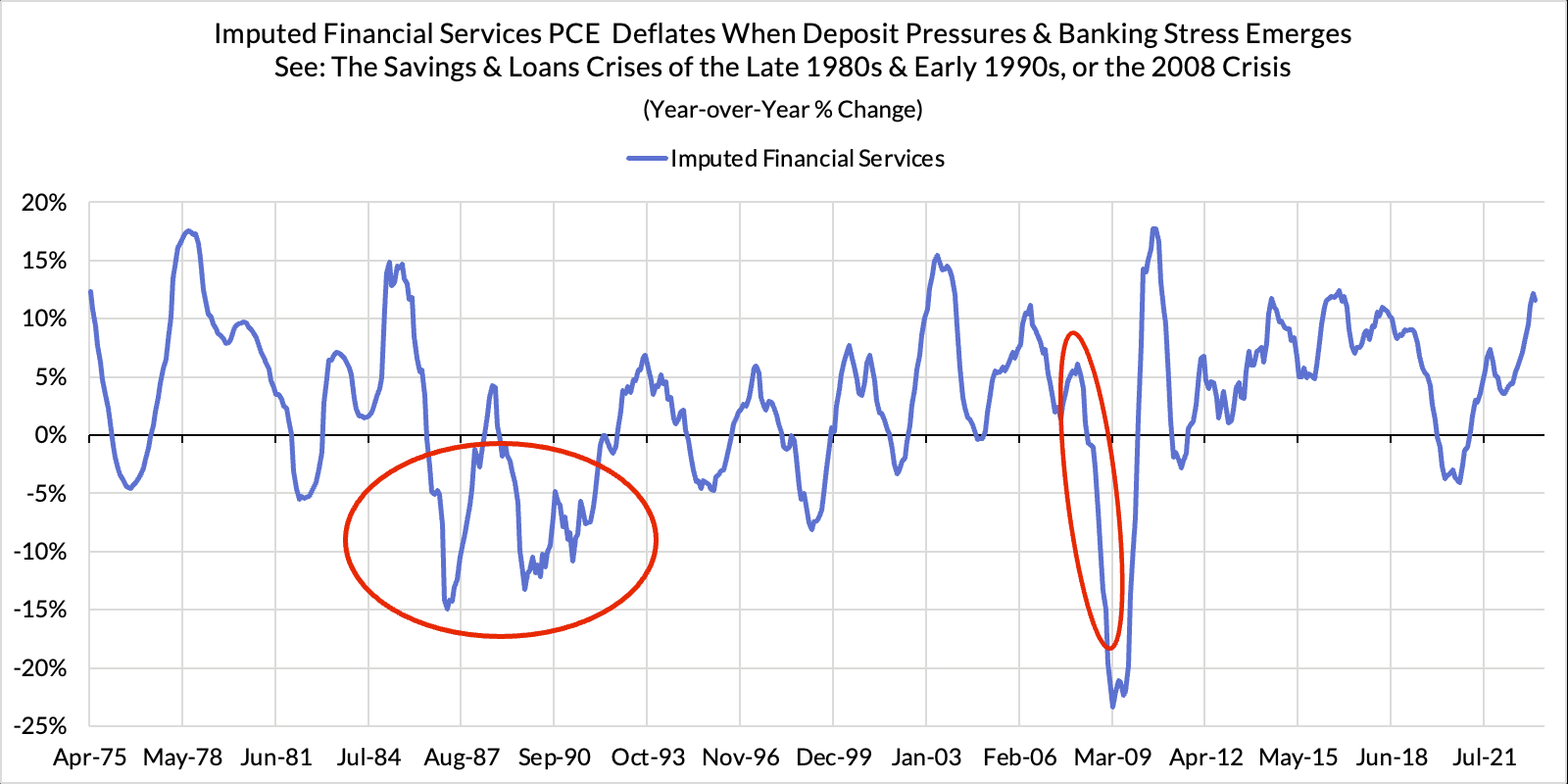

- Dark Spaces of Core Services Ex Housing PCE: It's growing increasingly likely we continue see slowing wage growth and higher deposit rates feed into the "dark spaces" of PCE not captured by either CPI or PPI: imputed financial services and input-cost compensation-based indices. We have seen more initial evidence confirming both dynamics over the past 2 PCE releases.

Potential Supply Shocks

- A big upside risk to food prices is likely to stem from the risk of flooding in California (from snowmelt), but this is a dynamic to flag for summer food prices, not March. If it did materialize, we would expect it to affect not just grocery store prices, but restaurant prices that count towards Core PCE and Core Services Ex Housing PCE.

- We are also growing more concerned about how lower oil prices could be influencing capex decisions and the resiliency of future supply in the face of Russian shut-ins. The DOE could be doing more to serve a market-stabilizing force via the SPR.

CPI Charts

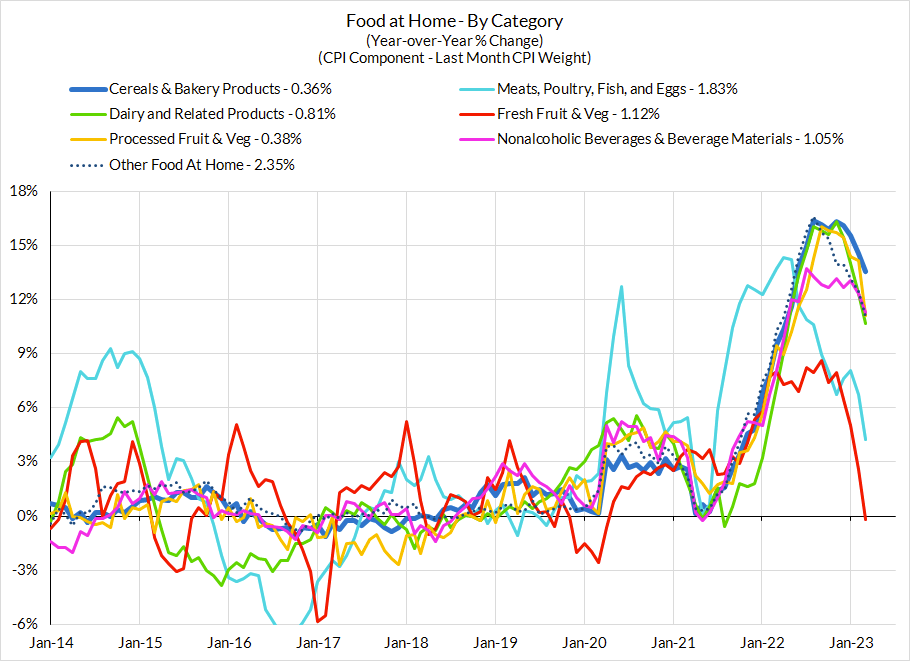

Non-Core CPI Components

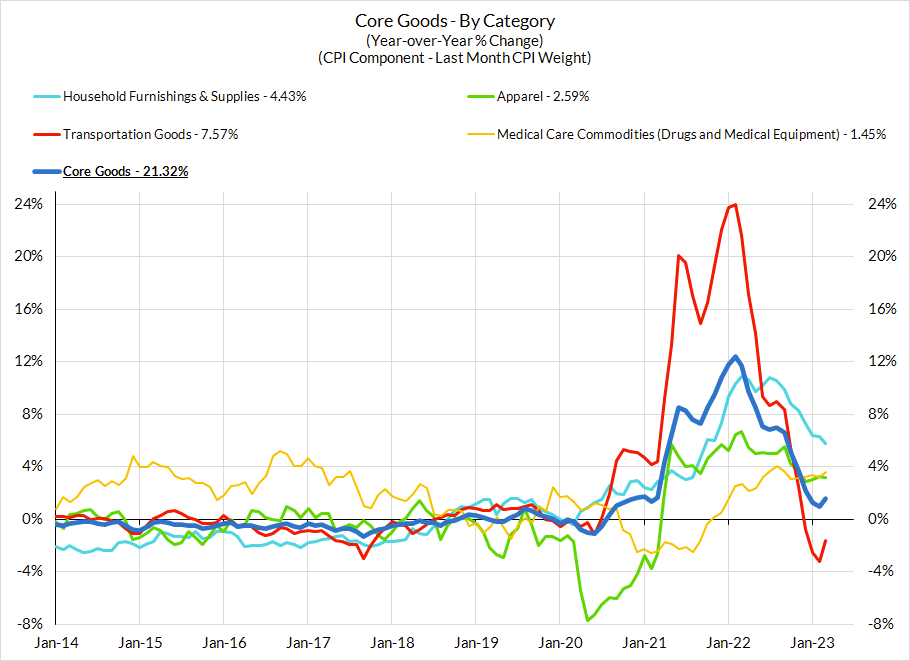

Core Goods CPI Components

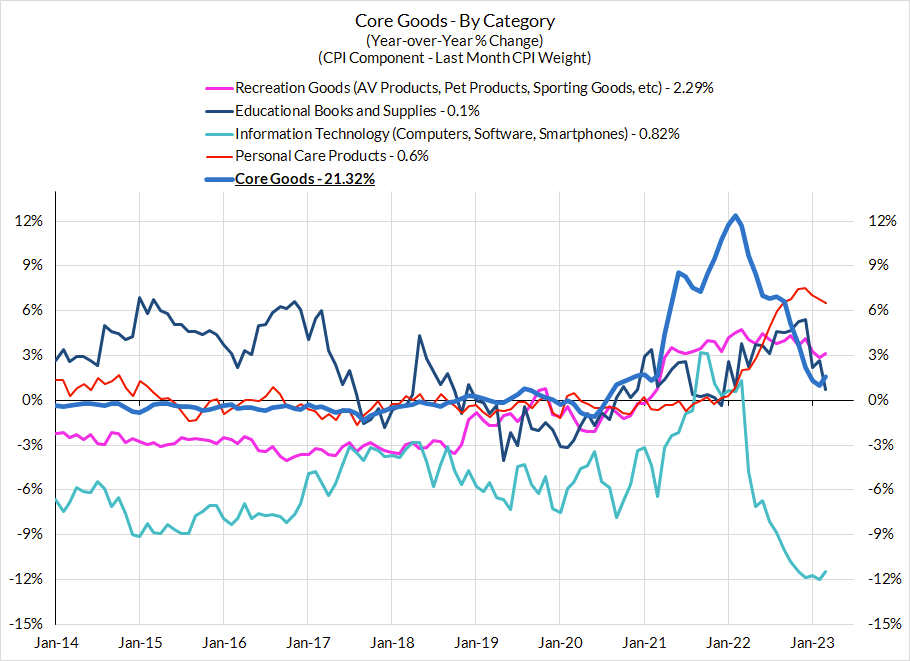

Core Goods CPI Components (Not All Relevant to Core PCE)

From Our PCE Recap (For Those Who Missed It):

For the Detail-Oriented: Core PCE Heatmaps

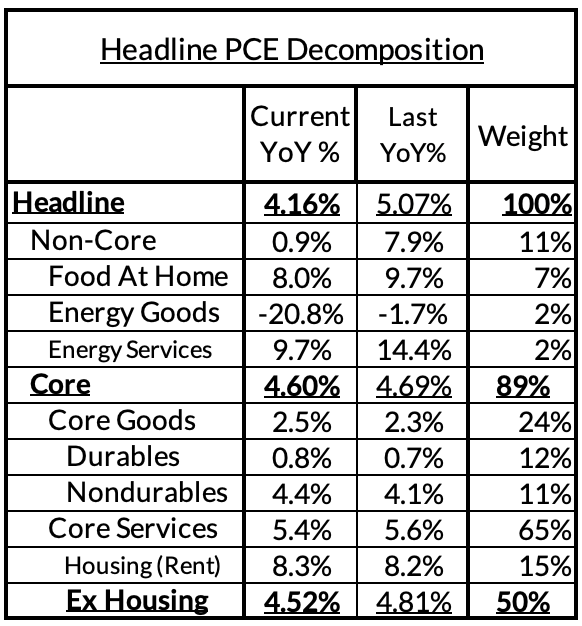

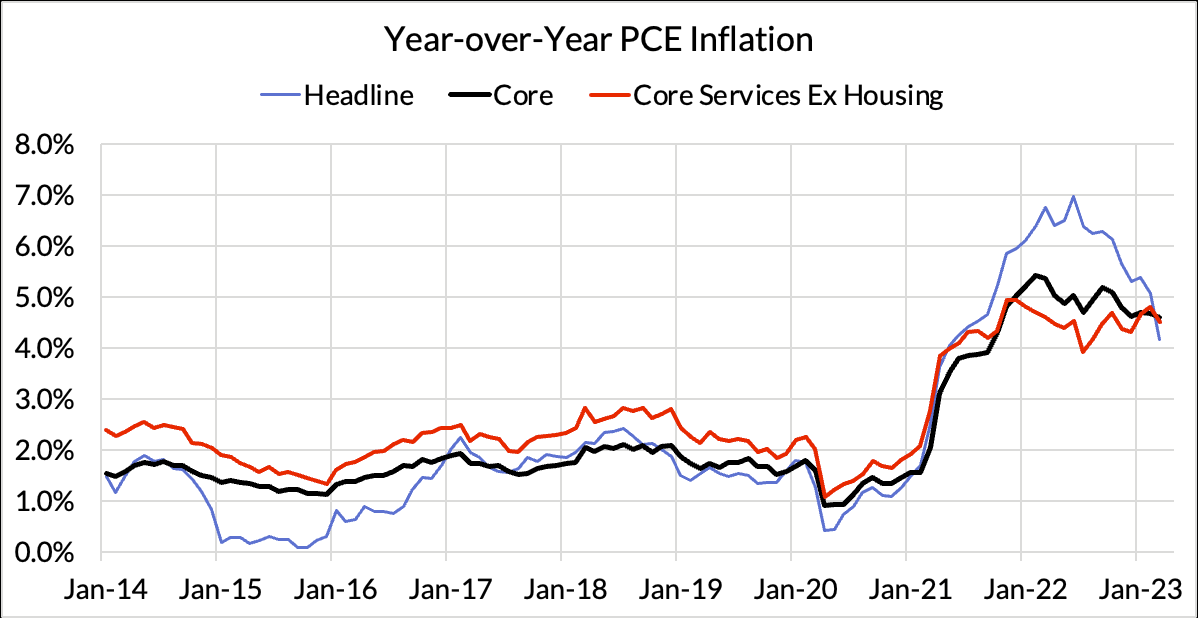

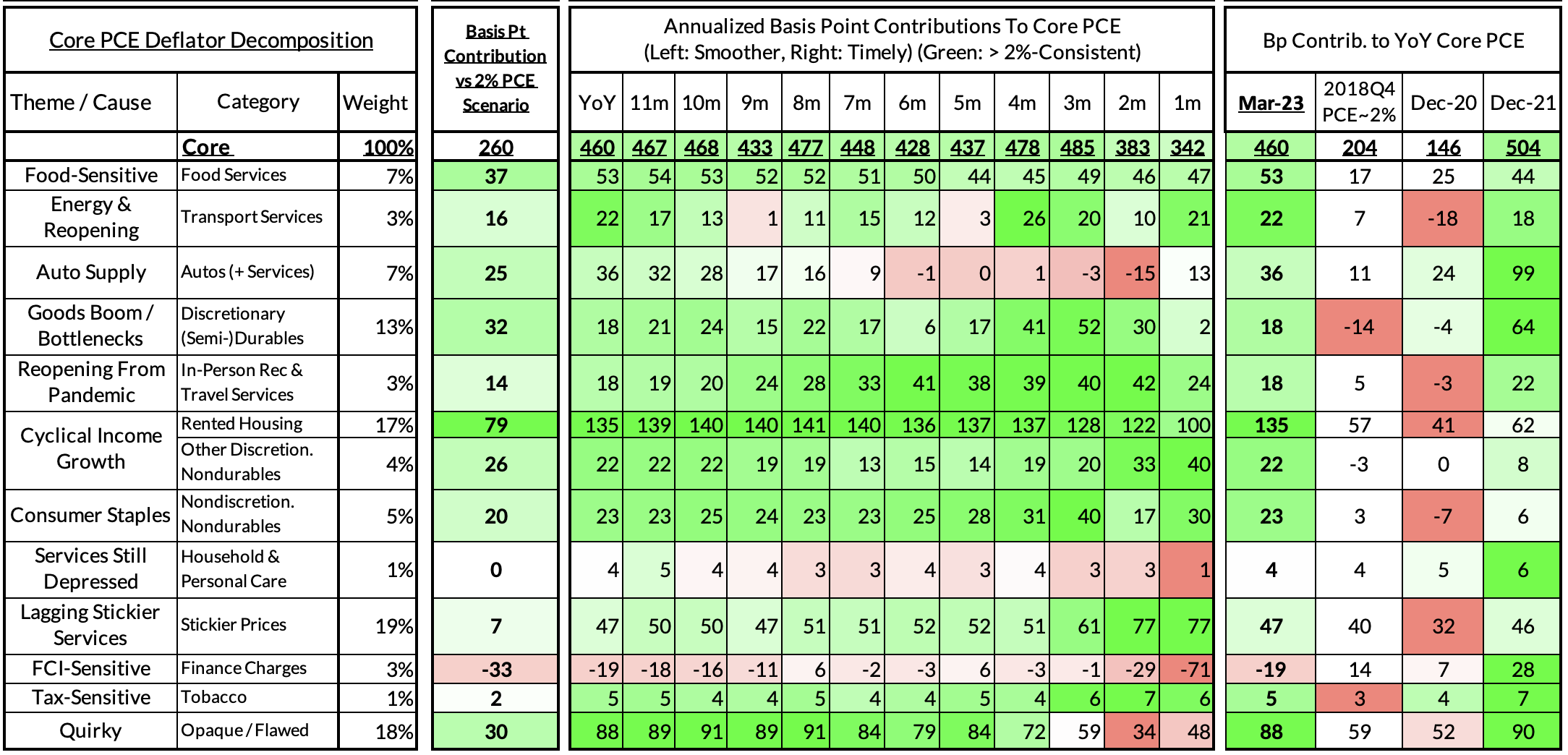

Right now Core PCE (PCE less food products and energy) is still running at 4.60%, 260 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and its demand-side effect on market rents in 2021-22.

There are other contributors to the overshoot, some more supply-driven (automobile bottlenecks likely explain 25 basis points, while food inputs likely added 37 basis points to the overshoot) and some more demand-driven (in-person recreation and travel services adding 14 basis points to the overshoot, discretionary nondurable goods adding 26 basis points), and some reflect both (airfares are both reopening-sensitive and energy-sensitive, adding 16 basis points to the overshoot). Quirky methodologies add another 30 basis points to the overshoot.

The final heatmap here gives you a sense of the overshoot on shorter annualized run-rates. March's monthly core PCE yielded a 138 basis point overshoot vs when PCE was near 2% target and core PCE was close to 2% (2.04%). March monthly core PCE is currently running at 3.42% annualized.

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

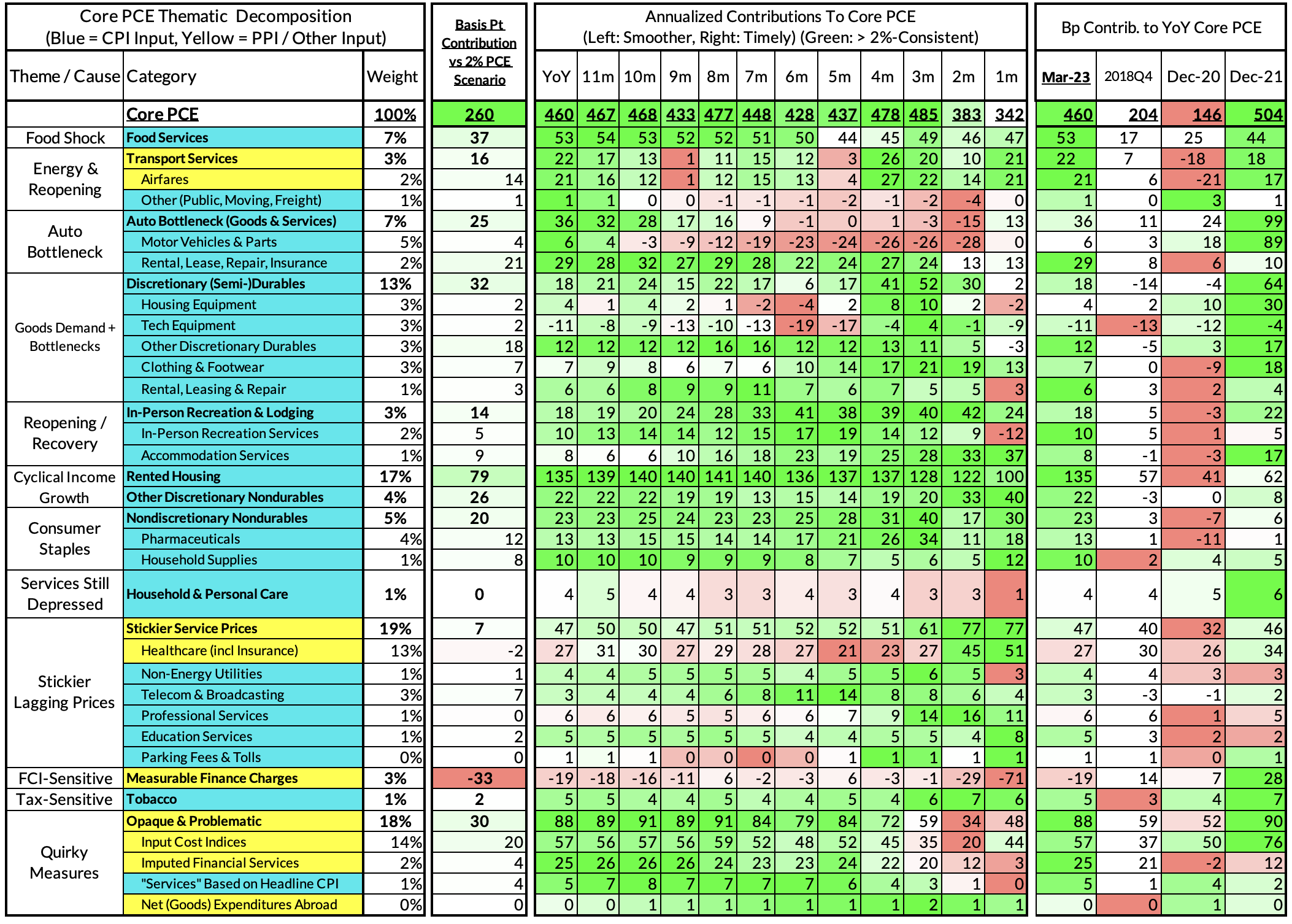

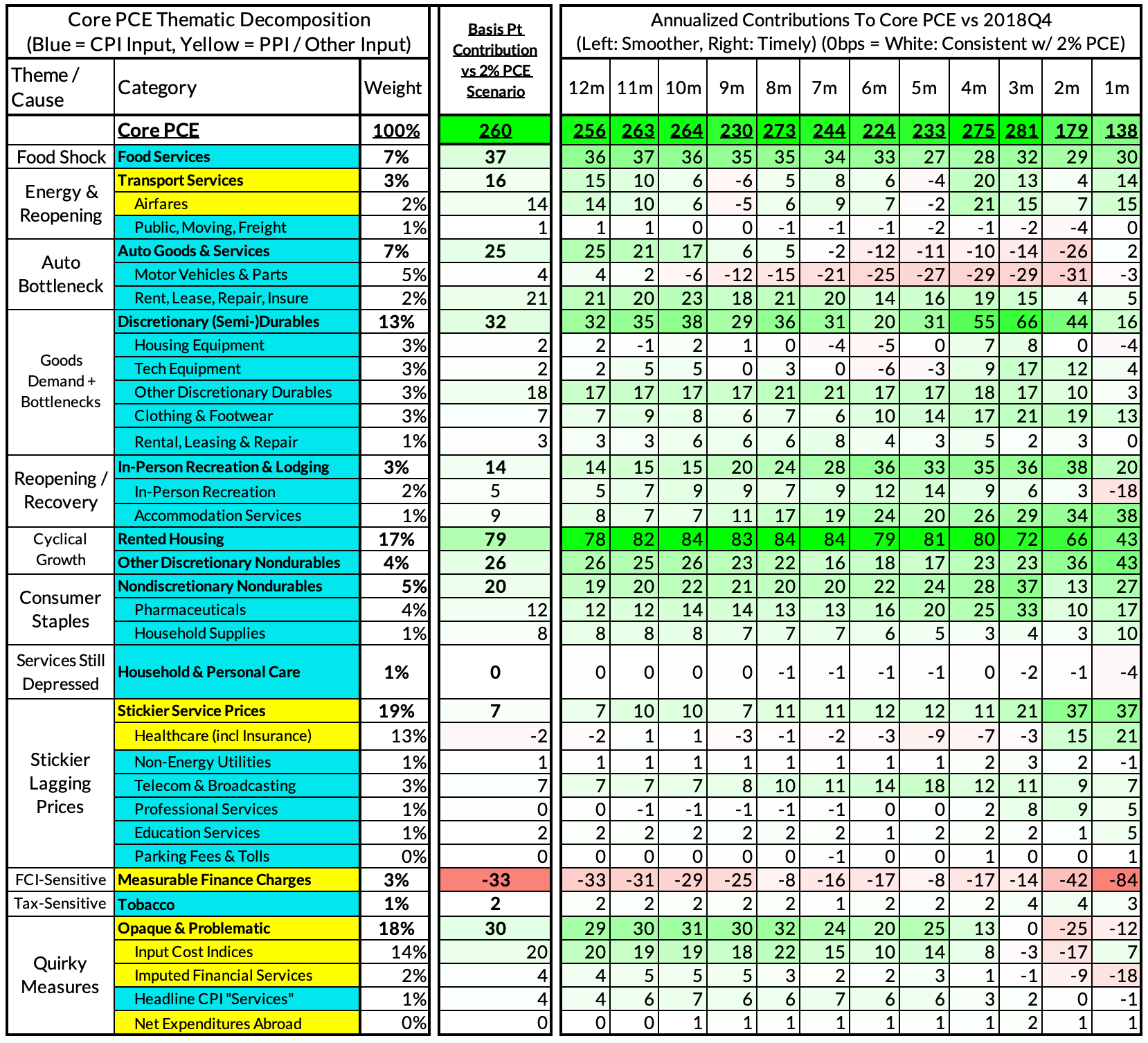

March's growth rate in "Core Services Ex Housing PCE" is on track to run at 4.52%, a 184 basis point overshoot versus the 2.68% run rate in this aggregate that coincided with 2% headline and core PCE.

We would call special attention to what we're seeing in the "Methodologically Quirky" categories we have flagged in the bottom rows. They are softening up quite a bit in recent months and could put downward pressure as slower wages, higher deposit rates, and headline inflation dynamics take further root.

The last heatmap gives you a sense of the overshoot on shorter annualized run-rates. March's monthly core PCE yielded a 25 basis point overshoot vs 2% target inflation (2.93% annualized growth vs the 2.68% run rate needed to be consistent with the Fed's overall PCE inflation goals).

Past Inflation Previews & Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me

- 12/12/22: November Inflation Preview: The Goods Deflation Cavalry Is Coming, But OER Can Upset An Optimistic Consensus Tomorrow

- 1/11/23: December Inflation Preview: Risks Skew To The Downside, But Upside Scenarios Remain Plausible

- 2/12/23: January Inflation Preview: Residual Seasonality & Stickier Services Pose Upside Risks

- 3/9/23: February Inflation Preview: Q1 Upside Risks Remain. Goods and Reopening-Sensitive Sectors Matter More Than Wages

- 4/8/23: March Inflation Preview: The Fed Seems Unaware We're Entering Another Automobile Inflation Storm