Core-Cast is our nowcasting model to track the Fed's preferred inflation gauges before and through their release date. The heatmaps below give a comprehensive view of how inflation components and themes are performing relative to what transpires when inflation is running at 2%.

Most of the Personal Consumption Expenditures (PCE) inflation gauges are sourced from Consumer Price Index (CPI) data, but Producer Price Index (PPI) input data is of increasing relevance, import price index (IPI) data can prove occasionally relevant. There are also some high-leverage components that only come out on the day of the PCE release.

This is a truncated version of the preview initially made available to our exclusive distribution this past weekend. Please reach out to us if you would like to access the full preview when it is first made available.

Summary

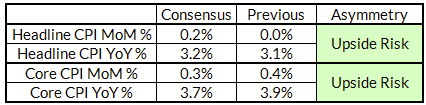

- Our biggest warning is that the January residual seasonality issues have correlated spillovers to February residual seasonality—January upside foretells further February upside, even if not for any purely "fundamental" reasons. The upside surprise in January across goods and services foretells some further upside in February, primarily because so much of the CPI surveys' measurement of price changes follows a bimonthly process. We should see some respite in goods deflation in February too before subsequently resuming.

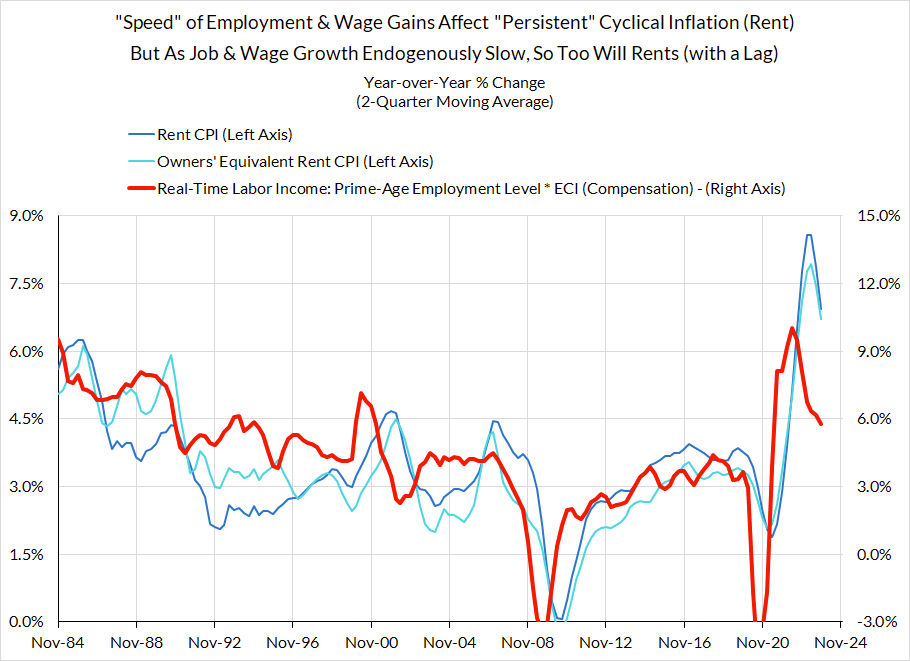

- Owners' equivalent rent dynamics are harder to anticipate. Prior to the BLS' own disclosure about the role of single-family-detached units in driving the divergence between rent and OER, I would have attributed the divergence to some mix of (1) noise, and (2) seasonal factor revisions overcorrecting. And to the best of our knowledge, this is still our baseline view, but given what the BLS presented in their webinar, there at least risks of something deeper shifting adversely in the CPI Housing Survey. We would not be shocked to see the January divergence persist or converge. Here the tails remain somewhat fatter than normal. And if we saw OER correct in a manner similar to rent of primary residence, the case for a May interest rate cut would more substantially strengthen. June remains our base case for first interest rate cut.

- The wedge should move back into positive territory in February. While we still expect a reasonably "hot" core CPI release, the core PCE implications should be tempered. Financial services PPI was a more one-time January-specific dynamic that drove Core PCE to surge ahead of Core CPI (42bps vs 39bps). We expect to see a 6-7 basis point wedge between Core CPI and Core PCE in February, implying 0.28% Core PCE month-over month.

Forecast Details

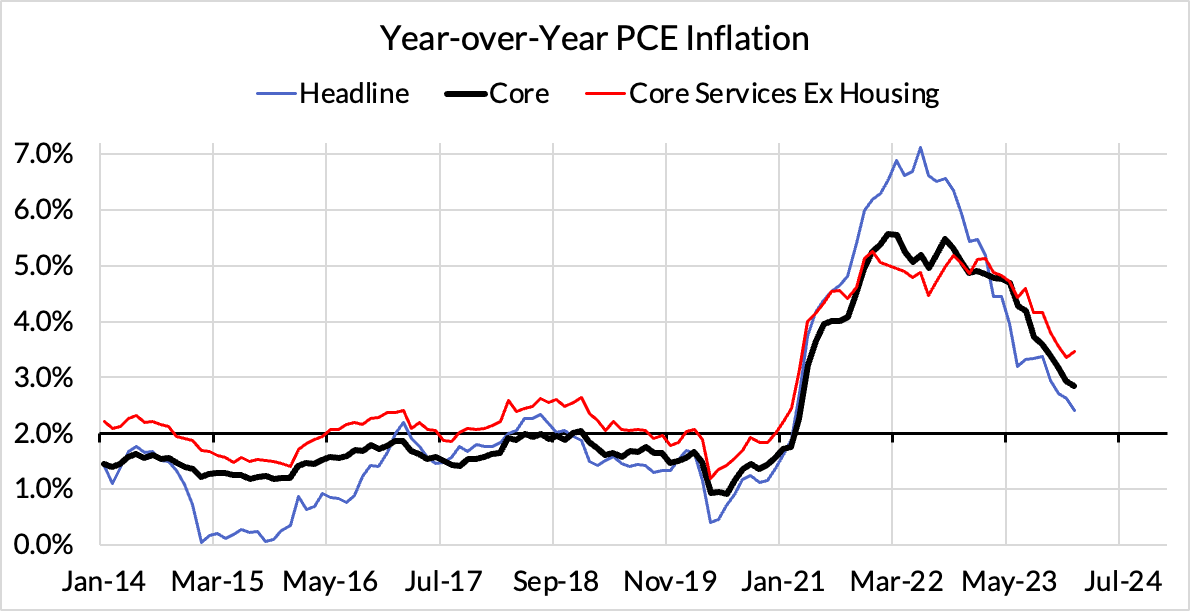

- Why brace for upside? Post-pandemic residual seasonality. We had competing hypotheses for whether Jan-Feb would be structurally hotter post-pandemic or only in a manner conditional on the presence of big supply shocks in the prior year. The former hypothesis looks to be almost unilaterally right. It's not a basis for panic about "inflation reacceleration" (though don't be surprised to see more people make that claim), but it does suggest that February will follow the same upside dynamics as January. CPI sampling tends to follow a bimonthly process for estimating price changes. That means "new year, new prices" likely foretells further strength in February to compound January's strength. As we get past February, the inflation readings should be more obviously favorable. Given the presence of residual seasonality of uncertain magnitude, year-over-year readings for PCE inflation gauges are a more robust yardstick.

- Residual seasonality that matters most for Core PCE is in goods prices: While we still expect some chunky price declines, we expect to see upside innovations in core goods CPI and core services CPI. The issue though is that core services CPI, outside of rent, OER, and a few other components, sits outside of Core PCE. There are still residual seasonality issues in the services PCE inputs (e.g. food services) but less pronounced.

- What to make of rent and OER? We want to stay humble here. We suspect the BLS' explanation for the divergence visible in the January data between "rent of primary residence" and "owners' equivalent rent" does not have substantial forward-looking value but we could be wrong. Our best guess is that the divergence was aggravated by recently revised seasonal factors and some additional noise. Nevertheless, there are new things we may learn here that force us to change our views. Thus, it's possible January's divergence persists for a longer time period, or else pleasantly surprises us with meaningful convergence. If we see the latter, the substantive case for reducing interest rates as early as May 1st improves.

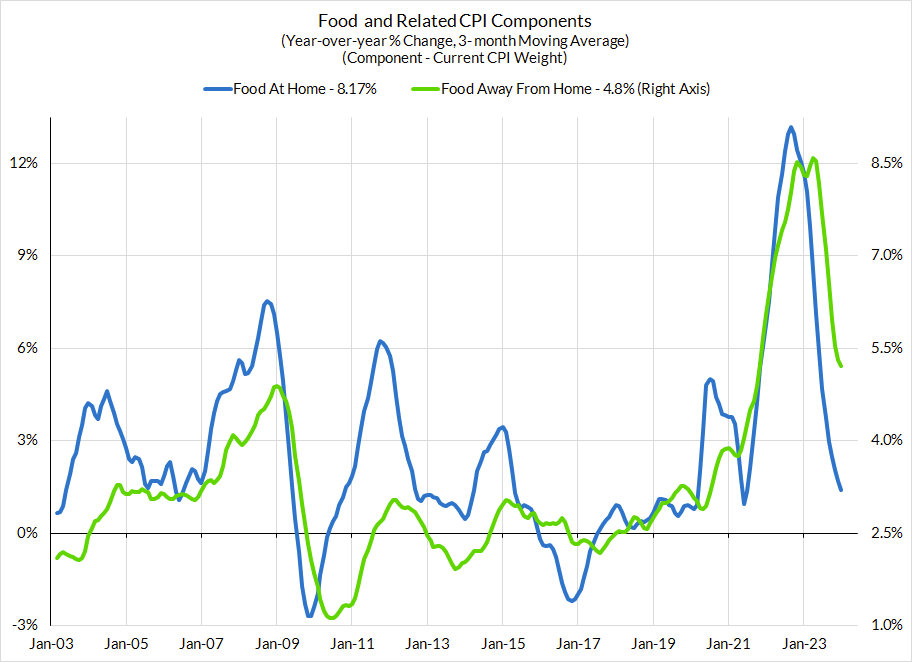

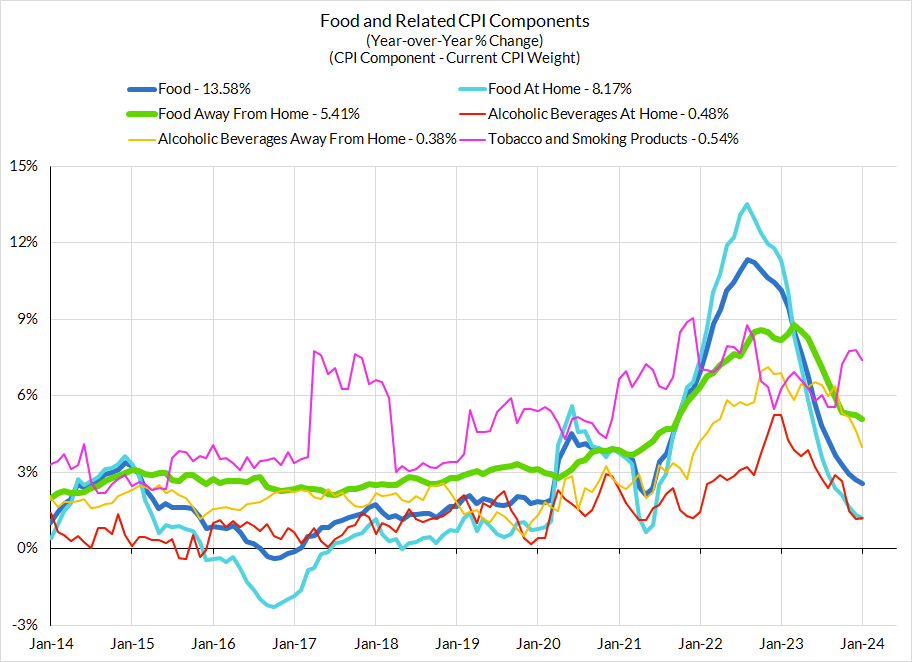

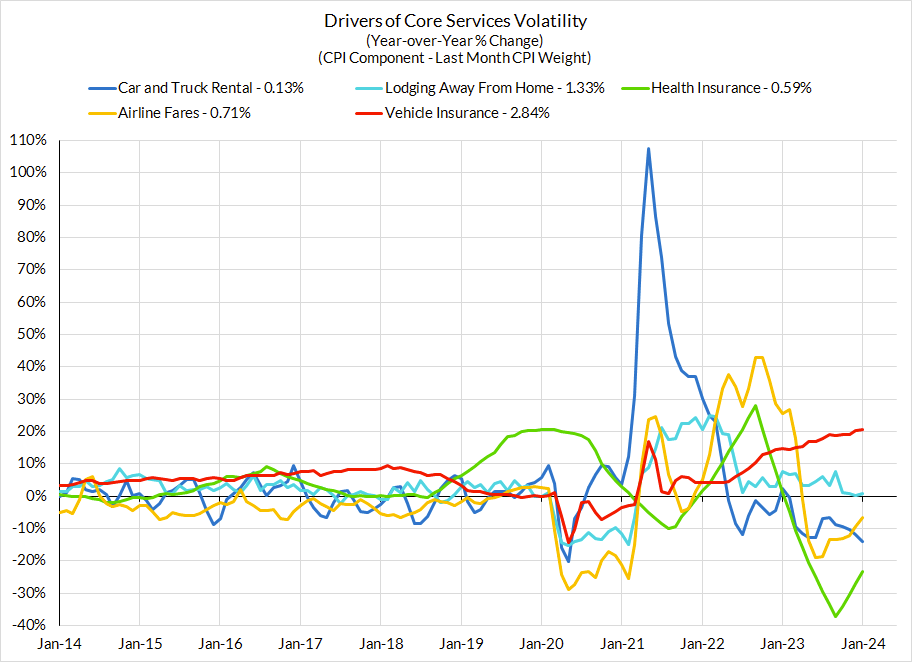

- Wedge dynamics favor Core PCE disinflation soon: Getting the big financial services PCE inflation impulse out of the way (from the big rally in stock prices at the end of Q4), Core PCE is likely poised to underperform Core CPI. Vehicle insurance PCE is far more muted than its CPI cognate. Airfare PPIs have substantially outperformed Airfare CPI (even after accounting for structural biases); some PPI underperformance relative to CPI seems likely in the coming months. We expect food services inflation to run on the stronger side in February as it did in January but the underlying food and energy supply chain dynamics bode favorably for grocery and restaurant disinflation in the months ahead.

- Watch out for revisions to healthcare services PPI/PCE inflation: While the CPI data is not revised, the PPI data is. In the case of healthcare services PPI (the input for PCE), this data is especially spiky in January, but the full January data isn't known until subsequent months of revision of the January data have transpired. What we learned from January PPI was quite benign but we saw a similar pattern emerge last year, with data subsequently revised higher for January than a more tepid initial release.

CPI Charts

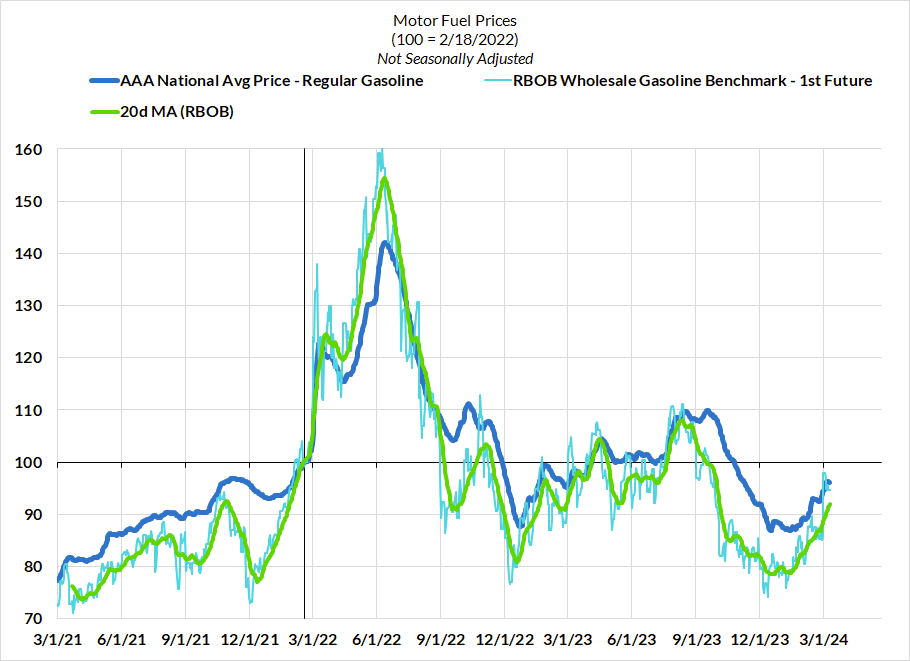

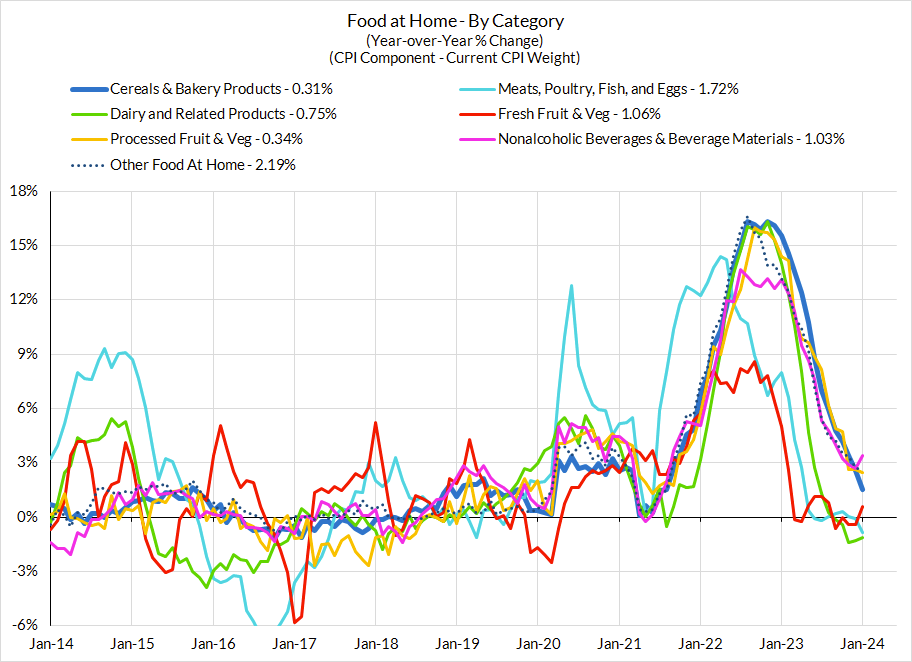

Non-Core CPI Components

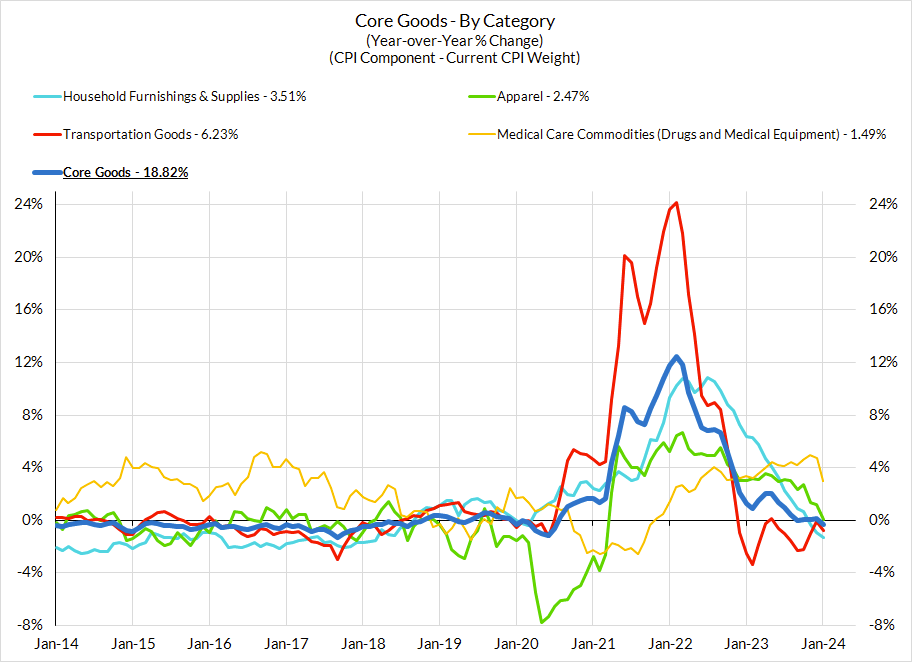

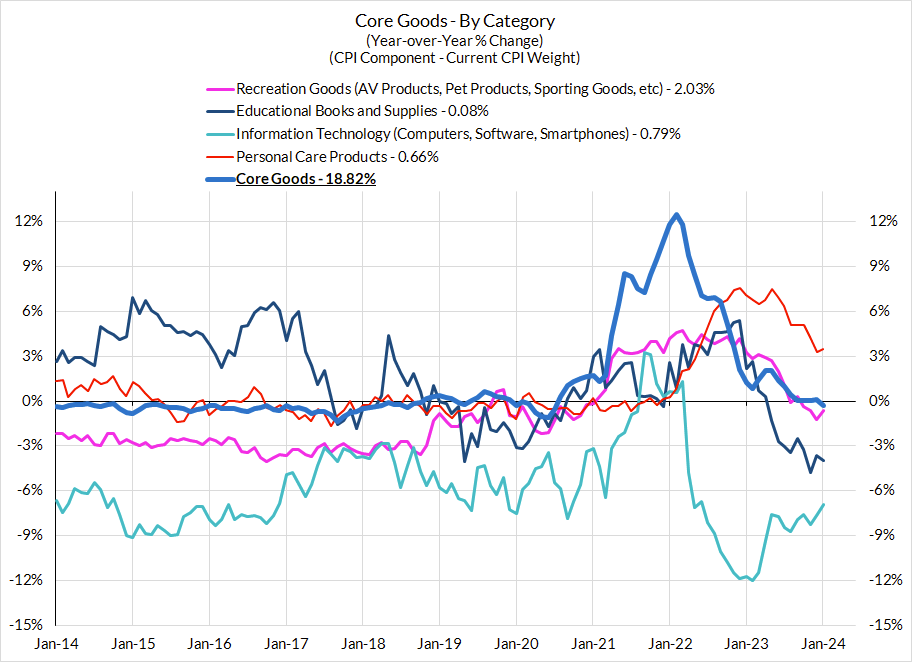

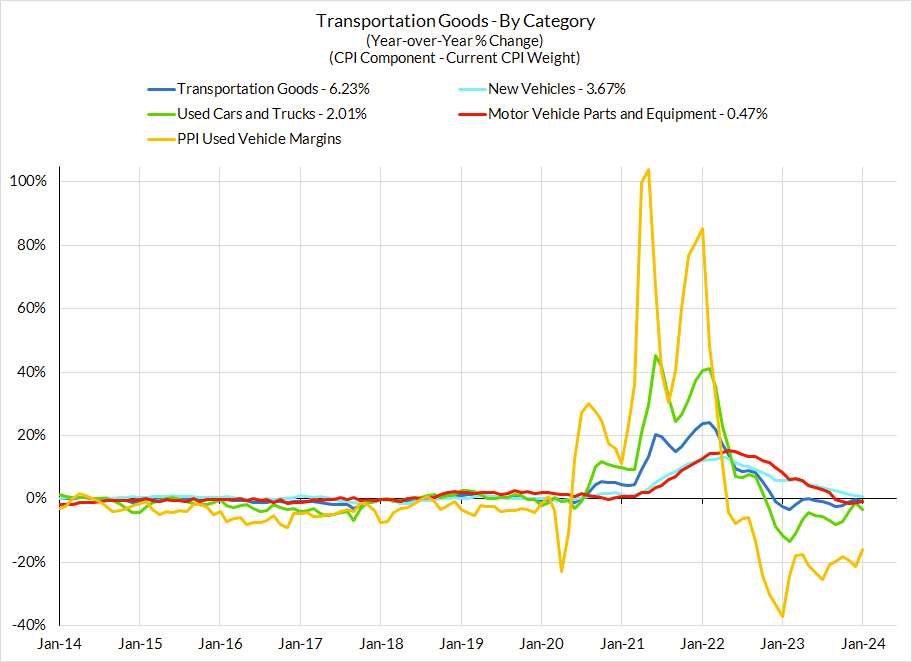

Core Goods CPI Components

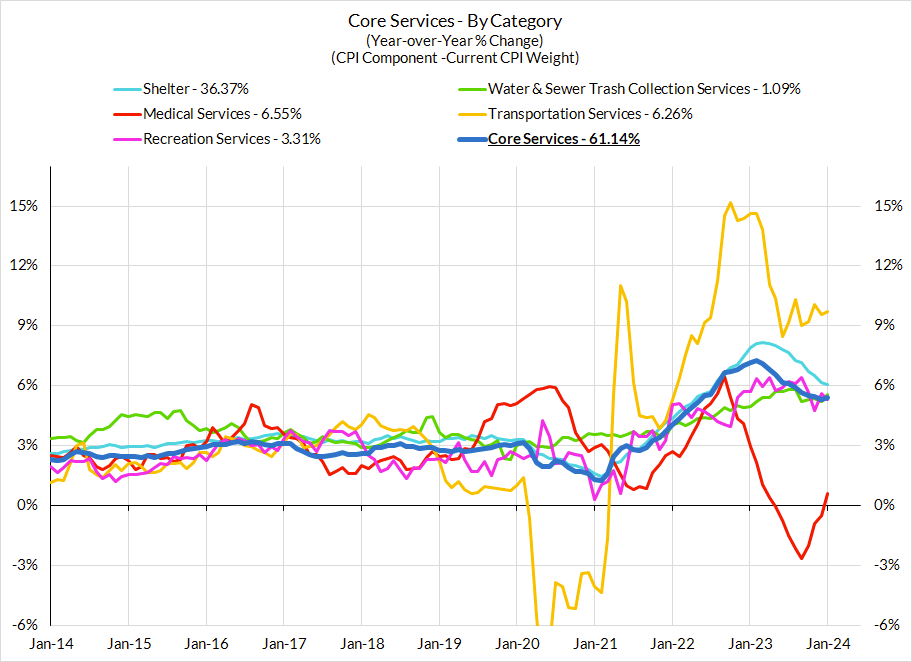

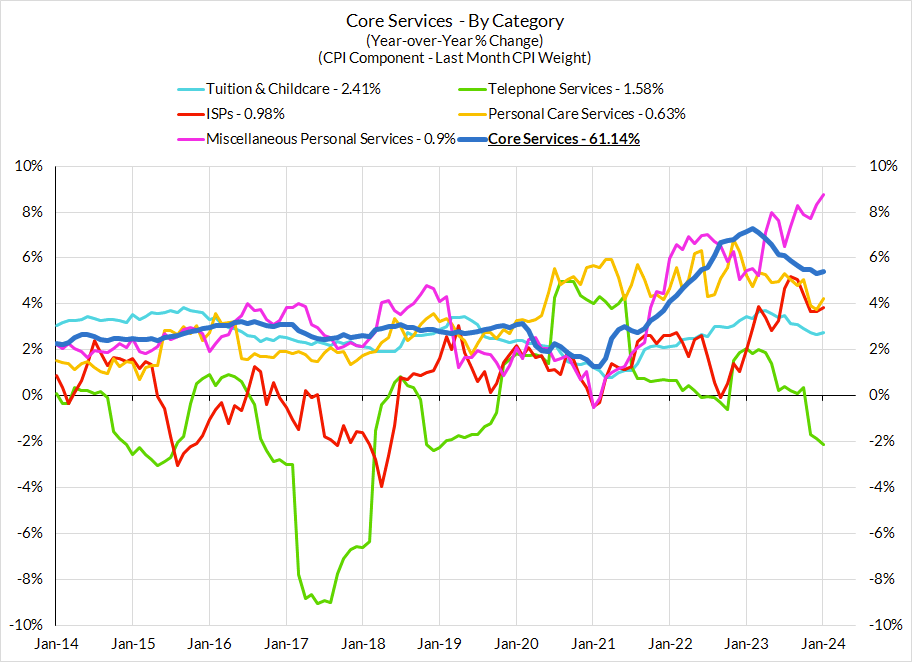

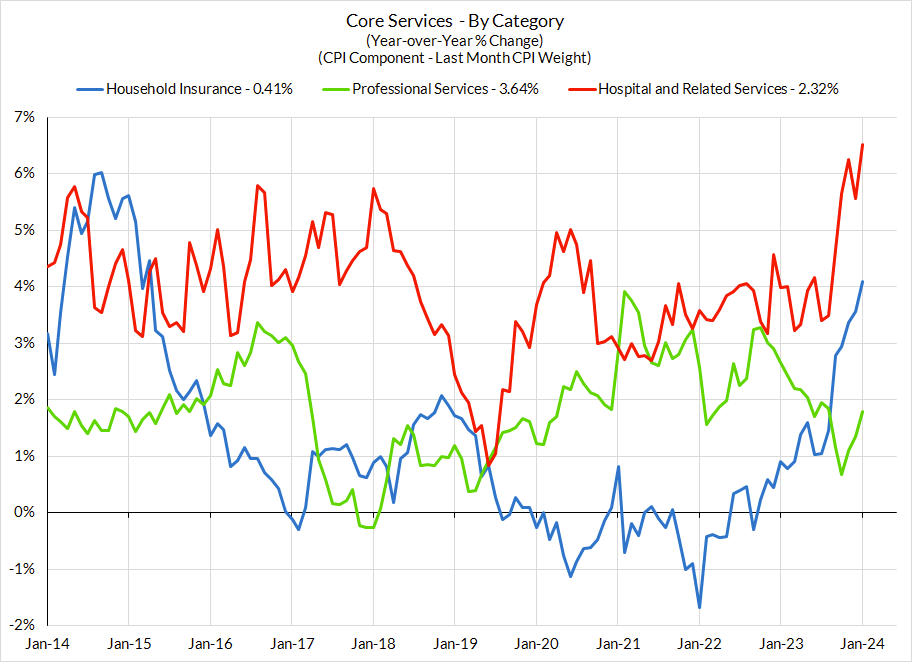

Core Services CPI Components (Not All Feed Into Core PCE)

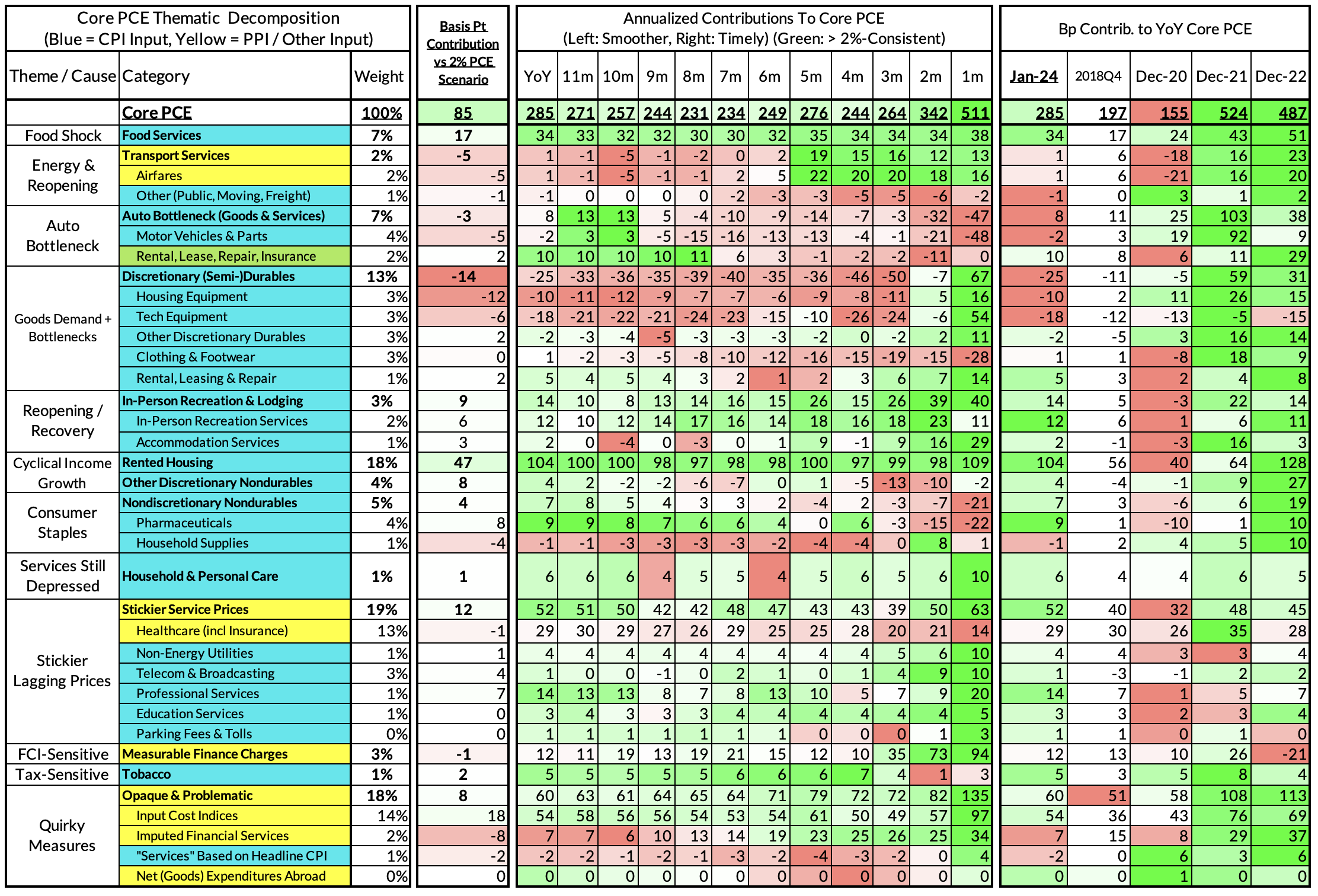

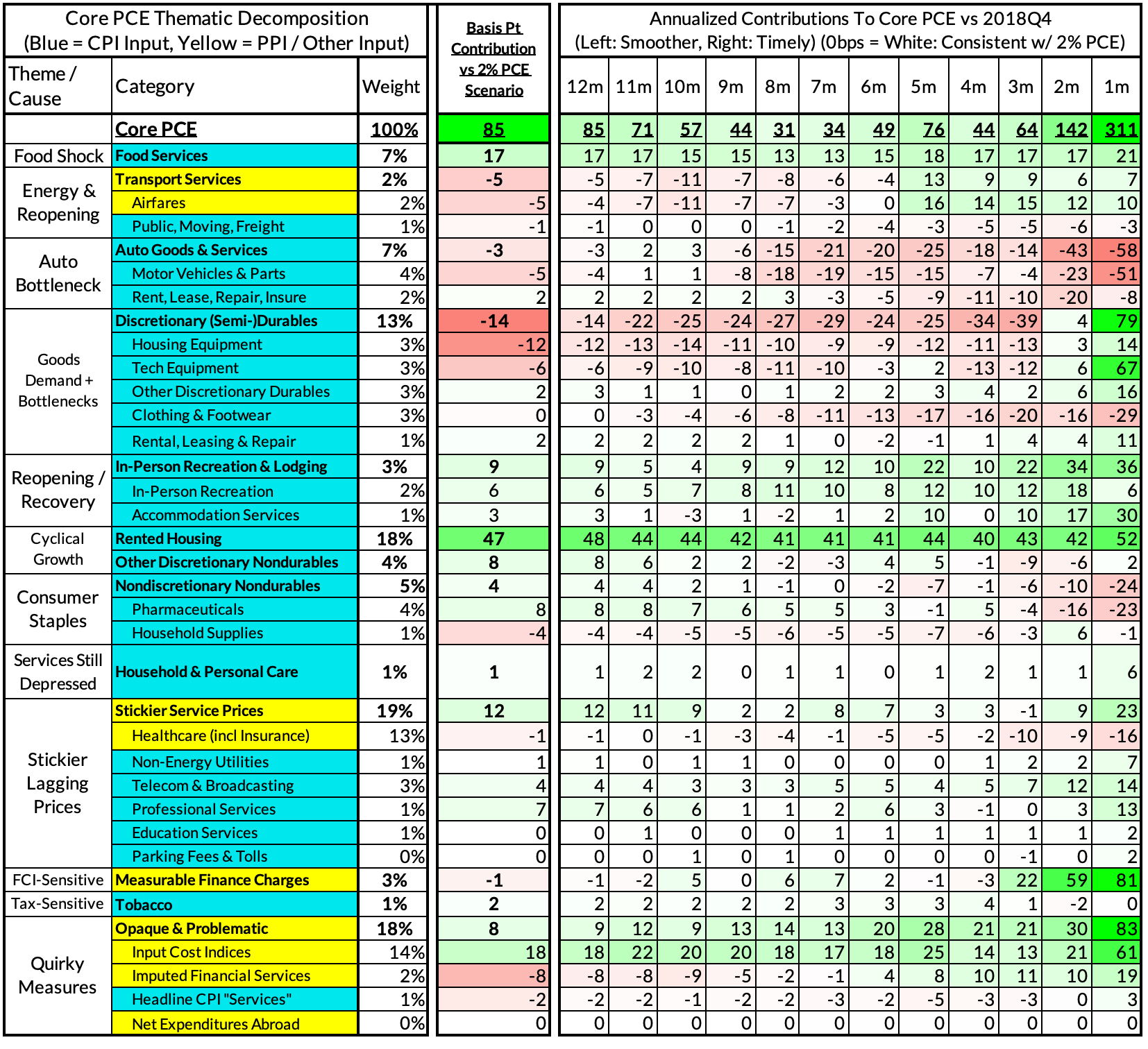

For the Detail-Oriented: Core PCE Heatmaps (As of January)

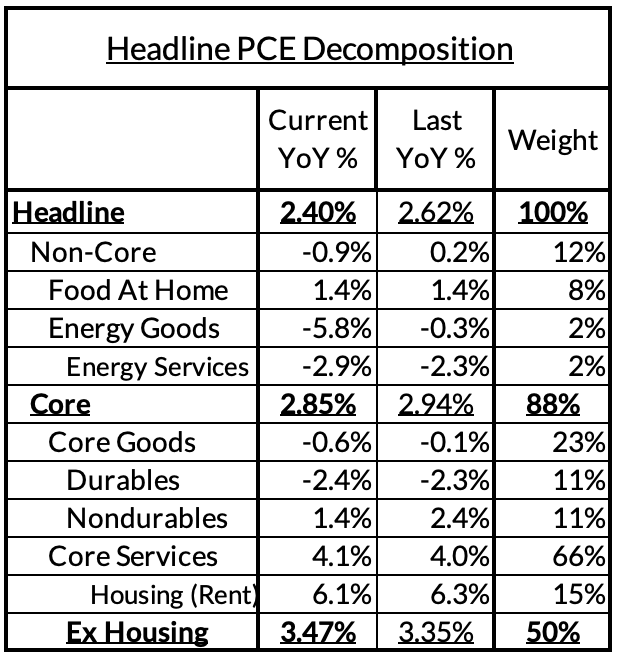

Core PCE (PCE less food products and energy) ran at a 2.85% year-over-year pace as of January, 85 basis points above the Fed's 2% inflation target for PCE. That overshoot is disproportionately driven by catch-up rent CPI inflation in response to the surge in household formation (a byproduct of rapidly recovering job growth) and market rents in 2021-22. Rent is contributing 47 basis points to the 85 basis point core PCE overshoot.

There are other contributors to the overshoot:

- Some more supply-driven (food inputs likely added 17 basis points to the overshoot)

- Some more demand-driven (in-person recreation and travel services likely added 9 basis points to the overshoot)

- Some with demand- and supply-side drivers (core nondurable goods are adding 12 basis points).

- Some oddball segments have offsetting effects (measured financial service charges now likely subtracting 1 basis point, while contributions from input cost indices and imputed financial services likely adding 10 basis points to Core PCE vs 2%-consistent outcomes).

The subsequent heatmap below gives you a sense of the overshoot on shorter annualized run-rates. January monthly annualized core PCE yielded a 311 basis point overshoot vs 2% target inflation (5.11% annualized).

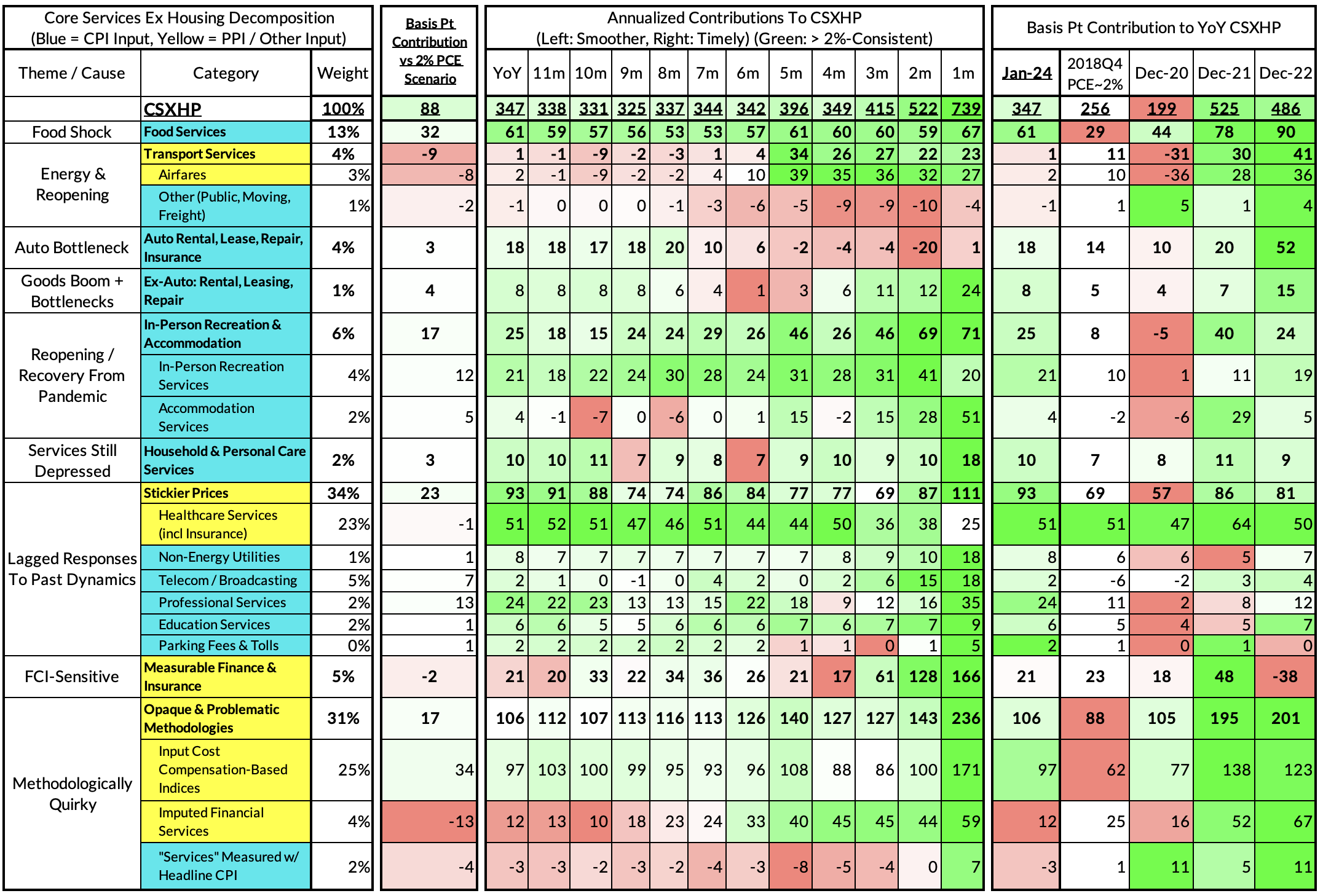

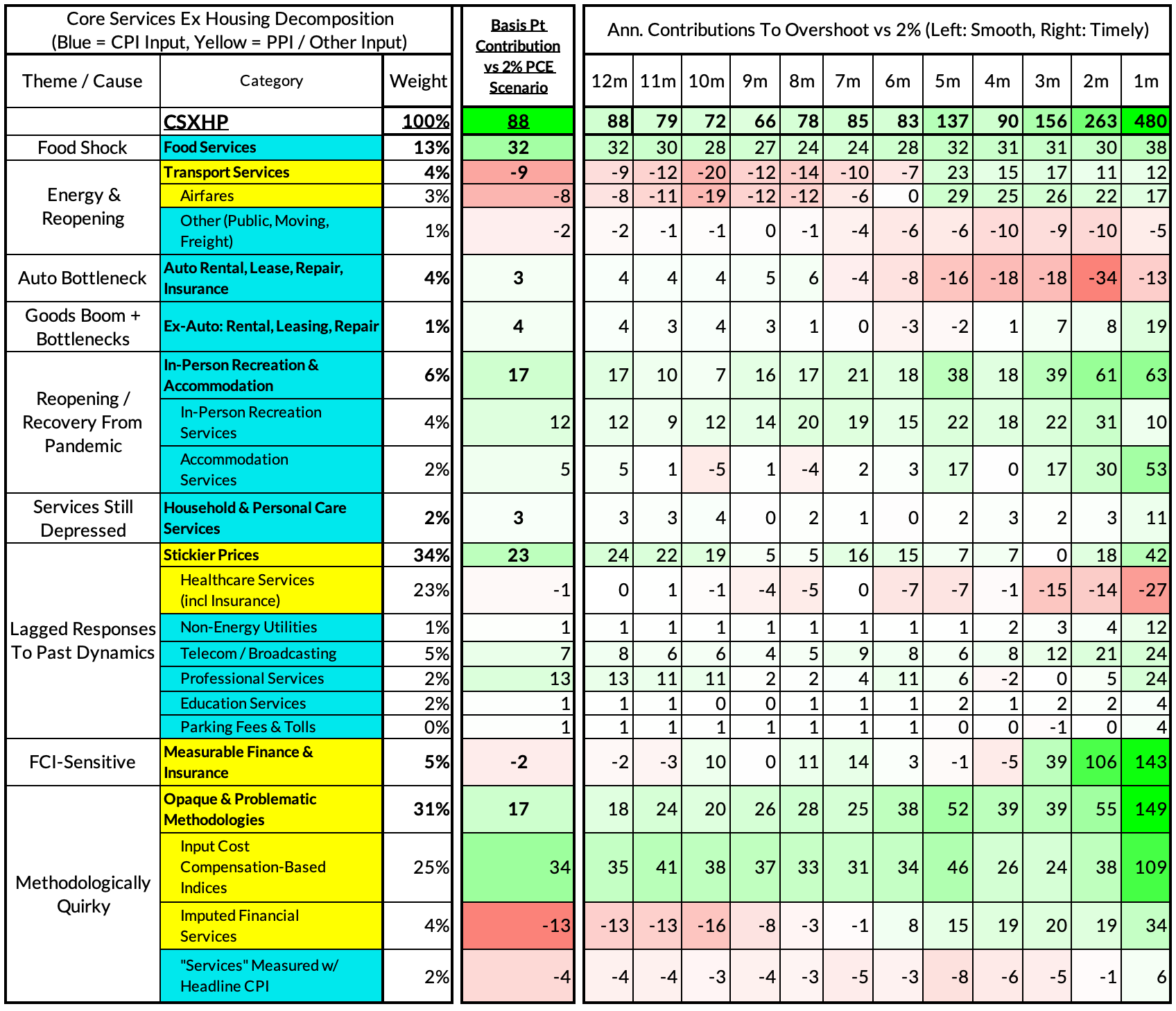

For the Detail-Oriented: Core Services Ex Housing PCE Heatmaps

The January growth rate in "Core Services Ex Housing" ('supercore') PCE ran at 3.47% year-over-year, an 88 basis point overshoot versus the ~2.59% run rate that coincided with ~2% headline and core PCE.

January monthly supercore ran at a 7.39% annualized rate, a 480 basis point overshoot of what would be consistent with 2% headline and core PCE. On a shorter run basis, this aggregation is highly sensitive to financial market dynamics.

Past Inflation Previews & Commentary

- 2/12/21: The Good, The Bad, and The Transitory

- 10/27/21: Offsetting Persistent Inflationary Pressures With Disinflationary Healthcare Policy

- 11/8/21: Q4 CPI Preview: What Will Hot Q4 Inflation Tell Us About 2022 Dynamics?

- 12/9/21: November CPI Preview: Planes, Constraints, and Automobiles: What to Look For in a Hot November CPI Print

- 2/9/22: January CPI Preview: Calendar Year Price Revisions Skew Risks To The Upside in January, But The Balance of Risks May Shift Soon After

- 3/9/22: Feb CPI - Short Preview: Inflection Points - Headline Upside (Putin), Core Downside (Used Cars)

- 4/11/22: March CPI Preview: Managing The Endogenous Slowdown: Transitioning From A Rapid Recovery To Non-Inflationary Growth

- 5/10/22: April CPI Preview: Subtle Headline CPI Upside, But Core PCE Should Reveal More Disinflation

- 6/9/22: May Inflation Preview: Peak Inflation? Not So Fast, My Friend. Upside Surprises Loom Large

- 7/12/22: June Inflation Preview: Lagging Consensus Catches Up To Hot Headline, But Relief Nearing…

- 8/8/22: July Inflation Preview: Finally, Fewer Fireworks

- 9/9/22: August Inflation Preview: Can Used Cars & Gasoline Overcome The Rest of The Russia Shock?

- 10/12/22: September Inflation Preview: Timing The Goods Deflation Lag Amidst Hot Inflation Prints

- 11/12/22: October Inflation Preview: When Will We See The 'Real' Goods Deflation Materialize? Until Then, Rent Rules Everything Around Me

- 12/12/22: November Inflation Preview: The Goods Deflation Cavalry Is Coming, But OER Can Upset An Optimistic Consensus Tomorrow

- 1/11/23: December Inflation Preview: Risks Skew To The Downside, But Upside Scenarios Remain Plausible

- 2/12/23: January Inflation Preview: Residual Seasonality & Stickier Services Pose Upside Risks

- 3/9/23: February Inflation Preview: Q1 Upside Risks Remain. Goods and Reopening-Sensitive Sectors Matter More Than Wages

- 4/8/23: March Inflation Preview: The Fed Seems Unaware We're Entering Another Automobile Inflation Storm

- 5/7/23: April Inflation Preview: Can PCE Silver Linings Overcome CPI Bite from the Used Cars Wolf and a "Slow Slowdown" in Rent CPI?

- 6/9/23: May Inflation Preview: Last Month of Used Cars Driving Upside Risk?

- 7/9/23: June Inflation Preview: The Path To The Fed's 2% PCE Goals Is Getting Clearer But Not Soon Enough To Forestall a July Hike

- 8/8/23: July Inflation Preview: Used Car Downside Can Hasten Path To 2% Core PCE Outcomes

- 9/12/23: August Inflation Preview: CPI Risks Growing More Balanced Even As PCE Risks Tilt More To The Downside

- 10/10/23: September (Pre-PPI) Inflation Preview: The Wedge Will Matter Again...Pulling Up CPI and Pushing Down PCE

- 11/13/23: October Inflation Preview: A Data Release That Can Dictate The Future of The Hiking (& Easing?) Cycles

- 12/11/23: November Inflation Preview: Headline Downside But Can Core PCE Keep A March "Normalization Cut" In Play?

- 1/10/24: December Inflation Preview: How Much More Disinflation Can Be "Banked" Before Q1 Begins?

- 2/9/24: January Inflation Preview: High Stakes Data Releases With Fat Tails On Both Sides